Search results with tag "Employed"

Self-employed contractors: understanding the law

www.cipd.co.ukSelf-employed people are responsible for their own income tax, NICs and VAT arrangements. As a result, self-employed individuals will need to account for income tax and pay self-employed persons’ National Insurance contributions (NICs). Individuals can also be both employed and self-employed simultaneously, for example if they work for an

Durable Power of Attorney Affidavit and Indemnification

www.fidelity.comEmployed Self-employed Occupation Employer Leave blank if self-employed. Employer Address City State/Province ZIP/Postal Code Country Retired Not employed Source of Income Pension, investments, spouse, etc. Enter full first and last name as evidenced by a government-issued, unexpired document (e.g., driver’s license, passport,

How to register as self-employed with HMRC

www.simplybusiness.co.ukHow to register as self-employed with HMRC age If you’ve decided to take the leap and set up as self-employed, you’re at the beginning of an exciting journey. However, before you get stuck in, there are a few things you should have covered. The first is setting up as self-employed with HMRC and, most likely, registering as a sole trader.

AIM for Self-Employed - Freddie Mac

sf.freddiemac.comAIM for self-employed is a capability within Loan Product Advisor that leverages access to optical character recognition (OCR) technology from third-party service providers to help enable the automation of certain income calculations for self-employed borrowers; this allows Loan Product Advisor to determine if you are eligible for ...

What can I claim on tax? A guide to self- employed expenses

www.simplybusiness.co.ukA guide to self-employed expenses Self-employed expenses calculator You need to rely on your tax records when calculating your allowable expenses – the figures will be unique to your business. It’s a case of adding up your expenses from your bills and receipts, so it’s important that you keep them all, otherwise you might miss out on a claim.

Eligible Self-Employed Individual

www.irs.govLeave for Certain Self-Employed Individuals in Part I and the Credit for Family Leave for Certain Self-Employed Individuals in Part II, you can only count the day once. Don't include the same day for both credits. Line 2. Enter the number of days in the period from January 1, 2021, through March 31, 2021, that you were unable to perform

THE FIDELITY SELF-EMPLOYED 401(K) CONTRIBUTION …

www.fidelity.comTHE FIDELITY SELF-EMPLOYED 401(K) CONTRIBUTION WORKSHEET FOR UNINCORPORATED BUSINESSES Over Calculating Your Maximum Plan Year Contribution If you are self-employed, the worksheet on the other side of this page may help you to calculate your retirement plan contributions.* However, you are strongly advised to consult a tax advisor or

Go to www.irs.gov/Form7202 for instructions and the latest ...

www.irs.govCredit for Family Leave for Certain Self-Employed Individuals. 25 . Number of days you were unable to perform services as a self-employed individual because of certain coronavirus-related care you provided to a son or daughter. (Do not enter more than 50 days.) See

ASSISTANCE FOR SELF-EMPLOYED, SMALL BUSINESS …

www.employnv.govASSISTANCE FOR SELF-EMPLOYED, SMALL BUSINESS OWNERS AND GIG WORKERS Freelance & Gig Worker Sites: https://www.entrepreneur.com/article/349238 …

The South Korean Health Care System - MED

www.med.or.jpemployees. In January 1988, self-employed people in rural areas were included under this system. The year 1989 is the most important year in the history of South Korean National Health Insurance Program. In July, the health insurance program for urban areas was expanded to include the self-employed. It took 12 years from the estab-

Completing the Self-Employed 401(k) Adoption …

www.fidelity.comRetirement Age is age 59½. 6 Indicate the eligibility and coverage requirements in effect as of the amendment effective date you provided in Section 1. 3 Social Security Integration (permitted disparity) is designed for multi-participant plans and is not generally appropriate for a Self-Employed 401(k) Retirement

PPP Loan Forgiveness Application Form 3508EZ Revised July ...

www.sba.gov• For a self-employed individual, independent contractor, or a sole proprietor, the self-employed individual, ... please use SBA Form 3508S. Do not submit this Checklist with your SBA Form 3508EZ. Each PPP loan must use a separate loan forgiveness application form. ... • Ignore reductions that arose from an inability to rehire individuals ...

