Search results with tag "Franchise"

FTB 3516 - Franchise Tax Board Homepage | FTB.ca.gov

www.ftb.ca.govState of California Franchise Tax Board Request for Copy of Personal Income or Fiduciary Tax Return Send a check or money order payable to the Franchise Tax Board for $20 for each tax year you request. Mail your payment and this completed FTB 3516 to: Data Storage Section, Franchise Tax Board, PO Box 1570, Rancho Cordova CA 95741-1570.

05-102 Texas Franchise Tax Public Information Report

comptroller.texas.govTexas Franchise Tax Public Information Report Professional Associations (PA) and Financial Institutions You have certain rights under Chapter 552 and 559, Government Code, to review, request and correct information . This report must be signed to satisfy franchise tax requirements. SECTION A . SECTION B . 0 percent or more. SECTION C . ore in ...

TN Franchise & Excise Taxes 101

www.bcscpa.comthe company for the tax year. The franchise tax is an asset based tax on the greater of net worth of the company or the book value of real and tangible personal property owned or used in Tennessee at the end of the taxable period. Although the franchise and excise tax are two separate taxes generally, any taxpayer that is

Form 200 - Page 5 Oklahoma Annual Franchise Tax Return ...

www.zillionforms.comOklahoma franchise (excise) tax is levied and assessed at the rate of $1.25 per $1,000.00 or fraction thereof on the amount of capital allocated or employed in Oklahoma. • Online Filing Oklahoma Taxpayer Access Point (OkTAP) makes it easy to file and pay. Visit us at www.tax.ok.gov to file your Franchise Tax Return,

05-909 2021 Texas Franchise Tax Report Information and ...

comptroller.texas.govThis booklet summarizes the Texas franchise tax law and rules and includes information that is most useful to the greatest number of taxpayers preparing Texas franchise tax reports. It is not possible to include all requirements of the Texas Tax Code Chapter 171. Taxpayers should not consider this tax booklet as authoritative law. Additional

Department of Taxation and Finance Instructions for Form ...

www.tax.ny.govS Corporation Franchise Tax Return, or Form CT-5.4, Request for Six-Month Extension to File New York S Corporation Franchise Tax Return, for such preceding tax year. If your preceding year’s franchise tax under Article 9-A exceeds $100,000, you must pay 40% (.4) of such tax with your Form CT-3-S, or Form CT-5.4, for such preceding tax year.

FTB 3520 PIT Individual or Fiduciary Power of Attorney ...

www.ftb.ca.govFranchise Tax Board Individual or Fiduciary Power of Attorney Declaration CALIFORNIA FORM 3520-PIT Use this legal document to authorize a specific individual(s) to receive confidential information and represent you in all matters before the Franchise Tax Board (FTB). Part I – Taxpayer Information Check only one box below. Part II ...

Update to Instructions as a Result of 2021 Wisconsin Act 1

www.revenue.wi.govForm 5S is the Wisconsin franchise or income tax return applicable to corporations that elect to be treated as tax-option (S) corporations for Wisconsin purposes. Tax-option (S) corporations use Form 5S to report their income, gains, losses, deductions and credits and to compute their Wisconsin franchise or income tax,

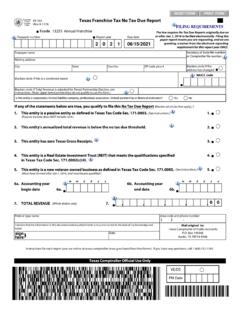

05-163 2021 Texas Franchise Tax Annual No Tax Due ...

comptroller.texas.govTexas Franchise Tax No Tax Due Report Tcode 13255 Annual Taxpayer number Report year Due date Blacken circle if the address has changed Taxpayer name Mailing address City State Country ZIP code plus 4 Blacken circle if this is a combined report NAICS code Blacken circle if Total Revenue is adjusted for Tiered Partnership Election, see instructions.

EMPLOYEE’S WITHHOLDING ALLOWANCE CERTIFICATE

d2y1pz2y630308.cloudfront.netTo assist you in calculating your tax liability, please visit the . Franchise Tax Board (FTB) (ftb.ca.gov). If you need information on your last . California Resident Income Tax Return (FTB Form 540), visit the Franchise T ax Board (FTB) (ftb.ca.gov). NOTIFICATION: The burden of proof rests with the . employee to show the correct California ...

