Search results with tag "Connecticut income tax"

IP 2021(12) Forms 1099-R, 1099-MISC, 1099-K ... - Connecticut

portal.ct.govPayments made to a Connecticut resident even if no Connecticut income tax was withheld; and b. Payments made to a nonresident of Connecticut if the payments relate to services performed wholly or partly in Connecticut even if no Connecticut income tax was withheld. • Federal Form 1099-R reporting distributions paid to Connecticut resident ...

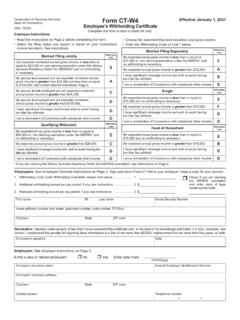

State of Connecticut Form CT-W4 Employee’s Withholding …

portal.ct.govForm CT-W4, Employee’s Withholding Certificate, provides your employer with the necessary information to withhold the correct amount of Connecticut income tax from your wages to ensure that you will not be underwithheld or overwithheld. You are required to pay Connecticut income tax as income is earned or received during the year.

Effective January 1, 2017 - CT.GOV-Connecticut's …

www.ct.govCONNECTICUT CIRCULAR CT Employer’s Tax GuideTaxGuide Connecticut Income Tax Withholding Requirements Taxpayer information is available on our website at

Form CT-W4 1, 2021 Employee’s Withholding Certificate

www.simsbury.k12.ct.us, Employee’s Withholding Certificate, provides your employer with the necessary information to withhold the correct . amount of Connecticut income tax from your wages to ensure that . you will not be underwithheld or overwithheld. You are required to pay Connecticut income tax as income is earned . or received during the year.

CT-1040ES (flat), 2017 Estimated Connecticut …

www.ct.govTax Calculation Schedule 1. Enter Connecticut AGI from 2017 Estimated Connecticut Income Tax Worksheet, Line 3. .....1. .00 2. Enter the exemption amount from Table A, Personal Exemptions.

2017 Income Tax Return FORM for Trusts and ... - Connecticut

www.ct.gov2017 FORM CT-1041 Connecticut Income Tax Return for Trusts and Estates • Resident Trusts and Estates • Nonresident Trusts and Estates • Part-Year Resident Trusts This booklet contains information and instructions about the following forms:

2013 Connecticut FORM Nonresident and CT-1040 …

www.ct.govImportant 2013 Connecticut Income Tax Topics: File Electronically File electronically... it is fast and free! Visit www.ct.gov/TSC to electronically file. For more information, see Taxpayer Service Center, on Page 53.

State of Connecticut Form CT-2210 2017 …

www.ct.govPage 1 of 10 Complete Form CT-2210 in blue or black ink only. Purpose: Filers of Forms CT-1040, CT-1040NR/PY, and CT-1041 who underpaid their estimated Connecticut income tax may use this form to calculate the amount of interest due or to lower or eliminate interest

2017 - CT.GOV-Connecticut's Official State Website

www.ct.govForms W-2 and 1099 Information Only enter information from your Forms W-2 and 1099 if Connecticut income tax was withheld. 17. Enter amount from Line 16.

Form CT-W4 Effective January 1, 2007 Employee’s ...

www.ct.gov2 of 4 Purpose: Form CT-W4, Employees Withholding Certificate, provides your employer with the necessary information to withhold the correct amount of Connecticut income tax from your wages to ensure that you will not be

Form CT-W4 Effective January 1, 2017 Employee’s ...

ct.govEmployee General Instructions Form CT-W4, Employee’s Withholding Certifi cate, provides your employer with the necessary information to withhold the correct amount of Connecticut income tax from your wages to ensure that

Similar queries

Connecticut, Connecticut resident, Connecticut income tax, S Withholding, Employer, Income, Effective January 1, 2017, 1040ES (flat), 2017 Estimated Connecticut, 2017 Income Tax, 2017, Connecticut FORM, Connecticut Form CT, Form CT, Form, Employee, Purpose, Employees Withholding Certificate, Withholding