Search results with tag "Cuts"

TARIFF SCHEDULE OF THE UNITED STATES HTSUS Canada …

ustr.gov02013002 High-qual. beef cuts, boneless, processed, fresh or chld., descr in gen. note 15 of the HTS 0 0 02013004 Bovine meat cuts (except high-qual. beef cuts), boneless, processed, fresh or chld., descr in gen. note 15 of the HTS 0 0 02013006 Bovine meat cuts, boneless, not processed, fresh or chld., descr in gen. note 15 of the HTS 0 0

U.S. 301 Lists - all lists combined

www.strtrade.com0202.30.06 Bovine meat cuts, boneless, not processed, frozen, descr in gen. note 15 of the HTS List 4A +7.5% Final 2/14/2020 0202.30.10 High-qual. beef cuts, boneless, processed, frozen, descr in add. US note 3 to Ch. 2 List 4A +7.5% Final 2/14/2020 0202.30.30 Bovine meat cuts (except high-qual. beef cuts), boneless, processed, frozen, descr in ...

National Daily Boxed Beef Cutout And Boxed Beef Cuts ...

mymarketnews.ams.usda.govMar 25, 2022 · National Boxed Beef Cuts - Negotiated Sales FOB Plant basis negotiated sales for delivery within 0-21 day period. Prior days sales after 1:30pm are included. Choice Cuts, Fat Limitations 1-6 (IM) = Individual Muscle IMPS/FL Sub-Primal # of Trades Total Pounds Price Range Weighted Average 109E 1 Rib, ribeye, lip-on, bn-in 21 181,389 698.00 - 806 ...

National Daily Boxed Beef Cutout And Boxed Beef Cuts ...

www.ams.usda.govNational Boxed Beef Cuts - Negotiated Sales FOB Plant basis negotiated sales for delivery within 0-21 day period. Prior days sales after 1:30pm are included. Choice Cuts, Fat Limitations 1-6 (IM) = Individual Muscle IMPS/FL Sub-Primal # of Trades Total Pounds Price Range Weighted Average 109E 1 Rib, ribeye, lip-on, bn-in 9 32,429 773.00 - 845 ...

USDA Nutrient Data Set for Retail Beef Cuts

www.ars.usda.govbeef supply according to the National Quality Beef Audit – 1998 (Boleman, S.L. et al., 1998). All carcasses were shipped to Texas A&M University for fabrication of the following retail cuts: arm roast, bottom round roast, bottom round steak, brisket – flat half, eye of round roast, flank

National Weekly Cutter Cow Cutout And Boxed Cow Beef Cuts ...

www.ams.usda.govBased on negotiated prices and volume of cow cuts delivered within 0-21 days and on average industry cutting yields. Values reflect U.S. dollars per 100 pounds. Cutter 90% 350#/up Current Cutout Value: 220.87 Change from prior day: -1.94 Item Price Value Change 90% lean 275.12 153.63 (1.15) 100% lean inside round 364.23 8.45 (0.11)

National Weekly Boxed Beef Cuts For Prime Product ...

www.ams.usda.govMaximum Average Fat Thickness Maximum Fat at any point 1. 3/4" (19mm) 1.0" 2. 1/4" (6mm) 1/2" 3. 1/8" (3mm) 1/4" ... National Weekly Boxed Beef Cuts For Prime Product - Negotiated Sales Email us with accessibility issues regarding this report. Title: XB456 Created Date:

Beef yield guide - .NET Framework

projectblue.blob.core.windows.netBeef carcase to primal cuts – yield information The information in this brochure is based on a 303kg carcase (side weight 151.5kg) , Classification R4H (after 2 weeks maturation). Therefore, the weights/percentages of cuts are intended to act as a guide only, as butchery techniques, carcase weights and types may vary from one business to another.

Publication 5307 (Rev. 6-2020) - IRS tax forms

www.irs.govOverview of the Tax Cuts and Jobs Act . Major tax reform that affects both individuals and businesses was enacted in December 2017. It’s commonly referred to as the Tax Cuts and Jobs Act, TCJA or tax reform. Most of the changes in this legislation were effective in 2018 and affect tax year 2018 and beyond.

