Search results with tag "Franchise tax"

TN Franchise & Excise Taxes 101

www.bcscpa.comthe company for the tax year. The franchise tax is an asset based tax on the greater of net worth of the company or the book value of real and tangible personal property owned or used in Tennessee at the end of the taxable period. Although the franchise and excise tax are two separate taxes generally, any taxpayer that is

2021 Form 512 Oklahoma Corporation Income and Franchise ...

oklahoma.gov• Franchise Tax If filing a Consolidated Franchise Tax Return for Oklahoma, the Oklahoma franchise tax for each corporation is computed separately and then combined for one total tax. Complete Form 512-FT “Computation of Oklahoma Consolidated Annual Franchise Tax” to determine the combined taxable income to report on page 2, Section Two ...

Department of Taxation and Finance Instructions for Form ...

www.tax.ny.govS Corporation Franchise Tax Return, or Form CT-5.4, Request for Six-Month Extension to File New York S Corporation Franchise Tax Return, for such preceding tax year. If your preceding year’s franchise tax under Article 9-A exceeds $100,000, you must pay 40% (.4) of such tax with your Form CT-3-S, or Form CT-5.4, for such preceding tax year.

2021 TC-20 Utah Corporation Franchise & Income Tax ...

tax.utah.govUtah, is subject to income tax rather than franchise tax. Example 2: A lender issuing credit cards to Utah customers from outside Utah that is not qualifi ed to do business in Utah and has no place of business in Utah is subject to income tax rather than franchise tax. A $100 minimum tax applies to the corporate income tax. Federal Form 1120 ...

2020 Oklahoma Corporation Income and Franchise Tax …

www.taxformfinder.org• Instructions for Completing Form 512 • 512 Corporation Income and Franchise Tax Form • Form 512-TI Computation of Oklahoma Consolidated Taxable Income ... Annual Franchise Tax” to determine the combined taxable income to report on page 2, Section Two, lines 18–25 of Form 512. Submit separate Form 512, pages 6-9 for each company ...

Withholding Income Tax Tables And Employer Instructions

www.dor.ms.govJan 01, 2013 · Income Tax Rates Taxable Income Tax Rate First $4,000 0% Next $1,000 3% Next $5,000 4% Excess of $10,000 5% If you have any questions, contact Withholding Tax at the address below: Withholding Tax Income & Franchise Tax Bureau Post Office Box 1033 Jackson, MS 39215-1033 601-923-7700

Oklahoma Franchise Tax Frequently Asked Questions

www.hccpas.netOklahoma Franchise Tax – Frequently Asked Questions Who files and pays franchise tax? All regular corporations and subchapter-S corporations are required to file Form 200, Annual Franchise Tax Return,

State Guidance Related to COVID-19: Telecommuting Issues ...

www.hodgsonruss.comincome tax based on where he is located when AR S.B. 484 California The California Franchise Tax Board issued No (for franchise tax purposes) The California Franchise Tax Board issued guidance on the“stay -at-home” executive order including the following question and response: “Will California treat a corporation that had

2020- 540 booklet - Franchise Tax Board Homepage | …

www.ftb.ca.govCalifornia Earned Income Tax Credit 69 Instructions for Form FTB 3514 73 2020 California Tax Table 87 ... return matches what you sent to the Franchise Tax Board (FTB) for that year. Go to . ftb.ca.gov. ... (but not less than $1,100) on your tax return by completing form FTB 3803, Parents’ Election to Report Child’s Interest and Dividends.

Counselor Reference Manual - Tax-Aide for CA2 | Tax …

aarpca2.orgAARP FOUNDATION TAX-AIDE CALIFORNIA COUNSELOR REFERENCE MANUAL (CRM) For TaxSlayer Online TAX YEAR 2017 The printed CRM can be ordered from the Franchise Tax Board

Texas Franchise Tax Public Information Report

my.cscglobal.comTEXAS FRANCHISE TAX PUBLIC INFORMATION REPORT (9-09/29) Taxpayer number Report year To be filed by Corporations and Limited Liability Companies (LLC) and Financial Institutions This report MUST be signed and filed to satisfy franchise tax requirements Tcode 13196 You have certain rights under Chapter 552 and 559, Government Code,

Form CT-3 General Business Corporation Franchise Tax ...

www.tax.ny.govFranchise Tax Return Tax Law – Article 9-A ... General corporate information Part 5 – Computation of investment capital for the current tax year ... see instructions)... 6 7Entire net income (ENI) (subtract line 6 from line 5)..... 7 8Investment and other exempt income (from Form CT-3.1, Schedule ...

