Search results with tag "Contributions"

CAMPAIGN TREASURER’S REPORT – ITEMIZED …

files.floridados.govcontributions in the original report. For example, amending an original M1 report that had 75 contributions means the sequence number of the first contribution having amendment type “ADD” will be 76; the second “ADD” contribution would be 77, etc. When amending an original M2 report that had 40 contributions, the

Class 2 National Insurance Contributions - GOV.UK

assets.publishing.service.gov.ukSelf-employed people who may be liable to pay income tax and National Insurance Contributions (NICs). General description of the measure. The measure will change the mechanism for collecting Class 2 NICs. It will enable self-employed customers to pay their Class 2 NICs through Self Assessment (SA) alongside income tax and Class 4 NICs.

2019 to 2020: National Insurance contributions Tables A, H ...

assets.publishing.service.gov.ukand HM Revenue and Customs National Insurance Contributions and Employer Office, of any change in circumstances. For example, change of address, change of name and particularly divorce if they pay category B reduced rate NICs. Abolition of secondary NICs for those employees under the age of 21 From April 2015 the rate of employer Class 1

National Insurance contributions (NICs) Tables

www.gov.imcalculate the director's National Insurance due there are two methods. Paid irregularly: Each time you pay a director, work out their National Insurance for their total pay over the tax year so far, including bonuses. To work out what contributions they owe, take off the total employee National Insurance th e y've p id so far ir.

CA38(2020) National Insurance contributions Tables A and J

assets.publishing.service.gov.ukNational Insurance contributions Tables A, H, J, M and Z These tables are for employers who are exempt from filing or unable to file payroll information online and use manual systems. Use from 6 April 2020 to 5 April 2021 inclusive Standard Rate NICs tables CA38. Forms and guidance in Braille, large print and audio

SLPs Performance Assessment Contributions Effectiveness …

www.asha.orgreport—portfolio assessment, “classroom” observation, and “teacher” self‐report appeared to be the most flexible and comprehensive options for evaluating SLPs. The Performance Assessment of Contributions and Effectiveness (PACE) for SLPs was developed by the

Indonesia Individual Income Tax Guide - Deloitte

www2.deloitte.comAssets and Liabilities Reporting 12 Tax Audits 13 Sanctions 13 Social Security 14 Important dates 16 Contacts 17. 4 Residency Rules ... religious contributions Actual amount, provided that valid supporting evidence is available and certain requirements are met. Indonesia Individual Income Tax Guide 11

IRS HSA Contribution 2022 HSA Contributions Limits (Based ...

www.llnl.govHSA Contribution Employee Only Coverage Family Coverage Employee Only Coverage Family Coverage $3,650 $7,300 $750 $1,500 $2,900 $5,800 Employees age 55 or older can contribute an additional $1,000. Created Date:

740-NP

revenue.ky.gov11. Election Workers—Income for Training or Working at Election Booths Taxable Exempt 12. Artistic Contributions Noncash contribution allowed as itemized deduction Appraised value allowed as itemized deduction or adjustment to income 13. State Income Taxes Deductible Nondeductible 14.

Deferred Compensation Plan (457 Plan)

www.nypa.govPlan participants age 50 or older, or participants who become age 50 during the year, are able to make Age 50 Catch-Up contributions. This additional contribution is not dependent on your prior years’ deferrals to a deferred compensation plan. The catch-up contribution limit is …

Diverse Peoples – Aboriginal Contributions and Inventions ...

www.edu.gov.mb.caTOBOGGAN – The Mi’kmaq people of eastern Canada invented the toboggan, or taba’gan to use the Mi’kmaq word. Toboggans were first made of bark and animal skins. By the year 1600, Mi’kmaq toboggans were made of thin boards, curved at the front. They were ideal for hauling game out of the woods, moving camp, and for travel. Many

SUPPLY AND DELIVERY OF COVID-19 PROTECTIVE …

www.etenders.gov.zaclearly labelled with the contract number and project name on the outside of the envelopes addressed to The ... insurance fund contributions and skills development levies; ... issued in terms of section 9(1) of the Broad-Based

What is FICA? - Social Security Administration

www.ssa.govWhat is FICA? FICA is a U.S. federal payroll tax. It stands for the . Federal Insurance Contributions Act and is deducted . from each paycheck. Your nine-digit number helps Social Security accurately record . your covered wages or self-employment. As you work and pay FICA taxes, you earn credits for Social Security benefits. How much is coming ...

