Search results with tag "Taxation"

Review No 01/2022: Energy taxation, carbon pricing and ...

www.eca.europa.euII The Energy Taxation Directive sets minimum taxation levels to ensure that the internal market functions properly, and can also be used to support other relevant policies such as climate action. III In July 2021, the Commission proposed a revision of the Energy Taxation Directive

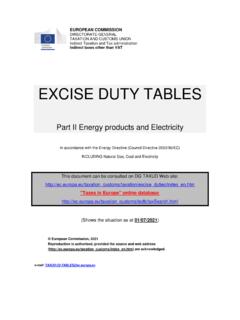

EXCISE DUTY TABLES

ec.europa.euIMPORTANT REMARK Concerning transitional arrangements for the "New Countries" of the European Union Council Directive 2003/96/EC – Energy taxation Directive The energy taxation Directive (2003/96/EC – "energy Directive") was adopted in 2003 and defines the fiscal structures and the levels of taxation to be imposed on energy products and electricity.

New York State Department of Taxation and Finance ST …

www.krollcorp.comNew York State Department of Taxation and Finance New York State and Local Sales and Use Tax Resale Certificate ST-120 (1/11) Name of seller Name of purchaser Street address Street address City State ZIP codeCity Mark an X in the appropriate box: Single-use certificateBlanket certificate Temporary vendors must issue a single-use certificate. To ...

Department of Taxation and Finance Instructions for Form ...

www.tax.ny.govDepartment of Taxation and Finance Instructions for Form IT-272 ... (for whom an exemption for New York State income tax purposes is allowed). List each eligible student only ... personal, living, or family expenses – Fees for course-related books, supplies, equipment, and

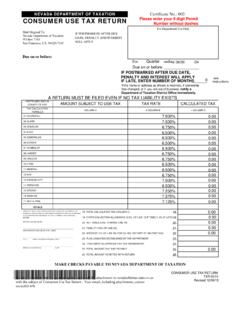

Certificate No.: 002- CONSUMER USE TAX RETURN - Nevada

tax.nv.govNEVADA DEPARTMENT OF TAXATION Certificate No.: 002-CONSUMER USE TAX RETURN For Department Use Only Mail Original To: Nevada Department of Taxation PO Box 7165 San Francisco, CA 94120-7165 Due on or before: For Quarter ending: A RETURN MUST BE FILED EVEN IF NO TAX LIABILITY EXISTS ENTER AMOUNTS IN

New York State Department of Taxation and Finance …

www.tax.ny.govNew York State Department of Taxation and Finance Office of Tax Policy Analysis Technical Services Division TSB-M-02(3)I Income Tax May 1, 2002 . Employer Requirements Concerning the Reporting of New York State, City of New York, and …

A Guide to Oil and Gas Taxation in Canada

assets.kpmgKPMG in Canada– A Guide to Oil and Gas Taxation in Canada THE TAX ENVIRONMENT The taxes imposed by any particular government are crucial to the viability of an oil and gas project. Too high a tax burden can make a project uneconomic, even though the project has excellent oil and gas prospects otherwise.

OECD WORK ON TAXATION

www.oecd.orgfora, taskforces and working groups, as well as the Global Forum on Transparency and Exchange of Information for Tax Purposes. Our work covers international and domestic issues, across direct and indirect taxation, and builds on strong relationships with OECD members and the engagement of a large number of non-OECD, G20 and developing countries

Department of Taxation and Finance Instructions for Form ...

www.tax.ny.govDepartment of Taxation and Finance Instructions for Form IT-216 ... See the instructions for Worksheet 1, line 2, for a special rule that allows 2020 dependent care benefits reported on line 2 to be used in ... dependency exemption for a child, see federal Publication 501.

Division Taxation Organizational December 2021

www.state.nj.usNew Jersey Division of Taxation Organizational Chart Property Administration December 2021 Assistant Director Property Administration Shelly Reilly Chief LPT Valuation & Mapping Melissa Gorman Chief LPT Policy & Planning Jessica Larned

CAT Syllabus - 2021

www.icmai.inKnow various records and returns under tax laws. Know statutory compliance under companies act. (A) Concept of Taxation: Constitution of India Taxation under Constitution Direct and Indirect Taxes Constitutional Amendment Taxes to be subsumed under GST Information on Website (B) Goods and Services Tax:

