Search results with tag "Entities"

Annual Report Guide for Schedule 3A and 3C Public Entities

www.westerncape.gov.zaSchedue 3A and 3C Public Entities 5 1.4. Applicability of the guide This guide applies to all schedule 3A and 3C public entities, as listed in the PFMA All other public entities will utilise their own formats, however if these public entities do not have a format, they could utilise this format as a guide.

PUBLIC ENTITIES CORPORATE GOVERNANCE ACT

www.sera.co.zw34. Conflicts of interest on part of board members and staff of public entities. 35. Minutes of meetings of boards of public entities. 36. Audit of accounts of public entities. PART VIII GENERAL 37. Declaration of assets by board members and senior staff of public entities. 38. Responsibilities of State appointees to boards of certain public ...

Synology DiskStation MIB Guide

global.download.synology.comNov 04, 2013 · IPV6-ICMP-MIB For entities implementing the ICMPv6 IPV6-MIB For entities implementing the IPv6 protocol IPV6-TCP-MIB For entities implementing TCP over IPv6 IPV6-UDP-MIB For entities implementing UDP over IPv6 NET-SNMP-AGENT-MIB For monitoring structures for the Net-SNMP agent NET-SNMP-EXTEND-MIB For scripted extensions for the …

SINGAPORE FINANCIAL REPORTING STANDARD FOR …

www.asc.gov.sgStandard for Small and Medium-sized Entities (“IFRS for SMEs”) as the Singapore Financial Reporting Standard for Small Entities (“SFRS for Small Entities”) as at 30 November 2010. Scope 2. For the purpose of this statement, “entities” refer to (a) companies incorporated under the Companies Act (Cap.

Not-for-Profit Entities (Topic 958) - FASB

asc.fasb.orgProfit Entities (Topic 958): Presentation and Disclosures by Not-for-Profit Entities for Contributed Nonfinancial Assets 958-10-65-4 The following represents the transition and effective date information related to Accounting Standards Update No. …

FREQUENTLY-ASKED QUESTIONS (FAQs) ON MALAYSIAN …

www.mia.org.myprivate entities shall comply with either: Malaysian Private Entities Reporting Standard (MPERS) in their entirety; or Malaysian Financial Reporting Standards (MFRS) in their entirety. Private entities that have applied FRSs shall apply either MFRS or the MPERS for annual periods beginning on or after 1 January 2018.

Malaysian Private Entities Reporting Standard (MPERS)

www.cas.net.myv Style of the document The text of the MPERS preserves the format and structure of Sections 2-35 of the International Financial Reporting Standard for Small and Medium-sized Entities (IFRS for SMEs) issued by the International Accounting Standards Board (IASB) in July 2009. Additions or deletions to the original text of Sections 2-35 of the IFRS for SMEs

PROTOCOL ON CORPORATE GOVERNANCE

www.gov.za4.4.1. all public entities listed in Schedules 2 and 3 (B) and (D) to the PFMA; and 4.4.2. any unlisted public entities that are subsidiaries of a public entity, whether listed or not. 5. Governance in Public Enterprises 5.1. Boards and Directors Boards constitute a fundamental base of corporate governance in the SOE’s.

Subsidiaries without Public Accountability: Disclosures

www.ifrs.orgAdditional disclosure requirements in the IFRS for SMEs Standard BC52 ... Investment entities. Investment entities. Changes in liabilities from financing activities. ... is limited to subsidiaries that meet the definition of a small and medium-sized entity (SME) as defined in the .

Intangibles—Goodwill and Other (Topic 350), Business ...

asc.fasb.orgBusiness Combinations (Topic 805), and Not-for-Profit Entities (Topic 958) No. 2019-06 May 2019 Extending the Private Company Accounting Alternatives on Goodwill and Certain Identifiable Intangible Assets to Not-for-Profit Entities An Amendment of …

Governance in the Public Sector - IFAC

www.ifac.orgregional governments (e.g., state, provincial, territorial), local governments (e.g., city, town), related governmental entities (e.g., agencies, boards, commissions) and government business enterprises (GBEs). Specifically, the principles in this Study are applicable to all public sector entities that form part of an

State-Owned Enterprises in the EU

ec.europa.euState-owned enterprises and fiscal implications 11 2.1. The links between state-owned enterprises and public finances 11 2.2. Contingent liabilities associated with state-owned enterprises 13 ... entities) 39 II.1.11. Return on capital employed (relative value of SOEs versus privately held entities) 40 II.1.12. Share of staff costs in OPEX ...

