Search results with tag "Withholding"

COVID-19 Withholding Requirements for teleworking …

www.marylandtaxes.govThe following tax alert addresses withholding questions received by the Office of the Comptroller of Maryland due to the unprecedented situation caused by the COVID-19 pandemic. Employer Withholding Requirements Maryland employer withholding requirements are not affected by the current shift from working

Municipal Income Tax Withholding & Refund Q & A Guide

ohiocpa.comwithholding requirements and raise other municipal tax issues. This Municipal Tax Q&A Guide (“Q&A Guide”) is provided to assist OSCPA members with understanding the post-2021 Ohio municipal income tax system withholding requirements and other potential municipal tax impacts resulting from hybrid working arrangements. The Q&A Guide is

Gaming Withholding and Reporting Threshold - IRS tax …

www.irs.govblackjack, craps, roulette, baccarat, or big wheel 6 are exempt from withholding and reporting.) (3) See Revenue Procedure 2007-57 for poker tournament filing and withholding requirements. (4) For tournaments other than poker tournamens, entry fees must be analyzed to see if the entry fee is a wager, and if the proceeds

Social Security Administration Benefit Verification Letter

www.lacera.comMedicare Prescription Drug Plan (We will notify you if the amount changes in 2022. If you did not elect ithholding as of November 1, 2021, we show $0.00) U.S. Federal fax withholding oluntary Federal tax withholding (If you did not elect voluntary tax withholding as of November 18, 2021, we show $0.00)

Iowa Withholding Annual VSP Report

tax.iowa.gov2020 Iowa Withholding Annual VSP Report tax.iowa.gov 44-007 (06/18/2020) Instructions . All withholding agents submit a completed Verified Summary of Payments Report (VSmust P) by February 15, 2021. Original or Amended VSP: Check the box below if you are submitting an original or amended report. If amending, please include an explanation of ...

Employee Withholding Exemption Certificate 2022

www.marylandtaxes.gov8. I certify that I am a legal resident of thestate of and am not subject to Maryland withholding because I meet the requirements set forth under the Servicemembers Civil Relief Act, as amended by the Military spouses Form MW507 . Employee Withholding Exemption Certificate . 202. 2. Comptroller of Maryland . FOR MARYLAND STATE GOVERNMENT ...

Tax Guide Page 1 of 73 16:15 - 5-Jan-2017 Supplemental ...

www.irs.govFederal Income Tax, Employee Social Security Tax, and Employee Medicare Tax Withholding Tables; and Tables for Withholding on Distributions of Indian Gaming Profits to Tribal Members. Withholding allowance. The 2017 amount for one with-holding allowance on an annual basis is $4,050. Qualified small business payroll tax credit for in

Tax and Estimated Withholding - IRS tax forms

www.irs.govThis publication explains both of these meth-ods. It also explains how to take credit on your return for the tax that was withheld and for your estimated tax payments. If you didn’t pay enough tax during the year, either through withholding or by making estima-ted tax payments, you may have to pay a pen-alty.

NYS-50-T-Y Yonkers Withholding Tax Tables and Methods ...

www.tax.ny.govMethod VIII — Annualized tax method - single or married ... use the revised withholding tax tables and methods in this publication to compute the amount of Yonkers resident personal income taxes to be withheld from employees. The Yonkers nonresident earnings tax …

Instructions for Form 941 (Rev. July 2020) - Smart Union

static.smart-union.orgwithholding tables are included in Pub. 15-T, Federal Income Tax Withholding Methods. Social security and Medicare tax for 2020. The rate of social security tax on taxable wages, except for qualified sick leave wages and qualified family leave wages, is 6.2% (0.062) each for the employer and employee or 12.4% (0.124) for both.

Child Care Stabilization Grant Tax Implications

www.michigan.govtax law. i Supplemental wages are taxable when received by the employee and, thus, subject to mandatory tax withholding (federal and state) and employment taxes by the employer. ii Your business may therefore have certain reporting, withholding, and payroll tax obligations for grant amounts that are paid to employees. iii

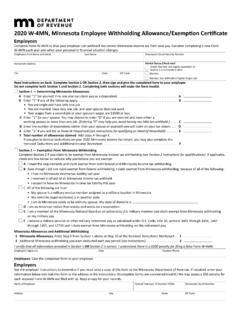

W-4MN, Minnesota Employee Withholding …

www.revenue.state.mn.us2020 W-4MN, Minnesota Employee Withholding Allowance/Exemption Certificate Employees: Give the completed form to your employer. Employers See the employer instructions to determine if you must send a copy of this form to the Minnesota Department of Revenue. If required, enter your information below and mail this form to the address in the ...

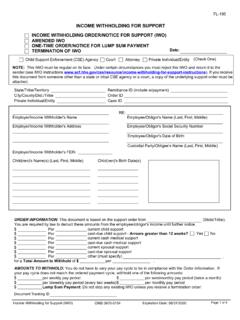

Income Withholding for Support

www.acf.hhs.govIf you cannot withhold the full amount of support for any or all orders for this employee/obligor, withhold % of disposable income for all orders. If the employee/obligor’s principal place of employment is not (State/Tribe), obtain withholding limitations, time requirements, the appropriate method to allocate among multiple child support ...

