Non Resident Decedent

Found 6 free book(s)New Jersey Tax Guide - State

www.state.nj.usForm L-9: Resident Decedent Affidavit Requesting Real Property Tax Waiver. This Form needs to be filed with the Inheritance & Estate Tax Branch to receive a Form 0-1 Waiver for real estate. Non-Resident Decedents (someone who died as a legal resident of another state or a foreign

1099-MISC Withholding Exemption Certificate (REV-1832)

www.revenue.pa.govof the trust agreement by a Pennsylvania resident. The trust will file a PA-41, Fiduciary Income Tax Return. See the instructions. Estate - PA Resident. I am the executor of the above-named person's estate. The decedent was a Pennsylvania resident at the time of death. The estate will . file a . PA-41, Fiduciary Income Tax Return. See the ...

Estate Tax Waivers

www.tax.ny.govtransferring title to the real property of a nonresident decedent. The surrogate’s court determines the authenticity (probate) of the decedent’s will and authorizes the person or persons named in the will as executor(s) to carry out their duties. The court also sees that estate assets are distributed in accordance with the

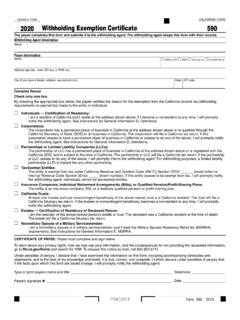

2020 Form 590 Withholding Exemption Certificate - California

www.ftb.ca.govI am the executor of the above-named person’s estate or trust. The decedent was a California resident at the time of death. The estate will file a California fiduciary tax return. Nonmilitary Spouse of a Military Servicemember: I am a nonmilitary spouse of a military servicemember and I meet the Military Spouse Residency Relief Act (MSRRA)

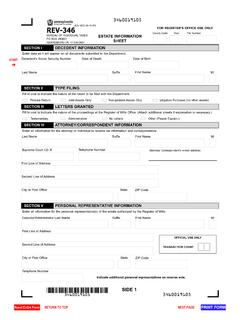

Instructions for REV-346 - Pennsylvania Department of Revenue

www.revenue.pa.govcounty of which the decedent was a resident at death. Please be aware the correspondent identified will receive. all correspondence from the department. It is the responsi-bility of the personal representative to notify the department . if the correspondent contact information changes. The department is authorized by law, 42 U.S.C. §405

2020 Form 541 California Fiduciary Income Tax Return

www.ftb.ca.gov3163203. Form 541 2020 . Side 3. Schedule B Income Distribution Deduction. Schedule G California Source Income and Deduction Apportionment. Complete …