SUSTAINABLE FINANCE INITIATIVES FOR THAILAND

www.bot.or.thDevelopment Goals (SDGs) and its Nationally Determined Contributions (NDCs) in its National Strategy, and the Twelfth National ).Economic and Social Development Plan (NESDP Sustainability has been one of the key strategic priorities …

A guide to your 2021 1099-R Tax Reporting Statement

www.mymerrill.com1099-R Tax Reporting Statement . Important tax reporting information to help you prepare your federal tax return . IRS Form 1099-R, “Distributions from Pensions, Annuities, Retirement or Profit Sharing Plans, IRAs, Insurance ... If you made non-deductible contributions, including a repayment of a qualified reservist distribution.

The role of men and boys in promoting gender equality

www.un.org2 activities take the contributions, priorities and needs of both women and men into consideration. This strategy is considered essential to ensure achievement of gender equality

Understanding Roth Contributions

www.spectrumhealth-retire.comcontribution amount. For 2022, the limit is $20,500, and if you are age 50 or older you can contribute an extra $6,500 for a total contribution amount of $27,000. Q: Can I contribute to a Roth IRA and a Roth 403(b)? A: Yes. Your participation in a Roth 403(b) plan has no impact on your ability to contribute to a Roth IRA. You

Beijing and Platform for Action Political Declaration Outcome

www.unwomen.org• Greater contributions of men as gender equality advocates; and • Exponentially increasing investments in gender equality and women’s rights. Gender equality is a shared vision of social justice and human rights.

Manuel pour Gestion Axée sur les Résultats et

www.unodc.orgcontributions fournies par Monica Belalcazar (SPIA/PAB/DPA), Nina Grellier (SPIA/PAB/DPA) ... nationaux du Bureau. Le SPIA coordonne la formulation du cadre stratégique de l'ONUDC1 et ... un guide évolutif ui aidea les esponsables de la mise en œuve à élaborer une vision

Employment Change Form New ... - Church Pension Group

www.cpg.orgpaid by employers in assessments for the defined benefit pension plans (Lay DB and Clergy Pension Plan) and/or the compensation used to calculate employer and employee contributions to the defined contribution plans (Lay DC and RSVP). Note that the definition of compensation for a defined benefit plan versus a defined contribution plan is ...

achieve NATO’s goals and objectives. external stakeholder ...

www.nato.int1 VACANCY NOTIFICATION/ NOTIFICATION DE LA VACANCE DU POSTE Head, Finance Planning and Contributions Section (220031) Primary Location: Belgium-Brussels NATO Body: NATO International Staff (NATO IS) Schedule: Full-time Application Deadline: 06-Mar-2022 Salary (Pay Basis): 8,206.40Euro (EUR) Monthly Grade: NATO Grade G20 Clearance Level: …

YEAST QUICK REFERENCE CHART - Lallemand Wine

www.lallemandwine.comLimits (ºC) (Aus/NZ experiences) Relative Potential for SO2 Production Relative Potential for H2S Production 60 ppm N 170 ppm N Whites Rosé Reds Sparkling Sensory contribution Neutral EVC Volume/ Esters Complexity Other Late Harvest Whites Secondary Ferment Restart Stuck Killer Factor IOC 18-2007™ High Low 15 10 to 30 Low ...

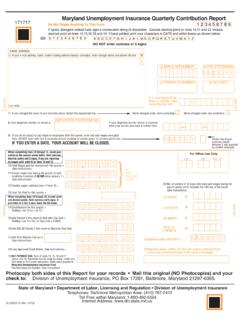

Maryland Unemployment Insurance Quarterly Contribution ...

www.zillionforms.com(See Instructions) 11)Excess wages paid during the quarter to each employee in excess of $8,500 since January 1 = (See Instructions) 12)Taxable wages: subtract Line 11 from 10 = 13)Your Tax Rate for this quarter = When completing lines 14 through 19, include cents and decimal points. Omit commas and $ signs. If

Is migration good for the economy? - OECD

www.oecd.orgEmployment is the single biggest determinant of migrants’ net fiscal contribution. Economic growth ... Survey of Labour and Income Dynamics, 1998-2008. The education status of immigrants varies ... same proportion, however, has not completed their upper-secondary education. Since 2000/01, immigrants have represented 31% of the increase

SUMMARY PLAN DESCRIPTION - MPIPHP

www.mpiphp.orgSummary Plan Description WDEAR PARTICIPANT: e are pleased to provide you with this updated Summary ... Plan is a Defined Benefit Plan, whereas the IAP is a Defined Contribution Plan. Please read the SPD in order to familiarize yourself with the benefits provided to you through the Plans.

