Search results with tag "S withholding"

Oregon Employee’s Withholding Statement and Exemption ...

www.oregon.govOregon Employee’s Withholding Statement and Exemption Certificate Office use only Page 1 of 1, 150-101-402 (Rev. 08-14-20, ver. 01) Employer’s name Employee’s signature (This form isn’t valid unless signed.) Social Security number (SSN) Federal employer identification number (FEIN) Date Address Employer’s address City City State State ...

Form 89-350-1 -1-000 (Rev. /1 MISSISSIPPI EMPLOYEE'S ...

www.dor.ms.govMISSISSIPPI EMPLOYEE'S WITHHOLDING EXEMPTION CERTIFICATE Employee's Name SSN Employee's Residence Number and Street City or Town State Zip Code Marital Status CLAIM YOUR WITHHOLDING PERSONAL EXEMPTION Personal Exemption Allowed . Amount Claimed . EMPLOYEE: 1. Single. Enter $6,000 as exemption . . . . $ File this form with your …

2022 Publication 926 - IRS tax forms

www.irs.govyour household employee asks you to withhold it and you agree. Employers will figure withholding based on the in-formation from the employee's most recently submitted Form W-4, Employee’s Withholding Certificate. Similarly, any employees hired prior to 2021 who wish to adjust their withholding must use the redesigned form. For the latest

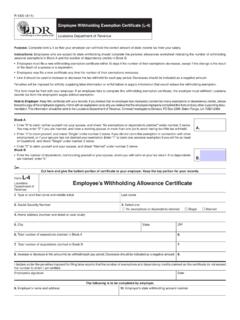

Employee’s Withholding Allowance Certificate

www.revenue.louisiana.govEmployee Withholding Exemption Certificate (L-4) Louisiana Department of Revenue Purpose: Complete form L-4 so that your employer can withhold the correct amount of state income tax from your salary. Instructions: Employees who are subject to state withholding should complete the personal allowances worksheet indicating the number of withholding ...

Employee’s Withholding Allowance Certificate

revenue.louisiana.govEmployee Withholding Exemption Certificate (L-4) Louisiana Department of Revenue Purpose: Complete form L-4 so that your employer can withhold the correct amount of state income tax from your salary. Instructions: Employees who are subject to state withholding should complete the personal allowances worksheet indicating the number of withholding ...

Oklahoma Tax Commission Employee’s Withholding …

www.ok.govOklahoma Tax Commission Employee’s Withholding Allowance Certificate Your First Name and Middle Initial Employee’s Signature (Form is not valid unless you sign it) Date (MM/DD/YYYY) Home Address (Number and Street or Rural Route)

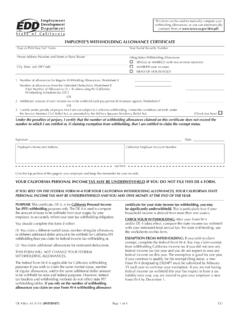

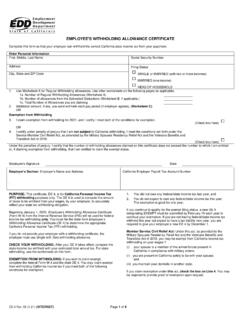

EMPLOYEE’S WITHHOLDING ALLOWANCE CERTIFICATE

www.edd.ca.govDE 4 Rev 50 (1-21) (INTERNET) EMPLOYEE’S WITHHOLDING ALLOWANCE CERTIFICATE Complete this form so that your employer can withhold the correct California state income tax from your paycheck. Enter Personal Information First, Middle, Last Name Social Security Number. Address. City, State, and ZIP Code. Filing Status. SINGLE or MARRIED (with two ...

Notice to Employee - Ohio Department of Taxation

www.tax.ohio.govown exemption on a separate certificate. from the husband’s wages and the wife’s wages. This ... Employee’s Withholding Exemption Certificate. Rev. 5/07. Taxation . Print full name Social Security number Home address and ZIP code Public school district of residence School district no.

