Search results with tag "Resident"

Department of Taxation and Finance Instructions for Form IT …

www.tax.ny.govpart‑year Yonkers resident income tax surcharge and Form IT-360.1 to compute your part‑year New York City resident tax or part‑year Yonkers resident income tax surcharge How to file Submit Forms IT‑360.1 and Y‑203, if applicable, with either your resident return, Form IT‑201, or your nonresident and part‑year resident return, Form ...

New Jersey Resident Return NJ-1040 - State

www.state.nj.usyour NJ tax return, and file it online. Any resident (or part-year resident) can use it to file their 2019 NJ-1040 for free. NJ E-File You can file your Form NJ-1040 for 2019 using NJ E-File, whether you are a full-year resident or a part-year resident. Use tax software you purchase, go to an online tax preparation website, or have a tax preparer

2021 M1NR, Nonresidents/Part-Year Residents

www.revenue.state.mn.usSee Income Tax Fact Sheets 1, Residency; 2, Part-Year Residents; and 3, Nonresidents, to determine your residency status for Minnesota tax purposes. If you are married and file a joint federal return, you must file a joint Minnesota return even if …

CLGS-32-1 (10-20) TAXPAYER ANNUAL LOCAL EARNED …

www.bensalempa.govResident PSD Code: Taxpayers are required to provide a Resident PSD (political subdivision) Code identifying where the taxpayer resided during the year. Keystone’s e-file will automatically include the PSD Code when filing online. Keystone includes your Resident PSD Code on your pre-printed tax form.

Tax Facts 97-4, Form N-15: Nonresident and Part-Year ...

files.hawaii.govAND PART-YEAR RESIDENT RETURN This issue of Tax Facts is devoted to answering questions about Form N-15. 1 Why do we have Form N-15? Form N-15 is filed by nonresident individuals who have Hawaii tax liability and by individuals who …

Rising Utility Costs and the Impact on Residents of ...

content.govdelivery.comMar 03, 2022 · residents of Multifamily-assisted properties who are responsible for paying for some or all the household’s utility bills. What is the data? The U.S. Department of Energy forecasts a three-year high in 2022 for average residential costs across the U.S.i What should owners/agents do? Owners of Multifamily-assisted properties for which HUD

This document has been archived. Please information on the ...

www.health.pa.gov• Residents with confirmed SARS-CoV-2 infection who have not met criteria for discontinuation of Transmission-Based Precautions as per PA-HAN-554 should be placed in isolation in the designated COVID Care Unit, regardless of vaccination status. • Residents who meet the criteria as fully vaccinated, or residents within 90 days of a

COVID-19 outbreaks in Australian residential aged care ...

www.health.gov.auJan 28, 2022 · 16,042 deaths at residential in care homes (or 49per cent). • 57 per cent of all aged care homes in Canada have had reported cases of COVID-19 in residents or staff (compared to 73per cent in Australia).

Form CT-1040NR/PY 2021 Connecticut Nonresident and …

portal.ct.govConnecticut Nonresident and Part-Year Resident Income Tax Return 2021 CT-1040NR/PY 2 Clip check here. Do not use staples. Do not send Forms W-2 or 1099, or Schedules CT K-1. Enter spouse’s name here and SSN below. 1 Print your SSN, name, mailing address, and city or town here. Department of Revenue Services State of Connecticut (Rev. 12/21)

Form CT-W4 Effective January 1, 2022

media.icims.comincome from Schedule 1 of Form CT-1040, Connecticut Resident Income Tax Return or Form CT-1040NR/PY, Connecticut Nonresident and Part‑Year Resident Income Tax Return. Filing Status Generally, the filing status you expect to report on your Connecticut income tax return is the same as the filing status you expect to report on your

Part III (Also: Part I, §§911; 1.911-2.) SECTION 1. PURPOSE

www.irs.govresident of, or was present in, a foreign country if the individual left the country during a period for which the Secretary of the Treasury , after consultation with the Secretary of ... and-resident-aliens-abroad; or consult the section under the heading . How to Get Tax Help. at the same web address. SECTION 6. DRAFTING INFORMATION

West Virginia Division of Natural Resources Resident ...

terradevwvstorage.blob.core.windows.netapplicant, to whom the license is to be issued, has been either a domiciled resident of West Virginia for the past thirty days, and that he/she is not more than six months in arrears on child support obligations as defined in WV Code 48-15, or is …

