Search results with tag "Decedent"

Personal Representatives Handbook - Florida Courts

www.17th.flcourts.org1. DECEDENT'S ESTATE The deceased person is referred to as the "decedent." Under the law, a legal proceeding known as "probate" usually is required to settle and dispose of a decedent's estate. The court proceedings are carried out in the probate court of the county of decedent's domicile at the time of death.

2020 I-030 Wisconsin Schedule CC, Request for a Closing ...

www.revenue.wi.govESTATES ONLY – Decedent’s last name Decedent’s first name TRUSTS ONLY – Legal name Individual or firm to whom the closing certificate should be mailed. Address Decedent’s social security number Estate’s/Trust’s federal EIN County of jurisdiction (Name Only) City. M.I. Probate case number Date of decedent’s death (MM DD YYYY) PART I

Form ET-85 New York State Estate Tax Certification Revised ...

www.tax.ny.govowner of property, the decedent’s next of kin, or any person having an interest in the estate who has a thorough knowledge of the decedent’s assets. The term executor includes executrix, administrator, administratrix, or personal representative of the decedent’s estate. Note: If an executor has not been appointed,

Non-Resident Inheritance Tax Frequently Asked Questions

www.state.nj.us10. The decedent’s estate is greater than $675,000. Can I file Form L -9 NR? 11. The decedent’s estate passes pursuant to a trust agreement. C an I file Form L9-NR? 12. If the decedent was a non-resident, do I need to file a New Jersey Estate Tax Return? 13. Do I file both Form L-9 NR and Form IT-NR for a non-resident? 14.

Application for Burial Allowance - New York City

www1.nyc.govlawsuit or settlement No Yes $ Does the Public Administrator have any of the decedent’s property or assets? No Yes ... decedent or the parent or legal guardian of a decedent who is under the age of 21 twenty- ... Total Cost of Funeral Expenses: $ (Total amount on the bill or contract) Specify the cost of the following:

DE-120(P) PROOF OF PERSONAL SERVICE OF NOTICE OF …

www.courts.ca.govJul 01, 2005 · DE-120(P) [New July 1, 2005] Page 1 of 1 . PROOF OF PERSONAL SERVICE OF NOTICE OF HEARING—DECEDENT'S ESTATE OR TRUST (Probate—Decedents' Estates) PROOF OF PERSONAL SERVICE OF NOTICE OF HEARING—DECEDENT'S ESTATE OR TRUST. I am over the age of 18 and not a party to this cause. I served the attached . Notice of …

Checklist for Opening Estate Formal Administration Intestate

www.jud11.flcourts.orgChecklist for Opening Estate Formal Administration ... For instance, if the Decedent has been dead for less than two years, proof of publication must be submitted. ... Decedent’s social security number, Decedent’s date of death, and county and …

SCHEDULE G INHERITANCE TAX RETURN INTER-VIVOS …

www.revenue.pa.govtheir relationship to the decedent and the date of the transfer. NOTE: When reporting real estate, include a copy of. the deed. VALUE AT DATE OF DEATH . The taxable amount is the value of the asset as of the date. of death. % OF DECEDENT’S INTERSET . Report the percent of the decedent’s interest that is subject. to tax. EXCLUSION

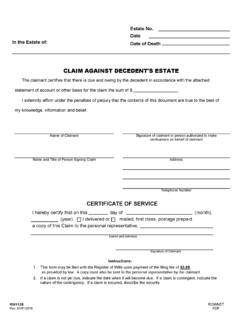

CLAIM AGAINST DECEDENT'S ESTATE - Maryland

registers.maryland.govJan 01, 2016 · CLAIM AGAINST DECEDENT'S ESTATE The claimant certifies that there is due and owing by the decedent in accordance with the attached statement of account or other basis for the claim the sum of $ . Name of Claimant Signature of claimant or person authorized to make verifications on behalf of claimant Name and Title of Person Signing Claim Address

COMPLETING YOUR ORDER FOR PROBATE, LETTERS AND …

www.courts.ca.gov0 The last will of the decedent named above having been proved, the court appoints (name): a. / executor. b. 0 administrator with will annexed 2. 1 The court appoints (name): a, administrator of the decedent's estate. b. 0 special administrator of decedent's estate (1) 1 with the special powers specified in the Order for Probate.

