Search results with tag "Superannuation"

Australian EXP TRIATE

cdn.sargon.cloudThe Tidswell Master Superannuation Plan was established in 1988 and is a public offer superannuation fund. The AESF is a division of the Plan [Division VII]. The Fund has been established by Diversa and the Promoter for the purpose of offering interests in an Australian Public Offer Superannuation Fund to:

Downsizer superannuation contributions

treasury.gov.auDownsizer superannuation contributions The Government has reduced a barrier for older Australians to move from homes that no longer meet their needs, so more homes can be available for younger Australian families. From 1 July 2018, people aged 65 and older can make a non-concessional (post-tax) superannuation contribution

Developing a Leading Practice Parental Leave Policy - WGEA

www.wgea.gov.auSuperannuation contributions are also paid on the employer’s paid parental leave scheme, and some employers are also paying superannuation on the government-funded scheme. Note: from 2022-24 EOCGE applications, if employer- funded PPL is for a period less than the government's scheme (i.e. less than 18 weeks), superannuation

Letter of compliance

www.caresuper.com.auSuperannuation Industry (Supervision) Act 1993 (SIS Act). CareSuper is not subject to a direction under Section 63 of the Superannuation Industry (Supervision) Act 1993. CareSuper is a registrable superannuation entity and may be nominated as a default fund as it meets the minimum statutory insurance cover requirements.

Letter of compliance

rest.com.auRest is a resident regulated superannuation fund within the meaning of the Superannuation Industry (Supervision) Act 1993 (SIS Act). Rest is a registrable superannuation entity (R1000016). Rest is not subject to a direction under section 63 of the SIS Act. Rest Super and Rest Corporate are eligible to be nominated as a default fund as they each

30 June 2021 icare Workers Insurance

www.icare.nsw.gov.auas a superannuation guarantee charge within the meaning of the Superannuation Guarantee (Administration) Act 1992 of the Commonwealth, or iii. to or as any other form of superannuation, provident or retirement fund or scheme, including a wholly or partly unfunded fund

Super choice - fund nomination form

www.unisuper.com.auThe Fund is a complying superannuation fund and a resident regulated superannuation fund within the meaning of the Superannuation Industry (Supervision) Act 1993 (Act). ... Super choice - fund nomination form Author: ... Nominate UniSuper as your super fund of choice Keywords: super choice, nomination, changing jobs, fund nomination Created Date:

Macquarie withdrawal form

www.macquarie.com.auMacquarie superannuation fund), you should also make SuperStream arrangements to ensure the receiving superannuation fund can receive your funds and process your rollover. To nominated bank account (if only one on file) u go to section 6 OR To account specified below

Super choice fund nomination form - Superannuation

www.mlc.com.auThe above Complying Fund Statement wording has been approved by the Australian Taxation Office as an acceptable notification that a Fund is a complying fund. Contribution Acceptance Section The Fund accepts all contribution types including superannuation guarantee contributions from any employer on your behalf.

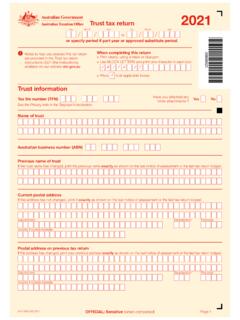

Trust tax return 2021 - Australian Taxation Office

www.ato.gov.auInterposed entity election status If the trustee has an existing election, write the earliest income year specified. If the trustee is making one or ... 13 Superannuation lump sums and employment termination payments Death benefit superannuation lump sum where the beneficiary is a non-dependant V, , .00 Taxed element

Essential Super PDS - CommBank

www.commbank.com.ausuperannuation trust and is subject to superannuation rules. It is not an investment in, deposit with, or other liability of the Bank ... insurance and other matters. The product dashboard for the MySuper product ... voluntary employer contributions such as …

Pay my super into AustralianSuper

www.australiansuper.comof the Superannuation Industry (Supervision) Act 1993 (SIS Act) and is not subject to a direction under section 63 of that Act. AustralianSuper is a registrable superannuation entity and may be nominated as a default fund, as it meets the minimum statutory insurance cover requirements.

Important things to know about your super

www.australiansuper.comSuperannuation Guarantee contributions Employers pay a compulsory contribution to your super known as the Superannuation Guarantee (SG). Currently, this is an amount equal to 10% of your annual salary (subject to salary cap). There are also other types of contributions that could help you grow your super.

Pay my super into AustralianSuper

www.australiansuper.comcontributions within the meaning of the Superannuation Industry (Supervision) Act 1993 (SIS Act). AustralianSuper is a registrable superannuation entity and may be nominated as a default fund, as it meets the minimum statutory insurance cover requirements. The Trustee of the Fund is AustralianSuper Pty Ltd ABN 94 006 457 987 AFSL 233788.