Claiming GST Credits on the Accountancy ... - Class Limited

www.class.com.auFor the Class Super Info Hub We often get asked why GST credits (whether at 100% or reduced credits at 75%) on the Accountancy, Taxation and Audit fees can’t be claimed, despite the SMSF being registered for GST. Our understanding of the legislation is such that the Accountancy, Audit and Taxation fees are generally not

Personal Property Assessment and Taxation - Oregon

www.oregon.govPersonal Property Assessment and Taxation All personal property is valued at 100 percent of its real market value unless exempt by statutes. Per-sonal property is taxable in the county where it is located as of the assessment date, January 1 at 1 a.m. Taxable personal property Taxable personal property includes machinery,

Explanatory Notes on the EU VAT changes in respect of call ...

ec.europa.euTAXATION AND CUSTOMS UNION Indirect Taxation and Tax administration Value Added Tax Published December 2019 Explanatory Notes on the EU VAT changes in respect of call-off stock arrangements, chain transactions and the exemption for intra-Community supplies of goods (“2020 Quick Fixes”) Council Directive (EU) 2018/1910

Chartered Accountants Amendments in federal taxation laws ...

assets.kpmgJul 14, 2021 · The Bill proposed to change this taxation regime in following manner: — Calculation of the gain on disposal as excess of consideration over the cost of asset; — ... The Tax Laws (Second Amendment) Ordinance 2021 had omitted first year allowance (available at 90% of the cost of an asset) under section 23A of ...

ON DWELLING HOUSE OF A NEW JERSEY RESIDENT SENIOR …

www.state.nj.usTaxpayers can appeal to the County Board of Taxation. April 1 of the current year is the last day on which an appeal can be filed. If a municipal assessor or tax collector has disallowed the claim too late to permit the filing of an appeal on or

INLAND REVENUE BOARD OF MALAYSIA PARTNERSHIPS …

phl.hasil.gov.myPARTNERSHIPS TAXATION PART II - COMPUTATION AND ALLOCATION OF INCOME Public Ruling No. 8/2021 INLAND REVENUE BOARD OF MALAYSIA Date of Publication: 29 December 2021 Page 5 of 19 Rama Lee 1,000 1,000 4,0003 335,000 Net profit 315,0004 Year of Assessment 2020 Computation of Provisional Adjusted Income ...

Form IT-201:2019:Resident Income Tax Return:it201

www.tax.ny.govDepartment of Taxation and Finance Resident Income Tax Return ... royalties, partnerships, S corporations, trusts, etc. (submit copy of federal Schedule E, Form 1040) 11 .00 Federal income and adjustments ... or offsets of state and local income taxes (from line 4) 25 .00 26 Pensions of NYS and local governments and the federal government ...

Chapter 237, HAR, General Excise Tax Law - Hawaii

files.hawaii.govThis is an unofficial compilation of the Hawaii Administrative Rules as of December 31, 2021. Historical Note: Chapter 237 of Title 18, Administrative Rules, is based substantially upon Regulation No. 57-1 of the Department of Taxation [Eff 6/4/57; R 2/16/82], Regulation No. 58-4 of the Department

0460 w20 ms 11

www.cambridgeinternational.orgContent Guide: E.g. old dependent Answers are likely to refer to: High dependency rate Stress on working population Increased taxation Lack of workforce Need to provide pensions Lack of innovation Difficulty recruiting armed forces Pressure on healthcare Under use of facilities for young people/closure of schools etc Positive effects =0

Instructions for Forms MT-456 and MT-456-ATT Alcoholic ...

www.tax.ny.govDepartment of Taxation and Finance Instructions for Forms MT-456 and MT-456-ATT Alcoholic Beverages Tax Return and Attachment MT-456-I (1/21) General information For information about the alcoholic beverages tax (ABT), visit our website (see Need help?) and search: ABT. Before you file a paper return, consider filing electronically.

Department of Taxation and Finance Instructions for Form ...

www.tax.ny.govPage 2 of 12 IT-2105-I (5/21) (2021) the Amended estimated tax worksheet on page 12, in the appropriate space(s) on the voucher. Be sure to separately enter the amounts for New York State, New York City, Yonkers, and MCTMT; then enter the total in the Total payment box.If there is no amount to be entered, leave blank.

