Search results with tag "Taxable"

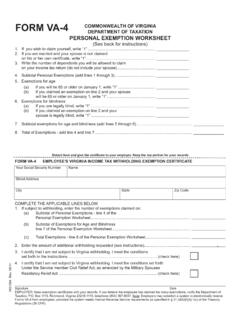

DEPARTMENT OF TAXATION PERSONAL EXEMPTION …

www.tax.virginia.govTaxable Years 2005, 2006 and 2007 Taxable Years 2008 and 2009 Taxable Years 2010 and 2011 Taxable Years 2012 and Beyond ... Virginia source income is from salaries and wages and such salaries and wages are subject to income taxation by your state of domicile. Line 4. Under the Servicemember Civil Relief Act, as amended by the Military Spouses ...

2022 Personal Property Summary - Kansas Department of …

ksrevenue.govHow does the county appraiser discover taxable personal property? The owners of taxable personal property are required by law to list their property each year with the county appraiser. When the owner does not list taxable property, the appraiser must discover the property and place it on the appraisal roll. Methods the

26 CFR 601.602: Tax forms and instructions. 6651, 6652 ...

www.irs.gov.01 Tax Rate Tables . For taxable years beginning in 2020, the tax rate tables under § 1 are as follows: TABLE 1 - Section 1(j)(2)(A) - Married Individuals Filing Joint Returns and Surviving . Spouses . If Taxable Income Is : The Tax Is: Not over $19,750 10% of the taxable income . Over $19,750 but $1,975 plus 12% of

TAX TABLES For Taxable Years Beginning After December …

files.hawaii.govPage 1 TAX TABLES For Taxable Years Beginning After December 31, 2017 Tax Table Must Be Used By Persons With Taxable Income Of Less Than $100,000

What Does My Pay Stub Mean? - South Dakota

ujs.sd.govDental – Dental Plan for employee and covered dependents. Accident – Accident Insurance Plan (taxable). Hosp Ind – Hospital Indemnity Plan (taxable). AFLAC – Voluntary payroll deduction. Additional benefits major medical doesn’t cover. Reliastar – Long Term Care (taxable). MedSpend – Medical Reimbursements.

In general. taxpayers of up to 20 percent of the taxpayer ...

www.irs.govThis revenue procedure applies to taxable years ending after December 31, 2017. Alternatively, taxpayers and RPEs may rely on the safe harbor set forth in Notice 2019-07, 2019-09 IRB 740, for the 2018 taxable year. The contemporaneous records requirement will not apply to taxable years beginning prior to January 1, 2020.

The business personal property tax in Connecticut

www.cga.ct.govSep 29, 2014 · As of the 2013 assessment year, taxable business personal property made up just over five percent of total taxable property within the state. The tax revenue generated by this base totals over $590 million each year. Even though the aggregate value of taxable personal property has increased every year (except for

Explanatory Notes on

ec.europa.eu4) Supplies of services by taxable persons not established within the EU or by taxable persons established within the EU but not in the Member State of consumption to non-taxable persons (final consumers). More explanations on transactions covered by point 1 can be found in chapter 4 of these Explanatory Notes.

INCOME AND DEDUCTIBLE ITEMS, SUMMARY CHART

www.michigan.gov• Y100% taxable (in excess of $300 for THR and HHI) • Installment winners of Michigan lottery who won prior to 12-30-88 Y Y ; N . Y ; Y Y . Lump sum distribution included in 10-year averaging (for individuals born before 1936) N N Y Y Medicare payments N N N N Military wages or retirements • NCombat pay not excluded from taxable on federal

2021 Publication 525 - IRS tax forms

www.irs.govder section 125(i) on voluntary employee salary reductions for contributions to health FSAs is $2,750. Department of the Treasury Internal Revenue Service Publication 525 Cat. No. 15047D Taxable and Nontaxable Income For use in preparing 2021 Returns Get forms and other information faster and easier at: •IRS.gov (English) •IRS.gov/Spanish ...

Quarterly Contribution Return and Report of Wages (DE 9)

souzaandassociates.comMar 09, 2017 · SDI Taxable Wages - Enter the total SDI taxable wages for the quarter. (Do not include exempt wages; refer to the DE 44 for details.) F3. Multiply F1 by the amount entered in F2 and enter this calculated amount in F3. ITEM G. California Personal Income Tax (PIT) Withheld - Enter total California PIT withheld during the quarter. NOTE:

Temporary Disability Insurance Program

www.nj.govEffective January 1, 2018, each worker contributes .19% of the taxable wage base. For 2018 the taxable wage base is $33,700 and the maximum yearly deduction for Temporary Disability Insurance is $64.03. Although the rates may vary, employers must also pay contributions on the first $33,700 in wages paid to each worker in 2018.