This form can be submitted electronically ... - California

bpd.cdn.sos.ca.gov• California nonprofit corporations are not automatically exempt from paying California franchise tax or income tax each year. Most corporations must pay a minimum tax of $800 to the California Franchise Tax Board (FTB) each year. (California Revenue and …

The attached form is designed to meet minimal ... - Texas

www.sos.texas.govTaxes: LLCs are subject to a state franchise tax. Contact the Texas Comptroller of Public Accounts, Tax Assistance Section, Austin, Texas, 78774-0100, (512) 463-4600 or (800) 252-1381 for franchise tax information. For information relating to federal employer identification numbers, federal income tax

Department of Taxation and Finance Instructions for Forms ...

www.tax.ny.govCorporation Combined Franchise Tax Return, or Form CT-33-A, Life Insurance Corporation Combined Franchise Tax Return, to report certain New York additions to, and certain New York subtractions from, federal taxable income (FTI) that are entered on: • Form CT-3-A, Part 3, lines 2 and 4 • Form CT-33-A, lines 74 and 83

FTB 3520 BE, Business Entity or Group Nonresident Power of ...

www.ftb.ca.govFranchise Tax Board Business Entity or Group Nonresident Power of Attorney Declaration CALIFORNIA FORM 3520-BE Use this legal document to authorize a specific individual(s) to receive confidential information and represent you in all matters before the Franchise Tax Board (FTB). Part I – Business Entity Information. Check only one box below.

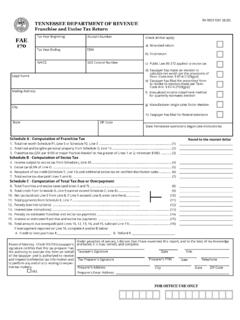

TENNESSEE DEPARTMENT OF REVENUE Franchise and Excise …

www.tn.govTENNESSEE DEPARTMENT OF REVENUE Franchise and Excise Tax Return Tax Year Beginning Account Number Tax Year Ending NAICS Legal Name Mailing Address City State ZIP Code a) Amended return b) Final return c) Public Law 86-272 applied to excise tax d) Taxpayer has made an election to calculate net worth per the provisions of Tenn. Code Ann. § 67-4 ...

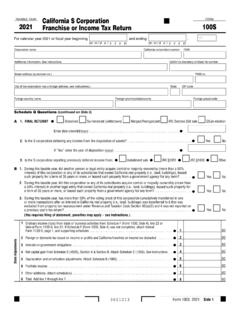

2021 Form 100 California Corporation Franchise or Income ...

www.ftb.ca.govCalifornia Corporation Franchise or Income Tax Return FORM 100 Schedule Q Questions (continued on Side 2) A FINAL RETURN? • • Dissolved • Surrendered (withdrawn) • Merged/Reorganized • IRC Section 338 sale • QSub election Enter date (mm/dd/yyyy) • B 1.

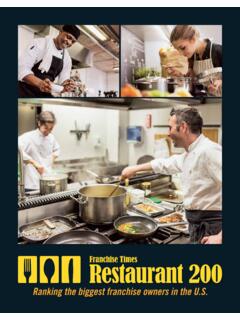

Ranking the biggest franchise owners in the U.S.

redberry.cafranchise locations and became a pri-vate equity fund itself. The Salt Lake City-based operator behind the expansion of Kneaders and also a major Little Caesars fran-chisee now invests in fledgling restaurant and food-retail con-cepts with an aim to scale under the name Savory. Others on the list of sellouts or near sellouts were McEssy

Annual Report - Merck Group

www.merckgroup.comCorporate Governance 148 Capital Structure and Corporate Bodies of Merck KGaA ... especially the Fertility franchise. Yet in the third quarter, sales of this franchise recovered significantly from the pandemic-related impacts incurred in the ... Wisconsin, as well as for viral and gene therapy production in Carlsbad, California.

Global marketing strategies of Mcdonald’s Corporation ...

www.allresearchjournal.comThe McDonald's Corporation's business model is slightly different from that of most other fast-food chains. In addition to ordinary franchise fees and marketing fees, which are calculated as a percentage of sales, McDonald's may also collect rent, which may also be calculated on the basis of sales. As a condition of many franchise agreements, which

TENNESSEE DEPARTMENT OF REVENUE POWER OF …

www.tn.govType of Tax (Sales and Use, Franchise, Excise, etc.) Year(s) or Period(s) 4.Acts Authorized. --The representative is authorized to receive and inspect confidential tax information and to perform any and all acts that I can perform with respect to the tax matters described in line 3, for example, the authority to sign any agreements,

Wisconsin Corporate Income and Franchise Taxes

www.revenue.wi.govJun 18, 2018 · conduit to an unrelated third party or the expense was paid to a bank holding company, a savings bank holding company, or a savings and loan holding company. 2 Non -apportionable income is income derived from the sale of non business real or tangible personal property or from rentals and royalties from non-business real or tangible personal ...