National Weekly Boxed Beef Cuts For Ungraded Product ...

www.ams.usda.govNational Weekly Boxed Beef Cuts For Ungraded Product - Negotiated Sales Email us with accessibility issues regarding this report. 171B 3 Round, outside round 15 42,731 266.41 - 296.81 277.48 171C 3 Round, eye of round - 174 3 Loin, short loin, 0x1 7 4,101 476.33 - 565.00 527.94

BEEF PRODUCTION SYSTEM GUIDELINES - Teagasc

www.teagasc.iethe beef cuts look less appealing and eating quality is reduced. Poorly fleshed young bulls are more likely to produce dark-cutting beef. • Strongest demand is for animals of up to approximately 400 kg carcase weight, which will produce steak cuts of the preferred size for most customers.

National Weekly Boxed Beef Cutout And Boxed Beef Cuts ...

www.ams.usda.govNational Weekly Boxed Beef Cutout And Boxed Beef Cuts - Negotiated Sales Email us with accessibility issues regarding this report. 169 5 Round, top inside, denuded 8 8,295 319.00 - 383.00 331.31 169A 5 Round, top inside, cap off 3 15,857 413.63 - 465.00 426.39

PAKISTAN CUSTOMS TARIFF 2020-21 PCT CODE …

download1.fbr.gov.pk0203.2200 - - Hams, shoulders and cuts thereof, with bone in 20 0203.2900 - - Other 20 02.04 Meat of sheep or goats, fresh, chilled or frozen. 0204.1000 - Carcasses and half carcasses of lamb, fresh or chilled 3 - Other meat of sheep, fresh or chilled: 0204.2100 - - Carcasses and half-carcasses 3 0204.2200 - - Other cuts with bone in 3

MMBB - 2021 Clergy Tax Return Preparation Guide for 2020 ...

www.mmbb.orgTax highlights for 2020 1. The Tax Cuts and Jobs Act of 2017 On December 22, 2017, President Donald Trump signed into law the $1.5 trillion Tax Cuts and Jobs Act of 2017. In brief, the Act amends the Internal Revenue Code to reduce tax rates and modify credits and deductions for individuals and businesses. With respect to individuals, the bill ...

Cattle and Beef Market Definitions - UT Extension

extension.tennessee.eduMiddle meats – Beef cuts from the rib and loin primals. Generally thought of as the steak cuts. Offal/variety meat – The name for internal organs and entrails of a butchered animal. Primal – The initial cut of meat from a separated carcass during butchering. Beef primals include the brisket, chuck, flank, loin, plate, rib and round.

Beef Cuts Chart - Canadian Beef | Canada Beef

canadabeef.caBEEF OXTAIL 1791 (NAMP) BRAISING I SIMMERING ROASTING REGULAR GROUND BEEF MAXIMUM FAT 3096 GROUND BEEF PATTIES 1136 (NAMP) (CMC) Information Centre No matter how you slice it, beef is a staple on menus across Canada. Above you'll find a list of the most popular cuts found in foodservice with icons indicating the best methods for cooking them.

Top 10 Inflammatory Foods To Stay Away From

www.drglenschaffer.comProcessed meat includes animal product that has been smoked, cured, salted or chemically preserved. ... and relegate red meat to a weekly treat. When you do eat red meat, remember to choose lean cuts and preferably, that of grass-fed animals. ... A prime example is boxed cereals which contain substantial amounts of added sugar and

2020 PA Corporate Net Income Tax - CT-1 Instructions (REV ...

www.revenue.pa.gov6. As amended by the Tax Cuts and Jobs Act, for tax years beginning after December 31, 2017, the 70-percent dividends-received deduc - tion is reduced to 50 percent and the 80-percent dividends-received deduction is reduced to 65 percent (Code Secs. 243(a)(1) and (c)(1). There was no change made to the 100% dividends-received

“Claiming an Education” by Adrienne Rich

net-workingworlds.weebly.comOne of the devastating weaknesses of university learning, of the store of knowledge and ... history, their ideas of social relationships, good and evil, sickness and health, etc. When you read ... "unscholarly," "group therapy," "faddism," etc., despite backlash and budget cuts, woman's studies are still growing, offering to more and more women ...