What is IR35? A guide for the self-employed

www.simplybusiness.co.ukpay employers’ National Insurance contributions (NICs) or give any employee benefits to contractors. So self-employed IR35 rules tackle those arrangements by testing the contract itself, working out whether it’s ‘inside IR35’ or ‘outside IR35’: • if your contract is inside IR35, it points towards employment. HMRC sees

Schedule C Worksheet for Self Employed Businesses and/or ...

www.kristels.comfor Self Employed Businesses and/or Independent Contractors IRS requires we have on file your own information to support all Schedule C’s Business Name (if any)_____ Address (if any) _____ Is this your first year in business? Yes

Tax Preparation Checklist - Intuit

digitalasset.intuit.comSelf-employed health insurance payment records Records of moving expenses Alimony paid Keogh, SEP, SIMPLE, and other self-employed pension plans Deductions and credits The government offers a number of deductions and credits to help lower the tax burden on individuals, which means more money in your pocket.

Self-Employed Online federal forms - H&R Block

www.hrblock.comForm 7202 Credits for Sick and Family Leave for Certain Self-Employed Individuals Form 8283 Noncash Charitable Contributions Form 8332 Release of Claim to Exemption Form 8379 Injured Spouse Form 8396 Mortgage Interest Credit Form 8453 Electronic Filing Form 8582 Passive Activity Loss Limitations

Self Employed Income Mortgage Application Guide

www.santander.co.ukSelf-employed income Use this simple guide to help you upload the right evidence to support your mortgage application. We need you to upload either: 1 Santander’s accountant’s certificate, filled in by an accountant with an acceptable qualification; or 2 Self-assessment tax forms (e.g. SA302) PLUS supporting Tax Year Overviews (TYOs)

Self-Employment In The United States - Bureau of Labor ...

www.bls.govSelf-employed with paid employees most likely to employ 1 to 4 workers Of the 1.4 million unincorporated self-employed business owners with paid employees in 2015, 70.0 percent had 1 to 4 employees. The proportion with more than 20 employees was very small, at 6.1 percent. The incorporated self-

Career Research - Teachnet.com

teachnet.comYou can get a great deal of valuable information about the world of work from people employed in various occupations. To identify employed individuals who may be able to supply you with current, comprehensive career information, begin with those persons most easily accessible to you; your family, friends, co-workers, school, and other resources.

Class 2 National Insurance Contributions - GOV.UK

assets.publishing.service.gov.ukSelf-employed people who may be liable to pay income tax and National Insurance Contributions (NICs). General description of the measure. The measure will change the mechanism for collecting Class 2 NICs. It will enable self-employed customers to pay their Class 2 NICs through Self Assessment (SA) alongside income tax and Class 4 NICs.

2021 Educational Opportunity Tax Credit Worksheet for ...

www.maine.govThe self-employed person may also qualify for the credit for employers if the self-employed person had employees during the tax year. For more information on the employer credit, see the Credit for Educational Opportunity Worksheet for Employers. SPECIFIC INSTRUCTIONS

State of Health in the EU Italy

www.euro.who.intDisclaimer: The opinions expressed and arguments employed herein are solely those of the authors and do not necessarily reflect the official views of the OECD or of its member countries, or of the European Observatory on Health Systems and Policies or …

APPLICATION FOR EMPLOYER, SECONDARY, SELF …

nib-bahamas.comThe National Insurance Act, 1972 Commonwealth of The Bahamas . APPLICATION FOR EMPLOYER, SECONDARY, SELF-EMPLOYED & VOLUNTARILY INSURED PERSONS NOTE: Branches with individual payrolls are required to register as a separate employer. PLEASE PRINT OR TYPE REQUEST FOR NEW REGISTRATION NUMBER UPDATE OF EXISTING …

FACTORS AFFECTING INDIVIDUALS TO ADOPT MOBILE …

www.jecr.orgunderstanding of what influences consumers to adopt this new product or service, this study employed the unified theory of acceptance and use of technology (UTAUT) with age and gender as moderating effects to elaborately investigate what affecting individuals to adopt mobile banking. The findings culled from this research can help

