Search results with tag "Unrelated"

Publication 598 (Rev. March 2021) - IRS tax forms

www.irs.govThis publication covers the rules for the tax on unrelated business income of exempt organ-izations. It explains: 1. Which organizations are subject to the tax (chapter 1), 2. What the requirements are for filing a tax return (chapter 2), 3. What an unrelated trade or business is (chapter 3), and 4. How to figure unrelated business taxable

D. ROYALTIES - IRS tax forms

www.irs.govMar 31, 1988 · Under IRC 511 a tax is imposed on the unrelated business taxable income of most exempt organizations. The term "unrelated business taxable income" is defined in IRC 512(a)(1) as the gross income derived by any organization from any unrelated trade or business regularly carried on by it, less directly connected deductions.

R. TAXATION OF PASSIVE INCOME AS UNRELATED …

www.irs.govunrelated business taxable income if the controlled organization were exempt. This is accomplished by multiplying a fraction times the pertinent income item. If the controlled organization is exempt from taxation, the numerator of the fraction is unrelated business taxable income. Reg. 1.512(b)-1(k)(2)(i).

Codes for Unrelated Business Activity - IRS tax forms

www.irs.govCodes for Unrelated Business Activity (If engaged in more than one unrelated business activity, select up to two codes for the principal activities. ... 551111 Offices of bank holding companies 551112 Offices of other holding companies 453000 Miscellaneous store retailers Code 524114 Direct health and medical insurance carriers

N. IRC 514 - UNRELATED DEBT-FINANCED INCOME

www.irs.govMay 07, 2001 · "unrelated debt-financed income" from investment property in proportion to the debt acquired in purchasing it. Property purchased with borrowed money (an "acquisition indebtedness") and held to produce investment income is called "debt financed property." Basically, due to the provisions of IRC 512(b)(4), IRC 514

CIFT-620 (1/19) Department of Revenue • Page 21 GENERAL ...

revenue.louisiana.govorganization that has income from an unrelated trade or business and files Federal Form 990-T with the Internal Revenue Service is subject to file and report its Louisiana-sourced unrelated business income to Louisiana. Louisiana Administrative Code (LAC) 61:I.1140 and Revenue Information Bulletin 09-009

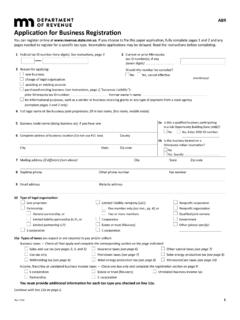

ABR, Application for Business Registration

www.revenue.state.mn.usIncome, franchise or unrelated business income taxes — Check one box only and complete the registration section on page 9: S corporation Estate or trust (fiduciary) Unrelated business income tax Partnership C corporation You must provide additional information for each tax type you checked on line 11a. Continue with line 11b on page 2.

2020 Corporate Income Tax Forms and Instruction Booklet ...

ksrevenue.govHowever, a corporation that is subject to the tax on unrelated business income by the IRC, who files a Form 990T, is also subject to the tax on unrelated business income for Kansas purposes and must file on Kansas Form K-120. In addition to the corporations exempt from federal income tax, there shall also be exempt for Kansas income tax

2020 Iowa Corporation Income Tax Instructions

tax.iowa.govunrelated business income on federal form 990-T must file on or before the 15th day of the fifth month following the end of the tax period. If the nonprofit corporation has no unrelated business income, even if filing a form 990- T to claim the small business health care tax credit, no Iowa return or copy of the

How to lose your 501(c)(3) tax-exempt status (without ...

www.irs.govunrelated business income (UBI), annual reporting obligation, and operation in accordance with stated exempt purpose(s). 1. Private Benefit/Inurement . Private benefit: A 501(c)(3) organization’s activities should be directed toward some exempt purpose. Its activities should not serve the private interests, or private benefit, of any ...

and Thefts Disasters, - IRS tax forms

www.irs.govwould otherwise include in income until Decem-ber 31, 2026. You may also be able to perma- ... or exchange with an unrelated person and dur-ing the 180-day period beginning on the date ... 4797 Sales of Business Property. See How To Get Tax Help near the end of this publication for information about getting publi-

Form 990-W Estimated Tax on Unrelated Business Taxable …

www.irs.govTax-exempt corporations, tax-exempt trusts, and domestic private foundations subject to tax under section 511, as well as domestic private foundations subject to tax under section 4940, must make estimated tax payments if the total estimated tax for the tax year (Form 990-W, line 10a) is $500 or more.

