Search results with tag "Through entity"

Pass-Through Entity Tax

www.tax.ny.govPTET on behalf of an eligible entity through the entity’s Business Online Services account, now through October 15, 2021. If the entity does not have a Business Online Services account, the authorized person will need to create one. For tax years beginning on or after January 1, 2022, the annual election may be made

MARYLAND PASS-THROUGH ENTITY 2018 SCHEDULE K-1 …

forms.marylandtaxes.govcom/rad-045 maryland schedule k-1 (510) pass-through entity member's information or fiscal year beginning 2018, ending 2018 information about the pass-through entity (pte)

SENATE BILL 605 - Maryland General Assembly

mgaleg.maryland.gov5 or nonresident entity members by a pass–through entity may not exceed the sum of all of 6 the nonresident and nonresident entity members’ shares of the pass–through entity’s 7 …

2020 IA 1065 Partnership Return of Income - Iowa

tax.iowa.govAmended Return Schedule, the IA 103 Pass-through Election to Pay Return and Voucher, and the instructions below for the IA 1065, line 10. See also Iowa Code §§ 422.25B and 422.25C. These provisions may be applied to a tax year prior to 2020 if the Department, the pass-through entity, and the pass-through entity owners agree.

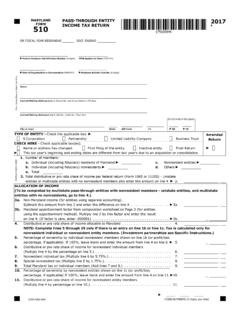

MARYLAND PASS-THROUGH ENTITY 2017 FORM INCOME …

forms.marylandtaxes.govMARYLAND FORM 510 PASS-THROUGH ENTITY INCOME TA RETURN COM/ RAD069 NAME FEIN 2017 page 3 Schedule A - COMPUTATION OF APPORTIONMENT FACTOR (Applies only to multistate pass-through entities.

Tax Challenges Arising from the Digitalisation of the ...

www.oecd.orgArticle 7.1. Ultimate Parent Entity that is a Flow-through Entity 39 Article 7.2. Ultimate Parent Entity subject to Deductible Dividend Regime 40 Article 7.3. Eligible Distribution Tax Systems 41 Article 7.4. Effective Tax Rate Computation for Investment Entities 42 Article 7.5. Investment Entity Tax Transparency Election 43 Article 7.6.

MARYLAND PASS-THROUGH ENTITY FORM INCOME TA …

forms.marylandtaxes.govMARYLAND FORM 510 PASS-THROUGH ENTITY INCOME TA RETURN COM /RAD-0 69 NAME FEIN 2018 page 3 Schedule A - COMPUTATION OF APPORTIONMENT FACTOR (Applies only to multistate pass-through entities.

California enacts pass-through entity tax election

www2.deloitte.comwhich includes a new elective pass-through entity (“PTE”) tax. Under the legislation qualifying PTEs, including entitiestaxed as a partnership or S corporation, may elect to pay an entity level state tax on income for taxable years beginning on or …

MARYLAND PASS-THROUGH ENTITY ELECTION INCOME …

marylandtaxes.govMARYLAND FORM 511 PASS-THROUGH ENTITY ELECTION INCOME TA RETURN C /R-0 6. NAME FEIN 2020 page 4 Schedule A - COMPUTATION OF APPORTIONMENT FACTOR (Applies only to multistate pass-through entities. See instructions.) NOTE: Special apportionment formulas are required for rental/ leasing, transportation, financial institutions, manufacturing

Pass-Through Entities Face Myriad State-Level Taxes ...

www.bradley.comMaryland Imposes an entity-level tax on pass- through entities that have nonresident owners; it functions much like a withholding tax. Arkansas Pass-through entity withholding requirement expanded to include corporate owners or members at the maximum rate for member C corporations for tax years beginning on and after Jan. 1, 2018.

Guidelines for Pass-Through Entity Withholding

townhall.virginia.gov"Pass-through entity" means any entity, including a limited partnership, a limited liability partnership, a general partnership, a limited liability company, a professional limited liability company, a business trust or a Subchapter S corporation, that is recognized as

Virginia Requirement for Withholding Tax by Pass-through ...

www.vsb.orgVirginia Requirement for Withholding Tax by Pass-through Entities by Robert A.Warwick and Richard L. Grier The withholding tax requirement first applies ... “pass-through entity” is “any entity, including a limited partnership, a limited liability part-nership, a general partnership, a limited lia- ...

