Search results with tag "Expenses"

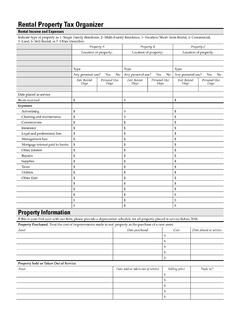

Rental Income and Expenses - Tax Happens

taxhappens.comor other real estate. Retirement. Notice from IRS or other revenue department. Divorce or separation. Self-employment. Charitable contributions of property in excess of $5,000. Commuting IRS regulations for investment expenses speci cally mention commuting expenses as being nondeductible, making the same commuting rules that apply to busi-

Tax Prep Checklist - H&R Block

www.hrblock.comAmounts of miles driven for charitable or medical purposes Expenses related to your investments Amount paid for preparation of last year’s tax return Employment-related expenses (dues, publications, tools, uniform cost and cleaning, travel) Job-hunting expenses Receipts for energy-saving home improvements Record of estimated tax payments made

Impairment-Related Work Expenses - Social Security

choosework.ssa.govExpenses paid for a guide dog or service animal that enables to you to work. This can include purchase of the animal, training, food, licenses, and veterinary services. Expenses for a non-service animal: Prosthesis. Artificial hip, artificial replacement of an arm, leg, or other part of the body: Any prosthetic device that is primarily for ...

2021 Itemized Deductions Medical Expenses

goldentax.comDependent Medical expenses paid for a dependent are deductible if the person was a dependent either at the time the ser-vices were provided or at the time the expenses were paid. For medical expense purposes, a dependent is any person for whom you can claim as a dependent, plus anyone who cannot be claimed as a dependent because of one of the ...

IRS HSA Contribution 2022 HSA Contributions Limits (Based ...

www.llnl.govThe HSA can be used to pay qualified medical, prescription, dental, and vision expenses. It can also be used to pay for qualified expenses for dependents not enrolled in a LLNS medical, dental, or vision plan if the dependent is a dependent under IRS rules (IRC Section 152). Please note that if you are enrolled in any

Form IT-216 Claim for Child and Dependent Care Credit Tax ...

www.tax.ny.govClaim for Child and Dependent Care Credit New York State • New York City Tax Law – Section 606(c) ... Note: If you are claiming expenses paid for a dependent child, include only those qualified expenses paid through the day preceding the child’s 13th birthday. 216002210094

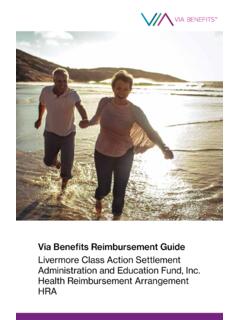

Via Benefits Reimbursement Guide

documents.viabenefits.comIf a reimbursement request is denied or not approved, the EOUE will list the reason. You may need to take action, such as providing additional supporting documentation. If you don’t have a sufficient balance in your reimbursement account, Via Benefits will reimburse as many expenses as possible. The remaining expenses

DI MINISTER FOR EDUCATION AND R INDUSTRIAL …

www.forgov.qld.gov.auexpenses or allowances during the period of the leave except in the case of illness or any other case determined by the chief executive. 9. Telephone calls, facsimiles and postage 9.1 Official telephone calls, facsimiles, etc. and postage costs are to be paid by the department concerned. 10. Incidental expenses or allowance

Day-to-Day Medical Expenses - VHI

www.vhi.ieDay-to-Day Medical Expenses Claim Form (For Text Alerts) PERFORATION. SEPTEMBER 2021 DDMENPOP22 ADULT CLAIMANTS DECLARATION - Must be completed by each adult claimant and signature provided below ... Parent/Legal Guardian Declaration - Signed when claiming for a patient under 18 years of age.