U.S. CHAMBER OF COMMERCE CORONAVIRUS EMERGENCY L …

www.uschamber.comMar 19, 2021 · help small businesses and self-employed individuals check eligibility and prepare to apply for a loan. Here’s what you need to know. Prepared by the U.S. CHAMBER OF COMMERCE CORONAVIRUS EMERGENCY L ANS Small Business Guide and Checklist Leer en Español Updated: March 19, 2021 THANK YOU TO OUR PRESENTING PARTNER

PAYCHECK PROTECTION PROGRAM (PPP) INFORMATION …

home.treasury.govconcerns, sole proprietorships, self-employed individuals, and independent contractors – with 500 or fewer employees can apply. Businesses in certain industries can have more than 500 employees if they meet applicable SBA employee-based size standards for those industries (click HERE for additional detail).

State of Health in the EU Finland

www.euro.who.intDisclaimer: The opinions expressed and arguments employed herein are solely those of the authors and do not necessarily reflect the official views of the OECD or of its member countries, or of the European Observatory on Health Systems and Policies or …

A Guide to Wage and Workplace Laws in Rhode ... - Rhode …

dlt.ri.govLabor Standards (Wage and Hour) Unit or your legal advisor for more detailed information. DLT is an Equal Opportunity Employer/Program. ... address, occupation, rate of pay and amount paid each pay period and hours worked each day and each week by its employees. ... persons employed between May 1 and October 1 in a resort establishment which

2021 Publication OR-ESTIMATE, Oregon Estimated Income …

www.oregon.govAllan is self-employed. Louise is a teacher. They’re calendar-year filers who want to know if they should make estimated tax payments in 2021. They use their 2020 federal return and schedules, their 2020 Oregon return and indexed Oregon figures, and the estimated tax worksheet to find their estimated 2021 tax, required annual

Checklist for Self-Employed Individuals - myinteger.com

myinteger.comVehicle Mileage Deduction-Typically it's more advantageous to claim the standard mileage allowance rather than actual expense.-If you claim a home office, anytime you leave your home related to your business, is deductible.

Official Gazette of the Republic of the Philippines | The ...

www.officialgazette.gov.phself-employed direct contributors shall be required to pay all missed contributions with an interest, compounded monthly, of at least three percent (3%) for employers and not exceeding one and one-half percent (1.5%) for self-earning, professional practitioners, and migrant workers. SEC. 10. Premium Contributions. For dlrect

Environmental Policy and Regulation in RUSSIA

www.oecd.orgThe opinions expressed and arguments employed herein do not necessarily reflect the official views of the Organisation or of the governments of its Member countries. ... The views expressed in this report are those of authors and do not necessarily reflect those of the Russian authorities, the OECD or its member countries. ...

TAX YEAR 2021 SMALL BUSINESS CHECKLIST - Tim Kelly

www.timkelly.comself-employed health insurance premiums outside services (paid to other businesses) postage printing and copy expense professional memberships retirement contributions for employees retirement contributions for owner(s) rental of vehicles, machinery or equipment rental of space or property repairs security email to lynn@timkelly.com or fax to ...

The Right to Adequate Food - Office of the United Nations ...

www.ohchr.orgii NOTE The designations employed and the presentation of the material in this publication do not imply the expression of any opinion whatsoever on the

(Schedule C) Self-Employed Business Expenses Worksheet …

sharetheharvest.comMar 09, 2018 · Business-Related Mileage: NOTE: Keep a written mileage log showing the date, miles, and business purpose for each trip. The IRS does not allow a deduction for undocumented mileage. If there are multiple vehicles, please attach a …

Broker Submission Checklist - MyState Bank

brokers.mystate.com.auThe items in this checklist are required for the loan application to be placed in queue for assessment ... Self Employed / Company / Trust: Tax file numbers removed from all documents Trust Deeds – Certified (if applicable) ... (who are individuals) or appropriate representatives of the borrower and guarantor (corporate applications e.g ...