Ultratax CS MD

cs.thomsonreuters.comForm 500UP—Underpayment of Estimated Maryland Income Tax by Corporations and Pass-Through Entities Form 500X—Amended Corporation Income Tax Return Form 510—Pass-Through Entity Income Tax Return Form 510D—Pass-Through Entity Declaration of Estimated Income Tax Form 510E—Application for Extension of Time to File

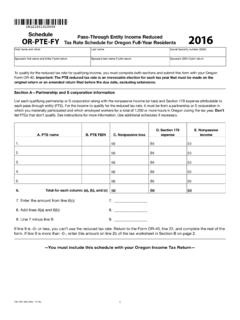

2016, Schedule OR-PTE-FY, Pass-through entity income ...

www.oregon.gov150-101-365 (Rev. 12-16) 1 Pass-Through Entity Income Reduced Tax Rate Schedule for Oregon Full-Year Residents Schedule OR-PTE-FY 2016 18121601010000 First name and initial

MARYLAND PASS-THROUGH ENTITY 2015 SCHEDULE K-1 …

www.zillionforms.comPASS-THROUGH ENTITY SCHEDULE K-1 INSTRUCTIONS 2015 General Instructions Use Maryland Schedule K-1 (510) to report the distributive or pro rata share of the member’s income, additions, subtractions, ... Maryland Economic Development Tax Credit, check the box for Nonrefundable.

MARYLAND PASS-THROUGH ENTITY 2016 ... - zillionforms.com

www.zillionforms.comPASS-THROUGH ENTITY SCHEDULE K-1 INSTRUCTIONS 2016 General Instructions Use Maryland Schedule K-1 (510) to report the distributive or pro rata share of the member’s income, additions, subtractions, ... Maryland Economic Development Tax Credit, check the box for Nonrefundable.

MARYLAND 2017

forms.marylandtaxes.gov• The Maryland Form 510 A Pass Through Entity Income Tax Return must be filed electronically if the pass-through entity has generated a business tax credit from Maryland Form 500CR or a Heritage Structure Rehabilitation Tax Credit from Form 502S to pass on to its members.

What’s New in State Taxes for Pass-Through Entities—Tips ...

home.kpmg.comPass-through entity filers should also take note of a position being taken by the Pennsylvania Department of Revenue. Under its current policy, the ... What’s New in State Taxes for Pass-Through Entities—Tips for the 2014 Tax Filing Season page 3 . State Tax Withholding .

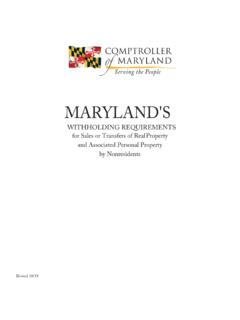

MARYLAND'S

www.marylandtaxes.govApass- through entity (i.e., S corporation, partnership, and limited liability company) may not file a Form MW506R. Any amounts paid on behalf of a pass-through entity must be allocated to . 4 . its owners at the end of the tax year and reported to its owners on a modified federal Schedule K-1 or ... We follow IRS guidelines on which capital ...

2011 Corporate Instructions 84-100 - Mississippi

www.dor.ms.govthrough entity owning property or doing business in the State of Mississippi, is subject to tax on his share of the pass- through entity net income, whether distributed or not.

Subrecipient Monitoring Of Federal Grants

grants.maryland.govSubrecipient Monitoring Of Federal Grants . 1 . ... Pass-through entity responsibilities . 3) Monitoring Activities throughout the Lifecycle . a) At the proposal stage . b) ... Maryland Emergency Management Agency gary.harrity@maryland.gov (410) 517-5116 . Questions/Comments! 32 .

PIT IT1140 Instructions Final 2014 - Ohio Department of ...

www.tax.ohio.govpass-through entity stating that the investor irrevocably agrees that the investor has nexus with Ohio and is subject to and liable for the corporation franchise tax calculated under R.C. 5733.06 with respect to the investor’s distributive share of income attributable to the pass-through

§ 105-163.010: § 105-163.011: § 105-163.012: § 105-163.014 ...

www.ncleg.netNC General Statutes - Chapter 105 Article 4A 1 Part 5. Tax Credits for Qualified Business Investments. ... A nonresident entity that provides for the performance in this State for ... Pass-through entity. – Defined in G.S. 105-228.90. (10) Payer. – A person who, in the course of a …

Massachusetts Withholding 030909te - K&L Gates

www.klgates.comA pass-through entity that maintains an office or engages in business in Massachusetts must, for tax years beginning on or after January 1, 2009, deduct and withhold Massachusetts taxes from a member's share of the entity's Massachusetts-

MARYLAND 2017

forms.marylandtaxes.govPeter Franchot, Comptroller MARYLAND 2017 PASS-THROUGH ENTITY INCOME TAX RETURN INSTRUCTIONS For filing calendar year or any other tax year or period beginning in 2017

FREQUENTLY ASKED QUESTIONS ON THE MARYLAND PASS …

www.marylandtaxes.govreceived for the tax paid by the electing pass-through entity. For tax year 2020 only, report the addback by entering the total of federal taxable income plus the amounts from 510K-1, Part D, Lines 2. and 4. on Line 1 of Form 504. For tax year 2020 only, a fiduciary member of an electing PTE reports the electing PTE credit on Line 29 of Form 504.

