Search results with tag "Tangible personal property"

FP-31 District of Columbia Personal Property Tax Instructions

mytax.dc.govDepreciation rates for tangible personal property not listed in the Depreciation Guidelines in this booklet may be obtained by calling (202) 727-4TAX(4829). Use Schedule A of the Personal Property Tax Return to report all depreciable property that you own which is subject to the personal property tax. Leased Property

Sales and Use Tax on Repair of Tangible Personal Property

floridarevenue.comFlorida Department of Revenue, Sales and Use Tax on Repair of Tangible Personal Property, Page 2 Maintenance or Service Warranty Contracts – A service warranty is “any contract or agreement for the cost of maintaining, repairing, or replacing tangible personal property.”

Sales and Use Tax on Repair of Tangible Personal Property

floridarevenue.comFlorida Department of Revenue, Sales and Use Tax on Repair of Tangible Personal Property, Page 2 Maintenance or Service Warranty Contracts – A service warranty is “any contract or agreement for the cost of maintaining, repairing, or replacing tangible personal property.”

Information Guide - Nebraska

revenue.nebraska.govPersonal Property Assessment Information Guide, August 2, 2021, Page 3 v Tangible personal property used directly in the generation of electricity using solar, biomass, or landfill gas is exempt from property tax if the depreciable tangible personal property was installed

MEMORANDUM DISTRIBUTING TANGIBLE PERSONAL …

www.waltemathlawoffice.comMEMORANDUM DISTRIBUTING TANGIBLE PERSONAL PROPERTY OF My will refers to a written statement or list concerning distribution of items of tangible personal property not otherwise specifically disposed of by my will. This memorandum is for that purpose: ITEM BENEFICIARY , 200 Signature THIS DOCUMENT MUST BE SIGNED.

2018 Personal Property Guide - FINAL

www.ksrevenue.orgIntroduction Kansas law states that all real property and personal property in this state, not expressly exempt, is subject to taxation. All tangible personal property owned …

An Annual Report must be filed by all business entities ...

dat.maryland.govGenerally, all tangible personal property owned, leased, consigned or used by the business, and located within the State of Maryland on January 1, 2018, must be reported. Property not in use must still be reported. All fully depreciated and expensed personal property must also be reported. Personal property includes, but is not limited to ...

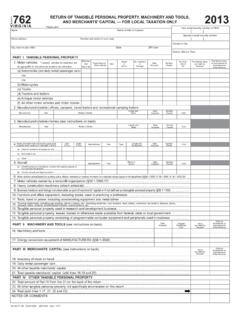

O R F 762 AND RETURN OF TANGIBLE PERSONAL PROPERTY ...

www.nottoway.orgPART I TANGIBLE PERSONAL PROPERTY 1. Motor vehicles * Leased vehicles for business use do not qualify for the personal property tax reduction. (a) Automobiles (not daily rental passenger cars)

Business Personal Property Rendition of Taxable Property

bisfiles.coThis form is to render tangible personal property used for the production of income that you own or manage and control as a fiduciary on Jan. 1 of this year (Tax Code Section 22.01). FILING INSTRUCTIONS: This document and all supporting documentation must be filed with the appraisal district office in the county in which the property is taxable.

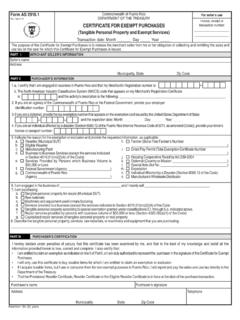

CERTIFICATE FOR EXEMPT PURCHASES transaction number ...

www.hacienda.gobierno.prTangible personal property according to special exemption granted under classifications 5.f. through 5.o. indicated above. Repair services provided by persons with business volume of $50,000 or less (Section 4020.05(a)(1) of the Cod e) Capitalized repair services of tangible personal property or real property 8.

STEP-BY-STEP INSTRUCTIONS FOR FILLING IN YOUR ... - …

files.hawaii.govA periodic general excise/use tax return (Form G-45), including an amended return, can be fi led and payment made ... sells or assists in the sale of tangible personal property, intangible personal property, or services on behalf of another ... page 10 of the General Instructions for Filing the General Excise/

12A-1.061 Rentals, Leases, and Licenses to Use …

www.miamidade.govas the sale, rental, lease, or license to use tangible personal property or the sale of taxable services when sold to a guest or tenant. See subsection (4) for use tax due on such taxable tangible personal property or services.