TRANSFER BETWEEN BUSINESS ENTITIES

www.dot.state.pa.usowned by same parties YES – (*) – Name change on vehicles titles in name of Corporation whose name is retained. Form MV-41A with Title (Form MV-4) attached No ; b. Stock of both ... TRANSFER, BETWEEN, BUSINESS, ENTITIES, LLC, Partnership, Sole Proprietorship, Individual, Corporation,

The Corporations Act / The Business Names Registration Act ...

companiesoffice.gov.mb.ca(Extra Provincial and Federal entities only) 4. Home Jurisdiction Registry Number (Extra Provincial and Federal entities only) 5. How or why was this name chosen? 6. Indicate where in Manitoba the business will be carried on ... Obscene or on public grounds objectionable Distinctive element should be added Descriptive element should be added.

Medicare NCCI 2022 Coding Policy Manual – Chap1 ...

www.cms.govApr 01, 2012 · Manual, the term “physician” would not include some of these entities because specific rules do not apply to them. For example, Anesthesia Rules [e.g., CMS “Internet-only Manual (IOM),” Publication 100-04 (“Medicare Claims Processing Manual”), Chapter 12

AASB 1060 Key Facts (03/20)

www.aasb.gov.auProfit Private Sector Entities, with comment period ended on 30 November 2019. Extensive outreach was conducted on the proposals, including roundtables in Melbourne, Sydney, Brisbane, Perth and Adelaide, attended by 127 stakeholders, a webinar with 162 participants, as well as separate consultations with the

United States - Information on residency for tax purposes ...

www.oecd.orgcitizen, as a foreign corporation or domestic corporation).Similarly, because disregarded entities are also fiscally transpare, ntthe residence of the disregarded entity has no bearing on whether its income is subject to U.S. federal tax; rather, tax is imposed on the disregarded entity’s sole owner in the state in which the owner is resident.

Wisconsin Tax Treatment of Tax- Option (S) Corporations ...

www.revenue.wi.govfor all of its disregarded entities. Such returns shall be signed by the person required to file the return or by a duly authorized agent but need not be verified by oath. Note: Prior to September 1, 2009, the owner was required to include the information from …

Employee Central Compound Employee API - help.sap.com

help.sap.commaster data from Employee Central to SAP systems, payroll systems, and benefits systems. Key Features The API returns all requested data of an employee in a single call providing a hierarchically structured response. The query response comprises all time slices of all entities specified in the request. You can apply filters in the query request.

Lecture 11 Phylogenetic trees

www.ncbi.nlm.nih.govvarious biological species or other entities that are believed to have a common ancestor. • Each node is called a taxonomic unit. • Internal nodes are generally called hypothetical taxonomic units ... have to be deleted (insertion and the deletion of the circle) Ordered characters and perfect phylogeny • Assume that we in the last common

IFRS 12 Disclosure of Interest in Other Entities - PKF

www.pkf.comTeak Limited Retail of widgets England 60% Non-wholly owned Willow Limited Manufacture of widgets Australia 100% Wholly owned Details of non-wholly owned subsidiaries that have a material non-controlling interest are disclosed in note 20.2. 20.2 Details of non-wholly owned subsidiaries that have material non-controlling interests

SAP Group Entities

www.sap.comMay 02, 2022 · REGION ENTITY COUNTRY GROUP ENTITY NAME APJ Viet Nam SAP SAP Vietnam Company Limited EMEA North Belgium SAP SAP Belgium – Systems, Applications and Products SA EMEA North Denmark SAP SAP Danmark A/S EMEA North Estonia SAP SAP Estonia OÜ EMEA North Finland SAP SAP Finland Oy EMEA North France Emarsys Emarsys …

ENGAGEMENT LETTER TEMPLATE FOR INDEPENDENT REVIEW ...

saicawebprstorage.blob.core.windows.net(IFRS) or the International Financial Reporting Standard for Small and Medium-sized Entities (IFRS for SMEs). 4 The wording in brackets (“… are not prepared … “) should be used if the company applied an entity specific basis of accounting. 5 The applicable financial reporting framework applied by the company could be IFRS or IFRS for ...

COVID-19 INFORMATION GUIDANCE FOR MASKS FOR THE …

open.alberta.caBusinesses and entities should promote COVID-19 vaccination to staff, volunteers and attendees and ... • Albertans must follow provincial requirements for wearing masks . ... the floor of a public washroom for example – use garbage cans or bring the used mask home with you.

