Search results with tag "Personal property"

FP-31 District of Columbia Personal Property Tax Instructions

mytax.dc.govThere is no tax due if the value of your personal property is $225,000 or less, however, you still must file the return. _____ Which other DC personal property tax forms may be filed? • Railroad Tangible Personal Property Return, Form FP-32; • Rolling Stock Tax Return, Form FP-34; • Extension of Time to File DC Personal Property TaxReturn ...

FAQs Business Personal Property What is a rendition for ...

bancad.orgOwners of tangible personal property that is used for the production of income Owners of tangible personal property on which an exemption has been cancelled or denied What types of property must be rendered? Business owners are required by State law to render personal property that is used in a business or used to produce income.

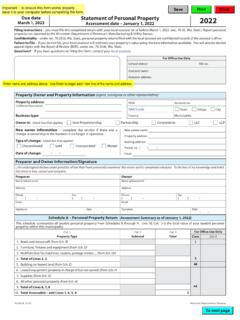

2022 PA-003 Statement of Personal Property

www.revenue.wi.govBusiness type: Property address: (if different from above) FEIN Account no. NAICS code CountyMunicipality TownVillageCity Schedule A – Personal Property Return (Assessment Summary as of January 1, 2022) This schedule summarizes all taxable personal property from Schedules B through H. Line 10, Col. 3 is the total value of your taxable personal

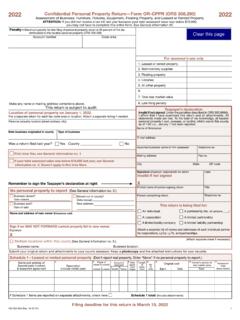

2022 Confidential Personal Property Return—Form OR-CPPR ...

www.oregon.gov2022 Confidential Personal Property Return—Form OR-CPPR (ORS 308.290) 2022 Penalty—Maximum penalty for late filing of personal property return is 50 percent of the tax attributable to the taxable personal property (ORS 308.296). Account number Code area Make any name or mailing address corrections above. This return is subject to audit.

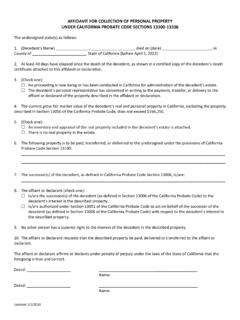

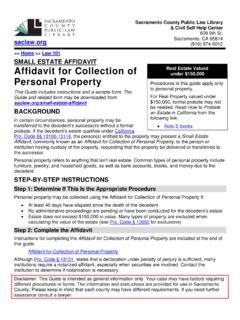

AFFIDAVIT FOR COLLECTION OF PERSONAL PROPERTY …

www.courts.ca.govThe decedent’s personal representative has consented in writing to the payment, transfer, or delivery to the affiant or declarant of the property described in the affidavit or declaration. 4. The current gross fair market value of the decedent’s real and personal property in California, excluding the property

Affidavit for Collection of Personal Property

saclaw.orgPersonal property may be collected using the Affidavit for Collection of Personal Property if: ... • An Inventory and Appraisal of all real property owned by the decedent in California, if any. This appraisal must be performed by an approved probate referee. Pro. Code § 13103

Inmate Property 2 - Oklahoma

oklahoma.govany personal property to another inmate. 2. If an inmate reports missing personal property, and the property is later found in the possession of another inmate and is not altered or distorted, the property will be returned to the rightful owner. D. Disposition Following Escape or …

2022 Assessment and Tax Roll Instructions for Clerks

www.revenue.wi.govproperty between real estate and personal property . 5. Manufacturing property DOR determines manufacturing property values and provides these values to the taxation district if there is manufacturing property located in the taxation district . DOR sends a Notice of Assessment (showing the full value of the manufacturing property) in late spring .

An Annual Report must be filed by all business entities ...

dat.maryland.govGenerally, all tangible personal property owned, leased, consigned or used by the business, and located within the State of Maryland on January 1, 2018, must be reported. Property not in use must still be reported. All fully depreciated and expensed personal property must also be reported. Personal property includes, but is not limited to ...

