Search results with tag "Employers"

PAYE-GEN-01-G05 - Guide for Employers in respect of ...

www.sars.gov.zaGUIDE FOR EMPLOYERS IN RESPECT OF EMPLOYMENT TAX INCENTIVE PAYE-GEN-01-G05 REVISION: 15 Page 5 of 20 • Employers deduct or withhold the amount of employees’ tax that is payable on remuneration paid or payable to an employee. • If the eligible employer hires a qualifying employee, the employer can deduct

NHWP Workplace Health Incentives - Centers for Disease ...

www.cdc.govMay 20, 2013 · Employers Holding Employees Accountable • 62% of employers plan on switching from participation-based incentives to outcomes-based incentives • They view this method as a means to control rising health care costs . Source: Towers Watson Survey . 11

WA Health WA COVID-19 TTIQ (Test, Trace, Isolate and ...

ww2.health.wa.gov.aulegislation require employers to ensure the safety of workers and others in the workplace, so far as is reasonably practicable. This includes preventing transmission of COVID-19 and responding to cases of COVID-19 in their workplace. The Department of Mines, Industry Regulation and Safety, Safe Work Australia , and the Small Business Development

The Employer’s Guide to the New Brunswick Atlantic ...

www.welcomenb.caTips to protect yourself from fraud ... New Brunswick to help designated employers recruit and hire individuals with the skills, education and work experience to fill labour marker shortages in New Brunswick , and who are ready to live and work in New Brunswick permanently. The program is not intended for family reunification, protected persons ...

FAQS ABOUT AFFORDABLE CARE ACT IMPLEMENTATION …

www.cms.govMay 11, 2015 · of HHS. Women’s preventive services recommended therein are required to be covered without cost sharing for plan years (or, in the individual market, policy years) beginning on or after August 1, 2012. Under the HRSA Guidelines, group health plans established or maintained by religious employers (and group health insurance

Newfoundland and Labrador (NL) Immigration Programs ...

www.gov.nl.caInternational Graduate application? ... their family as they integrate into their new life in Atlantic Canada. Upon designation, employers can then forward ... offer from a Newfoundland and Labrador employer ask if they are a Designated Employer with the Atlantic Immigration Program (AIP) and if they are not, direct them to contact our office.

Preventing manual handling injuries to catering staff - HSE

www.hse.gov.ukThis guidance is aimed at employers of catering staff, but provides useful information for employees and safety representatives. It identifies significant risk areas and offers practical examples of solutions you can apply in your workplace. Further HSE guidance on manual handling and preventing back pain and other

New Health Insurance Marketplace Coverage Options and …

payinfo.westchestergov.comThe information below corresponds to the Marketplace Employer Coverage Tool. Completing this section is optional for employers, but will help ensure employees understand their coverage choices. 13. Is the employee currently eligible for coverage offered by this employer, or will the employee be eligible in

Research in the NHS – HR Good Practice Resource Pack

www.myresearchproject.org.ukResearch in the NHS: HR Good Practice Resource Pack Page 2 of 6 ... Researchers and their employers should ensure that where applicable new Research Passport applications are supported by an appropriate disclosure. In particular, from 10 September onwards ... Algorthim continues on the next page

LICENSED PRACTICAL NURSES Entry Level Competencies

www.bccnm.caIn 2012, the Canadian Council for Practical Nurse Regulators (CCPNR), a federation of provincial and ... the CCPNR ELCs (identified with an * in this document) . The BC College of Nursing Professionals Board (now the BCCNM Board) approved the 79 ELCs for LPNs in June 2019 to be effective ... • A resource for employers and the public to ...

Health and Safety Law What you need to know - HSE

www.hse.gov.ukWhat employers must do for you 1 Decide what could harm you in your job and ... training you need to do your job. 5 Free of charge, provide you with any equipment and protective clothing you need, and ensure it is properly looked after. Health and Safety Law What you need to know Large print. Health and Safety Executive 2 of 4 pages 6 Provide ...

