Instructions for account for decedent

Found 13 free book(s)Financial Report C O N N E C T I C U T P R O B A T E C O U ...

www.ctprobate.govInstructions: 1) A fiduciary may use this financial report instead of filing a final account for a decedent s estate unless: (a) the court h as o rdered t he f iduciary t o f ile a n account; or (b ) an account i s required under the Probate Court Rules of Procedure, section 36.3. ...

Kentucky Inheritance and Estate Tax Forms and Instructions

revenue.ky.govForms and Instructions For Dates of Death on or After January 1, 2005 (Revised February, 2018) ... 140.080* or exempt organizations pursuant to Kentucky Revised Statute 140.060** either by virtue of the decedent’s ... Account Number Tax Mo Year 92A201 (6-16) Commonwealth of Kentucky DEPARTMENT OF REVENUE

Cover Sheet/Administration CONNECTICUT PROBATE COURTS ...

www.ctprobate.govInstructions: 1) A fiduciary may use this form as a cover sheet to the fiduciary’s account for a decedent’s estate. The fiduciary must attach supporting schedules containing the detail required under Probate Court Rules of Procedure, rule 38. Report all assets at fair market value on the date of death.

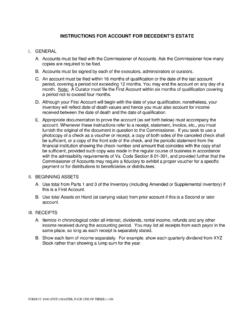

INSTRUCTIONS FOR ACCOUNT FOR DECEDENT’S ESTATE

www.courts.state.va.usINSTRUCTIONS FOR ACCOUNT FOR DECEDENT’S ESTATE I. GENERAL A. Accounts must be filed with the Commissioner of Accounts. Ask the Commissioner how many copies are required to be filed. B. Accounts must be signed by each of the executors, administrators or curators. C. An account must be filed within 16 months of qualification or the date of the ...

INSTRUCTIONS FOR INVENTORY – DECEDENT’S ESTATE …

www.courts.state.va.usor certificate will ordinarily be determined by the language on the form the decedent signed when opening the account. The decedent’s interest in a non-survivorship joint account or certificate is a part of the decedent’s probate estate and must be included on Part 1. The interests of the decedent and

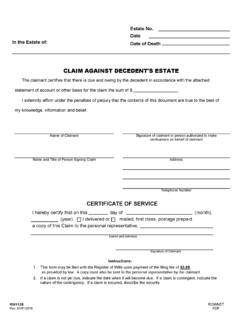

CLAIM AGAINST DECEDENT'S ESTATE - Maryland

registers.maryland.govJan 01, 2016 · CLAIM AGAINST DECEDENT'S ESTATE The claimant certifies that there is due and owing by the decedent in accordance with the attached statement of account or other basis for the claim the sum of $ . Name of Claimant Signature of claimant or person authorized to make verifications on behalf of claimant Name and Title of Person Signing Claim Address

DESCRIPTION OF PROPERTY DECEDENT’S (IF APPLICABLE) …

www.revenue.pa.govinclude the name of the transferee, the relationship to decedent. decedent’s. and the date of transfer. attach a copy of the deed for real estate. last 4 digits. exclusion. of account id. date of death. value of asset % of. interest. taxable. value. total (also enter on line 7, recapitulation) $ 1. (if applicable) (ex+) mod 03-19 (fi ...

FS Form 5336 (Revised November 2021) OMB No. 1530-0055 ...

www.treasurydirect.govestate. See the instructions for the definition of a voluntary representative. • ALL securities belonging to the decedent’s estate must be included in this transaction. • If the decedent’s securities and/or related payments are worth over $100,000 redemption and/or par value as …

Decedent’s Estate Administration Account CONNECTICUT ...

www.ctprobate.govA fiduciary may use this form to account for a decedent’s estate unless the court has ordered the fiduciary to account for income and principal separately, or Probate Court Rules of Procedure, section 38.1 requires a separate principal and income accounting. 2) Report all assets at fiduciary acquisition value unless otherwise indicated.

Instructions for Form 706-NA (Rev. September 2021)

www.irs.govinstructions. United States. The United States means the 50 states and the District of Columbia. Nonresident alien decedent. A nonresident alien decedent is a decedent who is neither domiciled in nor a citizen of the United States at the time of death. For purposes of this form, a citizen of a U.S. possession is not a U.S. citizen.

COMPLETING YOUR ORDER FOR PROBATE, LETTERS AND …

www.courts.ca.gov0 The last will of the decedent named above having been proved, the court appoints (name): a. / executor. b. 0 administrator with will annexed 2. 1 The court appoints (name): a, administrator of the decedent's estate. b. 0 special administrator of decedent's estate (1) 1 with the special powers specified in the Order for Probate.

Instructions for Form 4768 (Rev. February 2020)

www.irs.govAn executor filing Form 706 or 706-NA for a decedent's estate may file Form 4768 to apply for an extension of time to file under section 6081(a) and/or an extension of time to pay the estate tax under section 6161(a)(2). See the instructions for Form 706 or 706-NA for a definition of the term “executor.” If there is more than one executor,

2021 MI-1040 Book Instructions

www.michigan.govand will report an addition. See instructions for MI-1040, line29 on page 10 and Schedule 1, line 2 on page 12. Deduction for Wagering Losses. Ataxpayer may be eligible to deduct wagering losses claimed on their federal return as an itemized deduction. See instructions for Schedule 1, line21 on page 14 for more details.