California Solar Initiative

www.cpuc.ca.goventities, which caused CSI budgeting uncertainty. See CPUC Decision (D.)11-12-019 for more details. 9 The Center for Sustainable Energy (CSE) administered the CSI Program in SDG&E’s service territory. CPUC – California Solar Initiative – Annual Program Assessment

Cyber Security Recovery Plans for BES Cyber Systems - NERC

www.nerc.comCIP-009-6 — Cyber Security — Recovery Plans for BES Cyber Systems Page 3 of 25 4.2.3.4 For Distribution Providers, the systems and equipment that are not included in section 4.2.1 above. 4.2.3.5 Responsible Entities that identify that they have no BES Cyber Systems categorized as high impact or medium impact according to the CIP-002-5.1

Cyber Security Information Protection

www.nerc.comCIP-011-2 — Cyber Security — Information Protection Page 3 of 16 4.2.3.5 Responsible Entities that identify that they have no BES Cyber Systems categorized as high impact or medium impact according to the CIP-002-5.1 identification and categorization processes. 5. Effective Dates: See Implementation Plan for CIP-011-2. 6. Background:

Provider Relief Fund General and Targeted Distribution ...

www.hrsa.govReporting Entities will submit consolidated reports. The reporting requirements outlined in this section apply to all past and future PRF payments made under the legal authorities outlined in the section Overview of Legal Requirements for Reporting.

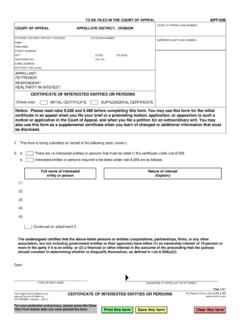

APP-008 Certificate of Interested Entities or Persons

www.courts.ca.govNotice: Please read rules 8.208 and 8.488 before completing this form. You may use this form for the initial certificate in an appeal when you file your brief or a prebriefing motion, application, or opposition to such a motion or application in the Court of Appeal, and when you file a petition for an extraordinary writ. You may

for Small and Medium-sized Entities (SMEs) IFRS for SMEs

iacsa.co.za30 foreign currency translation 192 31 hyperinflation 198 32 events after the end of the reporting period 201 33 related party disclosures 204 34 specialised activities 208 35 transition to the ifrs for smes 213 appendix a: effective date and transition 219 appendix b: glossary of terms 220 derivation table 241 approval by the board of the ifrs for smes issued in july 2009 243

KPMG IN MALAYSIA Wonderful SME Sdn. Bhd. 2016

assets.kpmgIn February 2014, the Malaysian Accounting Standards Board (“MASB”) issued MPERS, which is a new financial reporting framework for private entities. MPERS is effective for financial statements beginning on or after 1 January 2016, replacing the existing Private Entity Reporting Standards (“PERS”).

Arizona enacts elective Arizona small business tax and ...

www2.deloitte.comcertain pass-through entities that are treated as a partnership or S corporation for federal income tax purposes, including but not limited to: • Partners or shareholders of a business that is a partnership or S

Setting Up of BUSineSS entitieS And CloSUre

www.icsi.edul Cine Workers Welfare Fund Act, 1981 l Design Act, 2000 l Drugs and Cosmetics Act, 1940 l Employees’ Provident Funds and Miscellaneous Provisions Act, 1952 l Employee’s State Insurance Act, 1948 l Environment (Protection) Act, 1986 l Factories Act, 1948 l FEMA, 1999 l Foreign Contribution Regulation Act, 2010

A practical guide to the business review - KPMG

home.kpmgrequirements set out in section 359 for private companies and companies limited by guarantee; and ... listed issuers and other entities claiming compliance with the disclosure requirements of the Listing ... reference to the New Companies Ordinance and Hong Kong Financial Reporting Standards and Proposed Minor/Housekeeping Rule Amendments.