Mark Scheme (Results) January 2012 - Edexcel

qualifications.pearson.comMar 07, 2012 · January 2012 International GCSE Mathematics ... We provide a wide range of qualifications including academic, vocational, occupational and specific programmes for employers. For further information, please call our GCE line on 0844 576 0025, our GCSE team on 0844 576 0027, or visit our qualifications website at

Employers Guide for Completion - NHS Business Services ...

www.nhsbsa.nhs.ukbut continues in NHS employment, the retirement date for payment of benefits will be the day after NHS employment ceased. But, the date for Box 39 of form ... Employers should always complete the pay details at Parts 2 and 3, unless the member is a practitioner. You can leave Parts 2 and 3 blank for

Employers Internship Toolkit - Western Michigan University

wmich.eduMay 29, 2009 · ‘SHRM Guide to Organizing an Internship Program’ – Letty Klutz, PHR, and Chuck Salvetti ... You can load a previously saved search or you can click the “start new search” button. • Get Smart: ... Monitor the intern’s progress:

Oregon Annual Withholding Tax Reconciliation Report

www.oregon.govJan 31, 2018 · Federal Employer Identification Number (FEIN) Number of W-2s and 1099s ... 2017 Form OR-WR Oregon Annual Withholding Tax Reconciliation Report Return Due Date: January 31, 2018 Submit original form—do not submit photocopy Office use only Page 1 of 1, 150-206-012 (Rev. 01-18) 150-206-012 Rev. 01-17 ... Tax Reconciliation Report. The 2017 form ...

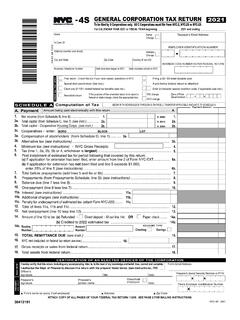

-4S

www1.nyc.govs Firm's name (or yours, if self-employed) s Address s Zip Code SIGN HERE PREPARER ' S USE ONLY employed: n Preparer's Social Security Number or PTIN Firm's Employer Identification Number ATTACH COPY OF ALL PAGES OF YOUR FEDERAL TAX RETURN 1120S. SEE PAGE 2 FOR MAILING INSTRUCTIONS. Taxpayer’s Email Address: _____ …

SAMPLE 123456.00 SAMPLE 1 2 3 4 5 6 . 0 0 SAMPLE Typed ...

www.uc.pa.govUC-2A REV 07-21 PA Form UC-2A, Employer’s Quarterly Report of Wages Paid to Each Employee See instructions on form UC-2INS. Information MUST be typewritten or printed in BLACK ink. Do NOT use commas (,) or dollar signs ($). If typed, disregard vertical bars and type a consecutive string of characters.

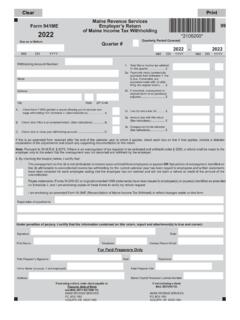

Maine Revenue Services Form 941ME Employer’s Return 2022

www.maine.govPursuant to 36 M.R.S. § 5276, if there is an overpayment of tax required to be deducted and withheld under § 5250, a refund shall be made to the . employer only to the extent that the overpayment was not deducted and withheld by the employer. 4. By checking the box(es) below, I …

Maine Revenue Services Form 941ME 99 2021

www.maine.govNote: Pursuant to 36 M.R.S. § 5276, if there is an overpayment of tax required to be deducted and withheld under § 5250, a refund shall be made to the employer only to the extent that the overpayment was not deducted and withheld by the employer. 4. By checking the box(es) below, I …

The Working Time Regulations 1998 - Legislation.gov.uk

www.legislation.gov.uk(4) Where a worker has worked for his employer for less than 17 weeks, the reference period applicable in his case is the period that has elapsed since he started work for his employer. (5) Paragraphs (3) and (4) shall apply to a worker who is excluded from the scope of certain

PERSONAL DATA 3. EMPLOYER 4. NATIONALITY - Delta …

delta-green.comdd 315 top secret//orcon//special access required-delta green 112382 agent documentation sheet united states form. created date: 2/18/2016 9:50:40 am ...

Employer guide to apprenticeships - GOV.UK

assets.publishing.service.gov.ukEmployer guide to apprenticeships What is an apprenticeship? An apprenticeship is a genuine job with an accompanying assessment and skills development programme. It is a way for individuals to earn while they learn gaining valuable skills and knowledge in a specific job role. The apprentice gains this through a wide mix of learning in the ...

Metro SHS Tax Employer Withholding Requirements

www.oregonmetro.govMar 18, 2021 · In May 2020 voters in greater Portland approved a measure to fund supportive housing services for ... and a 1% business income tax on net income for businesses with gross receipts above $5 million. This tax became effective ... Multnomah County Preschool for All tax, the local wages and loc al income taxes need to be reported ...