DESCRIPTION OF PROPERTY DECEDENT’S (IF APPLICABLE) …

www.revenue.pa.govinclude the name of the transferee, the relationship to decedent. decedent’s. and the date of transfer. attach a copy of the deed for real estate. last 4 digits. exclusion. of account id. date of death. value of asset % of. interest. taxable. value. total (also enter on line 7, recapitulation) $ 1. (if applicable) (ex+) mod 03-19 (fi ...

ACCOUNT FOR DECEDENT'S ESTATE - Judiciary of Virginia

www.vacourts.govform cc-1680 (master, page one of two) 07/18 . account for decedent’s estate. court file no. ..... commonwealth of virginia

NJ Transfer Inheritance and Estate Tax

www.nj.govmedical expenses, and other expenses incident to the injury. Any amount which is recovered in excess of these expenses is considered to be exempt from the tax. 4. The proceeds of any contract of insurance insuring the life of a resident or nonresident decedent paid or payable, by reason of the death of such decedent, to one or more named

Estate Tax Waivers

www.tax.ny.govtransferring title to the real property of a nonresident decedent. The surrogate’s court determines the authenticity (probate) of the decedent’s will and authorizes the person or persons named in the will as executor(s) to carry out their duties. The court also sees that estate assets are distributed in accordance with the

EXECUTOR™S CHECKLIST - Jonathan Pond

www.jonathanpond.comDone NA 25. To determine the decedent™s gross estate, ascertain all transfers to others within three years of the decedent™s death that required the filing of a gift tax return. qq

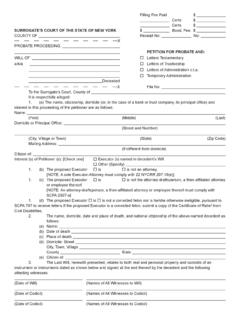

SURROGATE’S COURT OF THE STATE OF NEW YORK $ Bond, …

www.nycourts.gov10. Upon information and belief, no other petition for the probate of any will of the decedent or for letters of administration of the decedent’s estate has heretofore been filed in any court.

Chapter 28A. Administration of Decedents' Estates. § 28A …

www.ncleg.netNC General Statutes - Chapter 28A 1 Chapter 28A. Administration of Decedents' Estates. Article 1. Definitions and Other General Provisions. § 28A-1-1. Definitions. As used in this Chapter, unless the context otherwise requires, the term: (1) "Collector" means any person authorized to take possession, custody, or control

INSTRUCTIONS FOR ACCOUNT FOR DECEDENT’S ESTATE

www.vacourts.govAccount for Decedent’s Estate,” but only if all of the residual beneficiaries of the estate are also fiduciaries. See Va. Code Section 64.2-1314 and Form CC-1681 for further information.

ACCOUNT FOR DECEDENT'S ESTATE - Commissioner of …

www.henricocommissionerofaccounts.comform cc-1680 (master, page one of two) 07/18 . account for decedent’s estate. court file no. ..... commonwealth of virginia

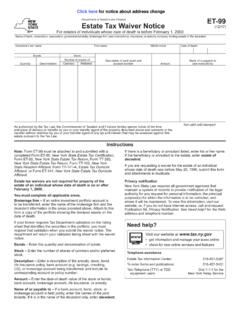

ET-99 Estate Tax Waiver Notice - Government of New York

www.tax.ny.govEstate Tax Waiver Notice ET-99 (12/17) Name of bank, corporation, association, governmental entity, brokerage firm (see instructions), insurance, or annuity company holding assets of the decedent Decedent’s last name First name Middle initial Date of death Not valid until stamped Instructions Note: Form ET-99 must be attached to and submitted ...

Title 12 Decedents’ Estates and Fiduciary Relations

delcode.delaware.govTitle 12 - Decedents’ Estates and Fiduciary Relations Page 2 Part II Wills Chapter 2 General Provisions Subchapter I Tenets and Principles § 201. Who may make a will. Any person of the age of 18 years, or upwards, of sound and disposing mind and memory, may make a will of real and personal estate.

Approved, SCAO STATE OF MICHIGAN FILE NO. LETTERS OF ...

www.courts.michigan.govlisted item must indicate the fair market value at the time of the decedent's death and the type and amount of any encumbrance. Where the decedent's date of death is on or after March 28, 2013, the lien amount will be deducted from the value of the real property for purposes of calculating the inventory fee under MCL 600.871(2).