IF YOU HAD A CHECKING AND/OR SAVINGS ACCOUNT WITH …

www.nsfodsettlement.comBANA has agreed to create a Settlement Fund of $75,000,000.00 (the “Settlement Amount”). As discussed separately below, attorneys’ fees, expenses, Service Awards to the Class Representatives, and costs to administer the Settlement will be paid out of this amount.

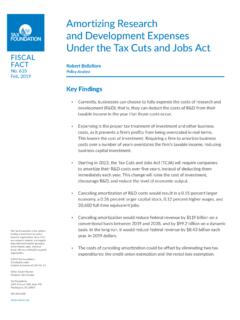

Amortizing Research and Development Expenses Under …

files.taxfoundation.orgproperty, while growing in importance, is still a relatively small share of the total capital stock. According to the Tax Foundation model, approximately 8.4 percent of the capital stock is intellectual property products. In comparison, nonresidential structures make up more than 36 percent of the U.S. capital stock.

Estate Checklist Guide ESTATE CHECKLIST & GUIDE

estateexec.comestate settlement process. 2 Estate Checklist Guide Fundamentally, it is the executor's responsibility to manage and wind down the deceased person's estate, ... funeral expenses, compensate the executor, etc. Such estates will be insolvent, ... Forward decedent’s mail to yourself Open an estate bank account Obtain an EIN for the estate Notify ...

Trade or Business Expenses Under IRC § 162 and Related ...

www.taxpayeradvocate.irs.gov., IRC § 165 (deductibility of losses), IRC § 167 (deductibility of depreciation), IRC § 183 (activities not engaged in for profit), and IRC § 1060 (special allocation rules for certain asset acquisitions, including the reporting of business asset sales when closing a business). 7. Comm’r v. Groetzinger, 480 U.S. 23, 35 (1987). 8

Psychology and Counselling Fees and Practice Requirements ...

www.sira.nsw.gov.auexpenses. Above $110 requires insurer pre-approval. Cost price including postage/freight WCO005 Providing copies of clinical notes and records Yes, provided at request of insurer] Flat fee of $60 (+GST) (inclusive of

(Schedule C) Self-Employed Business Expenses Worksheet …

sharetheharvest.comMar 09, 2018 · Business-Related Mileage: NOTE: Keep a written mileage log showing the date, miles, and business purpose for each trip. The IRS does not allow a deduction for undocumented mileage. If there are multiple vehicles, please attach a …

Eligible Expenses Guide - Premera Blue Cross

www.premera.comBreast reconstruction surgery following mastectomy Yes, to the extent that surgery was done following a mastectomy due to cancer. This is an exception to the general rules regarding cosmetic procedures. Calcium Yes, with prescription. Cane, walking Yes, if used to relieve sickness or disability.

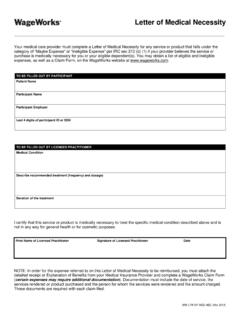

Letter of Medical Necessity - WageWorks

www.wageworks.comNOTE: In order for the expense referred to on this Letter of Medical Necessity to be reimbursed, you must attach the detailed receipt or Explanation of Benefits from your Medical Insurance Provider and complete a WageWorks Claim Form (certain expenses may require additional documentation). Documentation must include the date of service, the

HUMAN RESOURCES ACCOUNTING: CONCEPTS ... - EA Journals

www.eajournals.orgrecruiting, and training, as expenses. This treatment is like commodities such as materials or supplies, which doesn’t suit the accounting for human resources as an asset. And In an economy based on knowledge, people being knowledge holders become the most asset of an organization (Vatasoiu, et al, 2009).