FAE170 - Franchise and Excise Tax Return Instructions

www.tn.govgroup computed in accordance with the above instructions. Line 2: Enter franchise tax apportionment ratio as computed on Schedule 170NC, 170SF, or 170SC. Line 3: Multiply Line 1 by Line 2. Enter this amount here and on Schedule A, Line 1. Tenn. Code Ann. § 67-4- 2121 limits franchise tax base of any manufacturer to $2 billion.

State income and franchise tax - Q1 2016 - Ernst & …

www.ey.com2 | State income and franchise tax quarterly update K ey developments Louisiana enacts corporate income and franchise tax law changes During the 2016 First Extraordinary Session, the Legislature

Department of Taxation and Finance Instructions for Forms ...

www.tax.ny.govCorporation Combined Franchise Tax Return, or Form CT-33-A, Life Insurance Corporation Combined Franchise Tax Return, to report certain New York additions to, and certain New York subtractions from, federal taxable income (FTI) that are entered on: • Form CT-3-A, Part 3, lines 2 and 4 • Form CT-33-A, lines 74 and 83

05-102 Texas Franchise Tax Public Information Report

comptroller.texas.govTexas Franchise Tax Public Information Report Professional Associations (PA) and Financial Institutions You have certain rights under Chapter 552 and 559, Government Code, to review, request and correct information . This report must be signed to satisfy franchise tax requirements. SECTION A . SECTION B . 0 percent or more. SECTION C . ore in ...

Form 801—General Information (Application for ...

www.sos.state.tx.usthe Texas Comptroller of Public Accounts stating that the entity has satisfied all franchise tax liabilities and may be reinstated. Contact the Comptroller for assistance in complying with franchise tax filing requirements and obtaining the necessary tax clearance letter. The Comptroller may be contacted by e-mail at

AP-152 Application for Texas Identification Number

www.tdcj.texas.govCurrent Texas Identification Number – 11 digits: FOR STATE AGENCY USE ONLY. Are you currently reporting any Texas tax to the Comptroller's office such as sales tax or franchise tax? If "YES," enter Texas Taxpayer Number. Section 2 - Payee Information

GENERAL INSTRUCTIONS - Louisiana

www.revenue.louisiana.govA corporation will be subject to the franchise tax if it meets the above criteria, even if it is not required to pay income tax under Federal Public Law 86-272. Corporation franchise tax for foreign corporations continues to accrue as long as the corporation exercises its charter, does business, or owns or uses any

2021 Form 512-S Oklahoma Small Business Corporation …

oklahoma.govIncome and Franchise Tax Forms and Instructions This packet contains: • Instructions for completing Form 512-S • Form 512-S: Small Business Corporation Income Tax form • Form 512-S-SUP: Supplemental Schedule for Form 512-S, Part 5 • Form 512-SA: Nonresident Shareholder Agreement Income Tax Form

FTB 1240 California Franchise Tax Board …

www.ftb.ca.govWhere to Call or Write. Accounting Period/Method Change . . .800 .852 .5711 Change of Accounting Method/Period . Franchise Tax Board PO …

THE GOVERNOR’S SMALL BUSINESS HANDBOOK

gov.texas.govthe IRS and/or competent tax counsel regarding the decision to elect to file as an “S” corporation for federal tax purposes. This is not a matter that is handled by the Texas Governor’s Office.2 Corporations are subject to a state franchise tax. The filing fee for a certificate of formation for a for-profit corporation is $300.

