Search results with tag "Form ct"

State of Connecticut Form CT-W4 Employee’s Withholding ...

portal.ct.govForm CT-W4 (Rev. 12/20) Page 2 of 2 Form CT-W4 Instructions Employee General Instructions Form CT-W4, Employee’s Withholding Certificate, provides your employer with the necessary information to withhold the correct amount of Connecticut income tax from your wages to ensure that you will not be underwithheld or overwithheld.

Department of Revenue Services State of Connecticut Form ...

portal.ct.govForm CT-W4 (Rev. 12/21) Page 2 of 2 Form CT-W4 Instructions Employee General Instructions Form CT-W4Employee’s Withholding Certificate,, provides your employer with the necessary information to withhold the correct amount of Connecticut income tax from your wages to ensure that you will not be underwithheld or overwithheld.

State of Connecticut Form CT-2210 2017 …

www.ct.govPage 1 of 10 Complete Form CT-2210 in blue or black ink only. Purpose: Filers of Forms CT-1040, CT-1040NR/PY, and CT-1041 who underpaid their estimated Connecticut income tax may use this form to calculate the amount of interest due or to lower or eliminate interest

State of Connecticut Form CT-W4 Employee’s …

ct.govEmployee General Instructions Form CT-W4, Employee’s Withholding Certificate, provides your employer with the necessary information to withhold the correct amount of Connecticut income tax from your wages to ensure that

2021 - portal.ct.gov

portal.ct.gov20. Payments made with Form CT‑1040 EXT (request for extension of time to file) 20..00 20a. Connecticut earned income tax credit: From Schedule CT‑EITC, Line 16. 20a. .00 20b. Claim of right credit: From Form CT‑1040 CRC, Line 6. 20b. .00 20c. Pass‑Through Entity Tax Credit: From Schedule CT‑PE, Line 1. Schedule must be attached. 20c ...

Connecticut 2017 Resident FORM Income Tax CT …

www.ct.gov2017 FORM CT-1040 File early to protect your refund from identity thieves. DRS epartment of evenue ervices Connecticut Resident Income Tax Return Instructions

State of Connecticut Form CT-1127 2017 450 …

www.ct.govForm CT-1127 Instructions Purpose: The Commissioner of Revenue Services may grant an extension of time for payment of your Connecticut income tax and your individual use tax if you can show it will cause you

2021 - portal.ct.gov

portal.ct.govon Form CT-1120CU, Combined Unitary Corporation Business Tax Return. See Special Notice 2016(1), Combined Unitary Legislation. Who is Exempt From Corporation Business Tax The following companies are exempt from filing Form CT-1120: • Insurance companies incorporated under the laws of any other state or foreign government, and domestic

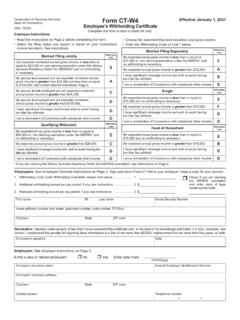

Form CT-W4 1, 2021 Employee’s Withholding Certificate

www.simsbury.k12.ct.usForm CT-W4 Instructions . Employee General Instructions. Form CT-W4, Employee’s Withholding Certificate, provides your employer with the necessary information to withhold the correct . amount of Connecticut income tax from your wages to ensure that . you will not be underwithheld or overwithheld.

Form CT-1120 FCIC 2016

www.ct.govForm CT-1120 FCIC Fixed Capital Investment Tax Credit Complete this form in blue or black ink only. Use Form CT-1120 FCIC to claim the credit allowed under Conn. Gen. Stat. §12-217w. Attach it to Form CT-1120K, Business Tax Credit Summary.

Form CT-W4 Effective January 1, 2017 Employee’s ...

ct.govEmployee General Instructions Form CT-W4, Employee’s Withholding Certifi cate, provides your employer with the necessary information to withhold the correct amount of Connecticut income tax from your wages to ensure that

Form CT-W4P Effective January 1, 2018 (Rev. 10/17 ...

www.ct.govForm CT-W4P Withholding Certifi cate for Pension or Annuity Payments Department of Revenue Services State of Connecticut (Rev. 10/17) Effective January 1, 2018

Form CT-W4 Effective January 1, 2007 Employee’s ...

www.ct.gov1 of 4 Form CT-W4 Employee’s Withholding Certificate 4. First Name Ml Last Name 5. Home Address 6. Social Security Number 7. City/Town 8. State 9.

Similar queries

Form CT, W4 Instructions, Instructions Form CT-W4, Form, Instructions Form CT, Connecticut Form CT, 2017, Connecticut income tax, W4 Employee, Employee, 1040 EXT, 1040, Connecticut, Instructions, State of Connecticut Form CT, 2016, 1120, Instructions. Form CT-W4, Form CT-1120 FCIC 2016, Form CT-1120 FCIC, Form CT-W4P Effective January 1, 2018 Rev. 10/17, W4P Withholding Certifi cate for Pension, Effective January 1, 2018, Form CT-W4 Effective January 1, 2007 Employee’s, W4 Employee’s Withholding Certificate