Search results with tag "Entity"

The Extended Entity Chapter 5 Relationship Model

media.lanecc.eduThe Extended Entity Relationship Model • Result of adding more semantic constructs to original entity relationship (ER) model • Diagram using this model is called an EER diagram (EERD) • Combines some of the Object-oriented concepts with Entity Relationship concepts. 2 Entity Supertypesand Subtypes • Entity supertype –Generic entity ...

SMALL ENTITY AND MICRO-ENTITY STATUS …

www.whda.comFor the purpose of micro-entity status, th is is the only distinction between US and non-US entities. The procedure for claiming micro-entity status includes the following requirements: • A certification of micro-entity status, which may be signed by a patent attorney, the assignee, or all

Doing Business Data Form - New York City

www1.nyc.govThe entity is not-for-profit The entity is an individual No individual or organization owns 10% or more of the entity Other (explain) Individual Owners (who own or control 10% or more of the entity) First Name MI Last Birth Date (mm/dd/yy) Office Title Employer (if …

CERTIFICATION OF MICRO ENTITY STATUS (INSTITUTION …

www.uspto.govNOTE: A signed copy of this “institution of higher education basis” micro entity certification form (PTO/SB/15B) filed together with a signed copy of the “gross income basis” micro entity certification form (PTO/SB/15A) will be taken to be a representation that any inventor or …

United States (U.S.) Commercial and Government Entity ...

cage.dla.milNorth Atlantic Treaty Organization (NATO) Commercial and Government Entity (NCAGE) Code is a five-character alpha-numeric identifier assigned to entities located outside of the United States and its territories to identify a commercial or government entity. For purposes of this SOP, the foreign CAGE Code may be identified as the NCAGE Code.

California’s Pass Through Entity Tax – Summary, Examples ...

singerlewak.comPer FTB (8/31/2021): A single member (SMLLC) cannot make the election to pay the passthrough entity tax. To be eligible, they must add a member or elect to be treated as an S corporation. However, an SMLLC owned by a husband and wife can elect to be taxed as a partnership and can qualify to pay the passthrough entity tax. (Rev. Proc. 2002-69)

What is a Public Entity? - qhrc.qld.gov.au

www.qhrc.qld.gov.au• local government, councillors and council employees. What is not a public entity? The Act defines a public entity as being ‘in and for Queensland’. This means that federal public services and entities are not included. Private schools are not public entities because they are not performing their services on behalf of the state.

MARYLAND PASS-THROUGH ENTITY INCOME TA RETURN …

www.marylandtaxes.govMARYLAND FORM 510 PASS-THROUGH ENTITY INCOME TA RETURN COM/ RAD0 0 NAME FEIN 2021 page 2 4. Distributive or pro rata share of income allocable to Maryland ..... 4. NOTE: Complete lines 5 through 19 if there is an entry on line 1b or line 1c. Tax is calculated only for nonresident individual or nonresident entity members.

Revenue Information Bulletin No. 19-019 February 5, 2020 ...

revenue.louisiana.govIndividual Income Tax Corporation Income Tax Fiduciary Income Tax Guidance on the Pass-Through Entity Election Act 442 of the 2019 Regular Session allows an S corporation or an entity taxed as a partnership for federal income tax purposes to elect to be taxed as if the entity had been required to file a federal income tax return as a C corporation.

Transition from DUNS Number to Unique Entity Identifier ...

www2.ed.govMar 02, 2022 · • The transition to using UEIs does not impact your entity's registration expiration date or when you need to renew. Once assigned, the UEI number will never expire; however, entity registrations do expire annually and require annual renewal. Please ensure that your organization renews its registration prior to the expiration date.

UNITED STATES PATENT AND TRADEMARK OFFICE …

www.wipo.int“Micro entity” certification, institution of higher education basis (Form PTO/SB/15B) .. ... 6 The amount in parentheses is applicable in case of filing by a “micro entity” ... and to assert small entity status (see paragraph US.20). Use of the Form PTO-1390 is not, however, required. ...