E-commerce in the World Trade Organization

www.iisd.orgCUTS International, Geneva is a non-profit NGO that catalyses the pro-trade, pro-equity voices of ... payment and the ultimate delivery of the goods or services do not have to be conducted online. An e-commerce transaction can be between enterprises, households, individuals,

Options Trading 101: The Ultimate Beginners Guide To …

optionstradingiq.comHowever, leverage cuts both ways and if the stock doesn’t move as expected, the investor could lose 100% of their investment. INCOME Using options to generate income is a popular strategy with investors. Covered calls are a logical place for stock investors to start because it is an easy scenario to understand.

2022 Budget Summary - USDA

www.usda.govThe 2022 Cuts, Consolidations, and Savings Volume of the President’s Budget identifies the lower-priority program activities per the GPRA Modernization Act. The public can access the

The Relationship Between Economic Conditions, Policing ...

cops.usdoj.govfederal analysis that examined the impact the economy has had on the law enforcement ... to make cuts in spending across the board, which includes spending on public safety. Over the last few years, many agencies have experienced ... their worth” to local policy makers in order to justify budget alloca-tions and staffing levels. All too often ...

Proposed 2021-23 Budget and Policy Highlights

ofm.wa.govbudget crisis. Acting decisively after the 2020 legislative session, the governor used his veto pen to make budget cuts that will save the state more than $440 million over three years. He directed state agencies under his authority to cancel a scheduled 3% wage increase for many government employees and begin furloughs for most state employees.

Benefits Fringe Tax Guide to Page 1 of 34 13:43 - 26-Dec ...

www.irs.govMoving expense reimbursements. P.L. 115-97, Tax Cuts and Jobs Act, suspends the exclusion for qualified moving expense reimbursements from your employee's income for tax years beginning after 2017 and before 2026. However, the exclusion is still available in the case of a member of the U.S. Armed Forces on active duty who

Guide 5 Preparing and Canning Poultry, Red Meats, and …

nchfp.uga.edujuices in today’s leaner meat cuts are usually not enough to cover most of the meat in raw packs. Hot pack—Precook meat until rare by roasting, stewing, or browning in a small amount of fat. Add 1 teaspoon of salt per quart to the jar, if desired. Fill hot jars with pieces and add boiling

An Introduction to the Low-Income Housing Tax Credit

sgp.fas.orgJan 26, 2021 · response to concerns over the effects of P.L. 115-97, commonly referred to as the Tax Cuts and Jobs Act (TCJA). The changes made by TCJA did not directly alter the LIHTC program; however, the act reduced corporate taxes, which had the …

26 CFR 601.105: Examination of returns and ... - IRS tax forms

www.irs.govof Public Law No. 115-97, 131 Stat. 2054 (2017), commonly referred to as the Tax Cuts and Jobs Act (TCJA). This revenue procedure provides rules for using optional standard mileage rates in computing the deductible costs of operating an automobile for business, charitable, medical, or moving expense purposes.

The Psychological Consequences of Sexual Trauma

vawnet.orgviolence against women face budget cuts from year to year, organizations have had to move away from grassroots models to professional models (Patricia Yancey Martin, 2005). Professional models include the use of evaluation and analytic tools and other activities related to writing proposals and managing grants and contracts. This requires knowledge

RETAIL BEEF CUTS - Certified Angus Beef

www.certifiedangusbeef.comSome photos courtesy of the National Cattlemen’s Beef Association. Visit CertifiedAngusBeef.com for cooking methods and recipe ideas. Braise. Sauté. Roast. Cooking time under 30 minutes. Ribeye Roast. Cowboy Steak. Rib Steak. Short Ribs. Back Ribs. Chef Cut Ribeye. Top Round. London Broil. Bottom Round . London Broil. Rump Roast. Round ...