PUBLIC SERVICE SUPERANNUATION SCHEME (PSSS)

www.treasury.go.kePublic Service Superannuation Scheme means the new contributory scheme. Retirement Benefits Authority means the Authority by that name established under section 3 of the Retirement Benefits Act (No. 3 of 1997). Retirement Savings Account means an account set up and maintained by the Scheme Administrator.

REMUNERATION PROCEDURES FOR PART-TIME CHAIRS …

www.qld.gov.auApplication These procedures apply for the purposes of determining remuneration for all part-time chairs and ... superannuation fund for their superannuation contributions. Taxation and GST Remuneration paid to chairs and members of government bodies is assessable under the Income Tax Assessment Act 1997 (Cth).

Regulatory Guide RG 78 Breach reporting by AFS licensees ...

asic.gov.auimprove an entity’s compliance framework and overall function. Instances of non-compliance highlight a weakness to be understood, so improvements can ... Superannuation and Financial Services Industry (Financial Services Royal Commission), which recommended that the Taskforce recommendations should be

UIF-GEN-01-G01 - Guide for Employers in respect of the ...

www.sars.gov.zapension, superannuation allowance or retiring allowance; that constitutes an amount contemplated in paragraphs (a), (cA), (d), (e) or (eA) of the definition of gross income in section 1 of the Income Tax Act; by way of commission. Section 1, definition of “remuneration” of UIC Act = Remuneration for UIC purposes Step three

Application for Social Housing - Queensland

www.qld.gov.audebentures, superannuation - allocated pension or lump sum payments, share from property sale or settlement. This includes residential property, vacant land, industrial property, commercial property, a live-aboard boat, cabin, donga, caravan, or manufactured/ transportable home.

Getting an Australian business number (ABN)

www.ato.gov.aumay not receive superannuation payments from ... may need to organise your own insurance. If you believe that you are being incorrectly treated as a contractor rather than an employee, contact the Fair Work Ombudsman on 13 13 94. What if you apply for an ABN when you are ... voluntary disclosure the false or misleading statement

30 September 2021 numbers - Hesta

www.hesta.com.auSuperannuation Trust Australia (HESTA) is run by people like you. Founded in 1987, our Trustee H.E.S.T. Australia Ltd is made up of an equal number of directors appointed by your industry employer and employee organisations, and two independent directors. Information about Trustee and Executive remuneration can be found online at

Final Prudential Practice Guide CPG 229 Climate Change ...

www.apra.gov.auregistrable superannuation entity (RSE) licensee (RSE licensee), a general insurer, a life company (including friendly societies), a private health insurer, an authorised non-operating holding company (NOHC) and, where applicable, Level 2 and Level 3 groups. This PPG is designed to be read together with CPS 220, SPS 220, CPS 510 and SPS 510, but

Customer Identification Form.

www.westpac.com.auBonus Superannuation/Pension Sale of assets Windfall Business income/earnings Loan Liquidation of assets Tax refund Business profits Insurance payment Redundancy Additional sources (please specify) ... ^^ A unique identifier of the person is a biometric marker of that person, for example a fingerprint. ...

Change of Address checklist - Australian Government

info.australia.gov.auSuperannuation fund/s Telephone Toll tags (e-tag, e-toll, touch tag, viatag etc) Union affiliations Veterinary service Water and sewerage. Author: Blackburn Created Date:

Circular Number: Circular 10/2021 - assets.gov.ie

assets.gov.ieany such agreement, the established principles3 for passing on special increases in pay to pension in payment should be considered. Amongst others, these include the 3 These are set out at Chapter 19 of the Superannuation Handbook and Guidance Notes for the Established

Application for Transfer - Queensland

www.qld.gov.auApplication No. Transfer application . pursuant to the Housing Act 2003. ... debentures, superannuation - allocated pension or lump sum payments, share from property sale or settlement. This could include residential, vacant land, industrial property, commercial

Additional Superannuation Contribution (ASC) Frequently ...

www.tcd.ieASC will only apply to pensionable remuneration, so non-pensionable allowances and non-pensionable overtime will not be subject to ASC (whereas they were subject to PRD). What are the applicable rates for 2019? ASC is charged at different rates with different threshold bands depending on the pension scheme a person is a member of.

Make AustralianSuper your default fund

www.australiansuper.comSuperannuation Guarantee contributions from employers and personal contributions from people that are self-employed. You can check a super fund’s authorised status at superfundlookup.gov.au Are your employees covered by an award or enterprise agreement ? You can nominate any MySuper complying fund as your default fund. An award :

59993 CHOICE OF SUPER FUND v1 - australianethical.com.au

www.australianethical.com.auChoice of fund nomination ... Date (DD/MM/YYYY) Choice of super fund form For Super members . AUSTRALIAN ETHICAL SUPER CHOICE OF SUPER FUND FORM fi V1.0 fi 18/08/2021 2 Employer records (employer use only) ... Trustee of the Australian Ethical Retail Superannuation Fund (ABN 49 633 667 743, USI/SPIN AET0100AU) Title: 59993 CHOICE …

110003 AIRPORTS AUTHORITY OF INDIA [SCHEDULE- -1 …

www.aai.aeroafter superannuation. iii) The eligible candidate should be clear from Vigilance/Disciplinary angle at the time of retirement. iv) There should be no criminal case pending against the eligible candidate and this will be self-certified by the respective candidate. EDUCATIONAL QUALIFICATION: ...