In CRS Self-Certification Form Entity - Standard Chartered

www.sc.comCRS Self-Certification – Entity Page 1 Please complete Parts 1 to 4 in BLOCK LETTERS and read the Instructions on how to complete this Self-Certification on page 5 and the Definitions on page 10. Part 1 Identification of Account Holder A)Name of Legal Entity or Branch B)Country/Jurisdiction of Incorporation or Organisation

Change of Address & Contact Information

www.sunlife.com.hkFor entity Policy Owner, please complete all of the followings . 如實體保單主權人,請填寫以下全部: CRS Self-Certification Form – Entity. 自我證明表格- 實體. Declaration of FATCA Classification for An Entity . FATCA實體分類之聲明. CRS Self-Certification Form - Controlling Person (if appropriate)

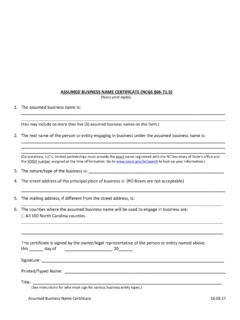

ASSUMED BUSINESS NAME CERTIFICATE (NCGS §66-71.5)

s3.us-west-2.amazonaws.commust be signed by a trustee or other person authorized to act on behalf of the trust. In the case of any other legal entity, the certificate must be signed in the name of the entity by an individual authorized to act for the entity. Please note: 1.These certificates do not expire or require renewal. HOWEVER, you must file an. Amendment of Assumed

Beneficial Ownership Requirements for Legal Entity ...

bsaaml.ffiec.govbeneficial ownership information for legal entity customers, on the basis of risk. Additionally, banks are not required to conduct retroactive reviews to obtain beneficial ownership information on legal entity customers that were existing customers as of May 11, 2018. However, the bank may need to obtain (and thereafter update) beneficial ownership

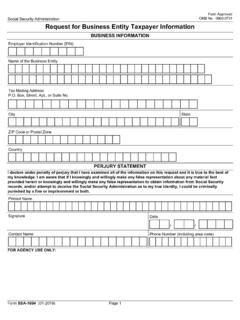

Request for Business Entity Taxpayer Information

www.ssa.govRevenue Service (IRS) when payments of $600 or more have been made to appointed representatives associated with a business entity as employees or partners. In order to meet this requirement, SSA must obtain the name, employer identification number (EIN), and address of the business entity. Instructions for Completing the Form

Knowledge Graph Embedding via Dynamic Mapping Matrix

aclanthology.orgNational Laboratory of Pattern Recognition (NLPR) Institute of Automation Chinese Academy of Sciences, Beijing, 100190, China fguoliang.ji,shizhu.he,lhxu,kliu,jzhao g@nlpr.ia.ac.cn ... two vectors to represent a named sym-bol object (entity and relation). The rst one represents the meaning of a(n) entity (relation), the other one is used to con ...

FOR GOVERNMENT ENTITY PROJECT - Alabama

revenue.alabama.govExempt Entity: 1. Signed Application 2. Copy of executed/Signed Contract, letter of intent, notice of Award, and/or notice to proceed General Contractor: 1. Signed Application 2. Copy of executed/Signed Contract, letter of intent, notice of Award, and/or notice to proceed 3. list of Subcontractors 4. Alabama board of General Contractor’s ...

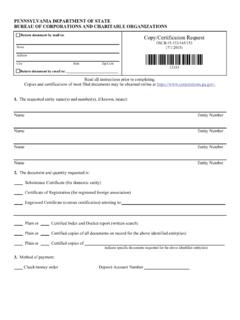

DSCB:15-133/145/153 Name *13353* - Pa Department of State

www.dos.pa.gov1. Give the entity name(s) and the entity number, if known, for which information is being requested. Up to four entities may be listed per form. 2. Give the quantity of documents requested, and if applicable, identify the specific documents or information requested (i.e. Articles of Incorporation, Statement of Merger

ASSUMED BUSINESS NAME CERTIFICATE (NCGS §66-71.5)

www.sosnc.govFor any other legal entity, list the legal name of the entity. Item 3: Describe the nature of the business. What types of goods or services are being provided? (Examples: Lawn Maintenance, Personal Fitness Training, Retail Sales, House Repair) Item 4:

共同匯報標準 - Common Reporting Standard (CRS) | HSBC

www.crs.hsbc.comEntity Tax Residency Self-Certification Form (CRS-E (HK)) (CRS-E (HK)) Part 3: Controlling Persons (Complete this part if the entity account holder is a passive NFE)

Instructions for Notification for Hazardous or Industrial Waste …

www.tceq.texas.govNumber assigned in the company’s home state. The company must notify as a hazardous waste transporter in their home state prior to applying for a solid waste registration in Texas. 2. Regulated Entity Number Enter the 9-digit Regulated Entity Number (RN) assigned by TCEQ if this site (or company, in the case of a transporter) already has one.

Cyber Essentials Self-Assessment Preparation Booklet

iasme.co.ukIf you are certifying the local entity of a multinational ... provide the name of the local entity as per Companies House Registration. Certification should cover one organisation; there are occasions when a certificate can be issued to more than one company. ... Based on the EU definitions of Micro (<10 employees, < €2m turnover), Small (<50 ...

REQUIREMENTS FOR LICENSE - CONTRACTOR ENTITY - …

cca.hawaii.govREQUIREMENTS FOR LICENSE - CONTRACTOR. Access this form via website at: cca.hawaii.gov/pvl. ENTITY - Corporation, Partnership, Joint Venture, LLP or LLC. Briefly, the requirements for a license are: 1) Registration with the Business Registration Division; 2) Have a good reputation for honesty, truthfulness, financial integrity and fair dealing;

2020 IA 1065 Partnership Return of Income - Iowa

tax.iowa.govAmended Return Schedule, the IA 103 Pass-through Election to Pay Return and Voucher, and the instructions below for the IA 1065, line 10. See also Iowa Code §§ 422.25B and 422.25C. These provisions may be applied to a tax year prior to 2020 if the Department, the pass-through entity, and the pass-through entity owners agree.

Exercises - web.cs.ucla.edu

web.cs.ucla.eduan entity set to represent an object, and deciding between an entity set and relationship set, in˜uence the accuracy with which the real-world concept is expressed. If the right design choice is not made, inconsistency and/or loss of information will result. A model which can be implemented in an ef˚cient manner is to be preferred for obvious ...

SWORN AFFIDAVIT B-BBEE EXEMPTED MICRO ENTERPRISE ...

www.winniemmlm.gov.zaSWORN AFFIDAVIT – B-BBEE EXEMPTED MICRO ENTERPRISE – SPECIALISED ENTITY ONLY – GENERAL - which include (Not Limited to) Non-Profit Organisations, Non-Profit Companies, Public Benefit Organisations etc. I, the undersigned, Full name & Surname Identity number Hereby declare under oath as follows: 1.

INTERNATIONAL STANDARD ON AUDITING 315 (REVISED ...

www.ifac.orgTHROUGH UNDERSTANDING THE ENTITY AND ITS ENVIRONMENT 879 ISA 315 (REVISED) AUDITING (b) Introduction Scope of this ISA 1. This International Standard on Auditing (ISA) deals with the auditor’s responsibility to identify and assess the risks of material misstatement in the financial statements, through understanding the entity and its environment,

federalregister.gov/d/2021-27531 govinfo

public-inspection.federalregister.govrequirement to designate an individual to serve as the CCO who must take reasonable steps to ensure that the SBS Entity establishes, maintains, and reviews written policies and procedures reasonably designed to achieve compliance with the Exchange Act and the rules and regulations thereunder relating to its business as an SBS Entity.3

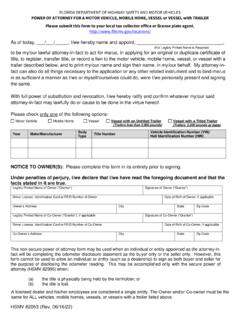

POWER OF ATTORNEY FOR A MOTOR VEHICLE, MOBILE …

osceolataxcollector.orgused to allow an individual or entity (such as a dealership) to sign as both buyer and seller for the purpose of disclosing the odometer reading. This may be accomplished only with the secure power of attorney (HSMV 82995) when: (a) the title is physically being held by the lienholder; or (b) the title is lost.