Admission Guidelines for Publicly Funded Continuing Care ...

albertahealthservices.caMay have varying levels of dementia but are behaviourally stable May require unscheduled reassurance Minimal risk for elopement but may wander, is easily redirected Social behaviour of resident does not induce fear and anxiety in other residents in this supportive living setting Minimal risk of self-harm or harm to others Functional Status:

2021 Form 760PY - Virginia Part-Year Resident Income Tax ...

www.tax.virginia.govVirginia Part-Year Resident Income Tax Return Due May 1, 2022 Form *VA760P121888* 760PY Page 1 Your Birth Date (mm-dd-yyyy) Spouse’s Birth Date (mm-dd-yyyy) B Spouse Filing Status 4 ONLY A You Include Spouse if Filing Status 2 Complete the Schedule of Income first and submit it with your Form 760PY. 00 00

2021 Virginia Form 760PY, Part-Year Resident Individual ...

www.tax.virginia.govVirginia Form 760PY Part-Year Resident Individual Income Tax Instructions Va. Dept. of Taxation 2614092 Rev. 03/22 u Please file electronically! u Filing on paper means waiting longer for your refund. Due to COVID-19 protocols, it will likely take longer than in previous years for a paper return to make its way through the system.

PREVIEW FORM - Indonesia

www.australiaawardsindonesia.orgapplication system might experience significant traffic increase closer to the closing time. ... or permanent resident status, at any stage of the application, selection, mobilization processes or ... be able to satisfy the admission requirements of the Australian university at which the Scholarship is to be undertaken.

Withholding Taxes Regime in Pakistan

www.icap.org.pkRegime in Pakistan. SEQUENCE OF PRESENTATION 1. What are Withholding Taxes 2. Why do we need Withholding Taxes 3. Withholding Taxes in the modern world 4. ... non-resident 15% of the gross amount for filers. WITHHOLDING TAX RATES SECTION WITHHOLDING AGENT Rate 153(1)(a) sales of goods Every Prescribed Person (section

4466 years of covering South Beltyears of covering South Belt

www.southbeltleader.comresidents/homeowners are invited to attend. The meetings take place the fi rst Tuesday of each month. Dobie AFJROTC sells BBQ The Dobie High School AFJROTC will hold a barbecue sandwich fundraiser Saturday, Feb. 26, at the area high school, located at 10220 Blackhawk, from noon until food is sold out. Cost is $10. Parys Burks-Henderson

EQUALITY DIVERSITY AND INCLUSION STRATEGY 2022-2026

www.wwl.nhs.ukThe number of residents in the Wigan Borough aged 65 and over is projected to increase to 24.9% by 2037. (ONS, 2013) The age of patients accessing hospital services is bias towards the older population, reflecting greater healthcare needs. Dementia is projected to rise – one in six people aged over 80 years have dementia. (Alzheimer’s Society)

RECRUTEMENT DES RESIDENTS POUR L’ESPAGNE Rentrée …

recrutement.aefe.frEn raison du calendrier de la campagne de recrutement, les candidats exerçant dans l’hémisphère sud sont autorisés à envoyer leur dossier sans la signature de leur chef d’établissement. Ambassade de France en Espagne SCAC - Pôle scolaire Recrutement 2022 Calle Marqués de la Ensenada, 10 28004 MADRID ESPAGNE

Long-Term Care Regulations Frequently Asked Questions …

www.champlainhealthline.caAn assessment of the client’s functional capacity, requirements for personal care, current behaviour and behaviour during the previous year is made by a Case Manager if the client is in the community or by a LTCH health care professional if the client already resides in a LTCH. The Resident Assessment Instrument (RAI) is the tool used

Senior Citizen Homestead Exemption--2020

www.kanecountyassessments.orgresident of a facility licensed under the Illinois Nursing Home Care Act or Illinois MR/DD Community Care Act, then the ex-emption shall continue so long as the residence continues to be occupied by the qualifying person’s spouse, or if the residence remains unoccupied but is still owned by the person qualified for the homestead exemption.