How to calculate Corporate Activity Tax (CAT)

www.oregon.gova. For tax years beginning on or after January 1, 2020 and ending before January 1, 2021, 80 percent of the tax for the tax year. ... • July 31. • October 31. • January 31. ... corresponding months in each of the three preceding taxable years bears to the taxable commercial activity for the three preceding years.

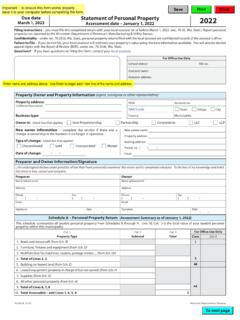

2022 PA-003 Statement of Personal Property

www.revenue.wi.govBusiness type: Property address: (if different from above) FEIN Account no. NAICS code CountyMunicipality TownVillageCity Schedule A – Personal Property Return (Assessment Summary as of January 1, 2022) This schedule summarizes all taxable personal property from Schedules B through H. Line 10, Col. 3 is the total value of your taxable personal

Arizona Form A-4

roadahead.arizona.eduWhat are my “Gross Taxable Wages”? For withholding purposes, your “gross taxable wages” are the wages that will generally be in box 1 of your federal Form W-2. It is your gross wages less any pretax deductions, such as your share of health insurance premiums. New Employees Complete this form within the first five days of your employment

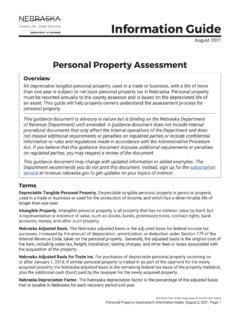

Information Guide - Nebraska

revenue.nebraska.govPersonal property returns filed on or after July 1 will be subject to a penalty of 25% of the tax due on the value added. Each year, all individuals or entities that own or lease taxable personal property in Nebraska must list all taxable tangible personal property with tax situs in Nebraska on the personal property return.

Tax Tables B-D - Taxable Pay Tables Manual Method

assets.publishing.service.gov.ukThroughout these tables, ‘taxable pay’ means any amount of pay after you have used the Pay Adjustment Tables, Tables A and entered the amount in column 5 of the RT11. To use Tables A you need to know the: • employee’s tax code • tax week/month number covering the date of payment – see the charts on page 3

AUPE General Support Services

www.albertahealthservices.cadate of disability. This benefit is taxable when received. Long Term Disability: This 75% employer paid plan will provide you with 66 2/3% of your regular salary for non-occupational illness or injury, payable after 24 weeks of disability. This benefit is taxable when received until age 65 maximum. LTD benefits continue after two years only if you

Property Tax Guide for Georgia Citizens

georgiadata.orgReal property is taxable in the county where the land is located, and personal property is taxable in the county where the owner maintains a permanent legal residence unless otherwise provided by law. (O.C.G.A. 48-5-11) For most counties, taxes are due by December 20, but this may vary from county to county. If taxes are not collected

Modified Adjusted Gross Income under the ACA

laborcenter.berkeley.eduUnder the Affordable Care Act, ... • Taxable interest • Taxable amount of pension, annuity or IRA distributions and Social Security benefits4 • Business income, farm income, capital gain, other gains (or loss) • Unemployment compensation • Ordinary dividends

50-141 General Real Property Rendition of Taxable Property

comptroller.texas.govGeneral Real Property Rendition of Taxable Property Form 50-141 CONFIDENTIAL. Tax Year _____ _____ _____ Appraisal District’s Name Appraisal District Account Number (if known) GENERAL INFORMATION: This form is for use in rendering for taxation real property owned or managed and controlled as a fiduciary on Jan. 1 of the year for which the ...

2016 540 California Resident Income Tax Return

www.ftb.ca.govTAXABLE YEAR 2016 California Resident Income Tax Return FORM 540 Fiscal year filers only: Enter month of year end: month_____ year 2017. Your first name. Initial. Last name. Suffix. Your SSN or ITIN. If joint tax return, spouse’s/RDP’s first name. Initial. Last name. Suffix. Spouse’s/RDP’s SSN or ITIN. Additional information (see ...

Your Guide to Unemployment Benefits - Colorado

cdle.colorado.govsteps to help you become employed. To find out what programs and training services may be available to ... Your unemployment benefits are taxable by both the federal and state governments. You can decide to have ... If you worked in or have wages in more than one state, you may choose to use these wages on your Colorado .