APPLICATION FOR EMPLOYMENT - GCIS

www.gcis.gov.zaF. WORK EXPERIENCE (Also attach a detailed CV)6 Employer (including current employer) Post held From To Reason for leaving MM YY MM YY If you were previously employed in the Public Service, is there any condition that prevents your re-appointment Yes No If yes, Provide the name of the previous employing department and indicate the

REPORTABLE IN THE SUPREME COURT OF INDIA CIVIL …

main.sci.gov.inemployed. Reliance is placed on Manjuri Bera (Smt) v. Oriental Insurance Co. Ltd. & Anr.3. It is urged that the respondent Nos. 1 & 2 may be entitled only to compensation under conventional heads as held in National Insurance Company Limited v. Pranay Sethi & Ors.4.

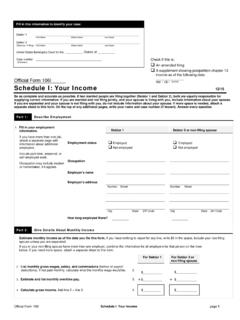

First Name Middle Name Last Name - United States Courts

www.uscourts.govHow long employed there? _____ Part 2: Give Details About Monthly Income Estimate monthly income as of the date you file this form. If you have nothing to report for any line, write $0 in the space. Include your non-filing spouse unless you are separated.

Public health advocacy

phabc.orgAdvocacy strategies draw from a range of tactics. These can involve “…creating and maintaining effective coalitions, the strategic use ... encompass the types of social action necessary to effectively modify the social determinants of ... the individual approach typically employed in issues of health care. As Wallack and Lawrence

Republic of South Africa - Department of Employment and …

www.labour.gov.zaF. WORK EXPERIENCE (Also attach a detailed CV)6 Employer (including current employer) Post held From To Reason for leaving YYMM If you were previously employed in the Public Service, is there any condition that prevents your re-appointment Yes No If yes, Provide the name of the previous employing department and indicate the

CareFirst BlueChoice, Inc. - OPM.gov

www.opm.gov• If you have any questions about the eligibility of a dependent, check with your personnel office if you are employed, with your retirement office (such as OPM) if you are retired, or with the National Finance Center if you are enrolled under Temporary Continuation of Coverage (TCC).

Application to pay self-employed National Insurance ...

assets.publishing.service.gov.ukPlease fill in this form in capital letters and send it to National Insurance contributions and Employer Office, HM Revenue and Customs, BX9 1AN. In the ‘Instruction to your bank or building society to pay by Direct Debit’ enter your National Insurance number in the ‘Reference’ box. Please detach and keep the Direct Debit guarantee.

CWF! - Registering for Self Assessment and National ...

www.moorebennett.co.ukRegistering for Self Assessment and National Insurance contributions if you are a self-employed sole trader For official use only System action complete If you are starting out in self-employment you need to tell us straightaway. If you are not starting within 28 days you cannot currently apply. If you delay registering as

WORKSHEET FOR DOCUMENTING ELIGIBLE HOUSEHOLD …

www.rd.usda.gov4. Additional Adult Household Member (s) who are not a Party to the Note (Primary Employment from Wages, Salary, Self-Employed, Additional income to Primary Employment, Other Income). Calculate and record how the calculation of each income source/type was determined in the space below. 5.

Similar queries

Employed, National Insurance, Employed Self, Self, To register as self-employed with HMRC, Should, HMRC, Freddie Mac, Employed individuals, WORKSHEET, National, Insurance, Completing the Self-Employed 401(k) Adoption, Retirement, Checklist, Individuals, Self Employed, Tax Preparation Checklist, H&R Block, Self Employed Income, Self-employed income, Career Research, Persons, Class 2 National Insurance Contributions, National Insurance Contributions, Class 2, Expressed and arguments employed herein, Small Business Guide and Checklist, Independent contractors, Detailed, Occupation, Persons employed, Oregon, Checklist for Self-Employed Individuals, Employed direct, Contributions, Expressed, OECD, The designations employed and the presentation, Self-Employed Business Expenses Worksheet, Business, Broker Submission Checklist, APPLICATION FOR EMPLOYMENT, United States Courts, Income, Public health advocacy, Strategies, Tactics, Social action, Social, CareFirst BlueChoice, Inc, Employed National Insurance, Self Assessment and National Insurance contributions