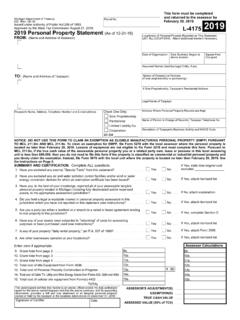

632, 2019 Personal Property Statement (as of 12-31-18) L-4175

www.michigan.gov632, Page 3 Parcel No. L-4175 SECTION G - Other Assessable Personal PropertyWhich You Own Assessable Tangible Personal Propertyin your possession that is not entitled to depreciation under GenerallyAccepted Accounting

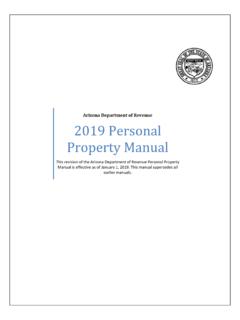

Manual Business Personal Property - AZDOR

azdor.govBusiness Personal Property Manual Introduction Introduction Arizona law provides authority for the identification, classification, valuation, and assessment of taxable personal property. These duties are administered jointly by the Department and the 15 county assessors. This publication contains information to assist

SMALL ESTATE AFFIDAVIT 1 - Maricopa County, Arizona

superiorcourt.maricopa.govSmall Estate Affidavit(s) of Transfer (Instead of Probate) Procedures: What to do after you have completed the affidavit: 1. To collect personal property: Take the “Affidavit for Collection of All Personal Property” to the person who has the personal property (cash, bank accounts, stocks and bonds, cars, jewelry, etc.) of the person who died.

Business axes for C Subcontractors, and Repairmen

ksrevenue.govretail sale, rental, or lease of tangible personal property, and, 2) the sale of labor services to install, apply, repair, service, alter, or maintain tangible personal property. Tangible personal property is goods or merchandise that can be owned or leased, has a physical presence, and can be moved (sometimes with great difficulty).

Homestead & Property Tax Relief Claim Instructions

www.ksrevenue.govA new property tax refund for homeowners, 65 years of age or older with household income of $16,800 or less, is available on Form K-40PT. The refund is 45% of the property taxes actually and timely paid on real or personal property used as their principal residence. Claimants who receive this property tax refund . cannot. claim a Homestead refund.

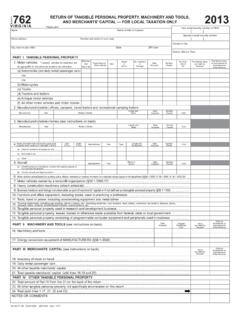

O R F 762 AND RETURN OF TANGIBLE PERSONAL PROPERTY ...

www.nottoway.orgPART I TANGIBLE PERSONAL PROPERTY 1. Motor vehicles * Leased vehicles for business use do not qualify for the personal property tax reduction. (a) Automobiles (not daily rental passenger cars)

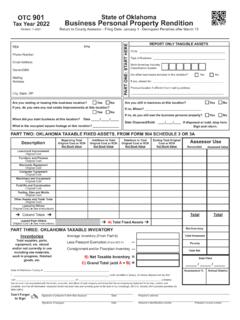

2022 Form 901 Business Personal Property Rendition

oklahoma.gov• Business Sold: date of sale, name and address of new owner. • Business Closed: date of closing or date all personal property was disposed, report location and value of any remaining property still owned on the assessing date, even if in storage. • Business Name Change: date of change and new name.

TRANSFER BY AFFIDAVIT

www.wisbar.orgIf personal property (including digital property as defined under §711.03(10), Wis. Stats.), specifically describe property including name of financial institutions and account type. See attached for additional property. ... Patient or inmate of a State of Wisconsin or Wisconsin

INSTRUCTIONS FOR COMPLETING AFFIDAVIT FOR THE …

www.courts.state.co.usFor additional information about collecting personal property, please review §15 -12-1201, C.R.S. and §15- 12-1202, C.R.S. 11. When the affidavit is presented to the person indebted to the decedent or in possession of decedent’s personal property, the person shall make payment or deliver the property to the person(s) specified in #7 of

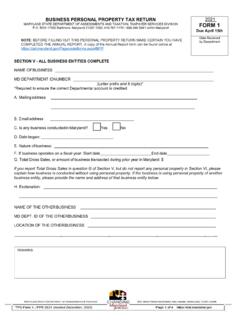

BUSINESS PERSONAL PROPERTY TAX RETURN 2021

dat.maryland.govBUSINESS PERSONAL PROPERTY TAX RETURN MARYLAND STATE DEPARTMENT OF ASSESSMENTS AND TAXATION, TAXPAYER SERVICES DIVISION P.O. BOX 17052 Baltimore, Maryland 21297-1052; 410-767-1170 • 888-246-5941 within Maryland ... If the property is located in a taxable jurisdiction, a detailed schedule by depreciation category should be …

TANGIBLE PERSONAL PROPERTY - Florida Department of …

floridarevenue.comproperty appraiser by April 1. Report all property located in the county on January 1. You must file a single return for each site in the county where you transact business. If you have freestanding property at multiple sites other than where you transact business, file a separate, but single, return for all

