Year Resident Return

Found 7 free book(s)New Jersey Resident Return NJ-1040

www.nj.govPart-Year Residents. There is no part-year resident return. You may have to file both Form NJ-1040 to report income you received for the part of the year you were a resident and Form NJ-1040NR if you had income from New Jersey sources for the part of the year you were a nonresident. Which Form to File

New Jersey Resident Return NJ-1040

www.nj.govThere is no part-year resident return. You may have to file both Form NJ-1040 to report income you received for the part of the year you were a resident and Form NJ-1040NR if you had income from New Jersey sources for the part of the year you were a nonresident. Which Form to File Military personnel and their spouses/civil union partners, see ...

Tax Facts 97-4, Form N-15: Nonresident and Part-Year ...

files.hawaii.govAND PART-YEAR RESIDENT RETURN This issue of Tax Facts is devoted to answering questions about Form N-15. 1 Why do we have Form N-15? Form N-15 is filed by nonresident individuals who have Hawaii tax liability and by individuals who …

2020 Form 540NR California Nonresident or Part-Year ...

www.ftb.ca.govCheck here if this is an AMENDED return. California Nonresident or Part-Year Resident Income Tax Return Fiscal year filers only: Enter month of year end: month_____ year 2021. 1 Single 2 3 Married/RDP filing jointly. See inst. Married/RDP filing separately. 4 Head of household (with qualifying person). See instructions. 5 Qualifying widow(er).

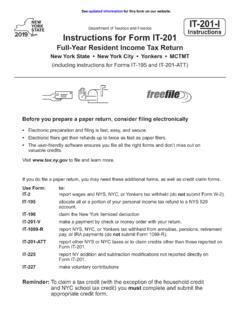

Full-Year Resident Income Tax Return

www.tax.ny.govFull-Year Resident Income Tax Return New York State • New York CityYonkers •• MCTMT (including instructions for Forms IT-195 and IT-201-ATT) Before you prepare a paper return, consider filing electronically • Electronic preparation and filing is fast, easy, and secure. • Electronic filers get their refunds up to twice as fast as paper ...

2021 Form OR-40-P, Oregon Individual Income Tax Return for ...

www.oregon.govOregon resident dates: Oregon Individual Income Tax Return for Part-year Residents Employment exception Military. 00612101020000 / / / / / / 2021 Form OR-40-P Page 2 of 11 150-101-055 (Rev. 08-23-21, ver. 01) • Use UPPERCASE letters. • Use blue or black ink. • Print actual size (100%). • Don’t submit photocopies or use staples.

Form IT-201 Resident Income Tax Return Tax Year 2021

www.tax.ny.gov57 Part-year Yonkers resident income tax surcharge (Form IT-360.1) 57 .00 IT-201 (2021) Page 3 of 4 58 Total New York City and Yonkers taxes / surcharges and MCTMT (add lines 54 …