Lisa, Rest Member

rest.com.auconsolidate your accounts any time and much more. Diverse investment options ... 03 Benefits of investing with Rest Super. 6 Like all investments, super has risks. To balance risk, super funds generally invest in a broad range of asset ... • The amount of your future superannuation savings (including contributions and returns)

ANNUAL REPORT 2020˛21

www.elgi.comand Superannuation Fund at rates to be from time to time. 2. Of the total remuneration, 30% is variable component and the rest is guaranteed pay. 3. The guaranteed pay will be structured based on the Company’s policy and the current pay structure as applicable to Senior Managerial Personnel. 4. The quantum of variable pay would be linked

Combine your super into AustralianSuper

www.australiansuper.comfor example if there is a superannuation agreement under the Family Law Act 1975 in place. Providing your TFN We’re authorised under super law to collect, use and disclose your Tax File Number (TFN). You don’t have to provide your TFN, but if we have it, we’ll be able to accept all types of contributions

Request for rollover of whole balance of super benefits ...

www.ato.gov.au*Unique superannuation identifier (non-SMSF) *Fund name *Australian business number (ABN) Fund details FROM (Transferring fund) BSB Account number Account name Electronic service address To (Receiving fund) *BSB *Account number *Account name *Electronic service address The trustee of your FROM fund may request further

KeyPass Application Form - Australia Post

auspost.com.auApplication Form Things to remember when applying for a Keypass ID card Download the Digital iD™ App from the Google Play ... Valid ID for participating Superannuation Funds Services. Visit auspost.com.au/Keypass for the full list. Keypass is …

Table of Contents

labour.gov.bn(i) Contributions to superannuation scheme/ provision fund (j) Payments to any registered co-operative society (k) Any other deductions which may be approved by the Minister. If an employee resigns and has served the required notice period, he must be paid all salary due to him on the last day of employment.

BT Panorama Super

www.btpanorama.com.auDisclosure about the insurance options available to you If you choose insurance cover through Panorama Super, important ... Superannuation is a means of saving for retirement which is in part, ... Voluntary super contributions (up to $15,000

Australia’s Gender Pay Gap Statistics - WGEA

www.wgea.gov.aumillion employees in Australia. This data includes superannuation, bonuses and other additional payments. The full-time total remuneration gender pay gap based on WGEA data is 20.1%, meaning men working full-time earn nearly $25,679 a year more than women working full-time. Figure 2: Full-time base salary and total remuneration, 2015-16 - 2019-2011

Jurisdiction’s name: Australia Information on Tax ...

www.oecd.org(companies, trusts, partnerships, and superannuation funds). A TFN is issued under the Income Tax Assessment Act 1936 (ITAA 1936) upon application by the client or as required by the ATO for internal purposes. Applying for a TFN can be completed online or via paper channels and will be issued once sufficient

Superannuation Savings Account Letter of Compliance

www.commbank.com.auSuperannuation Savings Account satisfies the preservation of benefits requirements in the RSA Regulations. 5. A Superannuation Savings Account can accept additional personal contributions through a Regular Savings Plan (via a direct debit arrangement). To establish a …

Superannuation Standard choice form

www.ato.gov.au1 Choice of superannuation (super) fund I request that all my future super contributions be paid to: (place an X in one of the boxes below) The APRA fund or retirement savings account (RSA) I nominate Complete items 2, 3 and 5 The self‑managed super fund (SMSF) I nominate Complete items 2, 4 and 5

Similar queries

Superannuation, Downsizer superannuation contributions, Developing a Leading Practice Parental Leave Policy, Default, Superannuation Fund, Fund, Superannuation Guarantee, SUPER CHOICE, Fund nomination form, SUPER FUND, CHOICE, Nomination, Fund nomination, Withdrawal, Super choice fund nomination form, Entity, Essential Super PDS, Insurance, Voluntary, Pay my super into, Important things to know about, Savings account, Account, REMUNERATION PROCEDURES FOR PART-TIME, Application, Executive, Unique, Change of Address, Established, Superannuation Handbook and Guidance Notes, Additional Superannuation Contribution ASC, Pensionable, Your default fund, SUPER FUND FORM, Super, Consolidate your, Benefits, Your, Combine your super into, Whole balance of super benefits, Unique superannuation, KeyPass Application, Keypass, Operative society, BT Panorama Super, Gender pay gap, Jurisdiction’s name: Australia Information, Superannuation Savings Account Letter of