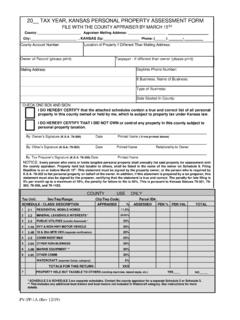

20 TAX YEAR, KANSAS PERSONAL PROPERTY ASSESSMENT …

ksrevenue.govExempt entities must also list taxable personal property belonging to others. Refer to Schedule 5 for applicable exemptions. Watercraft is defined as any boat or vessel designed to be propelled by machinery, oars, paddles, or wind action upon a sail for navigation on the water. Each watercraft may include one trailer and any nonelectric motor ...

2016 Form 568 Limited Liability Company Tax Booklet

www.ftb.ca.govPayments and Credits Applied to Use Tax – For taxable years beginning on or after January 1, 2015, if an LLC includes use tax on its income tax return, payments and credits will be applied to use tax irst, then towards franchise or income tax, …

Mauritius Highlights 2020 - Deloitte

www2.deloitte.comTax year – The calendar year ending on 31 December or the accounting year, which may not exceed 12 months, may be used. ... years starting on or after 1 July 2018. The CbC reports are due 12 months after the end of the relevant ... Taxable transactions – VAT is levied on the supply of goods and the provision of services.

2643 -Misouri Tax Registration Application

dor.mo.gov11. Retail Sales Tax License cannot be issued without a taxable begin date. If you are a seasonal business, check the months in which you will make sales. We will only require you to file a return in the months you check. 14. Filing Frequency: Your filing frequency is determined by the amount of state sales tax due.

PERSONAL PROPERTY FREQUENTLY ASKED QUESTIONS …

www.mass.govApr 01, 2019 · A good explanation of what personal property is taxable based on the form of ownership (individual, partnership, unincorporated entity or corporation) may be found in Part 3 of the personal property return, known as the Form of List or State Tax Form 2. 7. Is personal property in the nature of construction works in progress (“CWIP”) or not in

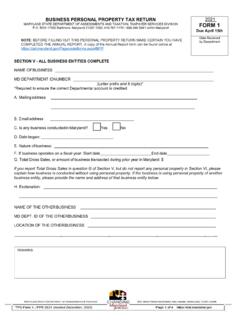

BUSINESS PERSONAL PROPERTY TAX RETURN 2021

dat.maryland.govBUSINESS PERSONAL PROPERTY TAX RETURN MARYLAND STATE DEPARTMENT OF ASSESSMENTS AND TAXATION, TAXPAYER SERVICES DIVISION P.O. BOX 17052 Baltimore, Maryland 21297-1052; 410-767-1170 • 888-246-5941 within Maryland ... If the property is located in a taxable jurisdiction, a detailed schedule by depreciation category should be …

Changes to UK VAT rules - FedEx | System Down

www.fedex.comunique EORI number and should sign up for CDS to access their statement. The representative group member will have to collate the statements to complete the VAT return. • Non-established taxable persons don’t need a Unique Taxpayer Reference to sign- up for CDS. • C79 Import certificates will still be produced if PVA is not

2021 KENT COUNTY CERTIFIED PROPERTY TAX RATES (PER …

www.accesskent.com(per $1000 of taxable value) k-12 schools. college intermediate schools twp/cities/villages authorities county total gu & state code public school name by assessing unit state education tax non- homestead tax commercial personal millage extra voted millages bulding & site debt grcc allocated operating voted special ed/ ...

Income Tax

www.sars.gov.zaincluded in X’s taxable income for the years of assessment ending on 28 February 2015 and subsequent years. A natural person who emigrates from South Africa to another country will cease to be a resident as from the date of emigrating. …

Form RRB-1099 Tax Statement General Information

www.rrb.govTo determine your taxable amount, follow the Instructions for Form 1040and/or Form 1040A Booklet(s), and/or IRS Pub. 939, General Rule for Pensions and Annuities. The totals reported on your Form RRB-1099 may not equal the total amount of SSEB payments you actually received during the tax year indicated.

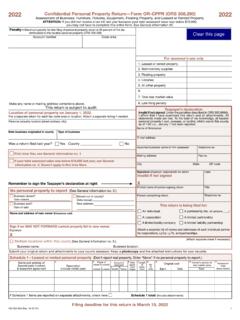

2022 Confidential Personal Property Return—Form OR-CPPR ...

www.oregon.gov2022 Confidential Personal Property Return—Form OR-CPPR (ORS 308.290) 2022 Penalty—Maximum penalty for late filing of personal property return is 50 percent of the tax attributable to the taxable personal property (ORS 308.296). Account number Code area Make any name or mailing address corrections above. This return is subject to audit.