EMPLOYEE’S WITHHOLDING ALLOWANCE CERTIFICATE

edd.ca.govDE 4 Rev 50 (1-21) (INTERNET) EMPLOYEE’S WITHHOLDING ALLOWANCE CERTIFICATE Complete this form so that your employer can withhold the correct California state income tax from your paycheck. Enter Personal Information First, Middle, Last Name Social Security Number. Address. City, State, and ZIP Code. Filing Status. SINGLE or MARRIED (with two ...

Employee’s Withholding Allowance Certificate (DE 4)

pagelystaging.ventura.orgEMPLOYEE’S WITHHOLDING ALLOWANCE CERTIFICATE. 1. Number of allowances for Regular Withholding Allowances, Worksheet A Number of allowances from the Estimated Deductions, Worksheet B Total Number of Allowances (A + B) when using the California Withholding Schedules for 2015 OR 2. Additional amount of state income tax to be withheld …

Frequently Asked Questions Re: Employee’s Withholding ...

www.meredith.eduRe: Employee’s Withholding Allowance Certificate NC-4EZ/NC-4 & Withholding Certificate for Pension or Annuity Payments NC-4P ~ 2 ~ Q5. Can I submit the federal W-4, instead of completing North Carolina’s Employee’s Withholding Allowance Certificate? A5. No, federal and State laws are different.

Connect Tax Rate and WRS Rate Changes 2022

civicsystems.blob.core.windows.netIf an employee completes a new 2020 W-4, the employees Tax Information will need to be updated. ... Michigan Michigan’s Exemption Amount has increased to $5,000.00 and the tax rate is unchanged at 4.25 ... Click here for Wisconsin’s Withholding Tax Guide updated 10/21. Follow these steps to make and verify this change.

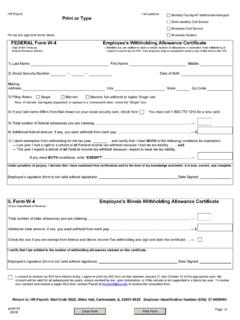

2022 Form W-4 - IRS tax forms

www.irs.govEmployee’s Withholding Certificate Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Give Form W-4 to your employer. Your withholding is subject to review by the IRS. OMB No. 1545-0074. 2022. Step 1: Enter Personal Information (a) First name and middle initial. Last name Address

WEST VIRGINIA EMPLOYER’S WITHHOLDING TAX TABLES

www.state.wv.us3 WV/IT-104 WEST VIRGINIA CERTIFICATE OF NONRESIDENCE Rev. 1/07 To be completed by employees who reside in Kentucky, Maryland, Ohio, Pennsylvania or Virginia. If you are a resident of Kentucky, Maryland, Ohio, Pennsylvania or Virginia and your only source of income from West Virginia i s wages or

Form HW-4 Rev 2016 Employee's Withholding Allowance and ...

files.hawaii.govFORM HW-4 (REV. 2017) STATE OF HAWAII — DEPARTMENT OF TAXATION EMPLOYEE’S WITHHOLDING ALLOWANCE AND STATUS CERTIFICATE INSTRUCTIONS (NOTE: References to “married” and “spouse” are also references to “in a civil union” and “civil union partner,” respectively.)

MASSACHUSETTS EMPLOYEE’S WITHHOLDING EXEMPTION …

worcesterschools.orgwithholding system adjustment for the $4,400 exemption for a spouse. D. DEPENDENT(S) — You may claim an exemption in line 3 for each individual who qualifies as …

2019 Form W-4 - IRS tax forms

www.irs.govSeparate here and give Form W-4 to your employer. Keep the worksheet(s) for your records. Form . W-4. Department of the Treasury Internal Revenue Service . Employee’s Withholding Allowance Certificate. . Whether you’re entitled to claim a certain number of allowances or exemption from withholding is subject to review by the IRS.

