Search results with tag "Pass through entity"

MARYLAND PASS-THROUGH ENTITY 2017 SCHEDULE K-1 …

forms.marylandtaxes.govcom/rad-045 maryland schedule k-1 (510) pass-through entity member's information or fiscal year beginning 2017, ending 2017 information about the pass-through entity (pte)

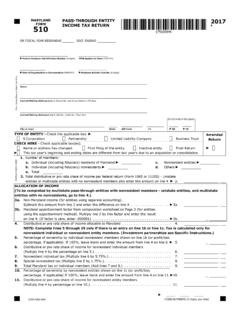

MARYLAND PASS-THROUGH ENTITY 2017 FORM INCOME …

forms.marylandtaxes.govMARYLAND FORM 510 PASS-THROUGH ENTITY INCOME TA RETURN COM/ RAD069 NAME FEIN 2017 page 3 Schedule A - COMPUTATION OF APPORTIONMENT FACTOR (Applies only to multistate pass-through entities.

MARYLAND 2017

forms.marylandtaxes.gov• The Maryland Form 510 A Pass Through Entity Income Tax Return must be filed electronically if the pass-through entity has generated a business tax credit from Maryland Form 500CR or a Heritage Structure Rehabilitation Tax Credit from Form 502S to pass on to its members.

STATE OF CONNECTICUT SN 2018(4) - ct.gov

www.ct.govBecause individual partners will get a credit for the Pass-Through Entity Tax paid by their pass-through entity, many resident individual and trust partners will

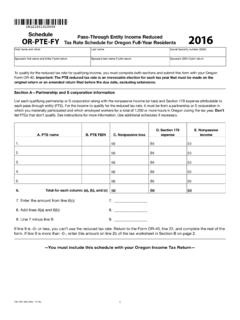

2016, Schedule OR-PTE-FY, Pass-through entity income ...

www.oregon.gov150-101-365 (Rev. 12-16) 3 Tiered entities. If you received nonpassive income that passed-through a PTE to you from another qualifying PTE, that income qualifies for the reduced tax rate if the lower-tier

The S-Corporation Election; Advantages & Disadvantages

www.irs.govPass through Entity • Advantages: –Taxation at individual level –Losses flow through –No double taxation –Capital gains & losses flow through –If active participation by shareholder, profits are not subject to NIIT 10

REAL ESTATE TAX RETURN DECLARATION OF ESTIMATED …

revenuefiles.delaware.govReal Estate Tax Return Declaration of Estimated Income Tax Instructions Every non-resident individual, pass through entity or corporation who makes, executes, delivers, accepts, or presents for recording any document, except those exemptions defined or described in Sections 1126, 1606 and 1909 of Title 30, or in whose behalf any document is

PASS-THROUGH ENTITY INCOME TA RETURN 510

www.marylandtaxes.govMARYLAND FORM 510 PASS-THROUGH ENTITY INCOME TA RETURN COM/ RAD-0 NAME FEIN 2020 page 3 Signature of general partner, officer or member Date Printed name of the Preparer/Firm's name Title Signature of preparer other than taxpayer (Required by Law)

Similar queries

PASS-THROUGH ENTITY, MARYLAND PASS-THROUGH ENTITY, FORM INCOME, Pass, Through, Maryland, Pass through entity, Through entity, S-Corporation Election; Advantages & Disadvantages, Level, TAX RETURN DECLARATION OF ESTIMATED, Tax Return Declaration of Estimated Income Tax, MARYLAND FORM 510 PASS-THROUGH ENTITY