PASS-THROUGH ENTITY INCOME AND FRANCHISE TAX …

www.dor.ms.govIRC Section 1031 like-kind exchange of property will apply to real property not held primarily for sale and Mississippi personal property per Miss. Code Ann. §27-7-9(f)(1)(A). Contractors with average gross receipts less than $25 million for the previous three (3) tax years are exempt

Homeowners Property Inventory Checklist

images.template.netproperty coverage: • Personal Property Replacement Coverage • Earthquake and Volcanic Eruption Coverage • Extended Coverage on Jewelry, Watches and Furs • Special Coverage for Boats, Motors and Boating Equipment • Scheduled Coverage for Specific Valuables

STEP-BY-STEP INSTRUCTIONS FOR FILLING IN YOUR ... - …

files.hawaii.govA periodic general excise/use tax return (Form G-45), including an amended return, can be fi led and payment made ... sells or assists in the sale of tangible personal property, intangible personal property, or services on behalf of another ... page 10 of the General Instructions for Filing the General Excise/

TANGIBLE PERSONAL PROPERTY TAX RETURN

floridarevenue.comTANGIBLE PERSONAL PROPERTY TAX RETURN CONFIDENTIAL DR-405, R. 01/18 Rule 12D-16.002, F.A.C. Eff. 01/18 Enter your account number, name, and address below.

Small Estate Affidavit - Affidavit for Collection of ...

saclaw.orgestate. OR The decedent's personal representative has consented in writing to the payment, transfer, or delivery to the affiant or declarant of the property described in the affidavit or declaration. 4.The current gross fair market value of the decedent's real and personal property in California, excluding the

Assessors' Manual, Data Collection - RFV

www.tax.ny.govh) Do not discuss property taxes. i) Do not smoke during an inspection. j) Do not comment on furnishings or personal property. k) Be careful of furnishings and property during the inspection. l) Conduct the inspection in a professional manner. When the inspection is completed, thank the owner or tenant for their cooperation and leave.

Information Guide - Nebraska

revenue.nebraska.govPersonal Property Assessment Information Guide, August 2, 2021, Page 1 Overview All depreciable tangible personal property, used in a trade or business, with a life of more ... 2016, and has a nameplate capacity of 100 kilowatts or more, but is …

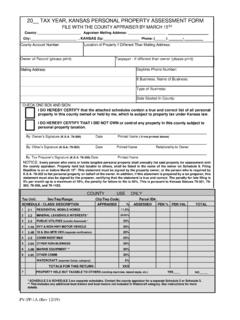

20 TAX YEAR, KANSAS PERSONAL PROPERTY ASSESSMENT …

ksrevenue.govExempt entities must also list taxable personal property belonging to others. Refer to Schedule 5 for applicable exemptions. Watercraft is defined as any boat or vessel designed to be propelled by machinery, oars, paddles, or wind action upon a sail for navigation on the water. Each watercraft may include one trailer and any nonelectric motor ...

AFFIDAVIT FOR COLLECTION OF ALL PERSONAL …

superiorcourt.maricopa.govAFFIDAVIT FOR COLLECTION OF ALL PERSONAL PROPERTY . STATE OF ARIZONA ) MARICOPA COUNTY ) By signing this affidavit, I swear or affirm under penalty of perjury that its contents are true and correct. 1. INFORMATION ABOUT THE DECEASED (THE PERSON WHO DIED): Name of person who died: Date of death: Place of death: 2. 30-DAY REQUIREMENT:

MARYLAND Application for Certificate of DO NOT WRITE OR ...

marylandtaxes.govUse Form MW506AE to apply for a Certificate of Full or Partial Exemption from the withholding requirements on the proceeds of the sale of real property and associated personal property in Maryland by nonresident individuals and nonresident entities. A nonresident entity is defined to mean an entity that: (1) is not

SMALL ESTATE AFFIDAVIT 1 - Pima County, Arizona

www.sc.pima.govAFFIDAVIT FOR COLLECTION OF ALL PERSONAL PROPERTY . STATE OF ARIZONA ) PIMA COUNTY )ss. By signing this affidavit, I swear or affirm under penalty of perjury that its contents are true and correct. 1. INFORMATION ABOUT THE DECEASED (THE PERSON WHO DIED): Name of person who died: Date of death: Place of death: 2. 30-DAY REQUIREMENT:

2020 Nebraska Farm Custom Rates - University of Nebraska ...

extensionpublications.unl.edupersonal property taxes, a charge for risk, and a return to management. Field conditions such as size of area, terrain, and location will vary, which could partially account for the range in the rates charged. Calculating Cost Associated with Fuel Price Changes The following is an example showing how custom rates may be adjusted as fuel prices ...