The Mobile Home Buyer’s & Resident’s Handbook

www.michigan.govConstruction Codes. The mailing address for the Bureau of Construction Codes is P.O. Box 30254, Lansing, MI 48909, and the telephone number is 517/241-9317. The Act establishes standards for construction of new communities and additions to existing communities, certificates of m obile home ownership ( titling), and business practices of the various

2017 Form 760 Resident Individual Income Tax Booklet

www.tax.virginia.govto conform to the Disaster Tax Relief and Airport and Airway Extension Act of 2017, as well as most provisions of the Tax Cuts and Jobs Act (TCJA) and the Bipartisan Budget Act of 2018 that are effective for Taxable Year 2017. However, there is an exception for the TCJA provision related to the medical expenses deduction.

2021 Form OR-40, Oregon Individual Income Tax Return for ...

www.oregon.govOregon Individual Income Tax Return for Full-year Residents. 00462101020000 / / / / / / 2021 Form OR-40 Page 2 of 8 150-101-040 (Rev. 08-23-21, ver. 01) • Use UPPERCASE letters. • Use blue or black ink. • Print actual size (100%). • Don’t submit photocopies or use staples.

TRANSITION REPORT

mayor.clevelandohio.govWelcome Letter from the Mayor 4-5 Co-Chairs & Managers 6-9 12-21 Economic Development ... and quality of life for Cleveland residents. MEMBERS Paul Clark, Co-Chair April Miller Boise Millie Caraballo Jade Davis ... Storefront renovation programs should incentivize new businesses to open as well as attract, retain, and support locally-owned ...

AIRFAX COUNTY REDEVELOPMENT AND HOUSING …

www.fairfaxcounty.govNOTIFICATION, DOCUMENTATION, CONFIDENTIALITY Exhibit 16-1: Your Violence Against Women Act (VAWA) Rights ... Exhibit 16-2: Sample Notice to Housing Choice Voucher Owners and Managers Regarding the Violence Against Women Act (VAWA) Housing Choice Voucher Aministrative Plan Cover and Table of Contents ... RAD PBV RESIDENT RIGHTS AND …

ORANGE COUNTY CODE ENFORCEMENT

www.orangecountyfl.netIf you have a homeowners association, invite the area . officer by calling 3-1-1. Once the residents and the area officer are in communication, a relationship can be formed. Maintaining that relationship is the best way to keep clean, orderly neighborhoods. I am a business owner. Code Enforcement . recently issued me a violation notice because

TACO BELL FOUNDATION 2022 LIVE MÁS SCHOLARSHIP …

www.tacobellfoundation.org• A legal resident of the 50 United States and the District of olumbia (“D..”), who is at least 16 ... addresses or under multiple identities will not be eligible for selection and forfeits any and all compensation provided, in Sponsor's sole discretion. Should multiple users of the same e …

2020 Maryland Medical Assistance Program Professional ...

health.maryland.gov“Assistant surgeon” means a second physician, physician assistant, nurse or nurse practitioner who actively assists the primary surgeon during a surgical procedure. “Attending physician” means a physician, other than a house officer, resident, intern, or emergency room physician, directly responsible for the patient's care.

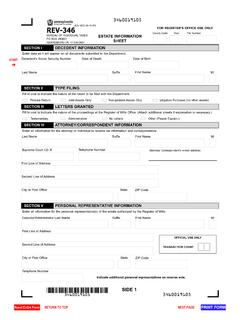

Instructions for REV-346 - Pennsylvania Department of Revenue

www.revenue.pa.govcounty of which the decedent was a resident at death. Please be aware the correspondent identified will receive. all correspondence from the department. It is the responsi-bility of the personal representative to notify the department . if the correspondent contact information changes. The department is authorized by law, 42 U.S.C. §405

PAGE 1 OF 1 DOCUMENT CHECKLIST - Canada

www.canada.caConfirmation of Permanent Residence (IMM 5292 or IMM 5688). If this document is no longer in your possession, provide an explanation letter and see section "Step 1. Gather Documents" in the instruction guide. Photocopy of both sides. of your Permanent Resident Card (PRC) if you have one. If this document is no longer in your possession, provide an

i

assets.publishing.service.gov.ukordinarily resident broadly means living lawfully in the UK on a properly settled basis for the time being. In most cases, nati onals of countries outside the European Economic Area must also have the status of ‘indefnite leave to remain’ in the UK.