“Build Back Better” Tax Proposals Approved by the House ...

www.mayerbrown.coma pass-through entity held by the US taxpayer or by any such CFC that is a tax resident in a foreign country and (iv) a branch of the US taxpayer or any such CFC that has a taxable presence in a foreign country. Income of the same foreign tax credit basket earned by …

TITLE 03 REGULATORY REVIEW AND EVALUATION

comptroller.marylandtaxes.govREGULATORY REVIEW AND EVALUATION ... Article, §§10-130—10-139, Annotated Code of Maryland, the Comptroller of the Treasury is currently reviewing and evaluating the following chapters of COMAR: Subtitle 01 OFFICE OF THE COMPTROLLER ... 03.04.07 Pass-Through Entity …

Kentucky Tax Registration Application and Instructions

revenue.ky.govB. Corporate partner(s) or member(s) receiving Kentucky distributive share income from your pass-through entity? ..... If you answered Yes to questions 54 A and/or 54 B, you must complete SECTION J. If you answered Yes to question 53, you must answer questions 54 A and 54 B.

SENATE BILL 890 - Maryland General Assembly

mgaleg.maryland.govsenate bill 890 3 (2)1 (i) subject to the requirements of this subsection,2 the subtraction under subsection (a) of this section includes the first 3 $20,000 of nonpassive income received by an individual who is a member 4 of a pass–through entity that meets the requirements of this section 5 and title 3, subtitle 13 of the labor and employment article.

2020 Form OR-41 Instructions, Fiduciary Income Tax, 150 ...

www.oregon.govPass-through entity (PTE) reduced tax rate. ORS 316.043 allows a taxpayer to claim a reduced tax rate for income from a PTE if certain conditions are met. See instructions for lines 9 and Schedule 1, line 4. A fiduciary return must be filed for: • Resident estates or trusts required to file a federal Form 1041 or 990-T.

The Maryland Agricultural Land Preservation

www.mda.maryland.govThe Maryland Agricultural Land Preservation Foundation. 1. From the Executive Director ... Pursuant to Maryland Ann. Statutes Tax-General Article § 10-723, an individual who conveys an easement ... appends the statute giving a member of a pass-through entity, such as “a member of an S Corporation, a general or limited partnership, a limited ...

Procedures for the Administration of Sponsored Projects ...

www.ora.umd.eduPass-Through Entity (PTE) is the organization which receives the award directly from the Prime Sponsor and flows down a portion of the work and a portion of the award funds to a …

TESTIMONY PRESENTED TO THE - GBC

gbc.orgnonpassive income that is attributable to a pass-through entity from their federal adjusted gross income to determine Maryland adjusted gross income. The Tax Foundation's 2013 State Business Tax Climate Index ranks Maryland at No. 41 on its

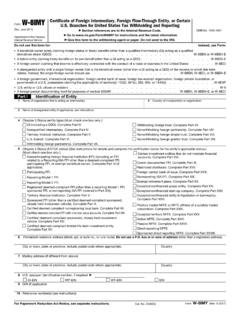

Form W-8IMY Certificate of Foreign Intermediary, Foreign ...

www.irs.govForm W-8IMY (Rev. June 2017) Department of the Treasury Internal Revenue Service . Certificate of Foreign Intermediary, Foreign Flow-Through Entity, or Certain

Similar queries

Through entity tax, Entity through, Entity, Through, Election, Through Entity, SENATE BILL 605, Maryland General Assembly, Pass, 2020 IA 1065 Partnership Return of Income, Return, MARYLAND PASS-THROUGH ENTITY, Maryland, Entity Tax, MARYLAND PASS-THROUGH ENTITY FORM INCOME TA, INCOME, MARYLAND PASS, MARYLAND FORM, INCOME TA, Guidelines for Pass-Through Entity Withholding, Virginia Requirement for Withholding Tax, Ultratax CS MD, MARYLAND PASS-THROUGH ENTITY 2015, Pass Through Entity, State Taxes for Pass-Through Entities—Tips, Guidelines, Instructions, Mississippi, Subrecipient Monitoring Of Federal Grants, PIT IT1140 Instructions Final 2014, Article 4A, Massachusetts Withholding 030909te, MARYLAND 2017, MARYLAND 2017 PASS, 2017, REGULATORY REVIEW AND EVALUATION, Kentucky Tax Registration Application and Instructions, Senate bill 890, The Maryland Agricultural Land Preservation, TESTIMONY PRESENTED TO THE, Form W-8IMY, Internal Revenue Service