Search results with tag "Retirement"

NJ Public Employees Retirement System (PERS) Retirement ...

hr.tcnj.eduApproximately 12 Months Prior To Retirement: Read Retirement Checklist Fact Sheet for details on how to apply. Use the Guide to Retirement link to learn more about eligibility requirements, survivor benefits, completing a retirement estimate and so much more. Please note, retirement estimates can be heard over the phone by calling the NJ ...

2021 FedEx Retirement Choice Decision Guide

fedexretirementchoice.comTake control of your retirement. We continue to provide you with competitive retirement benefits, and you should play an active role . in your retirement planning. Now is also a good time to review your contribution rate and investment options in the 401(k) Plan and how they fit into your overall retirement strategy.

LEOFF Plan 2 Retirement Know -how

leoff.wa.gov• Retirement planning considerations • Retirement ready options and considerations, including o Estimating your benefit o Purchasing an annuity o Purchasing additional service credit o Deferred Compensation or other deferred savings programs o Retirement application process o Insurance coverage for medical, life and long-term care ...

Plan Enrollment (Member Information Form)

www.drs.wa.govThis form confi rms your active enrollment in a Department of Retirement Systems PERS, TRS or SERS retirement plan. Sign and date this form the day you submit it to your employer. New member: I have chosen the retirement plan marked in Section 2. I understand my retirement plan selection is permanent.

Investo Retirement Annuity - Momentum

retail.momentum.co.zaA retirement annuity is primarily designed to help you grow your savings money for retirement so that you can draw a regular income during your retirement. It is a long-term savings product that helps you save and invest in a tax-e˜cient way. ... Investo_RA_v2 Created Date:

S U R S

surs.org1. Traditional Pension Plan 2. Portable Pension Plan 3. Retirement Savings Plan This guide focuses on the Retirement Savings Plan. A brief summary of the three plans is below. Additional information about the three retirement options can be found at surs.org. TRADITIONAL PENSION PLAN This is the historical SURS defined benefit retirement plan.

Secretary’s guidelines for retirement village asset ...

www.fairtrading.nsw.gov.auRetirement Villages Act 1999 (the . Act), all operators of retirement villages must prepare and keep up- to-date an asset management plan that complies with the Act and Regulation. Section 189B of the Act enables the Secretary to issue these Guidelines to assist you in complying with your obligations regarding asset management plans.

Department of the Army Retirement Planning Informational …

soldierforlife.army.milPre-Separation Counseling no later than 365 days before your effective retirement date. ... • Briefing includes Retirement Points, RCSBP/SBP, Retired Pay Application, VA, TRICARE, Federal Employees Dental and Vision Insurance Program (FEDVIP ), ... PCS, completion of military or civilian schooling, etc. ...

SCHEDULE S LINE-BY-LINE INSTRUCTIONS

ksrevenue.govKPERS, regular and special members of the Kansas Police and Firemen’s Retirement System and members of the Justice and Judges Retirement System. Current employees: Enter the amount you contributed from your salary to the Kansas Public Employees’ Retirement System (KPERS) as shown on your W-2 form, typically box 14.

Target Retirement 2050 Fund - The Vanguard Group

institutional.vanguard.comVanguard Target Retirement 2050 Fund seeks to provide capital appreciation and current income consistent with its current asset allocation. Benchmark Target Retirement 2050 Composite Ix Growth of a $10,000 investment: January 31, 2012— December 31, 2021 $29,690 Fund as of 12/31/21 $30,568 Benchmark as of 12/31/21 Annual returns

Employment Application Part1-Pre-Interview

omh.ny.govApr 06, 2021 · state or local employees from being rehired by the state or a political subdivision and receives pension benefits while employed. Applicants who are receiving service retirement benefits from New York State, Municipal or Political Subdivision Retirement System must have approval under Section 211 or 212 of the Retirement and Social Security Law

DEED OF ADMISSION-CUM-RETIREMENT - DKMS

www.dkms.co.inDEED OF ADMISSION-CUM-RETIREMENT ... the Deed of Partnership dated _____ entered into by and between the Continuing Partner & the Retiring Partner. ... any business transaction from date of this retirement. IN WITNESS WHEREOF the parties hereto have put their respective hands the day and

Agency Checklist for Phased Retirement - FERS

www.opm.govAgency Checklist for Phased Retirement - FERS Section A - Employing Office Checklist To be completed by office maintaining Official Personnel Folder Name of applicant (last, first, middle): Date of birth: Social security number: Are the following documents attached or actions taken? Indicate by a "check mark" for each item . Yes . No . Not ...

