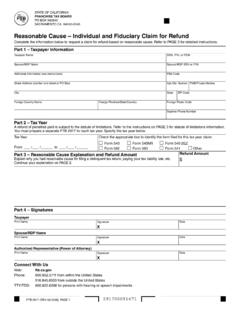

Reasonable Cause Individual And Fiduciary

Found 6 free book(s)FTB 2917 Reasonable Cause – Individual and Fiduciary …

www.ftb.ca.govReasonable Cause – Individual and Fiduciary Claim for Refund, to claim a refund based on reasonable cause for an individual or fiduciary. To claim a refund based on reasonable cause for a business entity, complete FTB 2924, Reasonable Cause – Business Entity Claim for Refund. FTB 1024, Penalty Reference Chart, lists penalties that can be

FTB 2924 Reasonable Cause – Business Entity Claim for …

www.ftb.ca.govReasonable Cause – Business Entity Claim for Refund, to claim a refund based on reasonable cause for your business entity. To claim a refund based on reasonable cause for an individual or fiduciary, complete FTB 2917, Reasonable Cause – Individual and Fiduciary Claim for Refund. FTB 1024, Penalty Reference Chart, lists penalties that can be

2021 Instructions for Form 3520-A - IRS tax forms

www.irs.govreasonable cause. Similarly, reluctance on the part of a foreign fiduciary or provisions in the trust instrument that prevent the disclosure of required information is not reasonable cause. See section 6677(d) for more information. Definitions. Distribution. A distribution received directly or indirectly from a foreign

New Fiduciary Advice Exemption: PTE 2020-02 Improving ...

www.dol.govNew Fiduciary Advice Exemption: PTE 2020-02 . ... investment advice fiduciaries with respect to employee benefit plans and individual retirement accounts (IRAs). Investment advice fiduciaries who rely on the exemption must render advice ... standard, a reasonable compensation standard, and a requirement to make no misleading

SUITABILITY IN ANNUITY TRANSACTIONS MODEL …

content.naic.orgB. Nothing herein shall be construed to create or imply a private cause of action for a violation of this regulation or to subject a producer to civil liability under the best interest standard of care outlined in Section 6 of this regulation or under standards governing the conduct of a fiduciary or a fiduciary relationship.

Offer in Compromise DTF-4

www.tax.ny.govDTF-4.1 (3/19) Page 3 of 4 Use the correct form • Use Form DTF-4.1, Offer in Compromise: For Fixed and Final Liabilities, to submit your request to compromise liabilities, where you do not have any formal protest or appeal rights. You do not have these rights if you: • owe tax, interest, or penalties due to: a math or clerical