Employee's Withholding Allowance Certificate (DE 4)

media.icims.comBeginning January 1, 2020, Employee's Withholding Allowance Certificate (Form W-4) from the Internal Revenue Service (IRS) will be used for federal income tax withholding only. You must file the state form Employee’s Withholding Allowance Certificate (DE 4) to determine the appropriate California Personal Income Tax (PIT) withholding.

NJ Employee’s Withholding Allowance Certificate

www.state.nj.usexemption from withholding. If you have questions about eligibility, filing status, withholding rates, etc. when completing this form, call the Division ofTaxation’s Customer Service Center at (609) 292-6400.

Missouri Department of Revenue Employee’s Withholding ...

dor.mo.govThis certificate is for income tax withholding and child support enforcement purposes only. Type or print. Notice To Employer: Within 20 days of hiring a new employee, send a copy of Form MO W-4 to the Missouri Department of Revenue, P.O. Box 3340,

Form IL-W-4 Employee’s and other Payee’s Illinois ...

www.ccc.eduJan 01, 2017 · Even if you claimed exemption from withholding on your federal Form W-4, U.S. Employee’s Withholding Allowance Certificate, because you do not expect to owe any federal income tax, you may be required to have Illinois Income Tax withheld from your pay (see Publication 130, Who is Required to Withhold Illinois Income Tax).

FORM MAINE W-4ME Employee’s Withholding …

www.maine.govNotice to Employers and Other Payers Maine law requires employers and other persons to withhold money from certain payments, most commonly wages, retirement payments and

IT-2104 Employee’s Withholding Allowance Certificate

www.tax.ny.govEmployee’s Withholding Allowance Certificate New York State • New York City • Yonkers Single or Head of household Married Married, but withhold at higher single rate Note: If married but legally separated, mark an X in the Single or Head of household box.

Employee’s Withholding - files.nc.gov

files.nc.govEmployee’s Signature Date I certify, under penalties provided by law, that I am entitled to the number of withholding allowances claimed on Line 1 above, or if claiming exemption from withholding, that I am entitled to claim the exempt status on Line 3 or 4, whichever applies.

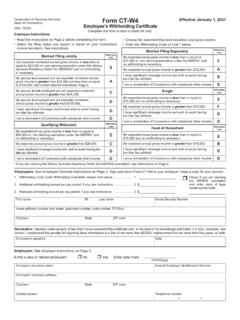

Form CT-W4 1, 2021 Employee’s Withholding Certificate

www.simsbury.k12.ct.us, Employee’s Withholding Certificate, provides your employer with the necessary information to withhold the correct . amount of Connecticut income tax from your wages to ensure that . you will not be underwithheld or overwithheld. You are required to pay Connecticut income tax as income is earned . or received during the year.

Exemption from Kansas withholding: Form W-4). Personal ...

www.ksrevenue.orgKansas Employee’s Withholding Allowance Certificate Whether you are entitled to claim a certain number of allowances or exemption from withholding is …

Employee's Withholding Allowance Certificate - eforms.siu.edu

eforms.siu.eduEmployee's Withholding Allowance Certificate →Whether you are entitled to claim a certain number of allowances or exemption from withholding is subject to review by the IRS.

L-4 Employee's Withholding Allowance Certificate

www.gram.eduR-1300 (4/01) State of Louisiana Department of Revenue Employee Withholding Exemption Certificate (L-4) Purpose: Complete form L-4 so that your employer can withhold the correct amount of state income tax from your salary.

IT-2104 Employee’s Withholding Allowance Certificate

cims.nyu.eduThis certificate, Form IT-2104, is completed by an employee and given to the employer to instruct the employer how much New York State (and New York City and Yonkers) tax to withhold from the employee’s pay.