Shipping Tax Guide - Deloitte

www2.deloitte.comShipping Taxation 12 Legislation 13 Registration Requirements 14 A. Vessels flying the Greek Flag 14 B. Vessels flying a foreign Flag 18 ... double tax treaty. Special Tax Regime There is a special provision regarding individuals that are taxed …

Table 1 Rates of County Levies for County Purposes for Tax ...

www.tax.virginia.gov1 Virginia Department of Taxation. Real Estate Tangible Personal Property Machinery and Tools Merchants' Capital Table 1 Rates of County Levies for County Purposes for Tax Year 2018 Fiscal 2019 ... Certain items of property are considered separate classifications and may be taxed at a lower tax rate. Not all localities levy these taxes on 100% ...

California Department of Tax and Fee Administration ...

www.cdtfa.ca.govCalifornia Department of Tax and Fee Administration. INFORMATION UPDATE. Assembly Bill (AB) 398 (Chapter 135, Stats. 2017) and AB 131 (Chapter 252, Stats. 2017) amended Revenue and Taxation Code (R&TC) section 6377.1, which provides for a partial sales and use tax exemption for certain manufacturing and research & development equipment.

CDTFA-230-G Partial Exemption Certificate for Qualified ...

www.cdtfa.ca.govpursuant to section 6051.2 and 6201.2 of the Revenue and Taxation Code, or pursuant to section 35 of article XIII of the California Constitution. This partial exemption also applies to lease payments made on or after September 1, 2001, for tangible personal property even if the lease agreement was entered into prior to September 1, 2001.

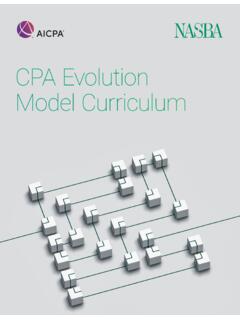

CPA Evolution Model Curriculum

thiswaytocpa.com73 Section 3: Tax Compliance and Planning (TCP) Discipline 73 Module 1: Individual Tax Fundamentals and Tax Planning 75 Module 2: Acquisition, Use and Disposition of Assets 76 Module 3: Tax Accounting Methods 77 Module 4: Federal Taxation of Entities 78 Module 5: C Corporations 79 Module 6: S Corporations 80 Module 7: Partnerships

Adult-Use Cannabis Legalization

cannabis.ny.govOn March 31, 2021, New York State legalized adult-use cannabis (also known as marijuana, or recreational marijuana) by passing the Marijuana Regulation & Taxation Act (MRTA). The legislation creates a new Office of Cannabis Management (OCM) governed by a Cannabis Control Board to oversee and implement the law.

NOTICE TO STAKEHOLDERS

ec.europa.euTAXATION AND CUSTOMS UNION International and General Affairs Brussels, 5 February 2021 NOTICE TO STAKEHOLDERS 1. LEGAL BASIS 1.1. Commission Implementing Regulation (EU) 2020/2254 of 29 December 2020 on the making out of statements on …

FOREIGN CORPORATION QUALIFICATION - Maryland

dat.maryland.govCorporations and Associations Article of the Annotated Code of Maryland, to do intrastate, interstate and foreign business as a foreign Corporation in the State of Maryland, hereby certifies to the State Department of Assessments and Taxation: (A) That the name of the Corporation is (B) The corporation was formed in the State of (C)

2021 Pass-Through Business Alternative Income Tax Return …

nj.govDivision of Taxation to send a bill. The Division generally has three years from the date the entity filed its PTE-100 or the original due date of the return, whichever is later, ... rect or indirect voting control of each pass-through entity. Section 318 of the federal Internal Revenue Code, 26 U.S.C. s.318, applies for determining voting ...

Paper F9 - Association of Chartered Certified Accountants

www.accaglobal.comMiller – Orr Model The Capital Asset Pricing Model The asset beta formula The Growth Model ... Cost of equity using dividend growth model = [(35 x 1.04)/ 450] + 0.04 = 12.08% ... continuing to ignore taxation but assuming a perfect capital market, Miller and Modigliani ...

Department of Taxation and Finance Instructions for Form ...

www.tax.ny.govreturn with the taxpayer, less any interest deductions directly or indirectly attributable to such income (the 40% safe harbor does not apply). Exempt cross-article dividends are one type of exempt unitary corporation dividends. Other exempt income cannot exceed ENI. If you attribute interest deductions to gross other exempt income and the

New Mexico Taxation and Revenue Department GROSS …

klvg4oyd4j.execute-api.us-west-2.amazonaws.comU01 Unpaid Doctor Services Credit. Attach RPD-41323. Refundable (apply credit amount to tax due in column C and amount to refund in column D) H01 High-wage Jobs tax credit. RPD-41290. (GRT excluding local options) I01 Investment tax credit. Attach RPD-41212. T02 Technology jobs and research and development (additional) tax credit.

