2a Employer S Quarterly Report Of

Found 9 free book(s)Pennsylvania Unemployment Compensation (P A U C) …

www.uc.pa.gov• Form UC-2A, Employer’s Quarterly Report of Wages Paid to Each Employee • Form UC-2INS, Instructions for Completing PA UC Quarterly Tax Forms • Form UC-2B, Employer’s Report of Employment and Business Changes (reverse side) REIMBURSABLE ACCOUNTS: Even when the employee contribution rate is zero, reimbursable employers are still ...

SAMPLE 123456.00 SAMPLE 1 2 3 4 5 6 . 0 0 SAMPLE Typed ...

www.uc.pa.govUC-2A REV 07-21 PA Form UC-2A, Employer’s Quarterly Report of Wages Paid to Each Employee See instructions on form UC-2INS. Information MUST be typewritten or printed in BLACK ink. Do NOT use commas (,) or dollar signs ($). If typed, disregard vertical bars and type a consecutive string of characters.

NJ New Hire Reporting Form

njcsesp.comFederal and state legislation (N.J.S.A. 2A: 17‐56.61) requires all New Jersey employers, both public and private, to report tothe State of New Jersey all newly hired, contracted, rehired, or returning to work employees. Information about new hire reporting and online reporting is available on our website: www.nj csesp.com. Send completed ...

NHES 0041 R-8/16

www.nhes.nh.gov118 Main Street, Suite 2A Colebrook, NH 03576 Tel 237-5859 or Fax 237-5865 By appointment only Plymouth: Whole Village Family Resource Center 258 Highland Street Plymouth, NH 03264 Tel: 603-536-3720 By appointment only Employer Status Report Sample Form - (Attachment I) Fax to (603) 225-4323 or mail to: NHES, ATTN: Contributions, 45 South Fruit ...

Form NYS-50 Employer's Guide to Unemployment Insurance ...

www.tax.ny.govEmployee’s Withholding Allowance Certificate, the employer may use the same number of allowances claimed on the federal Form W-4. If an employee submits a federal Form W-4 to an employer for tax year 2020 or later, and the employee does not file Form IT-2104, the employer may use zero as the number of allowances.

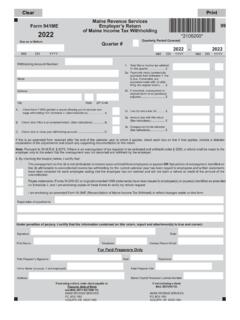

Maine Revenue Services Form 941ME Employer’s Return 2022

www.maine.govPursuant to 36 M.R.S. § 5276, if there is an overpayment of tax required to be deducted and withheld under § 5250, a refund shall be made to the . employer only to the extent that the overpayment was not deducted and withheld by the employer. 4. By checking the box(es) below, I …

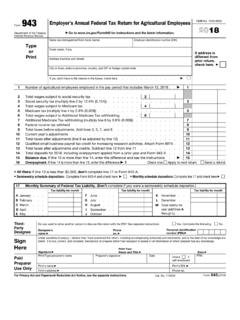

943 Employer’s Annual Federal Tax Return - IRS tax forms

www.irs.gov430121. Form . 943. 2021. Employer’s Annual Federal Tax Return for Agricultural Employees. Department of the Treasury Internal Revenue Service . . Go to

Maine Revenue Services Form 941ME 99 2021

www.maine.govNote: Pursuant to 36 M.R.S. § 5276, if there is an overpayment of tax required to be deducted and withheld under § 5250, a refund shall be made to the employer only to the extent that the overpayment was not deducted and withheld by the employer. 4. By checking the box(es) below, I …

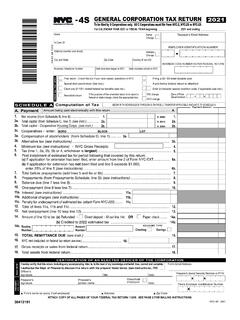

-4S

www1.nyc.govs Firm's name (or yours, if self-employed) s Address s Zip Code SIGN HERE PREPARER ' S USE ONLY employed: n Preparer's Social Security Number or PTIN Firm's Employer Identification Number ATTACH COPY OF ALL PAGES OF YOUR FEDERAL TAX RETURN 1120S. SEE PAGE 2 FOR MAILING INSTRUCTIONS. Taxpayer’s Email Address: _____ …