Travel Allowances and Expenses for Official Local ... - PAGBA

pagba.comJan 01, 2019 · Daily Subsistence Allowance (DSA) 18 Section 14(a) DSA shall be based on the daily rates established by the International Civil Service Commission of the United Nations. If destination is not listed therein, the DSA for the nearest country shall be adopted. If city of destination is not listed therein,

Wisconsin Medicaid—Spousal Impoverishment Protection

www.dhs.wisconsin.govThey can be reduced to allowable limits if they are used to pay for nursing home or home care costs or for other things, such as home repairs or improvements, vehicle repair or replacement, clothing, or other household expenses. If excess assets are not reduced, the spouse participating in Medicaid long-term care services cannot enroll in Medicaid.

RATES FOR REIMBURSABLE EXPENSES/# - Department of …

www.publicworks.gov.za2009-08-15 R20,00 R0,55 R1,00 R0,65 R1,15 R14,00 R18,00 ... [As from 1 April 2014, the Department will pay the tariffs as published by the Department of Transport without adding any surcharge to the published rates. The rates include fuel, ... Tariff from Per 24 hour day Part of day/per hour 2014-04-01 R355,00 R14,79 2014-04-01 R103,00 R4,29

Official Gazette of the Republic of the Philippines | The ...

www.officialgazette.gov.phEXPENSES AND ALLOWANCES FOR OFFICIAL LOCAL AND FOREIGN TRAVELS OF GOVERNMENT PERSONNEL WHEREAS, under Section 72, Chapter 7, Book VI of Executive Order (EO) No. 292, otherwise known as the "Administrative Code of 1987," the rates of per diem and other allowances for official travel in the government shall be determined

GAMBLING INCOME AND EXPENSES - IRS tax forms

www.irs.govpayer may be required to withhold 28% of the proceeds for Federal income tax. However, if you did not provide your Social Security number to the payer, the amount withheld will be 31%. The full amount of your gambling winnings for the year must be reported on line 21, Form 1040. If you itemize deductions, you can deduct your gambling

Form 8825 Partnership or an S Corporation Rental Real ...

www.irs.govRental Real Estate Income and Expenses of a OMB No. 1545-1186 Form 8825 Partnership or an S Corporation Department of the Treasury Internal Revenue Service ' Attach to Form 1065 or Form 1120S. Name Employer identification number 1 Show the kind and location of each property. See page 2 for additional properties.

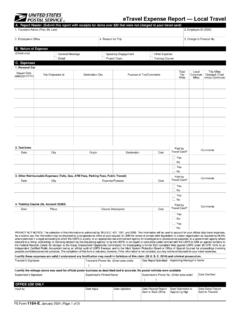

PS Form 1164-E, eTravel Expense Report — Local Travel

knowledgebase.ruralinfo.neteTravel Expense Report — Local Travel A. Report Header (Submit this report with receipts for items over $50 that were not charged to your travel card) 1. Traveler's Name (First, MI, Last) 2. Employee ID (SSN) 3. Employee's Office 4. Reason for Trip 5. Charge to Finance No. B. Nature of Expense C. Expenses (Check one) General Meetings Detail

Traffic Safety Grant Opportunities for Federal FY 2023

www.lahighwaysafety.orgFebruary 28, 2022. ... • Be eligible expenses under local, state, and federal laws/regulations. 3 ... The LHSC grants are funded in the form of sub-agreements (also referred to as contracts)reimbursable . Reimbursement of allowable expenditures is made by the LHSC on a monthly basis upon receipt of a complete

2022 BENEFITS eGUIDE

f.hubspotusercontent30.netcare expenses. To be eligible for the HSA, you cannot be covered through Medicare Part A or Part B or TRICARE programs. See the plan documents for full details. Important: Your contributions may not exceed the annual IRS limits listed below. HSA Contribution Limit 2022 Employee Only $3,650 Family (employee + 1 or more) $7,300 Catch-up (age 55 ...

2022 guidelines for health savings accounts (HSA)

www.uhc.comThe UnitedHealthcare plan with Health Savings Account (HSA) is a high deductible health plan (HDHP) that is designed to comply with IRS requirements so eligible enrollees may open a Health Savings Account (HSA) ... including but not limited to restrictions on distributions for qualified medical expenses set forth in section 213(d) of the ...