PERA 1 PERA Benefit Structure Highest Average Salary ...

copera-pensionx-web.specialdistrict.orgPERA Benefit Structure Highest Average Salary Percentages for Retirement Benefit Option 1 Use this table if you began PERA membership on or before June 30, 2005, had five years of service credit on January 1, 2011, and were eligible to receive a benefit on January 1, 2011. The shaded areas indicate reduced retirement percentages.

Westpac KiwiSaver Scheme Initial Retirement Withdrawal …

www.westpac.co.nzin my Initial Retirement Withdrawal Form is true and correct; and – I am 65 years old or over; and – If I first joined KiwiSaver before 1 July 2019, I have either: > been a member of a KiwiSaver scheme, and/or a complying superannuation fund, for 5 years or more; or > been a member of a KiwiSaver scheme, and/or a

Schwab Personal Choice Retirement Account (PCRA)

content.schwabplan.comSchwab Personal Choice Retirement Account®(PCRA) |age 3 of 3 P Your cash balances are swept into a multiple-bank cash feature product providing up to $500,000 FDIC insurance to your cash balance. 6 The cash feature is not intended to be a long-term investment.

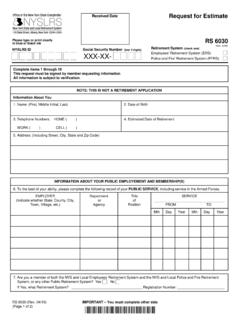

Request for Estimate (RS6030) - New York State Comptroller

www.osc.state.ny.usThere are laws governing employment after retirement and if you plan to be employed by or contract with a public employer, it is important for you to know about them. You may obtain information by writing to the Post -Retirement Employment Section, New York State and Local R etirement System, Albany, New York 12244.

Russia’s brazen and lawless military assault on Ukraine ...

www.gov.ca.govMar 02, 2022 · In addition, our Teachers’Retirement System holds $320 billion in assets, and the University ofCalifornia’s Retirement System another $170 billion. ... real asset investments, and debt –that have some nexus or relation to Russia’s ... These fiduciary obligations and our moral imperative before these atrocities demand that you act ...

Benefit Highlights - TSERS

files.nc.govBenefit Highlights - TSERS TSERSHLT Page 1 of 4 REV 20170101 TSERSHLT Page 4 of 4 REV 20170101. How do I qualify for Teachers’ and State Employees’ ... your retirement allowance will increase to the Maximum Allowance the following month for the remainder of your life. Your annual retirement benefit is based on

13. ALL INDIA SERVICES (DEATH-CUM-RETIREMENT …

dopt.gov.inand twenty days of earned leave where such leave was for more than one hundred and twenty days; 2(1)(b) "death-cum-retirement gratuity” means the lump sum granted to a member of the Service or his family in accordance with rule 19. 102(1)(bb)"Emoluments" means the basic pay, as defined in clause (aa) of rule 2 of the Indian

CSRS Employee Deductions and Agency Contributions FERS …

www.opm.govtemporarily change the agency contribution rate for the Civil Service Retirement System and the meployee withholding rate for both the CSRS and the Federal Employee Retirement System. All agencies, with the exception of the U.S. Postal Service and the Metropolitan Washington Airports Authority, must contribute an increase

Retiring from Public Employment - OPERS

www.opers.orgRetiring From Public Employment - Traditional Pension Plan Ohio Public Employees Retirement System • 1-800-222-7377 • www.opers.org 1 ... Now that you are beginning the retirement application process and making the transition from active member to benefit recipient, OPERS is committed to providing the same exemplary service while making the ...

Wells Fargo & Company 401(k) Plan ... - Empower Retirement

www.empower.comrecordkeeper and trustee transition . Effective January 1, 2021, Empower Retirement, LLC (Empower) will become the new recordkeeper and Great-West Trust Company, LLC (Great-West) will become the trustee for the Wells Fargo & Company 401(k) Plan. This FAQ provides a summary of key changes that will occur in connection with the 401(k) Plan

Dell EMC PowerEdge R650xs

i.dell.comFrom the silicon and supply chain all the way to asset retirement, know . that your servers are safe and secure with innovative Dell EMC and . Intel technologies. We give you the confidence of cyber resilience with . enterprise-class security that minimizes risk for any organization, from small business to hyperscale.

Planning your retirement - AustralianSuper

www.australiansuper.comHow will you spend your time? › Hobbies: you may already have some, or you might use your spare time to learn something new. Hobbies are a great way to keep in touch with friends and meet new people. › Travel: explore the world or your own backyard. › Activities with family and friends: social outings are a big part of most people’s lives.

