Sales and Use Tax Form E-500 Instructions - NC

that amount under the column “Tax.” Line 4- General State Rate: The State levies a 4.75% general rate of tax on the sales price of taxable tangible personal property, services or digital property sold at retail and not subject to a reduced rate of tax. Add the amounts entered in the columns “Purchases for Use” and “Receipts.”

Tags:

General, Property, Instructions, Personal, Tangible, Tangible personal property

Information

Domain:

Source:

Link to this page:

Please notify us if you found a problem with this document:

Documents from same domain

2018 SUMMARY OF BENEFITS - files.nc.gov

files.nc.govUnitedHealthcare® Group Medicare Advantage (PPO) is a Medicare Advantage PPO plan with a Medicare contract. To join this plan, you must be entitled to Medicare …

Medicare, Group, Advantage, Unitedhealthcare, Medicare advantage, 174 group medicare advantage

July 2015 Medicaid Bulletin - North Carolina

files.nc.govJuly 2015 Medicaid Bulletin. ... along with the CPT procedure code being submitted on the ... procedure code (99509). The crosswalk is not showing a match for this ...

Code, Medicaid, Procedures, 2015, Bulletin, Crosswalk, Procedure codes, 2015 medicaid bulletin

Early and Periodic Screening, Diagnostic and …

files.nc.govEarly and Periodic Screening, Diagnostic and Treatment Services: The Medicaid Benefit for Children Section II : The “EPSDT” Medical Necessity

Services, Screening, Treatment, Early, Periodic, Diagnostics, Diagnostic and, Early and periodic screening, Diagnostic and treatment services

PRIVATE DUTY NURSING Frequently Asked Questions

files.nc.govFrequently Asked Questions extended PA expiring. Once PDN reviews the new PA request, the beneficiary will follow the traditional PDN beneficiary extension plan, of up to a 6-month recertification timeframe. Q: Phone and Email Inquiries

Human Resources Training and Development - …

files.nc.govProviding adequate training and development of State employees can best be accomplished through the combined efforts of employees, supervisors on the job, departmental management and the Office of State Human Resources in cooperation

Development, Training, Human, Resource, Training and development, Human resources training and development

Preparing the Erosion and Sedimentation Control …

files.nc.govStrategy The erosion and sedimentation control plan should seek to protect the soil surface from erosion, control the amount and velocity of runoff, and capture all sediment on-site during each phase of the construction project.

Control, Plan, Preparing, Erosion, Sediment, Sedimentation, Erosion and sedimentation control plan, Preparing the erosion and sedimentation control

2015 – 2016 Sexual Abuse Annual Report - files.nc.gov

files.nc.gov1 | NCDPS: 2015 – 2016 Sexual Abuse Annual Report Introduction The Prison Rape Elimination Act of 2003 (PREA) was enacted by Congress to address the problem of sexual abuse and sexual harassment of persons in the custody

VOLUNTEER PROGRAM GUIDELINES - North Carolina

files.nc.govVOLUNTEER PROGRAM GUIDELINES VIP’s (Volunteers-in-Parks) September 2014. 2 ACKNOWLEDGEMENTS The North Carolina Division of Parks and Recreation would like to express appreciation to the Office of ... • Answers public inquiries about programs and directs interested volunteers to parks.

Programs, Guidelines, Park, Volunteer, Volunteer program guidelines, In parks

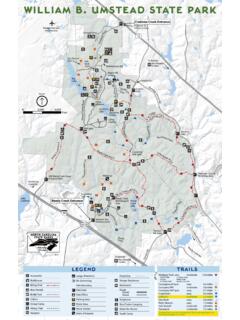

Crabtree Creek Entrance - North Carolina

files.nc.gov0 2,000 4,000 Feet North Big Lake Sycamore Lake Reedy Creek Lake Raleigh-Durham International Millstone. Exit 287 est Camp Crabtree Camp Lapihio

ILLICIT DISCHARGE DETECTION AND ELIMINATION …

files.nc.govILLICIT DISCHARGE DETECTION AND ELIMINATION PROGRAM (IDDE) Version 3.0 November 9, 2016 Page 1 of 15 IDDE BACKGROUND (40 CFR PART 122.34) LOCAL GOVERNMENTS must develop, implement and enforce a program to detect and eliminate illicit discharges (as …

Programs, Discharge, Elimination, Detection, Illicit, Illicit discharge detection and elimination, Illicit discharge detection and elimination program

Related documents

STEP-BY-STEP INSTRUCTIONS FOR FILLING IN YOUR ... - …

files.hawaii.govA periodic general excise/use tax return (Form G-45), including an amended return, can be fi led and payment made ... sells or assists in the sale of tangible personal property, intangible personal property, or services on behalf of another ... page 10 of the General Instructions for Filing the General Excise/