PERSONAL INCOME TAX WITHHOLDING — …

edd.ca.govPERSONAL INCOME TAX WITHHOLDING — SUPPLEMENTAL WAGE PAYMENTS, MOVING EXPENSE REIMBURSEMENT — WARN ACT PAYMENTS Supplemental Wage Payments When supplemental wages (bonuses, commissions, overtime pay, sales awards, back pay - including retroactive wage increases, reimbursement for nondeductible moving expenses, …

OVER-THE-ROAD TRUCKER EXPENSES LIST - PSTAP

www.pstap.orgdocument), you may received Form W-2, Wage and Tax Statement, for income from wages you receive as an employee. If you received a Form W-2 and the “Statutory employee” check box in Box 13 is marked, report that income on Schedule C, Profit and Loss from Business. Statutory employees include also certain agent or commission drivers.

Get your money faster. How to Submit Claims

webdocs.asiflex.comdependent care expenses are not for overnight camps, lessons, or classes to learn a specific skill or sport, or for educational sessions or classes. I understand that I am fully responsible for the accuracy of all information relating to this claim, and that unless an expense for which reimbursement is claimed is a proper expense under the Plan, I

Vehicle Registration and Insurance

www.novascotia.cathe expenses of a collision should one occur. A collision may or may not be your fault, but securing financial responsibility eases the unforeseen difficulties of managing the repairs, fines, towing, injuries, and mishaps associated with motor vehicle collisions. Vehicle Registration and Insurance 173 7 Accessible Parking Permit

2021 County of San Diego Employee Benefits Guide

www.sandiegocounty.govSep 11, 2020 · for eligible employees and their dependents. You enroll in the benefits you want and waive ... • Any amounts over the Flex Credits is your out-of-pocket expense. *Based on 24 pay periods in the year/twice monthly deductions. ... Health Savings Account (HSA)1 Health Reimbursement Account (HRA)2 Health Care Flexible Spending Account (HCFSA)

FARM BUSINESS PLAN WORKSHEET Projected/Actual …

forms.sc.egov.usda.govA - INCOME Form Approved - OMB No. 0560-0238 U.S. DEPARTMENT OF AGRICULTURE Farm Service Agency 1. Name FARM BUSINESS PLAN WORKSHEET. Projected/Actual Income and Expense. FSA-2038 (12-31-07) This form is available electronically. 2. For Production Cycle Beginning:

BUSINESS INCOME & EXPENSE WORKSHEET YEAR

cre8ivcpa.comINTEREST: Mortgage (on business bldg.): Paid to financial institution Paid to individual OTHER INTEREST: (do not include auto or truck) List life insurance loans separately Business only credit card *LEGAL & PROFESSIONAL: Attorney fees for business, accounting fees, bonds, permits, etc. OFFICE EXPENSE: Postage, stationery, office

SECTION 5. INTEREST EXPENSE (§ 163) AND AMORTIZABLE …

www.irs.govSECTION 19. SPECIAL RULES FOR LONG-TERM CONTRACTS (§ 460)..... 271.01 Small business taxpayer exceptions from requirement to account for certain long-term contracts under § 460 or to capitalize costs under § 263A for certain home

Grammar: Capital Letters - Upper Case or Lower Case?

writingforresults.netenshrined does not capitalize them. Here are some examples from The Income Tax Act: The Income Tax Act 6(8) . . . and a particular amount is paid to the taxpayer in a particular taxation year as a rebate under the Excise Tax Act in respect of any goods and services tax included in the amount of the expense, or the capital cost of the property . . .