New Jersey Tax Guide - State

www.state.nj.usForm L-9: Resident Decedent Affidavit Requesting Real Property Tax Waiver. This Form needs to be filed with the Inheritance & Estate Tax Branch to receive a Form 0-1 Waiver for real estate. Non-Resident Decedents (someone who died as a legal resident of another state or a foreign

INSTRUCTIONS FOR PRELIMINARY INVENTORY ON SIDE …

ncestateplanning.comThis part of the form is used to indicate certain property, rights and claims which are not administered by the personal representative as part of the decedent's estate and which the personal representative can not generally recover to pay debts of the decedent or claims against the estate. However,

INVENTORY FOR DECEDENT’S ESTATE COMMONWEALTH …

www.vacourts.gov[ ] On or before the date of filing this Inventory with the Commissioner of Accounts, I (we) sent a copy of it by first class mail to every person entitled to a copy, pursuant to Va. Code Section 64.21303- , who made a written request therefore. The names and addresses of the persons to whom copies were sent and the dates

CRS Self-certification Form for Individuals

www.citibank.com.hkcertain information about an account holder’s tax residence status. Please note that Citi may be legally required to report ... please update Part 2 – Country of Tax Residence and related Taxpayer Identification Number (TIN) or equivalent reflecting the ... In the case of an estate, the decedent should be identified as the Account Holder.

Kentucky Inheritance and Estate Tax Forms and Instructions

revenue.ky.govaccepted for the final settlement and closing of the administration of an estate. If inheritance tax or estate tax is due the ... (survivorship, payable on death, trust, etc.), the decedents will, or the intestate laws of this state: (1) Surviving spouse, parent (2) Child (adult or infant) child by blood, stepchild, child adopted during infancy ...

AICPA Practice Guide for Fiduciary Trust Accounting

www.paulmareducation.comApr 04, 2019 · A. Article 1 – Trustee’s Power to Adjust 35 1. Section 104 – Trustee’s Power to Adjust 35 B. Article 2 – Decedent’s Estate or Terminating Income Interest 35 1. Section 201 – Determination and Distribution of Net Income 35 2. Section 202 – Distribution to Residuary and Remainder Beneficiaries 36

1099-MISC Withholding Exemption Certificate (REV-1832)

www.revenue.pa.govof the trust agreement by a Pennsylvania resident. The trust will file a PA-41, Fiduciary Income Tax Return. See the instructions. Estate - PA Resident. I am the executor of the above-named person's estate. The decedent was a Pennsylvania resident at the time of death. The estate will . file a . PA-41, Fiduciary Income Tax Return. See the ...

The Social Security Administration's Death Master File ...

www.ssa.govness because some decedents included in both data . sources would be unmatchable as the result of inconsis tencies in the reporting of identifying information such as name, Social Security number, and date of birth (Preston and others 1996; Social Security Administration 2000b:6). Slight differences in the NCHS and DMF data sys

Form 706 (Rev. July 1999) - IRS tax forms

www.irs.gov7a Name and location of court where will was probated or estate administered 7b Case number ... 1976, other than gifts that are includible in decedent’s gross estate (section 2001(b))) 4 5 Add lines 3 and 4 5 6 Tentative tax on the amount on line 5 from Table A on page 12 of the instructions 6

2020 Form 590 Withholding Exemption Certificate - California

www.ftb.ca.govI am the executor of the above-named person’s estate or trust. The decedent was a California resident at the time of death. The estate will file a California fiduciary tax return. Nonmilitary Spouse of a Military Servicemember: I am a nonmilitary spouse of a military servicemember and I meet the Military Spouse Residency Relief Act (MSRRA)

SURROGATE S COURT OF THE STATE OF ... - Judiciary of …

www.nycourts.govVOLUNTARY ADMINISTRATION, Estate of SETTLEMENT OF ESTATE UNDER ARTICLE 13, SCPA _____, File No. _____ (as of 11/2019) Deceased. ... to pay the expenses of administration, the decedent=s reasonable funeral expenses and his/her debts in the order provided by law; and to distribute the balance to the person or persons and in the amount or ...

Voluntary Administration Checklist This Checklist is ...

www.nycourts.govEnter decedent’s name, including a/k/a’s, domicile, date of death, place of death ... Must be listed: names of all creditors, including unpaid funeral expenses, and the amount owed to each creditor. 11. Court should advise the voluntary administrator of his or her duties and that they ... • Affidavit in Relation to Settlement of Estate ...

