Search results with tag "S estate"

Personal Representatives Handbook - Florida Courts

www.17th.flcourts.orgsettle and dispose of a decedent's estate. The court proceedings are carried out in the probate court of the county of decedent's domicile at the time of death. It is necessary for the estate to be administered so that debts can be paid and valid title to assets can be transferred to those persons who are entitled to share in the estate.

Probate Guide - tncourts.gov

tncourts.govClerk’s Notice to Personal Representative ... decedent’s estate, whether testate or intestate. Although much of probate procedure is informal, it often involves a specialized vocabulary. For this reason, a glossary of terms often used in probate proceedings is included. Also attached to this guide are examples of various forms used

A Guide to Kansas Laws on Guardianship and Conservatorship

www.ksgprog.orgmanage such person’s estate, or to meet essential needs for physical health, safety or welfare, and who is in need of a guardian or a conservator, or both. 3.2 Appropriate alternative Means any program or service, or the use of a legal device or representative, which enables a person with an impairment to adequately meet essential needs for

Decedent’s Estate Administration Account CONNECTICUT ...

www.ctprobate.govThe following is a true and complete account of all assets of the decedent’s estate and the fiduciary’s receipts, payments and distributions. 2) All funeral expenses, taxes, administration expenses and all claims against the estate allowed by the fiduciary are

Wisconsin Estate Recovery Program Policy Changes Effective ...

www.dhs.wisconsin.gov• The deceased’s estate contains real estate used as part of the heir, beneficiary, or co-owner’s business, which may be, but is not limited to, a working farm, and recovery by the Department would affect the property and would result in the heir, beneficiary, or co-owner losing his or her means of a livelihood.

Non-Resident Inheritance Tax Frequently Asked Questions

www.state.nj.us10. The decedent’s estate is greater than $675,000. Can I file Form L -9 NR? 11. The decedent’s estate passes pursuant to a trust agreement. C an I file Form L9-NR? 12. If the decedent was a non-resident, do I need to file a New Jersey Estate Tax Return? 13. Do I file both Form L-9 NR and Form IT-NR for a non-resident? 14.

PROTECTIVE LIST CHECKLIST

www.supremecourt.justice.nsw.gov.auThis checklist is intended as a guide for more straight forward applications for probate. For wills made before 1 March 2008, ... Service of a notice on an incapable person’s representative does not entitle the applicant to dispense with an ... is appointed in executor B’s estate, executor C has a duty to continue the administration in the ...

INSTRUCTIONS FOR PRELIMINARY INVENTORY ON SIDE …

ncestateplanning.comThis part of the form is used to indicate certain property, rights and claims which are not administered by the personal representative as part of the decedent's estate and which the personal representative can not generally recover to pay debts of the decedent or claims against the estate. However,

AICPA Practice Guide for Fiduciary Trust Accounting

www.paulmareducation.comApr 04, 2019 · A. Article 1 – Trustee’s Power to Adjust 35 1. Section 104 – Trustee’s Power to Adjust 35 B. Article 2 – Decedent’s Estate or Terminating Income Interest 35 1. Section 201 – Determination and Distribution of Net Income 35 2. Section 202 – Distribution to Residuary and Remainder Beneficiaries 36

Extra-Statutory Concessions - GOV.UK

assets.publishing.service.gov.ukA13. Administration of estates: deficiencies of income allowed against income of another year A14. Deceased person's estate: residuary income received during the administration period A15. Dependent relative allowance A16. Annual payments (other than interest) paid out of income not brought into charge to income tax A17.

IMPORTANT: Follow instructions in filling out this form ...

www.savingsbonds.comPD F 5336 PART C – TYPE OF DISPOSITION As voluntary representative, you may request one of the following (mark the appropriate box): Payment to yourself as voluntary representative on behalf of all persons entitled to share in the decedent’s estate.

CERTIFICATION OF AUTHORITY TO TRANSFER VIRGINIA TITLE

www.dmv.virginia.govVSA 24 (01/25/2013) DO NOT USE THIS FORM IF: - an executor or administrator has been appointed for the deceased person's estate, - the vehicle is an out-of-state vehicle - the vehicle title must be transferred according to the laws of the state in

ADMINISTRATION OF DECEDENTS ESTATES - …

www.ctprobate.govThe following steps outline th e major responsibilities of the fiduciary in settling a decedent's estate. The outline is not intended to be all-inclusive and cover every

Financial Report C O N N E C T I C U T P R O B A T E C O U ...

www.ctprobate.govFinancial Report C O N N E C T I C U T P R O B A T E C O U R T S D ec ed ent s Estate PC-246 NEW 7/13 RECEIVED: Instructions: 1) A fiduciary may use this financial report instead of filing a final account for a decedent s estate unless: (a) the court h as o rdered t he f iduciary t o f ile a n account; or (b ) an account i s required under the ...

ADMINISTRATION OF A DECEDENT’S ESTATE (ADM)

www.dccourts.govJul 01, 1995 · FILING FOR THE ADMINISTRATION OF A DECEDENT’S ESTATE (ADM) IN THE DISTRICT OF COLUMBIA (VALUED AT MORE THAN $40,000) Office of the Register of Wills, Probate Division

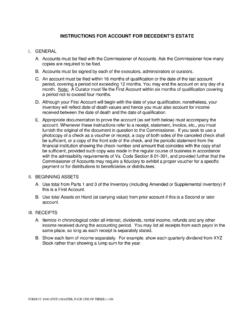

INSTRUCTIONS FOR ACCOUNT FOR DECEDENT’S ESTATE

www.courts.state.va.usFORM CC-1680 (INST) (MASTER, PAGE ONE OF THREE) 11/06 INSTRUCTIONS FOR ACCOUNT FOR DECEDENT’S ESTATE I. GENERAL A. Accounts …

Sec. 45a-106a. Fees in matters other than decedent's ...

www.ctprobate.govSec. 45a-106a. Fees in matters other than decedent's estate and fiduciary accountings. (a) The fees set forth in this section apply to each filing made in a Probate Court in any matter other than a decedent's estate. (b) The fee to file each of the following motions, petitions or applications in a Probate Court is two hundred fifty dollars:

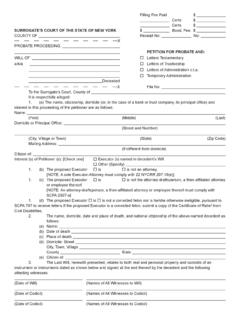

SURROGATE’S COURT OF THE STATE OF NEW YORK $ Bond, …

www.nycourts.gov10. Upon information and belief, no other petition for the probate of any will of the decedent or for letters of administration of the decedent’s estate has heretofore been filed in any court.

Similar queries

Decedent, S estate, Estate, Administered, Probate Guide, Personal Representative, Probate, Informal, Guide, Representative, Decedent’s Estate Administration Account, Account, ADMINISTRATION, Deceased, Non-Resident Inheritance Tax Frequently Asked Questions, S representative, INVENTORY, Fiduciary, Extra-Statutory Concessions, IMPORTANT: Follow instructions in filling, ADMINISTRATION OF DECEDENTS ESTATES, Outline, Financial Report C O N N E C T I C U T P R O B A T E C O U, Financial Report C O N N E C T I C U T P R O B A T E C O U R T S D ec ed ent s Estate PC, Financial report, INSTRUCTIONS FOR ACCOUNT FOR DECEDENT, S estate and fiduciary accountings