MIAMI-DADE COUNTY PROPERTY APPRAISER TANGIBLE …

www.miamidade.govTANGIBLE PERSONAL PROPERTY Report all property owned by you including fully depreciated items still in use. ASSETS PHYSICALLY REMOVED DURING THE LAST YEAR

Form ST-4, Exempt Use Certificate - LANJ

www.lanj.orgpurchased will be used for an exempt purpose under the Sales & Use Tax Act. The tangible personal property or services will be used for the following exempt purpose: The exemption on the sale of the tangible personal property or services to be used for the above described exempt purpose is provided in subsection N.J.S.A. 54:32B- (See reverse side

149 - Sales and Use Tax Exemption Certificate

dor.mo.gov• Purchases of Tangible Personal Property for resale: Retailers that are purchasing tangible personal property for resale purposes are exempt. from sales or use tax. The purchaser’s state tax ID number can be found on the Missouri Retail …

Sales and use tax exemption certificate for manufacturing ...

dor.wa.gov• places tangible personal property in the container, package, or wrapping in which the tangible personal property is normally sold or transported • is integral to research and development, or • is a repair and replacement part or repair/cleaning labor for eligible items. You cannot use this exemption for: • consumable items

Michigan Department of Treasury Tax Compliance Bureau ...

www.michigan.govExample: Retailer (a home improvement store) purchases tangible personal property (e.g., shelves) and hires a contractor to affix that tangible personal property to the real estate in Michigan upon which the store is located.

Statement of Reaffirmation of Tax Exemption FORM for Use ...

revenue.nebraska.govAn organization that owns real or tangible personal property, except licensed motor vehicles, and is seeking continuation of a property tax exemption must file this Statement of Reaffirmation of Tax Exemption, Form 451A, if: 1. The property is owned by and used exclusively for agricultural and horticultural societies; or 2. The property is: a.

For e-Filing only THE STATE OF NEW HAMPSHIRE

www.courts.nh.govC. Attachment C – Other Tangible Personal Property ..... $ On a separate sheet (Attachment C), list all other tangible personal property, including motor or recreational vehicles, farmers' utensils, mechanics' tools and livestock. For each motor or recreational vehicle, list the year, make and model.

Individual (Vehicle) Personal Property Tax FAQs What is ...

www.richmondgov.comThe percentages used to determine the assessed value of heavy trucks is the same as those used to value other business tangible personal property.

Condominium Law - New Jersey Division of …

www.njconsumeraffairs.gov(7) An accounting for all association funds, including capital accounts and contributions. (8) Association funds or control thereof. (9) All tangible personal property that is property of the association, represented by

Construction and Building Contractors - Board of …

www.boe.ca.govMachinery and equipment include property intended to be used in the production, manufacturing or processing of tangible personal property, the performance of services, or for other purposes (for example, research, testing

Sales and Use Tax Form E-500 Instructions - NC

files.nc.govthat amount under the column “Tax.” Line 4- General State Rate: The State levies a 4.75% general rate of tax on the sales price of taxable tangible personal property, services or digital property sold at retail and not subject to a reduced rate of tax. Add the amounts entered in the columns “Purchases for Use” and “Receipts.”

What's New System 21 Accelerated Cost Recovery - IRS tax …

www.irs.govGeneral Instructions Purpose of Form ... income tax return (other than Form 1120-S). ... Also, tangible personal property may include certain property used mainly to furnish lodging or in connection with the furnishing of lodging (except as provided in section 50(b)(2)). ...

SCHEDULE G INHERITANCE TAX RETURN INTER-VIVOS …

www.revenue.pa.govproperty or tangible personal property located in pennsylvania that was transferred. part ii ... general information schedule instructions information for transfers subject to tax if . completing part ii. ... inheritance tax return . nonresident. decedent. general information schedule instructions schedule h.