Health Reimbursement Account (HRA) Claim Form (Actives)

f.hubspotusercontent40.netInstructions for filling out this form: Complete each section in full. If filling out by hand, use black or blue ink and CAPITAL letters. Use documentation to complete each section of the form. A EXPENSE TYPE (indicate the type of expense that is being claimed for reimbursement) B START AND END DATE OF CLAIM C AMOUNT OF CLAIM SUBMITTED

Statewide Purchasing Card Policy

doas.ga.govrelated to charges made for employee travel through the online Travel and Expense Management System used in conjunction with Travel Inc., the TeamWorks Travel and Expense designated travel agency. III. LEGAL ISSUES All procurement laws in the Official Code of Georgia, Annotated, and administrative rules found

SEMA4 EMPLOYEE EXPENSE REPORT - Minnesota

mn.govknow these limits, contact your agency's business expense contact. Employees must submit an expense report within 60 days of incurring any expense(s) or the reimbursement comes taxable. All of the data you provide on this form is public information, except for your home

The PayFlex Card®, your account debit card - Aetna

docs.payflex.comYou can pay for an eligible expense with cash, check or a personal credit card. You can then use features online or . through the PayFlex Mobile® app to pay yourself back. You can also fill out a paper form and fax or mail it to PayFlex. Note: Remember to include supporting documentation when you submit your claim. 69.03.620.1 D (7/18)

Flex Elect Reimbursement Claim Form - California

www.calhr.ca.govveracity of all information relating to this claim, and that unless an expense for which payment or reimbursement is claimed is a proper expense under the Plan, I may be liable for payment of all related taxes including federal, state, or local income tax on amounts paid from the Plan which relate to such expense.

Form 63 0036 Combined Disposable Income Worksheet

dor.wa.govombined isposable Income Worksheet REV 63 0036 (1/27/22) Page 2 of 5 Line 4 If you filed a federal income tax return and reported depreciation and the net result was a loss, you must recalculate the net income/loss without the depreciation expense. …

Similar queries

Expenses, Real estate, Tax Prep Checklist, H&R Block, Medical, Travel, Record, Dependent, Qualified medical, Qualified expenses, Dependent Care, Reimbursement, Reimbursement request, Reimburse, Incidental expenses, Day-to-Day, Legal, Settlement, Amortizing Research and Development Expenses Under, Property, Total, More than, Estate Checklist Guide ESTATE CHECKLIST & GUIDE, Estate Checklist Guide, Decedent, Trade or Business Expenses Under IRC § 162, Depreciation, Flat, Self-Employed Business Expenses Worksheet, Business, Eligible Expenses Guide, Premera Blue Cross, Breast reconstruction, Following mastectomy, Following, Mastectomy, Letter of Medical Necessity, WageWorks, Expense, WageWorks Claim, Allowances and Expenses for Official, International Civil Service Commission, Wisconsin Medicaid—Spousal Impoverishment Protection, Allowable, Care, FOR REIMBURSABLE EXPENSES, 2014, Official, Allowances for official, GAMBLING INCOME AND EXPENSES, IRS tax forms, To withhold, Rental Real, Rental Real Estate Income and Expenses, ETravel Expense Report — Local Travel, Report, 2022, Reimbursable, Eligible, Health Savings Account, Qualified medical expenses, PERSONAL INCOME TAX WITHHOLDING —, PERSONAL INCOME TAX WITHHOLDING — SUPPLEMENTAL WAGE PAYMENTS, MOVING EXPENSE REIMBURSEMENT — WARN, OVER-THE-ROAD TRUCKER EXPENSES LIST, Wage and Tax, Dependent care expenses, Vehicle Registration and Insurance, FARM BUSINESS PLAN WORKSHEET Projected/Actual, Income, FARM BUSINESS PLAN WORKSHEET. Projected/Actual Income and Expense, RULES, Capitalize, Claim Form, Form, Claim, Travel and Expense, TeamWorks Travel and Expense, SEMA4 EMPLOYEE EXPENSE REPORT, Minnesota, Business expense, Account, Flex Elect Reimbursement Claim Form, California, Income Worksheet