Form WV/IT-104 - West Virginia - DISA

www.disa.milIf you are a resident of Kentucky, Maryland, Ohio, Pennsylvania or Virginia and your only source of income from West Virginia i s wages or salaries, you are exempt from West Virginia Personal Income Tax Withholding. Upon receipt of this form, properly completed, your employer is authorized to discontinue the withholding of West Virginia Income ...

PERSONAL INCOME TAX WITHHOLDING — …

edd.ca.govPERSONAL INCOME TAX WITHHOLDING — SUPPLEMENTAL WAGE PAYMENTS, MOVING EXPENSE REIMBURSEMENT — WARN ACT PAYMENTS Supplemental Wage Payments When supplemental wages (bonuses, commissions, overtime pay, sales awards, back pay - including retroactive wage increases, reimbursement for nondeductible moving expenses, …

FORM K-5C CORRECTED REPORT OF KENTUCKY …

revenue.ky.govK-5C CORRECTED REPORT OF KENTUCKY WITHHOLDING STATEMENTS Commonwealth of Kentucky Department of Revenue FORM Mail To: Sign Here Name Date Telephone Number Kentucky Department of Revenue Station # 57 501 High Street Frankfort, KY 40601-2103 ä Corrections may be made to Tax Year and Withholding Statements only (See instructions)

Employee Withholding Exemption Certificate 2022

interactive.marylandtaxes.govEmployee Withholding Exemption Certificate . 202. 2. Comptroller of Maryland . FOR MARYLAND STATE GOVERNMENT EMPLOYEES ONLY . Section 1 – Employee Information (Please complete form in black ink.) Payroll System (check one) RG CT UM . Name of Employing Agency Agency Number Social Security Number Employee Name

CALIFORNIA WITHHOLDING SCHEDULES FOR 2020

edd.ca.gov1. Subtract the employee's estimated deduction allowance shown in the "TABLE 2 - ESTIMATED DEDUCTION TABLE" from the gross wages subject to withholding; and 2. Compute the tax to be withheld using: METHOD A - WAGE BRACKET TABLE METHOD; or METHOD B - EXACT CALCULATION METHOD

Volume 7A, Chapter 44 - U.S. Department of Defense

comptroller.defense.gov2BDoD 7000.14-R Financial Management Regulation Volume 7A, Chapter 44 * April 2021. 44-1 . VOLUME 7A, CHAPTER 44: “WITHHOLDING OF INCOME TAX” SUMMARY OF MAJOR CHANGES . Changes are identified in this table and also denoted by blue font. Substantive revisions are denoted by an asterisk (*) symbol preceding the section,

RI W-4 2020 Layout 1

tax.ri.govRI W-4 State of Rhode Island and Providence Plantations 2020 Employee’s Withholding Allowance Certificate Under penalties of perjury, I declare that I have examined this certificate, and to the best of my knowledge and belief, it is true, correct and complete. Employee Signature ð Date Name - first, middle initial, last

Georgia Form (Rev. 08/02/16) Page 1

dor.georgia.gov(Rev. 08/02/16) Individual Income Tax Return Georgia Department of Revenue 5. ... Amount to be credited to 2017 ESTIMATED TAX ..... 29. 30. Georgia Wildlife Conservation Fund ... W-2s, OTHER WITHHOLDING DOCUMENTS, OR TAX RETURN. I authorize the …

Form W-4 | Employee’s Withholding Allowance Certificate

hr.wisc.eduYou can be claimed as a dependent on someone else’s tax return, and . 1. Your income exceeds $1050 and includes more than $3 50 of unearned income (interest on savings, dividends, etc.) for Federal or Wisconsin , or. 2. Your gross income (total unearned income and earned income) was more than $10,150 if single, $13,050 if head of household,

INCOME WITHHOLDING FOR SUPPORT

childsupport.ca.govThe federal limit is 50% of the disposable income if the obligor is supporting another family and 60% of the disposable income if the obligor is not supporting another family. However, those limits increase 5% --to 55% and 65% --if the arrears are greater than 12 weeks. If permitted by the state or tribe, you may deduct a fee

2020 Specifications for Electronic Submission of 1099B ...

revenue.ky.govElectronic filing is required when reporting 26 or more 1099 or W2G forms. Always identify yourself and your company with an external label on the CD. Include only payee records pertinent to Kentucky in your electronic file. Always use the correct Kentucky Withholding Account Number (6 digits) in the appropriate fields.