Anti-Bribery & CorruptionPolicy - GSK

www.gsk.comcritical role of our ABAC principles. ... - Risk governance forums provide enterprise oversight of our management of the ... (which includes public enterprises, and entities owned or controlled by the state); - Any officer or employee of a public international organisation (for example, the World

COMPANY SECRETARIES EXAMINATIONS, DECEMBER, 2021 …

www.icsi.eduSetting up of Business Entities and Closure (Module-I) Financial, Treasury and Forex Management (Module – II) Corporate Restructuring, Insolvency, Liquidation and Winding – up (Module – II) 27.12.2021 Multidisciplinary Case Studies Monday Capital Markets and Securities Laws (Module-II) Corporate and Management Accounting -II) (OMR Based)

ARTICLES OF THE MODEL - OECD

www.oecd.orgArticle 14 [Deleted] Article 15 Income from employment Article 16 Directors’ fees Article 17 Entertainers and sportspersons Article 18 Pensions ... funds for the benefit of entities or arrangements referred to in subdivision (i). ARTICLES OF THE MODEL CONVENTION [as they read on 21 November 2017]

DEPARTMENT OF HEALTH & HUMAN SERVICES

www.cms.govAug 06, 2019 · sponsors and their downstream entities for current and prospective members. Subsection 80.1 – Customer Service Call Center Requirements and Standards Revise sentence to read: Plans/Part D sponsors must operate a toll-free customer service call centers for current and prospective enrollees.

SETTING UP OF BUSINESS ENTITIES AND CLOSURE - ICSI

www.icsi.eduvi l Limited Liability Partnership Act, 2008 l Limestone and Dolomite Mines Labour Welfare Fund Act, 1972 l Maternity Benefit (Amendment) Act, 2017 l Mica Mines Labour Welfare Fund Act, 1946 l Micro, Small and Medium Enterprises Development Act, 2006 l Mines Act, 1952 l Minimum Wages Act, 1948 l Motor Transport Workers Act, 1961 l National Green Tribunal Act, 2010

ICD 705 Physical Security Construction Requirements for SAP

www.cdse.eduA SAPF is an accredited area, room, group of rooms, building, or installation where SAP materials may be stored, used, discussed, manufactured, or electronically processed. ... • Not-DOD U.S. government entities that require access to DOD SAPFs . ... ICD 705-2 that are required by SAP managers should be negotiated between the SAO and AO.

Form ST-5C Contractor’s Sales Tax Exempt Purchase Certificate

www.mass.govDec 12, 2017 · governmental entities under MGL Ch. 64H, sec. 6(tt). “Consult-ing or operating contractors or subcontractors,” as defined in MGL Ch. 64H, sec. 6(tt) purchasing tangible personal property on behalf of, and acting as agents of, and providing “qualified serv-ices” (as defined in MGL c. 64H, sec. 6(tt)) to a governmental

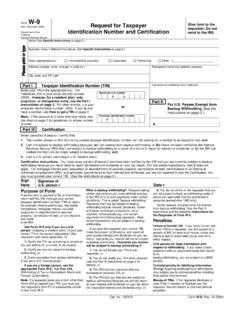

Form W-9 (Rev. December 2000) Request for Taxpayer

www.nj.gova domestic owner) that is disregarded as an entity separate from its owner under Treasury regulations section 301.7701-3, enter the owner's name on the "Name" line. Enter the LLC's name on the "Business name" line. Caution: A disregarded domestic entity that has a foreign owner must use the appropriate Form W-8. Other entities.

Similar queries

Public entities, Public, Synology DiskStation MIB Guide, Entities, SINGAPORE FINANCIAL REPORTING STANDARD FOR, For Small and Medium, Sized Entities, Ifrs, SMEs, Singapore Financial Reporting Standard for Small Entities, For Small Entities, Not-for-Profit Entities Topic 958, Profit Entities, Malaysian, Private entities, Malaysian Private Entities Reporting Standard MPERS, Reporting, MPERS, Reporting Standard, PROTOCOL ON CORPORATE GOVERNANCE, Governance, Small and medium, Sized, Topic, For-Profit Entities Topic 958, For-Profit Entities, Governance in the Public Sector, Provincial, State-owned enterprises, Owned, Profit, Foreign, Disregarded entities, Disregarded, Deleted, IFRS 12 Disclosure of Interest in Other Entities, Teak, SAP Group Entities, SAP SAP, Security, NERC, Security Information, Information, Effective, Reporting Entities, Certificate of Interested Entities or Persons, Notice, Opposition, Standards, Private, Reporting Standards, Business, SETTING UP OF BUSINESS ENTITIES AND CLOSURE, Fund, Employees, Provident, Practical guide to the business review, For private, Hong Kong Financial Reporting Standards, Role, Oversight, Entities owned, State, Setting up of Business Entities, ARTICLES OF THE MODEL, OECD, Labour, Amendment, Group, Governmental entities, Governmental