GST PRACTITIONER ELIGIBILITY, REGISTRATION & …

icmai.inFORM GST PCT 03 Notice seeking additional information on application for enrolment or show cause notice FORM GST PCT 04 Order of rejection of application for enrolment or disqualification of a GST practitioner found guilty of misconduct FORM GST PCT 05 Authorisation/ withdrawal of authorisation to engage a GST practitioner by a taxable person.

Philippines Highlights 2021 - Deloitte

www2.deloitte.com: Philippine corporations generally are taxed at a rate of 25% as from 1 July 2020 (reduced from 30%), except for corporations with net taxable income not exceeding PHP 5 million and with total assets not exceeding PHP 100 million, which are taxed at a rate of 20%. The rate for ROHQs is 10% until 31 December 2021; thereafter, ROHQs will be taxed at

2021-22 OSAP Student Income Verification: Canadian Non ...

osap.gov.on.ca2021-22 OSAP Student Income Verification: Canadian Non-Taxable and/or Foreign Income Purpose Deadline This form and all required documents must be received no later than 12 months after the start of your 2021-22 study period. If the income information cannot be verified, Ontario Student Grant funding you

Did You Receive Unemployment Benefits? - IRS tax forms

www.irs.govUnemployment benefits are taxable. Unemployment benefits must be reported on your federal tax return. A record number of Americans are applying for unemployment compensation due to the COVID-19 . Outbreak. If you received unemployment benefits, as well as the additional $600 per

FUND FACTS - RBC Select Balanced Portfolio - Series A

funds.rbcgam.comJun 30, 2021 · Date series started: December 31, 1986 Total value of the fund on May 31, 2021: $46,142.2 Million ... you'll have to include in your taxable income any money you make on ... The following tables show the fees and expenses you could pay …

2018 I-111 Form 1 Instructions - Wisconsin Income Tax

www.revenue.wi.govOn Friday, December 14, 2018, Governor Scott Walker signed . 2017 Wisconsin Act 368. The law allows tax-option (S) corporations to elect to be taxed at the entity level effective for taxable years beginning on or after January 1, 2018. As a result of the new law, tax-option (S) corporations may now elect to be taxed at the entity level

tax.utah.gov TC-62S Sales and Use Tax Return

d2l2jhoszs7d12.cloudfront.netamount of taxable sales reported on this line by the tax rate for food and food ingredients provided on this line. Line 10 Determine any credit for sales of electricity, heat, gas, ... must contain a value, if applicable. _____ If you need an accommodation under the Americans with Disabili-ties Act, email taxada@utah.gov, or call 801-297-3811 ...

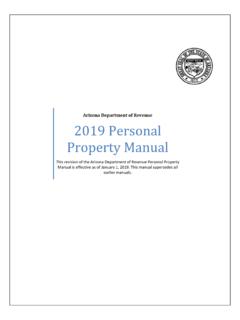

Manual Business Personal Property - AZDOR

azdor.govBusiness Personal Property Manual Introduction Introduction Arizona law provides authority for the identification, classification, valuation, and assessment of taxable personal property. These duties are administered jointly by the Department and the 15 county assessors. This publication contains information to assist

TAXABLE YEAR 2016 California Resident Income Tax …

www.efile.comPersonal Income Tax Booklet 2016 . Page 9. 2016 Instructions for Form 540 — California Resident Income Tax Return. References in these instructions are to the Internal Revenue Code (IRC) as of

Similar queries

Taxable, Virginia, Wages, Personal Property Summary, Taxable personal property, Property, Taxable property, Tables, For taxable years beginning, TABLES For Taxable Years Beginning After December, TABLES For Taxable Years Beginning After December 31, 2017, Employee, Benefits, General, Revenue procedure, Taxable year, Business personal property, Taxable business personal property, Taxable persons, Established, Taxable persons established, Michigan, IRS tax forms, Voluntary, Taxable and Nontaxable Income, Taxable wages, Years, Ending, July 31, Taxable years, Statement of Personal Property, Business, Personal Property, Taxable personal, Taxable Pay Tables Manual Method, Property Tax, Modified Adjusted Gross Income under, Under, Rendition of Taxable, 2016, California Resident Income Tax, TAXABLE YEAR 2016 California Resident Income Tax, Year, Become, 568 Limited Liability Company Tax Booklet, Income tax, July, Changes to UK VAT rules, FedEx, Number, Established taxable persons, Taxable value, 1099 Tax Statement General Information, General Rule, GST PRACTITIONER ELIGIBILITY, REGISTRATION &, Philippines Highlights 2021, OSAP Student Income Verification: Canadian Non, OSAP Student Income Verification: Canadian Non-Taxable, Income, Student, Unemployment benefits, Unemployment, RBC Select Balanced, December, After, Value, Personal Income, California Resident Income Tax Return