Form MO-1120 Instructions - Missouri Department of Revenue

dor.mo.govfrom federal income tax. The preceding sentence shall notexempt apply to unrelated business taxable income and other income on which Chapter 1 of the Internal Revenue Code imposes the federal income tax or any other tax measured by income; Note: Any corporation filing a Federal Form 990, 990EZ, 990N, or

2020 NET PROFIT INCOME TAX FORM 27 INSTRUCTION …

service.ritaohio.comHowever, should a nonprofit have unrelated business income, saidnonprofit is required to file a municipal return and pay tax thereon. Extensions of Time to File. A federal extension extends the municipal due date to the fifteenth day of the tenth month after the last day of the taxable year to which the return relates. ...

Chapter 02 Business Ethics - testallbank.com

testallbank.comA) Ethics is unrelated to the law because ethics answers only moral questions. B) The law establishes ethical rules and boundaries, because laws take …

Instructions for C and S Corporation Income Tax Returns

dor.sc.govunrelated business income Which form do I use? † SC1120 - C Corporation † SC1120S - S Corporation † SC1101B - Bank † SC1104 - Savings & Loan Association Taxpayers filing a federal 1120-F, 1120-H, 1120-POL, 1120-REIT, or similar variation of the federal 1120 should file the

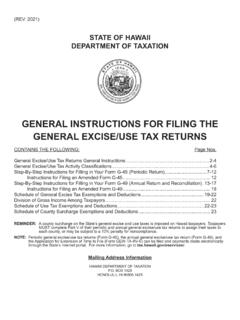

GENERAL INSTRUCTIONS FOR FILING THE GENERAL …

files.hawaii.govThe GET is a privilege tax imposed on business activity in the State of Hawaii. The tax is imposed on the gross income received by the person en-gaging in the business activity. The GET applies ... silent auctions) and activities unrelated to the organization’s exempt purpose are taxable activities. See Tax Facts Nos. 98-3 and 99-4 for more ...

Wisconsin Corporate Income and Franchise Taxes

www.revenue.wi.govJun 18, 2018 · conduit to an unrelated third party or the expense was paid to a bank holding company, a savings bank holding company, or a savings and loan holding company. 2 Non -apportionable income is income derived from the sale of non business real or tangible personal property or from rentals and royalties from non-business real or tangible personal ...

Forms and Instructions

otr.cfo.dc.govgranted an exemption by the DC Office of Tax and Revenue (OTR). If you are an exempt organization with unrelated business income, as defined in the Internal Revenue Code (IRC) §512, you must file a Form D-20, by the 15th day of the fifth month after the end of your tax year. You are required to pay at least the minimum tax even if

2019 Instructions for Form 1120 - Internal Revenue Service

www.irs.govThe Internal Revenue Service is a proud partner with the National Center for Missing & Exploited Children® (NCMEC). ... Estimated Tax Payments. Interest and Penalties. Accounting Methods. ... with unrelated trade or business income 990-T Religious or apostolic organization exempt under section 501(d) 1065

2020 Minnesota Corporation Franchise Tax

www.revenue.state.mn.usExempt organizations file Form M4NP, Unrelated Business Income Tax Return. ... If the Internal Revenue Service (IRS) grants an extension of time to file your federal return that is longer than the Minnesota automatic seven- ... If, during the 12 months ending June 30 of the tax year, you paid $10,000 or more in estimated tax payments, you are ...

Wisconsin Tax Bulletin

www.revenue.wi.govo Section 302 relating to unrelated business taxable income • Section 2 of P.L. 116-98 relating to cash contributions for the relief of the families of the dead or wounded victims of the mass shooting in Virginia Beach, VA

Similar queries

IRS tax forms, Tax on unrelated business income, Unrelated, Business, Unrelated business, Income, Codes for Unrelated Business Activity, Codes, Bank, Unrelated debt-financed income, Debt, Revenue, Internal Revenue Service, Unrelated business income, ABR, Application for Business Registration, Income tax, Tax on Unrelated Business, Missouri, Unrelated business taxable income, Internal Revenue, INCOME TAX FORM 27 INSTRUCTION, Instructions, Wisconsin Corporate Income and Franchise Taxes, Estimated tax, Business income, Unrelated Business Income Tax, Wisconsin Tax Bulletin