General, Property, Instructions, Personal, Return, Tangible, Tax return, Personal property, General instructions, Tangible personal property

2022 PERSONAL PROPERTY TAX FORMS AND …

revenue.ky.govINSTRUCTIONS TANGIBLE PROPERTY TAX RETURNS (REVENUE FORMS 62A500, 62A500-A, 62A500-C, 62A500-L , 62A500-S1, 62A500-W and 62A500–MI) Definitions and General Instructions The tangible personal property tax return includes instructions to assist taxpayers in preparing Revenue Forms 62A500, 62A500-A,

General, Property, Instructions, Personal, Return, Tangible, General instructions, Personal property tax, Tangible personal property tax return, Instructions tangible property tax

SCHEDULE G INHERITANCE TAX RETURN INTER-VIVOS …

www.revenue.pa.govproperty or tangible personal property located in pennsylvania that was transferred. part ii ... general information schedule instructions information for transfers subject to tax if . completing part ii. ... inheritance tax return . nonresident. decedent. general information schedule instructions schedule h.

General, Property, Instructions, Personal, Return, Tangible, Tax return, Tangible personal property

What's New System 21 Accelerated Cost Recovery - IRS tax …

www.irs.govGeneral Instructions Purpose of Form ... income tax return (other than Form 1120-S). ... Also, tangible personal property may include certain property used mainly to furnish lodging or in connection with the furnishing of lodging (except as provided in section 50(b)(2)). ...

General, Property, Instructions, Personal, Return, Tangible, Tax return, General instructions, Tangible personal property, Irs tax

FP-31 District of Columbia Personal Property Tax Instructions

mytax.dc.govDepreciation rates for tangible personal property not listed in the Depreciation Guidelines in this booklet may be obtained by calling (202) 727-4TAX(4829). Use Schedule A of the Personal Property Tax Return to report all depreciable property that you own which is subject to the personal property tax. Leased Property

Property, Instructions, Personal, Return, Tangible, Personal property tax, Tangible personal property, Personal property tax return, Personal property tax instructions

Kentucky Tax Registration Application and Instructions

revenue.ky.govKentucky Tax Registration Application. and Instructions. www.revenue.ky.gov. COMMONWEALTH OF KENTUCKY. DEPARTMENT OF REVENUE. FRANKFORT, KENTUCKY 40620 ... General Partnership Joint Venture Estate Government ... Are you a remote retailer selling tangible personal property or digital property delivered or transferred electronically to a.

General, Revenue, Kentucky, Property, Instructions, Registration, Personal, Tangible, Tangible personal property, Kentucky tax registration

Instructions for Form 8883 (Rev. October 2017) - IRS tax forms

www.irs.govGeneral Instructions Future Developments For the latest information about ... U.S. Income Tax Return for an S Corporation. Old target (consolidated return). If the ... personal property within the meaning of section 1092(d)(1) and Regulations

Form, General, Property, Instructions, Personal, Return, Tax return, Personal property, General instructions, Irs tax forms

GENERAL INSTRUCTIONS FOR FILING THE GENERAL …

dotax.ehawaii.govNOTE: Periodic general excise/use tax returns (Form G-45), the annual general excise/use tax return (Form G-49), and the Application For Extension Of Time To File The Annual Return And Reconciliation General Excise/Use Tax (Form G-39) may be electronically filed (e-filed) with the Department of Taxation. For more information, go to

General, Instructions, Return, Tax return, General instructions

Instructions for Franchise and Excise Tax Return - Tennessee

www.tn.govInstructions: FAE170 – Franchise and Excise Tax Return . General Information Enter the beginning and ending dates of the period covered by this return. If applicable, short period dates may be entered. A return can cover a 52/53-week filing …

General, Instructions, Tennessee, Return, Excise, Franchise, Franchise and excise tax return

Instructions for Form IT-205 Fiduciary Income Tax Return ...

www.tax.ny.govGeneral instructions Who must file The fiduciary of a New York State resident estate or trust must file a return on Form IT-205 if the estate or trust: – is required to file a federal income tax return for the tax year; – had any New York taxable income for the tax year; or – is subject to a separate tax on lump-sum distributions.

General, Instructions, Return, Tax return, General instructions

Related search queries

Instructions, General, Tax return, Return, Tangible personal property, Personal property, General instructions, Personal property tax, INSTRUCTIONS TANGIBLE PROPERTY TAX, Tangible personal property tax return, Property, IRS tax, Personal Property Tax Instructions, Personal Property Tax Return, Kentucky Tax Registration, KENTUCKY, IRS tax forms, Franchise and Excise Tax Return, Tennessee