Filing Requirements - State Corporation Commission

scc.virginia.govcertified public accountant, and insurance consultant. Article III Registered Agent The registered agent’s sole duty is to receive legal documents and notices on behalf of the company. The company may not serve as its own registered agent. The registered agent must be an individual or entity that meets one of the qualifications.

AUTHORIZATION TO DISCLOSE INFORMATION TO THE …

soarworks.samhsa.govA covered entity (that is, a source of medical information about you) may not condition treatment, ... To State audit agencies for auditing State supplementation payments and Medicaid eligibility considerations; 2. To third party contacts where necessary to establish or verify information provided by representative payees or payee

Unit One: The Earth System and its Components

www.soas.ac.ukenvironment’, not least because it highlights the fact that the natural world is a dynamic, complex entity with its own laws and processes, rather than being simply a passive space that is inhabited, exploited and given significance by humans. Moreover, increasingly, scientists have acknowledged that the study of

7 Main Objectives of a Business Firm

itcollege.ac.inHere the firm is not considered as a single entity with a single goal of profit maximisation by the entrepreneur. ... expectations and choices. They look at the firm as an organisational coalition of managers, workers, shareholders, suppliers, customers, and so on. ... O. Williamson assumes that the law of diminishing marginal utility applies ...

Prince William County Tax Administration BUSINESS LICENSE ...

www.pwcva.govFor businesses renewing their license, application, and payment in full is due on or before March 1, 2022. After March 1, 2022, include late filing penalty of 10% and daily interest calculated at a rate of 10% per annum. BUSINESS ENTITY AND BUSINESS OWNER . Corporation or LLC

Reportable HMDA Data: A Regulatory and Reporting …

files.consumerfinance.govIdentifier assigned to identify and retrieve a loan or application that contains the FI’s LEI, an internally generated sequence of characters, and a check digit . NULI: Identifier assigned to identify a loan or application . ULI. Assign and report a ULI that: 1. Begins with the financial institution’s Legal Entity Identifier as defined

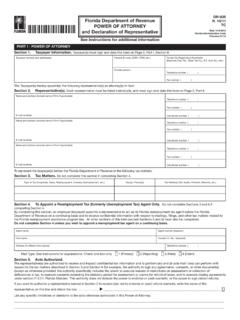

Power of Attorney and Declaration of Representative

revenue.louisiana.govPART I. POWER OF ATTORNEY Taxpayer(s) must sign and date this form on page 2. PLEASE TYPE OR PRINT. Your Name or Name of Entity Spouse’s Name, if a joint return (or corporate officer, partner or fiduciary, if a business) Street Address City State ZIP

What is the Public Health System - NACCHO

www.naccho.orgSome of the organizations and sectors that are involved in the public health system include: P Puubbll iicc hh eeaaltt gg nnc ss, such as the state or local health department, which serve as the governmental entity for public health and play a major role in creating and ensuring the existence of a strong public health system.

HOW TO OBTAIN YOUR TAX CLEARANCE INFORMATION …

www.gov.zaAs a Small, Micro or Medium Enterprise (SMME), at some point or another you will be required to provide / confirm / share your Tax Clearance information with another entity. This could be to apply for a tender, new contract, good ... requirements: • Registration status …

CHAPTER FIVE Unit Cohesion and Military Performance1

www.law.berkeley.edurelationship to military performance has evolved in the years since, but the importance ... diagrams, though many related concepts—leadership, communication, interdependence, heterogeneity—appear ... and identification with their group as an entity, and this can occur “even though they are unacquainted with many, if not most, of the other ...

CPT Surgery Coding Guidelines - AHIMA

campus.ahima.orgAHIMA has no liability or responsibility to any person or entity with respect to any loss or damage caused by the use of this audio ... inpatient, surgical centers, physician office, clinic, law firms, consulting, and third-party carrier areas. She is also a frequent speaker on coding, documentation, and compliance topics. ... Many Choices for ...