2017 California 540 Personal Income Tax Booklet - Forms ...

www.ftb.ca.gov540 Forms & Instructions Members of the Franchise Tax Board Betty T. Yee, Chair Diane L. Harkey, Member Michael Cohen, Member 2017 Personal Income Tax Booklet CALIFORNIA

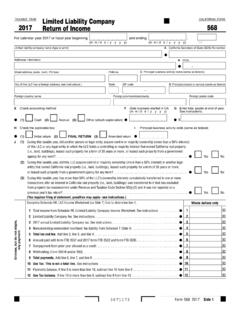

2017 FORM 568 Limited Liability Company Return of Income

www.ftb.ca.govReturn of Income CALIFORNIA FORM 568 For calendar year 2017 or fiscal year beginning and ending . ... Side 2 Form 568 2017 Whole dollars only 13 Tax and fee due. If line 5 is more than line 11, ... required by the Franchise Tax Board.

2016 M4, Corporation Franchise Tax Return

www.revenue.state.mn.us999 I authorize the Minnesota Depart-ment of Revenue to discuss this tax return with the preparer. I declare that this return is correct and complete to the best of my knowledge and belief.

Form CT-3-S-I:2013:Instructions for Forms C-3-S and CT-3-S ...

www.tax.ny.govNew York State Department of Taxation and Finance Instructions for Forms CT-3-S and CT-3-S-ATT New York S Corporation Franchise Tax Return and Attachment

2021 Instructions for Form 590 - Business & Financial Services

bfs.ucr.eduSection 18662 requires withholding of income or franchise tax on payments of California source income made to nonresidents of California. For more information, See General Information B, Income Subject to Withholding. Registered Domestic Partners (RDPs) – For purposes of California income tax, references

Instructions for Completing the Articles of Organization ...

bpd.cdn.sos.ca.govInstructions for Completing the . Articles of Organization (Form LLC-1) To form a limited liability company (LLC), you must file Articles of Organization (Form LLC-1) with the California Secretary ... Franchise Tax Board each year. (California Revenue and Taxation Code section 17941.) For more information, please

STREET ADDRESS: STATE OF CALIFORNIA OFFICE OF THE …

oag.ca.govby the Franchise Tax Board upon application for California tax . Every charitable corporation, unincorporated association and trustee holding assets for charitable purposes or doing business in California, unless exempt, is required to register with the Attorney General within thirty days after receipt of assets (cash or other forms of property).

FTB 1082, Research & Development Credit: Frequently Asked ...

www.ftb.ca.gov1. What is California's Research & Development (R&D) Credit? The California R&D Credit reduces income or franchise tax. You qualify for the credit if you paid or incurred qualified

Dissolvong Busienss Entities and Corporate …

www.staleylaw.com15702.DOC 072913:0827-2- William C. Staley 818-936-3490 • The existence of the corporation generally creates the obligation to pay a franchise tax for the privi-lege of having a corporation, whether or not it is

FRANCHISE TAX BOARD PO BOX 942857 SACRAMENTO …

homestudyonline.comSTATE OF CALIFORNIA FRANCHISE TAX BOARD PO BOX 942857 SACRAMENTO CA 94257-0540 FTB 3556 LLC MEO (REV 09-2009) SIDE 1 Limited Liability Company Filing Information

Similar queries

Franchise, Excise, FRANCHISE TAX, Franchise and excise tax, Franchise Tax Return, Utah, Income tax, Corporate income tax, Oklahoma Corporation Income and Franchise Tax, Instructions for Completing, Corporation Income and Franchise Tax, Instructions, Tax Income, Oklahoma Franchise Tax Frequently Asked Questions, Oklahoma Franchise Tax – Frequently Asked Questions, California, CALIFORNIA FRANCHISE TAX, Corporation, California tax, The Franchise Tax, Completing, Counselor Reference Manual, CALIFORNIA COUNSELOR REFERENCE MANUAL, TEXAS FRANCHISE TAX PUBLIC INFORMATION REPORT, Report, Corporate, Income, State income and franchise tax - Q1, Ernst &, State income and franchise tax, Texas Franchise Tax, Texas, Application for Texas Identification Number, Texas tax, Louisiana, SMALL BUSINESS, Personal Income Tax Booklet, Personal Income Tax Booklet CALIFORNIA, 2017, Return, Income CALIFORNIA, Minnesota Depart-ment of Revenue, I:2013:Instructions for Forms C, New York State Department of Taxation and Finance, 2021 Instructions, Form, California income tax, Articles of Organization, FTB 1082, Research & Development Credit, Entities and Corporate, Limited Liability Company Filing Information