Family Life Education Content Areas: Content and Practice ...

www.ncfr.org“Practice” which relates to the tasks expected of an entry-level CFLE. The “practice” segment serves ... and family needs, identification and evaluation of options and resources, implementation of ... and their impact on and contribution to individuals and families

IRA Distribution Request for Withdrawal, Rollover or ...

static.chasecdn.comIndividual Retirement Account ("IRA") (including SEP-IRAs and Beneficiary IRAs). • Authorize a one-time direct rollover from an IRA to an employer-sponsored plan. • Authorize the return of an excess IRA contribution. What you need to know • If your distribution would lower your account balance below $1,500, we will not process the request. If

Short Form Annual Return/Report of Small Employee Benefit …

www.dol.govdefined contribution plans. Profit-sharing plans, stock bonus plans, money purchase plans, 401(k) plans, Code section 403(b) plans covered by Title I of ERISA, and IRA plans established by an employer are among the pension benefit plans for which an annual return/report must be filed. Welfare benefit plans provide benefits such as medical,

Tax Tables 2022 Edition - Morgan Stanley

www.morganstanley.comJan 18, 2022 · Oct 17, 2022 –Last day to file federal income tax return if 6-month extension was requested by April 18, 2022. Last day to recharacterize an eligible Traditional IRA or Roth IRA contribution from 2021 if extension was filed or tax return was filed by April 18, 2022 (and certain conditions were met). Last day to

Connection of Power Generating Modules to DNO …

www.energynetworks.orgDistribution Network Operator (DNO) Distribution Network. Customers with ... • Information about the fault level contribution from the Power Generating Facility at the Connection Point, although you do not need to provide this information here …

Economic Contribution of the Film and Television Industry ...

www.mpa-apac.orgEconomic Contribution of the Film and Television Industry in India, 2017 India’s entire media and entertainment (M&E) industry represents under 1% of its GDP. This scale often provides the lens under which the industry is viewed. This report, which focuses on the film, television, and OTT industries (which

Are Ideas Getting Harder to Find? - Stanford University

web.stanford.eduwhich research productivity is constant.2 An important justification for assuming ... contribution of this paper: study the idea production function at the micro level to ... point to a well-known decline in pharmaceutical innovation per dollar of pharma - ceutical research. Absent theory, these seem like natural measures of research pro- ...

Instructions for Completing the Quarterly Contribution …

edd.ca.gov• Column 1 - Enter the amounts previously reported on your return, report, or your most recent adjustment form. Complete all fields, even if there are no changes. • Column 2 - Enter the amounts that you should have reported on the above return report or adjustment form. Complete all fields, even if there are no changes.

OLD MUTUAL SUPERFUND PENSION AND PROVIDENT …

www.oldmutual.co.zaJun 15, 2021 · The Funds are defined contribution in nature, and are registered under section 4 of the Pension Funds Act and approved under the Second Schedule to the Income Tax Act. The Funds are Type A umbrella funds. The Old Mutual SuperFund Pension Fund is a regi stered pension fund. At retirement, Members are

Non-borrower financial contribution form - Wells Fargo

www08.wellsfargomedia.comNon-borrower financial contribution form This form is to be completed by individuals at your property address who are not on the loan as borrowers, but who have agreed to include their

2022 MALAYSIA BENEFITS SUMMARY - ON Semiconductor

www.onsemi.com2022 MALAYSIA BENEFITS SUMMARY . Employees are eligible for most benefits programs on the first day of employment. ... (EPF) in excess of the statutory EPF contribution is : • 2% for more than 1 year of service and below 4 years of service • 3.5% for more than 4 years of service. ... in accordance with the Health Plan Policy. ...

2022 guidelines for health savings accounts (HSA)

www.uhc.comHSA contribution limits Consumers can contribute up to the annual maximum amount as determined by the IRS. Maximum contribution amounts for 2022 are $3,650 for self-only and $7,300 for families. The annual “catch-up” contribution amount for individuals age 55 or older will remain $1,000. Consumers can contribute up to the annual maximum amount

Sixth Assessment Report

www.ipcc.chreports as well as the findings from the three cross-Working Group Special Reports prepared during this assessment cycle: Special Report on Global Warming ... • There is an increased emphasis on adaptation and the contribution of adaptation to solutions with adaptation integrated into each chapter and cross-chapter paper. This includes

ARE WE THERE YET? What’s Next for HR - Ross School of ...

michiganross.umich.edustature and contribution to business success. But the journey ahead should focus on the intent to deliver ongoing and increas-ing value, rather than striving for an end point when that value will be realized. In the spirit of simplicity, let me suggest steps in the journey ahead and discuss them accordingly:i 1. One mega-message for HR’s ...