The Ultimate Resistance Tubes Workout Guide - Ryher

www.ryher.comspots, or cuts. • Get a good grip by wrapping the band or tube around your hand when beginning an exercise. •If your resistance tubing has a grip, check to make sure that it is secure. • Never pull the band or tube directly toward your face. •Never tie …

LB&I Concept Unit

www.irs.govThe Tax Cuts and Jobs Act (TCJA) transitioned the United States from a primarily deferral -based international tax system to a ... system subpart F income or income subject to tax under the GILTI regime of Section 951A. A dividend otherwise eligible for a deduction under Section 245A is deductible only to the extent that it exceeds the ...

2017 Form 760 Resident Individual Income Tax Booklet

www.tax.virginia.govto conform to the Disaster Tax Relief and Airport and Airway Extension Act of 2017, as well as most provisions of the Tax Cuts and Jobs Act (TCJA) and the Bipartisan Budget Act of 2018 that are effective for Taxable Year 2017. However, there is an exception for the TCJA provision related to the medical expenses deduction.

Meat Standards Australia beef information kit

www.mla.com.authan 63,000 individual cuts. A very large database contains details of the consumer scores for each cut in conjunction with product information. This includes the animal’s breed, sex, age and growth history, detailed processing and chiller assessment data together with the individual cut and muscle, days of ageing and cooking method tested.

“Trickle Down” Theory - Hoover Institution

www.hoover.orgthe 1920s tax cuts, it was not simply that investors’ incomes rose but that ... value of these securities was almost three times the size of the federal government’s annual budget, and more than half as large as the national debt.14 In short, these were sums of money with great potential impact on the economy, depending on where they were ...

DEPARTMENT OF THE TREASURY 31 CFR Part ... - Federal …

public-inspection.federalregister.govpatterns during the pandemic.7 Facing these budget challenges, many State, local, and Tribal governments have been forced to make cuts to services or their workforces, or delay critical investments. From February to May of 2020, State, local, and Tribal governments reduced their ... Inequity and the Disproportionate Impact of COVID-19 on ...

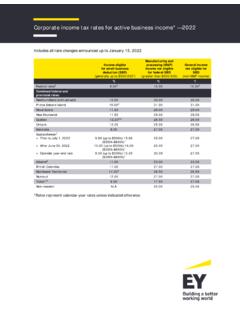

Corporate income tax rates for active business income - 2022

assets.ey.comJan 15, 2022 · As part of the 2021–22 federal budget, the federal government has ... In recognition of the impact that the COVID-19 pandemic may have ... Alberta has accelerated the tax cuts that were enacted in 2019, by reducing the province’s general corporate income tax rate from 10.00% to 8.00% effective July 1, 2020. The rate was originally

2020 Tax Brackets - Tax Foundation

files.taxfoundation.orgThe Tax Cuts and Jobs Act includes a 20 percent deduction for pass-through businesses against up to $163,300 of qualified business income for single taxpayers and $326,600 for married taxpayers filing jointly (Table 7). TABLE 7. 2020 Qualified Business Income Deduction Thresholds Filing Status Threshold Single Individuals $163,300

Prime Sirloin “Steak Tartare,” Herb Aioli, Mustard Bone ...

www.marinabaysands.comAdd To The Cuts Foie Gras Fried Organic Egg Point Reyes Blue Cheese Caramelized Shallots, Pearl & Cipollini Onions Roasted Bone Marrow, Parsley Half 400g Maine Lobster **All prices are subject to 10% service charge and 7% GST Tasting of New York Sirloin USDA Prime Illinois Corn Fed 120g American Wagyu, Snake River Farms 120g

SCHOOL LEADERS: CHALLENGING ROLES AND IMPACT …

www.oecd.orgbudget cuts, an emphasis on administration rather than leadership, and a ‘conspiracy of busyness’, that is the way time, space and communication patterns are structured. These influences result in the job of school leader being seen by potential candidates as too demanding,

SUBSTANTIATION OF BUSINESS EXPENSES

d2qo664k65t0qy.cloudfront.netcarrying on any trade or business. However, § 274(a)(1), as revised by the Tax Cuts and Jobs Act of 2017, generally disallows a deduction for any item with respect to an activity that is of a type generally considered to constitute entertainment, amusement, or recreation.

