Search results with tag "Business personal property"

Manual Business Personal Property - AZDOR

azdor.govBusiness Personal Property Manual Identification of Business Personal Property ratio. The classes of property and their corresponding assessment ratios are set forth in A.R.S. 42-12001 to 42-12009 and 42-15001 to 42-15009, respectively. Most locally assessed business and agricultural personal property, including

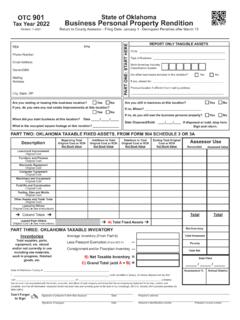

2022 Form 901 Business Personal Property Rendition

oklahoma.gov• Business Sold: date of sale, name and address of new owner. • Business Closed: date of closing or date all personal property was disposed, report location and value of any remaining property still owned on the assessing date, even if in storage. • Business Name Change: date of change and new name.

The business personal property tax in Connecticut

www.cga.ct.govSep 29, 2014 · As of the 2013 assessment year, taxable business personal property made up just over five percent of total taxable property within the state. The tax revenue generated by this base totals over $590 million each year. Even though the aggregate value of taxable personal property has increased every year (except for

2017 Business Personal Property Reporting - Roosevelt County

www.rooseveltcounty.comNEW MEXICO BUSINESS PERSONAL PROPERTY REPORT 2017 OFFICIAL REQUEST-RESPONSE REQUIRED Deadline for response is the last day of February. Any report received after the last day of February is subject to a civil

CONFIDENTIAL 2018 WITH A TOTAL ... - Personal …

www.personalpropertypro.comSample Tarrant County (Bob Jones) 3.1 GENERAL PROPERTY DESCRIPTION Account # 12345678 Tax Year 2018 Identify by type/category and location all taxable business personal property in your possession on January 1 by darkening the "YES" or …

Business Personal Property FAQs What is considered ...

www.richmondgov.comBusiness Personal Property FAQs What is considered business personal property? Personal property, e.g. furniture, fixtures and equipment, that is used or employed in a trade or

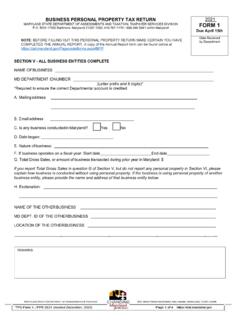

BUSINESS PERSONAL PROPERTY TAX RETURN 2021

dat.maryland.govbusiness personal property tax return maryland state department of assessments and taxation, taxpayer services division p.o. box 17052 baltimore, maryland 21297-1052; 410-767-1170 • 888-246-5941 within maryland note: before filling out this personal property return make certain you have completed the annual report.