No Surprises Act

cga.ct.govGenerally, the act requires group health plans (i.e., employer sponsored plans governed under ERISA) and group and individual health insurance policies that cover emergency services to cover them: 1. without the need for prior authorization; 2. regardless of whether the provider is in- or out-of-network; and 3.

FTA Drug and Alcohol

www.transit.dot.govJan 01, 2022 · the requesting employer for an updated release of information form that includes a proper, wet signature. If the requesting employer . is unresponsive or disagrees . with your request for updated information, you may contact the FTA Drug and Alcohol Project Office for assistance at fta.damis@ dot.gov or 617-494-6336. Return-to-Work Agreements after

Important instructions for filling out the Employer ...

www.bestcompaniesgroup.com4. For questions requiring a numeric response: ... 6. You will be able to access the Employer Questionnaire as often as necessary prior to the submission deadline. Even if you submitted the questionnaire, you will still be able to log back in and make any ... disability, nationality, language and socio-economic status.

Employer provided living accommodation - GOV.UK

assets.publishing.service.gov.ukIf accommodation is provided under the travel and subsistence rules, it is often exempt. Where this is not the case, its taxable value is the cost to the employer less any rent paid by the employee. Living accommodation If accommodation is living accommodation, calculating the taxable value depends on a range of different factors:

KY Income Tax Employer’s State KY State Wages Withheld ...

revenue.ky.govDo not include other state withholding or local income tax. Employee’s Social Security Number Employer’s Identification Number (EIN) KY State Wages (Box 16 of Form W-2) KY Income Tax Withheld (Box 17 of Form W-2) Employer’s State I.D. Number (Box 15 of Form W-2) State TOTAL FROM ALL W-2s

E-FILE AND E-PAY MANDATE WAIVER REQUEST

edd.ca.gov• Enter the eight-digit employer payroll tax account number and the business name. • Enter the two-digit year and quarter you are requesting the mandate waiver. Example: Tax year 2018, 3: rd: quarter • Select the reason you are unable to comply with the electronic requirements. If “other good cause” is selected, provide an explanation.

INF 1102, Commercial or Government Employer Pull Notice ...

www.dmv.ca.govTitle: INF 1102, Commercial or Government Employer Pull Notice. Enrollment of Out-of-State Licensed Drivers Author: CA DMV Subject: index-ready The INF 1102 form: is used when an employer needs to add an out-of-state licensed driver to the EPN program, is not used to delete drivers, will provide information on the "Driver Record Report" containing only information from …

Special Economic Zones Tax Incentive Guide

www.thedtic.gov.zawage the employee receives unaffected. The employer can claim the ETI and reduce the amount of Pay-As-You-Earn (PAYE) tax payable by the amount of the total ETI calculated in respect of all qualifying employees. The employment tax incentive guide can be found on the SARS website.

Consumer Directed Employer (CDE) Services ...

www.consumerdirectwa.comConsumer Directed Employer (CDE). Co-employment is an arrangement under which CDWA and the Client share employment responsibilities. The Client is your managing employer. They are responsible for selecting, scheduling, supervising and dismissing their IPs. They are also responsible for training to their Care Plan. CDWA is your legal employer of ...

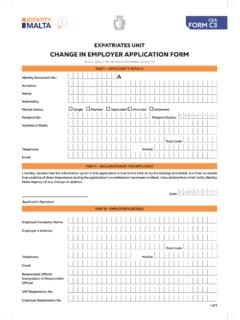

EXPATRIATES UNIT CHANGE IN EMPLOYER APPLICATION …

www.identitymalta.comÿ 3. Original employment contract signed & dated by both the applicant & the new employer; ÿ 4. Position description, according to the template provided, filled in by the employer & signed by the applicant; ÿ 5. The employer is required to provide proof of an advertisement carried out with Jobsplus or an advert in the

Ohio and School District Employer Withholding Tax Due ...

tax.ohio.gov* An employer who is required to remit partial-weekly shall file the Ohio IT 942, Ohio Employer’s EFT 4th Quarter/Annual Reconciliation of Income Tax Withheld, no later than the last day of the month following the end of the calendar year. File the Ohio IT 942 on Ohio Business Gateway. EFT filers do not file the Ohio IT 941.