Women at Work Trends 2016 - International Labour …

www.ilo.orgC reating and protecting quality jobs in the care economy 89. 6. Promoting decent work for care professionals, including domestic and migrant workers 90. 7. Extending long-term care coverage for older persons 91. 8. Promoting family-friendly flexible working arrangements 91. 9. E ncouraging individual income taxation to boost the participation ...

STATE AND LOCAL SALES/USE TAX RATE CHANGES

ksrevenue.govwebsite 60 days in advance (see EDU-96). For a current listingof the sales tax rates, visit the Kansas Department of Revenue website at: ksrevenue. gov /salesratechanges.html. EDU-96 Rev. 7-21. DIVISION OF TAXATION. 120 SE 10. th. Ave. PO BOX 3506. TOPEKA, KS 66601 -3506 PHONE: 785-368-8222 FAX: 785-296-2073 www.ksrevenue.gov

Information Bulletin, November 25, 2021 - Fiscal measures ...

www.finances.gouv.qc.cathat year; ⎯ a person who is exempt from tax under any of sections 982 and 983 of the Taxation Act or any of subparagraphs a to d and f of the first paragraph of section 96 of the Tax Administration Act for the base year, or the cohabiting spouse of such a person at the end of that year. Amount paid

Department of Taxation and Finance Instructions for Form ...

www.tax.ny.govline instructions below. Enter in column b the portion of each amount that is derived from New York City during the resident period. ... additions and subtractions (from lines 7, 9, and 9a) that relates to the trust’s New York State resident period in the computation of the

Streamlined Sales and Use Tax Agreement for New Jersey

www.nj.govG Resale # _____ 6. Sign here. I declare that the information on this certificate is correct and complete to the best of my knowledge and belief. ... information on the taxability of common goods and services, and the applicability of the sales tax exemptions allowed under New Jersey law, see the Division’s website at: ... NJ Taxation Subject ...

ROAD TO RECOVERY

cdn.ymaws.comJun 14, 2021 · LLM (Taxation), LLM (Corporate Law), Chartered Certified Accountant (FCCA), Advanced Certificate in Tax Practice (with distinction), Passed Levels 1, 2 and 3 of the Chartered Financial Analyst examinations, LLB, Admitted Attorney of the High Court of South Africa MTP(SA) member

Taxation of lump sum death benefits - GOV.UK

assets.publishing.service.gov.ukThe scheme administrator of a registered pension scheme is liable for the tax charge on lump sum death benefits. Where UK pensions tax relief has been provided to individuals who are members of non-UK pension schemes, there are similar tax charges to those that exist for registered schemes on payments following the individual’s death.

Similar queries

Taxation, Arrangements, Department of Taxation and Finance, Department of Taxation, Exemption, Personal, Certificate No.: 002- CONSUMER USE TAX RETURN, Nevada, NEVADA DEPARTMENT OF TAXATION Certificate No.: 002-CONSUMER USE TAX RETURN, Department Use, Nevada Department of Taxation, RETURN, NO TAX, New York State Department of Taxation and Finance, New York State, New York, A Guide, OECD WORK ON TAXATION, Global Forum, OECD, Worksheet, Division, Division of Taxation Organizational Chart, Valuation, Laws, Amendment, Accountancy ... - Class, Class, The Accountancy, Taxation and Audit fees, Accountancy, Personal Property Assessment, Oregon, Property, Taxation laws, Bill, County, Resident Income Tax Return, Trusts, Income, State, Hawaii, Hawaii Administrative Rules, Title 18, Administrative Rules, Department, Guide, Alcoholic, Alcoholic beverages, Double, Virginia, Administration, Chapter, Revenue and Taxation Code, Section, Marijuana, The Marijuana Regulation, Taxation Act, Article, Indirect, Model, Capital, The Growth Model, Growth model, Taxpayer, Attribute, Services, Economy, Kansas Department of Revenue, DIVISION OF TAXATION, Year, The Taxation, Department of Taxation and Finance Instructions for, Line instructions, Additions and subtractions, Resale, Certificate, Goods, Chartered, Taxation of lump sum death benefits, Pension, Lump sum death benefits, Pension schemes, Schemes