ACGME Resident/Fellow Survey Content Areas

www.acgme.orgEducational Content • Instruction on scientific inquiry principals • Opportunities for research participation • Taught about health care disparities • Education in assessing patient goals • Instruction on maintaining physical and emotional well-being • Instruction on minimizing effects of sleep deprivation

Mayor BUREAU OF EXAMINATIONS NOTICE OF EXAMINATION

www1.nyc.govWHAT THE JOB INVOLVES: Assistant Resident Buildings Superintendents, under general supervision, supervise the operation and ... (This is a brief description of what you might do in this position and does not include all the duties of this ... Note, below) for the title of Supervisor of Housing Caretakers, Heating Plant Technician (Housing ...

DAILY WORK REPORT - New York State Department of ...

www.dot.ny.govresident engineer. murk 1 reverse (06/08) equipment own./operators. masons carpenters. ironworkers truck drivers. equip. operator laborer. foreperson classification. op 1 op 2. op 3 op 4. type id # op 1 op 2. op 3 op 4 . labor op 1: op 2: op 3: op 4: created date:

Form CT-W4P 2022 - Connecticut

portal.ct.govForm CT-W4P. 2022 WithholdingCertificate for Pension or Annuity Payments New withholding requirement: Effective January 1, 2018, a payer must withhold Connecticut income tax from taxable pension or annuity payments made to a Connecticut resident. You must complete this form for payments made on or after January 1, 2018,

2) Chapter 2: ACH Payment Processing ACH Payment …

www.fiscal.treasury.gov2-4 A Guide to Federal Government ACH Payments 2. ACH Payment Processing Green Book New Depository Institutions Because the FOMF is updated on a monthly basis, a new depository institution may not receive ... • Where a federal payment is disbursed to a resident of a nursing facility, as defined in 42 U.S.C. 1396r, the payment may be deposited ...

Resident or Nonresident Alien Decision Chart - IRS tax forms

apps.irs.govDetermine residency status for federal income tax purposes. step Were you a lawful permanent resident of the United States (had a 1 “green card”) at any time during the current tax year? YES – RESIDENT Alien for U.S. tax purposes ¹, ² NO – Go to Step 2 step Were you physically present in the United States on at least 31

Residential Care/Assisted Living Compendium: Illinois - ASPE

aspe.hhs.govSupportive living facilities may serve residents age 22 or older who have been screened and determined to meet Department-defined eligibility criteria. Applicants must have their name checked against the sex offender registry data base. Residents may be discharged if they are a danger to self or others or have needs that the facility cannot meet.

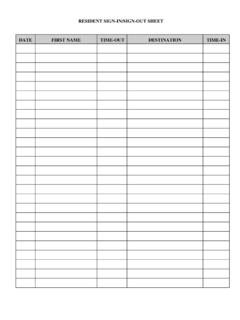

RESIDENT SIGN-IN/SIGN-OUT SHEET DATE FIRST NAME …

www.thesheepfold.orgTIME-IN . Title: Microsoft Word - resident sign-in sign-out sheet.doc Author: Jeremy Hendrickson Created Date: 9/13/2008 2:31:54 AM ...

Similar queries

Form, Year, Resident income tax, Resident tax, Resident return, Form IT‑201, YEAR RESIDENT RETURN, Jersey Resident Return, State, Return, RESIDENT, Year Residents, Resident PSD Code, Resident PSD, Code, PSD Code, Hawaii, Residents, Care, Connecticut Nonresident and, Connecticut Nonresident and Part-Year Resident Income, Connecticut, Income, Connecticut Resident Income, Connecticut Nonresident and Part‑Year Resident Income, Connecticut income, Aliens, Abroad, Virginia Division of Natural Resources Resident, Admission Guidelines for Publicly Funded Continuing, Dementia, Virginia, Experience, Admission, Regime, Homeowners, Alzheimer, Recrutement, RESIDENTS POUR L’ESPAGNE Rentrée, De recrutement, Term Care Regulations Frequently Asked Questions, Assessment, Resident Assessment Instrument, Facility, Construction, Form 760 Resident Individual Income Tax Booklet, The Tax Cuts and Jobs Act, Welcome, NOTIFICATION, Sample, Notice, Selection, Assistant, Decedent, DOCUMENT CHECKLIST, Permanent, Permanent Resident, ACGME Resident/Fellow Survey Content Areas, Educational, Effects, Description, Title, Supervisor, 2: ACH Payment Processing ACH Payment, Payments 2. ACH Payment Processing, IRS tax forms, Residency, Assisted Living, ASPE, Applicants, RESIDENT SIGN-IN/SIGN-OUT, Date, TIME, Resident sign-in sign-out