Medicare & NYSHIP

www.cs.ny.govNew York State Health Insurance Program (NYSHIP) that provides you with the most complete coverage. This publication provides important health insurance information about Medicare and NYSHIP. Do not depend on Social Security, Medicare, another health plan or another employer for information as they may be unfamiliar with the NYSHIP requirements

Employer Declaration for Ignition Interlock Exemption

www.dol.wa.govEmployer Declaration for Ignition Interlock Exemption Author: Washington State Department of Licensing Subject: Form used to get an exemption when you are required to have an ignition interlock device \(IID\) and your employer requires you drive a vehicle without an IID. Created Date: 1/21/2022 3:12:08 PM

2022 Publication 926

www.irs.govthe employer share of social security tax was due by De-cember 31, 2021, and the remainder is due by December 31, 2022. Because both December 31, 2021, and Decem-ber 31, 2022, are nonbusiness days, payments made on the next business day will be considered timely. Any pay-

PERSONAL INJURY CLAIM DOCUMENT CHECKLIST - VCF

www.vcf.govsubmitted directly to the VCF by your employer – such as a letter from the employer confirming work at the site*, an official personnel roster and site credentials confirming work location, workers’ injury report (documenting injury at the site), or a pay stub showing dates of work and the location where work was performed.

Form WV/IT-104 - West Virginia - DISA

www.disa.milIf you are a resident of Kentucky, Maryland, Ohio, Pennsylvania or Virginia and your only source of income from West Virginia i s wages or salaries, you are exempt from West Virginia Personal Income Tax Withholding. Upon receipt of this form, properly completed, your employer is authorized to discontinue the withholding of West Virginia Income ...

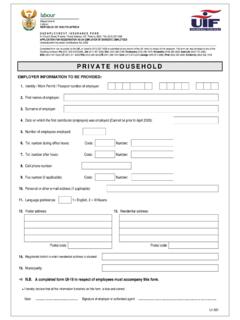

Form UI-8D - Application for registration as an employer of

www.westerncape.gov.zaCompleted form can be posted to the UIF, or faxed to (012) 337-1636 or submitted at any branch of the UIF which is closest to the employer. The form can also be faxed to any of the following numbers: Pta (012) 309 5142/5286; Jhb (011) 497 3293; Dbn (031) 366 2156; Polokwane (015) 290 1670; Mmabatho (018) 384 2658; East Ldn (043) 701 3263;

Employer Tax Handbook 2018 - .NET Framework

esdorchardstorage.blob.core.windows.netDec 31, 2020 · The Employment Security Department is an equal opportunity employer/ programs. Auxiliary aids and services are available upon request to individuals with disabilities. Language assistance services for lim-ited English proficient individuals are available free of charge. Washington Relay Ser-vice: 711

Exhibit: Child Support Order - TexasLawHelp.org

texaslawhelp.orgserved on the employer . unless: 1) child support payments are more than 30 days late, or. 2) the past due amount is the same or more than the monthly child support amount, or. 3) another violation of this child support order occurs, or . 4) the Office of the Attorney General Child Support Division is providing services to Obligee.

Form RI-941 Employer s Quarterly Tax Return and ...

tax.ri.govFederal employer identification number For the quarter ending: E-mail address City, town or post office State ZIPcode 2nd MONTH OF QUARTER 3rd MONTH OF QUARTER 2 State income tax withholding payments made to the RIDivision of Taxation to date for this quarter..... 2 Monthly payers use these 3 boxes

Similar queries

Employers, NHWP Workplace Health Incentives, Workers, Tips, Application, Atlantic, Designation, Employer, Back pain, Coverage, Employer Coverage Tool, Continues, 2012, Health and Safety, Need to know, What employers, Need, Employers Internship Toolkit, Western Michigan University, Guide, Organizing, Start, Smart, Monitor, Oregon, Federal Employer, 2017, Return, S Employer, 2A, Employer’s Quarterly Report of, Maine, 3. EMPLOYER 4. NATIONALITY, Delta, Employer guide, Earn, SHS Tax Employer Withholding Requirements, Portland, Business, Multnomah, Insurance, Request, Important instructions for filling out, Nationality, Employer provided living accommodation, Accommodation, State, Mandate waiver, Commercial or Government Employer Pull, Commercial or Government Employer Pull Notice. Enrollment, Out-of-State Licensed Drivers, As-You, EXPATRIATES UNIT CHANGE IN EMPLOYER APPLICATION, Employer Withholding, Employer Declaration for Ignition Interlock Exemption, Exemption, Injury, Your employer, West Virginia, Virginia, Tax Withholding, Withholding, Form, Application for registration as an employer, 2658, An equal opportunity employer, Ser-vice, Child Support, Services