Understanding USDA Beef Quality Grades - Meat Science

meat.tamu.eduCuts most commonly consumed as USDA Prime steaks are more often ... USDA Beef carcass quality grades are determined based on two basic factors: the maturity of the animal at harvest and the amount of intramuscular fat (marbling) in the surface of the ribeye muscle as observed between the 12th and 13th ribs. The vast

THE POSITIVE ECONOMIC IMPACT OF IMMIGRATION

www.fwd.uswhich they used to purchase goods and services, stimulate local business activity, and create jobs. Proposed cuts would exclude 22 million people from the United States over the next five decades, making it the largest cut to legal immigration since the 1920s. This would have devastating effects on our economy, including a 2%

Kernel k-means, Spectral Clustering and Normalized Cuts

www.cs.utexas.eduapproach is spectral clustering algorithms, which use the eigenvectors of an affinity matrix to obtain a clustering of the data. A popular objective function used in spectral clus-tering is to minimize the normalized cut [12]. On the surface, kernel k-means and spectral clustering appear to be completely different approaches. In this pa-

The use of glass thermometers in a food service ...

www1.nyc.gov• The "First Aid Choking" poster must be posted in a visible (conspicuous) place in ... shellfish, beef, lamb and all other meats must be cooked to a minimum temperature of 140°F. • All hot foods stored in a hot holding unit must be held at 140°F or higher. ... trips, falls, cuts, lacerations, burns, muscle strains, sprains and electrocution.

2021 Tax Season Reference Guide - National Association of ...

www.natptax.comThe Tax Cuts and Jobs Act (TCJA) also added a $500 nonrefundable credit for each dependent who is not a qualifying child for purposes of the child tax credit. In other words, taxpayers can claim the $500 other dependent credit (ODC) for qualifying children age 17 or older and for qualifying relatives. Beginning with tax year 2018, no child tax ...

ALL INDIA INSTITUTE OF MEDICAL SCIENCES, New ... - …

www.aiimsexams.ac.inctus-2021 1.1 AIIMS, NEW DELHI An Act of Parliament in 1956 established the All India Institute of Medical Sciences (AIIMS, New Delhi), as an autonomous institution of national importance and defined its objectives and functions. By virtue of this Act, the Institute grants its own medical degrees and other

Similar queries

TARIFF SCHEDULE OF THE UNITED STATES, BEEF CUTS, Cuts, Beef, Boxed Beef Cutout, Weekly Boxed Beef Cuts For Prime Product, Maximum, Publication 5307, IRS tax forms, Tax Cuts and Jobs Act, Weekly Boxed Beef Cuts, National Weekly Boxed Beef Cutout, Boxed Beef Cuts, Lamb, Guide, Cattle and Beef Market Definitions, Product, Weekly, Prime, Boxed, Claiming an Education, Devastating, Social, Budget cuts, Commerce in the World Trade Organization, The ultimate, Trading 101: The Ultimate Beginners Guide To, Budget, USDA, Federal, The impact, Tax Guide, Preparing and Canning Poultry, Red, Today, Roasting, Low-Income Housing Tax, Tax Cuts, The Psychological Consequences of Sexual Trauma, S Beef, The Ultimate Resistance Tubes Workout Guide, Section, Form 760 Resident Individual Income Tax Booklet, The Tax Cuts and Jobs Act, Impact, Federal budget, 2020 Tax Brackets, SCHOOL LEADERS: CHALLENGING ROLES AND IMPACT, Stimulate, Business, Means, Spectral Clustering and Normalized Cuts, Spectral, Poster, 2021 Tax Season Reference Guide, Ctus