TRAVEL & TOURISM ECONOMIC IMPACT 2019 WORLD

www.slovenia.infoWORLD: DIRECT CONTRIBUTION OF TRAVEL & TOURISM TO GDP WORLD:TOTAL CONTRIBUTION OF TRAVEL & TOURISM TO GDP 1 All values are in constant 2018 prices & exchange rates TRAVEL & TOURISM'S CONTRIBUTION TO GDP1 The direct contribution of Travel & Tourism to GDP in 2018 was USD2,750.7bn (3.2% of GDP). This is forecast to rise …

A TOURISM VISION FOR LONDON - London and Partners

files.londonandpartners.comThe economic contribution of the tourism economy to the UK, Deloitte & Oxford Economics, 2013 Queen’s Diamond Jubilee celebration . 10 11 This document sets out a vision for London’s tourism industry up to 2025. London & Partners has created this vision through bespoke research

This is an advance draft copy of a California tax form. It ...

www.ftb.ca.govAnnual contribution amount. Multiply line 3 by line 7. Round to nearest whole dollar amount ... If you or a family member are not a California resident, you or your family member are not eligible to purchase a ... who is expected to file a tax return, to claim other family members as dependents, and who, if qualified, would take the PAS for the ...

Additional Superannuation Contribution (ASC) Frequently ...

www.tcd.ieASC will only apply to pensionable remuneration, so non-pensionable allowances and non-pensionable overtime will not be subject to ASC (whereas they were subject to PRD). What are the applicable rates for 2019? ASC is charged at different rates with different threshold bands depending on the pension scheme a person is a member of.

Probation Hostels’ (Approved Premises) Contribution to ...

www.justiceinspectorates.gov.ukit is right to do so. The quality of resettlement and rehabilitation services was mixed, however. It was noticeably better for women than for men. We found that independent hostels providing services under contract also perform well. We were impressed with the purposeful involvement of residents in many aspects of day-to-day life.

PAUL’S CONTRIBUTION TO CHRISTIANITY

cocsrban.comsin’ and comes under the grace of God. 6. Christian Ethics Paul is adamant that life in Christ is a changed life. To the Roman Christians who might have the mistaken belief that they could continue to live the life of sin so that they could receive God’s grace all the more, Paul made it doubly clear to them, “By no means!

HOW TO CALCULATE YOUR QUOTA AND LEVY BILL

www.mom.gov.sg*For the first 2 years of your employee’s PR status, the CPF contribution is at a graduated rate (i.e. lower rates compared to a Singaporean, or PRs beyond the 3rd year). Hence, in order to meet a full-time headcount contribution, your company may consider contributing the normal CPF rate (similar to any local employee of the same age) in order

Similar queries

Contributions, Class 2 National Insurance Contributions, National Insurance Contributions, Class 2, Class, 2020: National Insurance contributions Tables A, National Insurance contributions (NICs) Tables, National Insurance, 2020) National Insurance contributions Tables A, National Insurance contributions Tables A, Tables, 2020, SLPs Performance Assessment Contributions Effectiveness, Assessment, Effectiveness, Reporting, HSA contribution, Election, Contribution, Plan, Diverse Peoples – Aboriginal Contributions and Inventions, Mi’kmaq, Contract, Project, Section, Based, What is FICA, Social Security Administration, FICA, Federal Insurance Contributions Act, Nationally Determined Contributions, NDCs, 1099-R Tax Reporting Statement, Tax reporting, Women, Manuel pour Gestion Axée sur les Résultats, Bureau, Pension, Defined benefit pension, Defined contribution, Defined benefit, Versus, Contributions Section, YEAST QUICK REFERENCE CHART, Limits, Quarterly Contribution, Instructions, Completing, OECD, Income, Their, Summary Plan Description, SUMMARY, Contribution Plan, Family, Expected, Rollover, Retirement, Return, Tax Tables 2022 Edition, Morgan Stanley, IRA contribution, Connection of Power Generating Modules, Distribution Network, Fault, Economic Contribution of the Film, Economic Contribution of the Film and Television Industry in India, 2017, Research, Innovation, Of research, Instructions for Completing the Quarterly Contribution, Adjustment form, PROVIDENT, Pension fund, Wells, Reports, ARE WE THERE YET? What’s Next, Travel & Tourism, Tourism, California, Additional Superannuation Contribution ASC, Pensionable, Probation Hostels’ (Approved Premises) Contribution, Resettlement, PAUL’S CONTRIBUTION TO CHRISTIANITY, Under, CPF contribution, Rates