Search results with tag "Business entity"

Application for Certificate of Registration to Transact ...

scc.virginia.goventity, then include the following: the business entity’s name, the capacity in which the business entity is signing on behalf of the LLC, the individual’s printed name, and the individual’s business entity-related title. Providing an entity phone number or email address allows for quicker communication if there is an issue with the filing.

A Guide to the SBA’s Size Program and Affiliation Rules

www.sba.govThe NDAA requires that SBA publish this compliance guide to assist business ... (HUBZone) program; Women-Owned Small Business (WOSB) and Economically Disadvantaged Women-Owned Small Business (EDWOSB) programs; ... A business concern eligible for assistance from SBA as a small business is a business entity:

FTB 2924 Reasonable Cause – Business Entity Claim for …

www.ftb.ca.govReasonable Cause – Business Entity Claim for Refund. Complete the information below to request a claim for refund based on reasonable cause. Refer to PAGE 3 for detailed instructions. Part 1 – Business Entity Information Business. ... Other. Refund Amount $ …

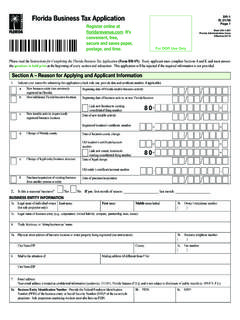

Florida Business Tax Application DR-1

floridarevenue.comDR-1 R. 01/18 Page 3 BUSINESS BACKGROUND INFORMATION 13. Has this business entity ever been known by another name? Yes No If yes, provide previous name: 14. Has this business entity ever been issued a certificate of registration, certificate number or tax account number by the Florida Department

Prince William County Tax Administration BUSINESS LICENSE ...

www.pwcva.govFor businesses renewing their license, application, and payment in full is due on or before March 1, 2022. After March 1, 2022, include late filing penalty of 10% and daily interest calculated at a rate of 10% per annum. BUSINESS ENTITY AND BUSINESS OWNER . Corporation or LLC

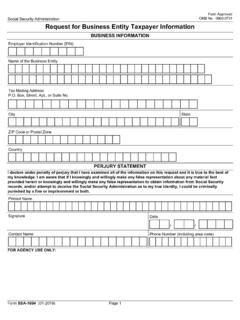

Request for Business Entity Taxpayer Information

www.ssa.govName of Business Entity. Enter your business name as shown on required Federal tax documents. Normally, this will match the name used when you filed a Form SS-4 to apply for an EIN. Tax Mailing Address . Please enter your tax mailing address. SSA will mail Form 1099-MISC to you at this address if payments of $600 or more are

FTB 3520 BE, Business Entity or Group Nonresident Power of ...

www.ftb.ca.gov8561213 FTB 3520-BE 2021 Side 1 (If the POA Declaration is related to matters for the 540NR group nonresident tax return) (A subsidiary not included with the unitary taxpayer’s group tax return must file its own POA Declaration) Business Entity 540NR Group Nonresident Return Full legal business name Street address (number and street) or PO box

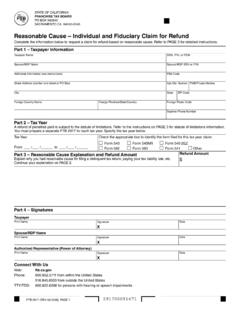

FTB 2917 Reasonable Cause – Individual and Fiduciary …

www.ftb.ca.govReasonable Cause – Individual and Fiduciary Claim for Refund, to claim a refund based on reasonable cause for an individual or fiduciary. To claim a refund based on reasonable cause for a business entity, complete FTB 2924, Reasonable Cause – Business Entity Claim for Refund. FTB 1024, Penalty Reference Chart, lists penalties that can be

ABLE OF CONTENTS

www.state.nj.usmay complete the Public Records Filing for New Business Entity pages 23-24 in addition to pages 17-19. Please note that the Public Records Filing should be submitted prior to the completion of form NJ-REG, but form NJ-REG must be submitted within 60 days of filing the new business entity. Sales Tax?

Decentralized Autonomous Organization (DAO): Frequently ...

sos.wyo.govBegin by selecting the business entity type of Limited Liability Company; During step 1, select Decentralized Autonomous Organization as the Additional Designation from the drop-down list (this drop-down is located under the business entity name fields); During step 6, follow the instructions on the screen specific for DAOs.

FLORIDA DEPARTMENT OF STATE DIVISION OF …

form.sunbiz.orgCertificate of Conversion For . Florida Profit Corporation. Into “Other Business Entity” This Certificate of Conversion is submitted to convert the following Florida Profit Corporation into an “Other Business Entity” in accordance with s. 607.1113, Florida Statutes.

Topic: Non-Profit Entity Conversion Question by: Julia ...

www.iaca.orgAt this time Montana Code Annotated does not give us the authority to allow a “nonprofit” corporation to convert to another business entity type.

1 of 21 State of Florida Department of Business and ...

www.myfloridalicense.com1 of 21 DBPR CILB 9 Qualifying an Additional Business Entity Under the Same License Category 2012 April Incorporated by Rule: 61-35.010 State of Florida

Where to Register Your Business Choosing a Business Entity

files.hawaii.govTAX FACTS 31-1 State of awaii, Department of Taxation Revised March 2018 Tax Facts is a publication that provides general information on tax subjects of current interest to taxpayers and is not a substitute for legal or other professional

FLORIDA DEPARTMENT OF STATE DIVISION OF …

form.sunbiz.orgFLORIDA DEPARTMENT OF STATE . DIVISION OF CORPORATIONS . Attached is a form to convert an “Other Business Entity” into a “Florida Profit Corporation” pursuant to section 607.1115,

MOTOR CLUB LICENSING FOR REGULATED STATES

www.nsdmc.com7/6/2018 MATRIX FOR REGULATED MOTOR CLUB STATES Page 1 of 9 Alabama RESIDENT NON-RESIDENT RENEWAL If already licensed: If already licensed: 12/31 Annually Copy of Resident Automobile Club License Copy of Non-resident Alabama Automobile Club License $25.00 Business Entity

Similar queries

Entity, Business Entity, Guide, Program, Affiliation, Compliance guide, Business, Women-Owned Small Business, WOSB, Small business, Reasonable Cause – Business Entity Claim, Other, Florida Business Tax Application, Florida, BUSINESS LICENSE, License, Request for Business Entity Taxpayer Information, Reasonable Cause – Individual and Fiduciary, Reasonable Cause – Individual and Fiduciary Claim, Claim, Reasonable cause, FLORIDA DEPARTMENT OF STATE DIVISION OF, Non-Profit Entity Conversion Question by, State of Florida Department of Business, FLORIDA DEPARTMENT OF STATE . DIVISION OF, MATRIX FOR REGULATED MOTOR CLUB STATES, RESIDENT NON, Resident