North Carolina Department of Revenue

cfcc.eduNorth Carolina Department of Revenue NC-4 EZ Employee’s Withholding Allowance Certificate 10-13 Single Head of Household Married or Qualifying Widow(er) Social Security Number Marital Status

Notice to Employee - Ohio Department of Taxation

www.tax.ohio.govNotice to Employee 1. For state purposes, an individual may claim only natural de- ... 2. You may file a new certificate at any time if the number of your exemptions increases. ... Employee’s Withholding Exemption Certificate. Rev. 5/07. Taxation . Print full name .

NC-4 Employee’s Withholding 11-15 Allowance Certificate

www.northeastern.eduPURPOSE - Complete Form NC-4, Employee’s Withholding Allowance Certificate, so that your employer can withhold the correct amount of State income tax from your pay.

FORM KENTUCKY’S WITHHOLDING 2021

revenue.ky.govAll Kentucky wage earners are taxed at a flat 5% tax rate with an allowance for the standard deduction. You may be exempt from withholding if any of the four conditions below are met: 1. You may be exempt from withholding for 2021 if both the following apply:

MS Employee’s Withholding Exemption Certificate

www.dor.ms.govcertificate does not exceed the amount to which I am entitled or I am entitled to claim exempt status. ˘ˇˆ˙˝˝ ˛˜)!˚$%#˝& ˚$˝& (e) An additional exemption of $1,500 may be …

SOUTH CAROLINA EMPLOYEE'S WITHHOLDING …

dor.sc.govSOUTH CAROLINA EMPLOYEE'S WITHHOLDING ALLOWANCE CERTIFICATE. 1350. dor.sc.gov INSTRUCTIONS . Employee instructions . Complete the SC W-4 so your employer can withhold the correct South Carolina Income Tax from your pay. If you have too much tax withheld, you will receive a refund when you file your tax return. If you have too little tax ...

STATE OF GEORGIA EMPLOYEE’S WITHHOLDING …

dor.georgia.govform g-4 (rev. 02/15/19) state of georgia employee’s withholding allowance certificate 1a. your full name 1b. your social security number 2a. home address (number, street, or rural route) 2b. city, state and zip code

State of Connecticut Form CT-W4 Employee’s Withholding ...

portal.ct.govForm CT-W4, Employee’s Withholding Certificate, provides your employer with the necessary information to withhold the correct amount of Connecticut income tax from your wages to ensure that you will not be underwithheld or overwithheld. You are required to pay Connecticut income tax as income is earned or received during the year.

State of Connecticut Form CT-W4 Employee’s Withholding ...

ct.govEmployee General Instructions Form CT-W4, Employee’s Withholding Certificate, provides your employer with the necessary information to withhold the correct amount of Connecticut income tax from your wages to ensure that

State of Connecticut Form CT-W4 Employee’s Withholding …

portal.ct.govForm CT-W4, Employee’s Withholding Certificate, provides your employer with the necessary information to withhold the correct amount of Connecticut income tax from your wages to ensure that you will not be underwithheld or overwithheld. You are required to pay Connecticut income tax as income is earned or received during the year.

Similar queries

Oregon, S Withholding, Exemption, Exemption Certificate, MISSISSIPPI EMPLOYEE, Employee, Withholding, IRS tax forms, CERTIFICATE, Withholding Exemption Certificate, Louisiana, Employee Withholding Exemption Certificate, DE 4 Rev, Ohio Department of Taxation, California, DE 4, California Withholding, Withholding Certificate, Michigan Michigan, Form W-4, West Virginia, Virginia, 2017, S WITHHOLDING ALLOWANCE AND STATUS CERTIFICATE, Missouri, MAINE W, 4ME Employee, Maine, IT-2104, Employer, Connecticut income tax, Income, Employee Withholding, North Carolina Department of Revenue, North Carolina Department of Revenue NC, Kentucky, Allowance, Georgia, S withholding allowance certificate, S Withholding Certificate, Connecticut