Decommissioning US Power Plants - Resources for the Future

media.rff.orgturbines, coal-fired boilers, or individual wind turbines. Plants refers to the facilities where these individual units are located, often including multiple generating units and incorporating transmission equipment, fuel processing facilities, and other infrastructure. The bulk of this analysis focuses on the retirement of plants.

Corporate Goal Case

www.eia.govrequires remaining coal-fired generating plants to operate at higher utilization rates following the retirement of older, less-efficient coal plants, leaving only the most-efficient plants in operation. More projected generation from natural gas in the Reference case than in the Corporate Goal case results in slightly higher electricity-related CO

Note: The draft you are looking for begins on the next ...

www.irs.govA qualified employer plan (retirement plan) can maintain a separate account or annuity under the plan (a deemed IRA) to receive voluntary employee contributions. If the separate account or annuity otherwise meets the requirements of an IRA, it will be subject only to IRA rules. An employee's account can be treated as a tra-ditional IRA or a ...

OLD MUTUAL SUPERFUND PENSION AND PROVIDENT …

www.oldmutual.co.zaJun 15, 2021 · The Funds are defined contribution in nature, and are registered under section 4 of the Pension Funds Act and approved under the Second Schedule to the Income Tax Act. The Funds are Type A umbrella funds. The Old Mutual SuperFund Pension Fund is a regi stered pension fund. At retirement, Members are

POLICE AND FIREMEN'S RETIREMENT SYSTEM OF NEW …

www.state.nj.usExecutive Director Report - Noted a.) MultiState - Noted B-1+ CIO Report Noted B-2 Board's Due Diligence Memo - Noted a.) Resolution - Adopted (Vote: 11:1; Trustee Megariotis: Nae.) B-3 Investment Committee Memo - Noted (a) Alternative Investment Due Diligence Procedures - Noted B-4 CIO Memo regarding Thoma Bravo Funds - Noted a.)

HM Government, Gender Equality Monitor

assets.publishing.service.gov.ukin pension outcomes. We know that the GPG increases with age and translates into an income gap in later life. As the GPG closes, it is important that the gap in pension outcomes for men and women is closing with it. Addressing some of the underlying labour market issues will have a positive impact on retirement outcomes as well as during ...

Voya Fixed Account

www.voyaretirementplans.comresponsible for all obligations under its contracts. Asset Class: Stability of Principal Important Information This information should be read in conjunction with your contract prospectus, contract prospectus summary or disclosure booklet, as applicable. Please read them carefully before investing. Voya Retirement Insurance and Annuity Company

PERA 6 PERA Benefit Structure Highest Average Salary ...

copera-pensionx-web.specialdistrict.orgPERA Benefit Structure Highest Average Salary Percentages for Retirement Benefit Option 1 Use this table if you began PERA membership between January 1, 2007, and December 31, 2010, and were not eligible to receive a benefit on January 1, 2011. Also, this table applies to you if you began membership on or before December 31, 2006,

2020 TRUST DECANTING CHART: STATE BY STATE - NFP

webfiles2.nfp.comU.S. and abroad. Securities may be offered through Executive Services Securities, LLC, member FINRA/SIPC, and investment advisory services may be offered through NFP Retirement, Inc., subsidiaries of NFP.

2021 Form W-4P - Department of Retirement Systems

www.drs.wa.goveligible rollover distributions or for payments to U.S. citizens to be delivered outside the United States or its possessions), or (b) to have an additional amount of tax withheld. Your options depend on whether the payment is periodic, nonperiodic, or an eligible rollover distribution, as explained on pages 2 and 3.

City of Los Angeles Handbook for City Employees

per.lacity.orgLos Angeles City Employees’ Retirement System You are encouraged to visit the individual Department websites to learn more about their specific programs and services offered.

ons i s i c e l d a i nc a n i F at retirement

files.moneysmart.gov.aufortnightly pension rate was $826.20 for a single person and $1,245.60 for a couple combined. You may also be eligible for pension and/or clean energy supplements. For singles the maximum combined supplement rate is $81.40 a fortnight. For couples it is $122.60 a fortnight. Pension and supplement rates are updated in March and September each year.

FEDERAL EXEMPTIONS - United States Courts

www.lawb.uscourts.govRetirement Benefits 5 USC § 8346 - Civil Service employees. 22 USC § 4060 - Foreign service employees. 10 USC § 1440 - Military service employees. 45 USC § 231m - Railroad workers. 42 USC § 407 - Social Security benefits. 38 USC § 3101 - Veteran's benefits. 50 USC § 403 - CIA employees. 38 USC § 1562(c) - Military Medal of Honor Roll ...

