Unrelated Business Income

Found 9 free book(s)2020 Corporate Income Tax Forms and Instruction Booklet ...

ksrevenue.govHowever, a corporation that is subject to the tax on unrelated business income by the IRC, who files a Form 990T, is also subject to the tax on unrelated business income for Kansas purposes and must file on Kansas Form K-120. In addition to the corporations exempt from federal income tax, there shall also be exempt for Kansas income tax

2020 Iowa Corporation Income Tax Instructions

tax.iowa.govunrelated business income on federal form 990-T must file on or before the 15th day of the fifth month following the end of the tax period. If the nonprofit corporation has no unrelated business income, even if filing a form 990- T to claim the small business health care tax credit, no Iowa return or copy of the

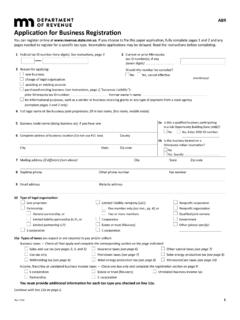

ABR, Application for Business Registration

www.revenue.state.mn.usIncome, franchise or unrelated business income taxes — Check one box only and complete the registration section on page 9: S corporation Estate or trust (fiduciary) Unrelated business income tax Partnership C corporation You must provide additional information for each tax type you checked on line 11a. Continue with line 11b on page 2.

Publication 598 (Rev. March 2021) - IRS tax forms

www.irs.govon unrelated business income of exempt organ-izations. It explains: 1. Which organizations are subject to the tax (chapter 1), 2. What the requirements are for filing a tax return (chapter 2), 3. What an unrelated trade or business is (chapter 3), and 4. How to figure unrelated business taxable income (chapter 4).

Instructions for C and S Corporation Income Tax Returns

dor.sc.govunrelated business income Which form do I use? † SC1120 - C Corporation † SC1120S - S Corporation † SC1101B - Bank † SC1104 - Savings & Loan Association Taxpayers filing a federal 1120-F, 1120-H, 1120-POL, 1120-REIT, or similar variation of the federal 1120 should file the

2020 NET PROFIT INCOME TAX FORM 27 INSTRUCTION …

service.ritaohio.comHowever, should a nonprofit have unrelated business income, saidnonprofit is required to file a municipal return and pay tax thereon. Extensions of Time to File. A federal extension extends the municipal due date to the fifteenth day of the tenth month after the last day of the taxable year to which the return relates. ...

R. TAXATION OF PASSIVE INCOME AS UNRELATED …

www.irs.govunrelated business taxable income if the controlled organization were exempt. This is accomplished by multiplying a fraction times the pertinent income item. If the controlled organization is exempt from taxation, the numerator of the fraction is unrelated business taxable income. Reg. 1.512(b)-1(k)(2)(i).

Wisconsin Corporate Income and Franchise Taxes

www.revenue.wi.govJun 18, 2018 · conduit to an unrelated third party or the expense was paid to a bank holding company, a savings bank holding company, or a savings and loan holding company. 2 Non -apportionable income is income derived from the sale of non business real or tangible personal property or from rentals and royalties from non-business real or tangible personal ...

Attachment A Section 8 Definition of Annual Income 24 CFR ...

www.hud.govAttachment A – Section 8 Definition of Annual Income 24 CFR, Part 5, Subpart F (Section 5.609) § 5.609 Annual Income. (a) Annual income means all amounts, monetary or not, which: (1) Go to, or on behalf of, the family head or spouse (even if temporarily absent) or to any other