Disregarded Entities

Found 4 free book(s)Certificate of Status of Beneficial Owner for United ...

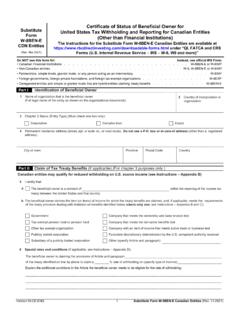

www.rbcdirectinvesting.comUnited States Tax Withholding and Reporting for Canadian Entities (Other than Financial Institutions) The Instructions for the Substitute Form W-8BEN-E Canadian Entities are available at ... • Disregarded entities and simple or grantor trusts that are hybrid entities claiming treaty benefits . . . . . . . . . . . . W-8BEN-E.

Pass-Through Entity Tax

www.tax.ny.govan entity that is disregarded for tax purposes, such as a single member limited liability company, is treated as if issued directly to the individuals or entities that include the disregarded entity ’s activity on their income tax returns. The calculation of PTE taxable income differs between electing New York S corporations

Request Taxpayer Identification Number Certification

www.doa.virginia.govDisregarded Entity Partnership ... Nonresident Aliens and Foreign Entities). Nonresident alien who becomes a resident alien. Generally, only a nonresident alien individual may use the terms of a tax treaty to reduce or eliminate U.S. tax on certain types of income. However, most

Part I Section 223 – Health Savings Accounts—HDHP Family ...

www.irs.govindividual may also have permitted insurance, and certain disregarded coverage in addition to an HDHP. A plan does not fail to be treated as an HDHP merely because it covers preventive care without a deductible. An HDHP is a health plan that satisfies certain requirements with respect to