2021

saicawebprstorage.blob.core.windows.netassessing the risks of material misstatement through understanding the entity and its environment” (ISA 315 (Revised) 2019) ISA 315 (Revised 2019) is a foundational standard as it deals with the auditor’s

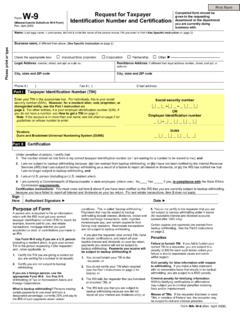

Form W-9 Request for Taxpayer Business name, if different ...

www.irs.govEnter the business name as shown on required Federal tax documents. This name should match the name shown on the charter or other legal document creating the entity. You may enter any business, trade, or “doing business as” name on the business name line. Note: See the chart on this page for further clarification of name and TIN combinations.

W-9 Request for Taxpayer Identification Number and ...

www.mass.govA disregarded domestic entity that has a foreign owner must use the appropriate Form W-8. Other entities. Enter your business name as any business, trade, or DBA name on the “Business name” line. Part I - Taxpayer Identification . Number (TIN) certification. Enter your TIN in the appropriate box. If you are a resident alien and you do not

Florida Department of Revenue R. 10/11 POWER OF …

floridarevenue.comA Power of Attorney is a legal document authorizing someone other than yourself to act as your representative. ... • For any other entity: Enter the name, business address, FEIN, and telephone number(s), as well as the name of a contact person familiar with this matter.

Prompt-Learning for Fine-Grained Entity Typing

arxiv.orgintuitively bridges the objective form gap between pre-training and fine-tuning. Sufficient empirical analysis shows that, either for manually picking hand-crafted prompts (Liu et al.,2021b;Han et al., 2021b) or automatically building auto-generated prompts (Shin et al.,2020;Gao et al.,2020;Lester et al.,2021), taking prompts for tuning models is

Similar queries

Entity, Relationship, Entity Relationship, ENTITY AND MICRO-ENTITY STATUS, Micro, Entity status, Requirements, Doing Business, New York City, Entity Other, CERTIFICATION OF MICRO ENTITY STATUS INSTITUTION, Institution, Micro entity certification, Identifier, Through Entity Tax, Election, Entity tax, What is a Public Entity, Councillors, MARYLAND PASS, THROUGH ENTITY INCOME TA, MARYLAND FORM, Pass, Income, Maryland, Through, Through Entity Election, UNITED STATES PATENT AND TRADEMARK OFFICE, Micro entity, Certification, CRS Self-Certification Form Entity, CRS Self, Instructions, Self, Certification Form, ASSUMED BUSINESS NAME CERTIFICATE NCGS, Other, Beneficial Ownership Requirements for Legal Entity, Beneficial ownership, Request for Business Entity Taxpayer Information, Appointed representatives, Recognition, Named, Alabama, List, Name, Entity name, Business, Entity Tax Residency Self-Certification Form CRS, Regulated Entity, REQUIREMENTS FOR LICENSE - CONTRACTOR, ENTITY - Corporation, Partnership, Joint Venture, License, 2020 IA 1065 Partnership Return of Income, Return, Through entity, SWORN AFFIDAVIT B, BBEE EXEMPTED MICRO ENTERPRISE, SWORN AFFIDAVIT – B-BBEE EXEMPTED MICRO ENTERPRISE – SPECIALISED ENTITY ONLY, Understanding the entity and, Serve, Power of Attorney, Public, Audit, Considerations, Earth System and its Components, Environment, Choices, BUSINESS LICENSE, BUSINESS ENTITY, HMDA, Entity Identifier, The public health system, Public health system, Status, Unit Cohesion and Military Performance1, Diagrams, AHIMA, Law firms, Of material misstatement through understanding the entity and its environment, Request, Taxpayer Business, Foreign, Alien, POWER OF, Prompt-Learning for Fine-Grained Entity Typing, Bridges