BARRIER CRIMES for Licensed Assisted Living Facilities and ...

www.dss.virginia.govArson – Burning or Destroying Personal Property, Standing Grain, Etc. 18.2-81 Arson – Causing, Inciting, Etc. Threats to Bomb or Damage Buildings or Means of Transportation; False Information as to Danger to Such Buildings, Etc. 18.2-84 Arson – Manufacture, Possession, Use, Etc. of Fire Bombs or Explosive Materialsor Devices 18.2-85

Business axes for Motor ehicle Transactions

ksrevenue.gov(dealer) for the purchase or lease of a new motor vehicle are exempt from sales tax. Additional manufacturer’s rebates for items of tangible personal property that are attached to the vehicle, such as running boards, brush guards, trailer hitches, etc. are exempt from tax if they are shown on the bill of sale and are paid directly to the dealer.

Department of Taxation and Finance Instructions for Form ...

www.tax.ny.govminimum tax of each member of the combined group that is subject to the MTA surcharge that is value of all its real and tangible personal property. In the instance of included on Form CT-3-A, Part 2, line 4b. If line 4 is less than line 7, go to line 13a. If line 4 is greater than or equal to line 7, continue with line 8a.

STATE DISCLOSURES - Compliance

compliance.docutech.comestate Prior to the collection of a mortgage broker fee Ala. Code § 5-25-12(a)(1) Mortgage ... personal property of every kind and of every interest ... Enforcement for Mortgage Licensing Act of 2010 or the Alaska Small Loans Act (Alaska Stat. §§ 06.20.010 through 06.20.920)) Both A refinance of a mortgage loan (aka a residential ...

www.PCSMYPOV

pcsmypov.blob.core.windows.netadditional information and country specific requirements, view the Defense Transportation Regulation, Part IV, and Attachment K3-Shipping Your POV and the SDDC Personal Property Consignment Instruction Guide (PPCIG) located on the Links Tab on our website. Documentation Requirements Replace your windshield wiper and fluid

Personal Property Tax - Wa

dor.wa.govPersonal property tax Most people know that property tax applies to real property, however, some may not know that property tax also applies to personal property. Most personal property owned by individuals is exempt. For example, household goods and personal effects are not subject to property tax. However, if these items are used

PERSONAL PROPERTY FREQUENTLY ASKED QUESTIONS …

www.mass.govApr 01, 2019 · A good explanation of what personal property is taxable based on the form of ownership (individual, partnership, unincorporated entity or corporation) may be found in Part 3 of the personal property return, known as the Form of List or State Tax Form 2. 7. Is personal property in the nature of construction works in progress (“CWIP”) or not in

Property Tax Rules - Florida Dept. of Revenue

www.floridarevenue.com12D-1.003 Situs of Personal Property for Assessment Purposes. Personal property not specifically addressed by this rule shall be assessed at its tax situs as determined pursuant to Sections 192.001(11), 192.032 and 192.042 of the F.S. (1) Tangible personal property physically located in a county on January 1 on a temporary or

Personal Property Tax - Wa

dor.wa.govproperty owner (seller) owes the full amount of taxes due in 2011 for the ... property tax. An exemption or partial exemption may apply to some farm machinery and equipment. Contact ... • Personal property accounts valued at less than $500 (Those qualifying for the $15,000 head

Property Tax Guide for Georgia Citizens

georgiadata.orgReal property is taxable in the county where the land is located, and personal property is taxable in the county where the owner maintains a permanent legal residence unless otherwise provided by law. (O.C.G.A. 48-5-11) For most counties, taxes are due by December 20, but this may vary from county to county. If taxes are not collected

PERSONAL PROPERTY - Missouri State Tax Commission

stc.mo.gov1) The taxpayer is in military service and is outside the state; (2) The taxpayer filed timely, but in the wrong county; (3) There was a loss of records due to fire or flood; (4) The taxpayer can show the list was mailed timely as evidenced by the date of postmark; or (5) The assessor determines that no form for listing personal property was mailed to the taxpayer for that tax

Similar queries

Personal Property Tax Instructions, Personal property, Personal property tax forms, Property, Statement of Personal Property, Business, Taxable personal property, Taxable personal, Affidavit, Collection of Personal Property, PERSONAL, California, Property owned, Inmate Property, Inmate, Tangible personal property, Tangible Personal, Estate Affidavit, Collection, Homestead, Business Personal Property, Taxable, Report, File, Scheduled, Instructions, General, Tax return, Return, General Instructions, Small Estate Affidavit, Estate, Information, Nameplate, Full, Partial, Pima County, Arizona, AFFIDAVIT FOR COLLECTION, Farm Custom, Custom, Vehicle, Sales tax, STATE DISCLOSURES, Small, Defense Transportation Regulation, Part IV, Personal Property Tax, County, Property Tax, Missouri