Civil Service Act

www.scsc.pa.govCIVIL SERVICE ACT Act of August 5, 1941 (P.L. 752, No. 286) COMMONWEALTH OF PENNSYLVANIA STATE CIVIL SERVICE COMMISSION ... Examination 7 Retirement 23 Position 6 List 7, 14 Separation 22 Procedure 14 Safety program 20 Testimony 11, 29 Qualifications for 15 Selection of eligibles 18 Training programs 20 ...

SOCIAL SECURITY SYSTEM/GOVERNMENT SERVICE …

www.sss.gov.phSOCIAL SECURITY SYSTEM/GOVERNMENT SERVICE INSURANCE SYSTEM CERTIFICATION OF SEPARATION FROM LAST ... NO OTHER CLAIM FILED REMARKS: CLEARED BY: DATE: FOR: ... Certification. For Retirement/Old Age/Disability Claim Only GSIS DATA Republic of the Philippines SOCIAL SECURITY SYSTEM/GOVERNMENT SERVICE …

401 (k) Savings Plan Enrollment Guide - Empower …

www.empower.comJPMorgan Chase 401(k) Savings Plan Enrollment uide. Section 2: Saving begins . automatically. JPMorgan Chase is here to help make enrolling in the Plan and saving for your retirement as easy as possible. Unless you enroll on your own, you will be automatically enrolled in the Plan at the end of your 31-day grace period.

FIRST ETIREMEN ITHDRAWAL - ANZ Bank New Zealand

www.anz.co.nz• If I am subject to the five-year membership period (i.e. I joined KiwiSaver prior to 1 July 2019 aged between 60 and 64), by making a retirement withdrawal I agree to opt out of the five-year membership period. This means I will no longer be eligible to receive any Government contributions . and my employer can stop their contributions.

AMP announces FY 21 results For personal use only

www.asx.com.auA$1.9 billion of regular pension payments to customers in retirement. AUM on the flagship North platform increased A$9.8 billion to A$61.4 billion, driven by improved investment markets and an increase in inflows from external financial advisers, up …

SCHEDULE S 2020 114320 KANSAS SUPPLEMENTAL SCHEDULE

ksrevenue.govA8. KPERS lump sum distributions exempt from Kansas income tax. A9. Interest on U.S. Government obligations (reduced by related expenses) A10. State or local income tax refund (if included in line 1 of Form K-40) A11. Retirement benefits specifically exempt from Kansas income tax (do NOT include social security benefits or KPERS lump sum ...

Retirement Homes Policy to Implement Directive #3

www.rhra.caRetirement homes must ensure that the following are put in place to facilitate safe visits: a. Adequate staffing: The home has sufficient staff to implement the policies related to visitors and to ensure safe visiting as determined by the home’s leadership. b.

Retirement Homes Policy to Implement Directive #3

www.rhra.caRetirement homes must ensure that the following are put in place to facilitate safe visits: a. Adequate staffing: The home has sufficient staff to implement the policies related to visitors and to ensure safe visiting as determined by the home’s leadership. b.

Similar queries

Public Employees Retirement System, Retirement, And investment, Retirement planning, Your, Member Information, Confi, Department of Retirement Systems, Retirement annuity, Plan, Retirement plan, For retirement, Retirement villages, Separation, Briefing, Civilian, SCHEDULE S, INSTRUCTIONS, KPERS, Kansas Public Employees’ Retirement System, Target Retirement, Vanguard, Vanguard Target Retirement 2050 Fund, Employees, Retirement System, DEED OF ADMISSION-CUM-RETIREMENT, Deed, Agency Checklist for Phased Retirement - FERS, Checklist, Benefit Structure Highest Average Salary, Benefit Structure Highest Average Salary Percentages for Retirement Benefit Option, Benefit, Retirement percentages, KiwiSaver, Schwab Personal Choice Retirement Account, Request for Estimate, New York State Comptroller, Public, New York, R etirement, Asset, Obligations, Highlights, INDIA SERVICES DEATH-CUM-RETIREMENT, Earned leave, Leave, Gratuity, Civil Service Retirement System, Service, OPERS, Pension, Transition, Planning your retirement, Hobbies, Decommissioning US Power Plants, Coal, Fired, Generating, Fired generating, Account, PROVIDENT, Defined contribution, Pension fund, Executive, Regarding, Gender Equality Monitor, Form W-4P, Rollover, Angeles Handbook for City Employees, CIVIL SERVICE ACT, CIVIL SERVICE, SOCIAL, GOVERNMENT SERVICE, GOVERNMENT SERVICE INSURANCE SYSTEM, OTHER, GSIS, 401 (k) Savings Plan Enrollment Guide, JPMorgan Chase 401(k) Savings Plan Enrollment, JPMorgan Chase, Retirement homes