Kentucky Tax Registration Application and Instructions

revenue.ky.govKentucky Tax Registration Application. and Instructions. www.revenue.ky.gov. COMMONWEALTH OF KENTUCKY. DEPARTMENT OF REVENUE. FRANKFORT, KENTUCKY 40620 ... General Partnership Joint Venture Estate Government ... Are you a remote retailer selling tangible personal property or digital property delivered or transferred electronically to a.

SALES AND USE TAX ON SERVICES - Connecticut General …

www.cga.ct.govDec 15, 2015 · real property, including the voluntary evaluation, prevention, treatment, containment or removal of hazardous waste or air, water, or soil contaminants (CGS § 12-407(a)(37)(I)) Radio and television repair (CGS § 12-407(a)(37)(O)) Repair or maintenance services to tangible personal property and maintenance, repair, or warranty

Department of Defense INSTRUCTION

www.esd.whs.milDepartment of Defense . INSTRUCTION . NUMBER 8320.04 . September 3, 2015 . Incorporating Change 1, November 14, 2017 . USD(AT&L) SUBJECT: Item Unique Identification (IUID) Standards for Tangible Personal Property

Estate Tax Filing Checklist - Wa

dor.wa.gov• Domiciled was in the state of Washington or owned real or tangible personal property located in the state of Washington; and • Entire estate’s gross value exceeds the filing threshold for the year of the decedent’s death. Date death occurred Filing threshold 01/01/16 to 10/22/16 $2,000,000 10/23/16 to current Same as exclusion amount

State income tax apportionment What you need to know now

www2.deloitte.comother than of tangible personal property. States that have recently transitioned to market-based rules include: •Arizona (elective phase-in 2014-2017) •California (elective in 2011 and 2012, mandatory as of 2013) •District of Columbia (2015) •Massachusetts (2014) •Missouri (effective August 28, 2015) •Nebraska (2014) •New York ...

TSB-M-19(2)S:(5/19):Sales Tax Collection Requirement for ...

www.tax.ny.govMay 31, 2019 · tangible personal property (including sales of prewritten computer software that is downloaded or remotely accessed by the customer) that it facilitates for marketplace sellers, regardless of whether the marketplace seller is required to register for sales tax purposes.

TANGIBLE PERSONAL PROPERTY - FloridaRevenue.com

floridarevenue.comWhat Is Tangible Personal Property? Tangible personal property (TPP) is all goods, property other than real estate, and other articles of value that

Property Tax Rules - Florida Dept. of Revenue

www.floridarevenue.com12D-1.003 Situs of Personal Property for Assessment Purposes. Personal property not specifically addressed by this rule shall be assessed at its tax situs as determined pursuant to Sections 192.001(11), 192.032 and 192.042 of the F.S. (1) Tangible personal property physically located in a county on January 1 on a temporary or

TANGIBLE PERSONAL PROPERTY - Florida Dept. of Revenue

floridarevenue.comTangible personal property (TPP) is all goods, property other than real estate, and other articles of value that the owner can physically possess and has intrinsic value. Inventory, household goods, and some vehicular items are excluded. …

Similar queries

Personal Property Tax Instructions, Tangible personal property, Personal Property Tax Return, Property, Personal property tax, On Repair of Tangible Personal Property, Use Tax on Repair of Tangible Personal Property, Personal Property Assessment, MEMORANDUM DISTRIBUTING TANGIBLE PERSONAL, MEMORANDUM DISTRIBUTING TANGIBLE PERSONAL PROPERTY, Memorandum, Personal Property Guide, Personal property, Filing, Instructions, General, Tax return, Return, General Instructions, MIAMI-DADE COUNTY PROPERTY APPRAISER TANGIBLE, USE TAX, Use Tax Exemption, Of Tangible Personal Property, Missouri, Use tax exemption certificate for manufacturing, Repair, THE STATE OF NEW HAMPSHIRE, Individual (Vehicle) Personal Property Tax, Condominium, New Jersey Division of, Construction and Building Contractors, IRS tax, Kentucky Tax Registration, KENTUCKY, Connecticut General, Department of Defense INSTRUCTION, Department of Defense . INSTRUCTION, 2017, County