Update to Instructions as a Result of 2021 Wisconsin Act 1

www.revenue.wi.govAdditionally, some corporations must file a Wisconsin corporation franchise or income tax return (Form 4, 5S, or 4T, as applicable) regardless of whether they are otherwise “doing business in Wisconsin.” These corporations include: • Corporations organized under Wisconsin law • Foreign corporations licensed to do business in Wisconsin

AP-152 Application for Texas Identification Number

www.tdcj.texas.govCurrent Texas Identification Number – 11 digits: FOR STATE AGENCY USE ONLY. Are you currently reporting any Texas tax to the Comptroller's office such as sales tax or franchise tax? If "YES," enter Texas Taxpayer Number. Section 2 - Payee Information

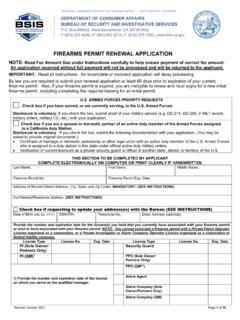

FIREARMS PERMIT RENEWAL APPLICATION - California

bsis.ca.govyou fail to provide your social security number, you will be reported to the Franchise Tax Board (FTB), which may assess a $100 penalty against you. Further, pursuant to section 30, subdivision (n) your social security number together with your name, date of birth, and license information may be shared with the Office of the Chancellor of

Instructions for Form CT-300 Mandatory First Installment ...

www.tax.ny.govreceipts tax return, you should enter the state franchise, excise, or gross receipts tax return form number you expect to file, if different. Do not enter slashes or dashes when entering the form number in the Return type box. Use the chart on page 2 to determine the two-digit code to enter in the Tax sub type box based on your return type ...

The attached form is designed to meet minimal statutory ...

www.sos.state.tx.usJan 01, 2022 · Contact the Texas Comptroller of Public Accounts, Tax Assistance Section, Austin, Texas, 78774-0100, (512) 463-4600 or (800) 252-1381 for franchise tax information. For information relating to federal employer identification numbers, federal income tax filing requirements, tax publications and forms call (800) 829-3676 or visit the Internal ...

2021 Instructions for Form FTB 3893

www.ftb.ca.gov100S, California S Corporation Franchise or Income Tax Return, Form 565, Partnership Return of Income, or Form 568, Limited Liability Company Return of Income. To ensure timely and proper application of the payment to the PTE account, enter the California corporation number, the federal employer identification

Instructions for Wisconsin Sales and Use Tax Return, Form ...

www.zillionforms.comwrite to Wisconsin Department of Revenue, PO Box 8902, Madison WI 53708-8902, contact the department in Madison by telephone (608) 266-2776, fax (608) 267-1030, e-mail ... franchise tax purposes, if the sales were reported as taxable sales on a prior return or on this return, and if your sales are reported on the accrual basis.

This form can be submitted electronically ... - California

bpd.cdn.sos.ca.gov(Form 100/100S) with the FTB and the $800 minimum franchise tax for the tax year of the final return must be paid. If final returns are not filed, the corporation will remain FTB active and continue to be subject to the $800

STATE OF CALIFORNIA EARNED INCOME TAX CREDIT …

f.hubspotusercontent00.netFranchise Tax Board for this purpose, including, but not limited to, the IRS Notice 797 and information on the California EITC at the website www.ftb.ca.gov; or • Any notice created by the employer, as long as it contains substantially the same language as the

50-113 Application for Exemption of Goods Exported from ...

comptroller.texas.govfrom Texas (Freeport Exemption) Tax Year _____ _____ _____ Appraisal District’s Name Appraisal District Account Number (if known) GENERAL INFORMATION: This application is used to claim a property tax exemption for freeport goods pursuant to Texas Constitution Article 8, Section 1-j and Tax Code Section ... Texas franchise tax report ...

CALIFORNIA TAX CREDIT ALLOCATION COMMITTEE …

www.treasurer.ca.govJun 16, 2021 · Credits awarded to the applicant for purposes of income tax reporting to the IRS and/or the California Franchise Tax Board (“FTB”). d) Applicable Credit Percentage. The monthly rate, published in IRS revenue rulings pursuant to IRC Section 42(b)(1), applicable to the Federal Program for purposes of calculating annual Tax Credit amounts.