Other Tax Rates - KPMG

home.kpmgOther Tax Rates 4 Non-Resident Withholding Tax Rates for Treaty Countries/ 137 Country2 Interest3 Dividends4 Royalties5 Pensions/ Annuities6 Serbia 10% 5/15% 10% 15/25% Singapore 15 15 15 25 Slovak Republic 10 5/15 0/10 15/25 Slovenia 10 5/15 10 0/10/15/25 South Africa 7 10 5/15 6/10 25 Spain 10 5/15 0/10 15/25 Sri Lanka 15 15 0/10 15/25 Sweden 10 5/15 0/10 25

Form RI-941 Employer s Quarterly Tax Return and ...

tax.ri.govFederal employer identification number For the quarter ending: E-mail address City, town or post office State ZIPcode 2nd MONTH OF QUARTER 3rd MONTH OF QUARTER 2 State income tax withholding payments made to the RIDivision of Taxation to date for this quarter..... 2 Monthly payers use these 3 boxes

Form W-8BEN Certificate of Foreign Status of Beneficial ...

scs.fidelity.comFor broker transactions or barter exchanges, the beneficial owner is an exempt foreign person as defined in the instructions. Furthermore, I authorize this form to be provided to any withholding agent that has control, receipt, or custody of the income of which I am the beneficial owner or

W-4 Employee’s Withholding Certificate - Ohio University

www.ohio.edu(a) First name and middle initial Last name Address City or town, state, and ZIP code (b) Social security number aDoes your name match the name on your social security card? If not, to ensure you get credit for your earnings, contact SSA at 800-772-1213 or go to www.ssa.gov. (c) Single or Married filing separately

R-121 121 WE Fourth Quarter ... - revenue.louisiana.gov

revenue.louisiana.govLines 1-3 Enter the amount of Louisiana income tax withheld or required to be withheld from the wages of your employees for the appropriate month. Line 4 Add Lines 1, 2 and 3. This is the total amount of taxes withheld for the quarter. Line 5 Calculate the total amount of withholding taxes that was remitted to the department during the quarter.

Metro SHS Tax Employer Withholding Requirements

www.oregonmetro.govMar 18, 2021 · In May 2020 voters in greater Portland approved a measure to fund supportive housing services for ... and a 1% business income tax on net income for businesses with gross receipts above $5 million. This tax became effective ... Multnomah County Preschool for All tax, the local wages and loc al income taxes need to be reported ...

Ohio and School District Employer Withholding Tax Due ...

tax.ohio.gov* An employer who is required to remit partial-weekly shall file the Ohio IT 942, Ohio Employer’s EFT 4th Quarter/Annual Reconciliation of Income Tax Withheld, no later than the last day of the month following the end of the calendar year. File the Ohio IT 942 on Ohio Business Gateway. EFT filers do not file the Ohio IT 941.

Connect Tax Rate and WRS Rate Changes 2022

civicsystems.blob.core.windows.netIf an employee completes a new 2020 W-4, the employees Tax Information will need to be updated. ... Michigan Michigan’s Exemption Amount has increased to $5,000.00 and the tax rate is unchanged at 4.25 ... Click here for Wisconsin’s Withholding Tax Guide updated 10/21. Follow these steps to make and verify this change.

Withholding Calculation Rules Effective January 1, 2022

portal.ct.govfrom Table D - Tax Recapture. 10. Add the withholding amounts from Step 7, Step 8, and Step 9. 11. Use the annualized salary (Step 3) and employee’s withholding code (Step 4) to determine the decimal amount from Table E - Personal Tax Credits. 12. Multiply the withholding amount (Step 10) by 1.00 minus the decimal amount (Step 11).

Similar queries

Withholding Requirements for teleworking, Tax alert, Withholding, Ohio, Gaming Withholding and Reporting Threshold, IRS tax, Blackjack, Medicare Prescription Drug, Iowa Withholding Annual VSP Report, Withholding agents, Withholding Exemption Certificate, Tax Guide, Tax Withholding, With-holding, IRS tax forms, Meth-ods, Withholding Tax, Annualized tax, Minnesota, Certificate, Instructions, Minnesota Department of Revenue, INCOME WITHHOLDING FOR SUPPORT, Withhold, West Virginia, Virginia, Employer, PERSONAL INCOME TAX WITHHOLDING —, PERSONAL INCOME TAX WITHHOLDING — SUPPLEMENTAL WAGE PAYMENTS, MOVING EXPENSE REIMBURSEMENT — WARN, Reimbursement, Kentucky, Kentucky Withholding, Employee Withholding Exemption Certificate, Employee, CALIFORNIA WITHHOLDING SCHEDULES FOR 2020, EXACT, Volume 7A, Chapter 44, U.S. Department of Defense, VOLUME 7A, CHAPTER 44: “WITHHOLDING OF INCOME, Providence Plantations, S Withholding Allowance, TAX RETURN, 2017, Income, Limit, Electronic, Electronic filing, Foreign, Employee’s Withholding Certificate, Ohio University, First, Louisiana, SHS Tax Employer Withholding Requirements, Portland, Business, Multnomah, Employer Withholding, Michigan Michigan, S Withholding, Annualized