West Virginia EstatE appraisEmEnt & nonprobatE inVEntory

kanawha.usThis booklet is furnished by the Tax Account Administration Division of the West Virginia State Tax Department for use in filing the Appraisement and Nonprobate Inventory Forms for estates and decedents dying on or after July 13, 2001. an important mEssagE For EstatE rEprEsEntatiVEs: When a person dies an estate is created. An estate includes ...

STATE OF MARYLAND REGISTER OF WILLS

registers.maryland.govESTATE OF (Decedent’s Name) ESTATE NO. W20000 Date of Death: January 1, 2008 FIRST AND FINAL ACCOUNT of (Name), Personal Representative (or Special Administrator for First or Interim Account) for the period beginning January 1, 2008 and ending September 1, 2008 USUMMARY OF TR ANSACTIONS U URECEIPTS U UDISBURSEMENTS

Checklist for Opening Estate Summary Administration Intestate

www.jud11.flcourts.orgChecklist for Opening Estate Summary Administration Intestate The below checklist may be helpful in the preparing for filing a new Summary Administration. Each case is different, so other documents may be required. For instance, if the Decedent has been dead for less than two years, a copy of all paid funeral bills must be submitted.

PROBATE CASE COVERSHEET AND CERTIFICATE OF …

www.lacourt.orgNotice – Initial Trust Filing & Notice to Creditors [3038] Petition – Special Needs Trust (Initial) [3297] ... Release of Decedent’s Remains (Initial) [3077] Petition – Spousal/Domestic Partner Property (Initial) [3179] ... I accept service and notices to be delivered to me by [ ] Email [ ] Cell Phone. Home Address: Street :

IT-NR Inheritance Tax Return Non-Resident Decedent - State

www.state.nj.usinheritance tax return is an amount, to the extent recovered, which is equal to specific expenses related to the injury. These expenses are similar to those mentioned in section a. above and include funeral expenses, hospitalization and

PROBATE COURT OF CUYAHOGA COUNTY, OHIO ANTHONY …

probate.cuyahogacounty.usestates of decedents who die before January 1, 2002. ... Applicant for a release from administration Other interested person Attorney for any of the above. Attorney Registration No. _____ PROBATE COURT OF CUYAHOGA COUNTY, OHIO …

Estate Checklist Guide ESTATE CHECKLIST & GUIDE

estateexec.comestate settlement process. 2 Estate Checklist Guide Fundamentally, it is the executor's responsibility to manage and wind down the deceased person's estate, ... funeral expenses, compensate the executor, etc. Such estates will be insolvent, ... Forward decedent’s mail to yourself Open an estate bank account Obtain an EIN for the estate Notify ...

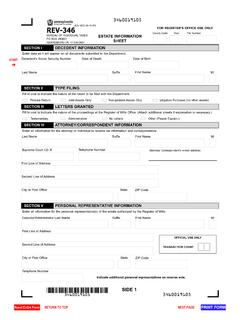

Instructions for REV-346 - Pennsylvania Department of Revenue

www.revenue.pa.govcounty of which the decedent was a resident at death. Please be aware the correspondent identified will receive. all correspondence from the department. It is the responsi-bility of the personal representative to notify the department . if the correspondent contact information changes. The department is authorized by law, 42 U.S.C. §405

Similar queries

Decedent, Of decedent, Estate, York State Estate Tax Certification, Non-Resident Inheritance Tax Frequently Asked Questions, S Estate, Burial, New York City, Settlement, Expenses, SERVICE OF NOTICE OF HEARING—DECEDENT, Publication, CLAIM AGAINST DECEDENT'S ESTATE, Account, COMPLETING YOUR ORDER FOR PROBATE, ACCOUNT FOR DECEDENT'S ESTATE, Judiciary, Account for decedent’s estate, Nonresident decedent, EXECUTOR™S CHECKLIST, Chapter 28A. Administration of Decedents' Estates, Chapter 28A 1 Chapter 28A. Administration of Decedents' Estates, Chapter, INSTRUCTIONS, Commonwealth, Estate Tax Waiver Notice, Government of New York, Decedent Decedent, Decedents’ Estates and Fiduciary Relations, State, Resident Decedent, Resident, Inventory, Administered, INVENTORY FOR DECEDENT’S ESTATE, Status, Update, Kentucky, Administration, Decedents, Fiduciary, Social Security Administration, IRS tax forms, Estate administered, California, California resident, Judiciary of, Notice, Service, Inheritance, Non-Resident Decedent, Of decedents, Estate Checklist Guide ESTATE CHECKLIST & GUIDE, Estate Checklist Guide