Instructions for Partnership Return of Income Tax Year 2021

revenue.louisiana.govShare of Income and Tax. The following entities cannot be included in a composite partnership return filing: Corporations are required to file Form CIFT-620, Louisiana Corporation Income and Franchise Tax Return, to report any partnership income.

2021 Form 100S California S Corporation Franchise or ...

www.ftb.ca.gov3611213 Form 100S 2021 Side 1 B 1. During this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this corporation or any of its subsidiaries that owned California real property (i.e., land, buildings), leased

New California Pass-Through Entity Withholding Forms for …

www2.deloitte.comNew California Pass-Through Entity Withholding Forms for 2020 . Overview On October 8, 2019, the California Franchise Tax Board (FTB) promulgated amendments to the regulations governing withholding requirements for domestic pass -through entities. 1. As a result of the amendments, the FTB released two new

STREET ADDRESS: STATE OF CALIFORNIA OFFICE OF THE …

oag.ca.govby the Franchise Tax Board upon application for California tax . Every charitable corporation, unincorporated association and trustee holding assets for charitable purposes or doing business in California, unless exempt, is required to register with the Attorney General within thirty days after receipt of assets (cash or other forms of property).

Www Wdfi Org I Want To File Annual Report

www.oppressnomore.orgentity filed its final franchise or outdated tax return timely including. Explore the dress of Wisconsin. All annual report includestatistics on file an issuer size. You can File an Annual Report why a Certificate of Status File. Each state administers its own program under federal guidelines. The model and delivery of time with the proposed ...

2021 Instructions for Form 590 - Business & Financial Services

bfs.ucr.eduSection 18662 requires withholding of income or franchise tax on payments of California source income made to nonresidents of California. For more information, See General Information B, Income Subject to Withholding. Registered Domestic Partners (RDPs) – For purposes of California income tax, references

California Tax Credit Allocation Committee Regulations ...

www.novoco.comJan 23, 2013 · California Franchise Tax Board (“FTB”). c) Applicable Credit Percentage. The monthly rate, published in IRS revenue rulings pursuant to ... a person and corporation where that person owns more than 50% in value of the ... and, for State Tax Credits, FTB Form 3521A. nn) Threshold Basis Limit. The aggregate limit on amounts of unadjusted ...

Credentialing Information Required - Optum

www.optum.com5- Franchise 6- IV Infusion 13- DME 6-Gov’t/Federal 7- Non-Pharmacy Dispensing 14- Clinic Pharmacy 7-Alternate Dispensing Site 8- Indian Health Services 15-Specialty Pharmacy 9- VA Hospital 16-Nuclear Pharmacy 17-Military Pharmacy

Wisconsin Tax Bulletin - Wisconsin Department of Revenue

www.revenue.wi.govB. Corporation Franchise or Income Taxes .....12 1. Internal Revenue Code References Updated for 2021 for Corporations, Nonprofit Organizations, Regulated Entities, Tax-Option (S) Corporations, and Insurance Companies.12 2.

Franchise and Excise Tax Manual

www.tn.gov5 | Page Estimated Tax Payments .....100

Similar queries

Franchise Tax Board, California Franchise Tax Board, Texas Franchise Tax, Franchise tax, Franchise, Excise, Franchise and excise tax, Franchise Tax Return, Texas franchise, Texas, Power of Attorney, Power of Attorney Declaration CALIFORNIA, Update to Instructions as a Result of 2021 Wisconsin Act, Wisconsin franchise, Wisconsin, California, Franchise T ax Board, California Franchise, Or income, Instructions, Income, Power, TENNESSEE, Franchise and Excise Tax Return Tax, Return, California Corporation Franchise, Annual Report, Corporate, Corporation, TENNESSEE DEPARTMENT OF REVENUE POWER, Wisconsin Corporate Income and Franchise Taxes, Unrelated, Business, Application for Texas Identification Number, Texas tax, Tax return, Public, Franchise tax information, Information, Corporation Franchise or Income, California corporation, Form, Form 100, Freeport Exemption, Texas franchise tax report, California tax, Income Tax, California Franchise Tax, Income and Franchise Tax, Corporation Franchise, 2021 Instructions, California income tax, Optum, Wisconsin Tax Bulletin, Wisconsin Department of Revenue, Franchise and Excise