Search results with tag "Excise"

Form OR-20-S Instructions 2020 Oregon S Corporation Tax

www.oregon.govOregon has two types of corporate taxes: excise and income. Excise tax is the most common. Most corpora-tions don’t qualify for Oregon’s income tax. Excise tax requirements. Excise tax is a tax for the privi - lege of doing business in Oregon. It’s measured by net income. S corporations doing business in Oregon must file a Form OR-20-S to ...

Explanatory Memorandum to Notification Nos. 02 to 15 ...

www.indiabudget.gov.inExplanatory Memorandum to Notification Nos. 01/2022-Central Excise dated the 1st February, 2022: - S.No. Notification No. Description 1. 01/2022-Central Excise dated 1st February, 2022 Seeks to further amend Notification No. 11/2017-Central Excise, dated 30th June, 2017, to increase Basic Excise Duty on Unblended Petrol and Diesel, in

U.S. Infrastructure Bill reinstates Superfund excise taxes

www2.deloitte.com(“Superfund”) excise taxes on the production or import of certain chemicals through December 31, 2031, effective for periods after June 30, 2022. This Tax Alert provides some background, summarizes the Superfund excise taxes , and provides some taxpayer considerations related to the Superfund excise taxes.

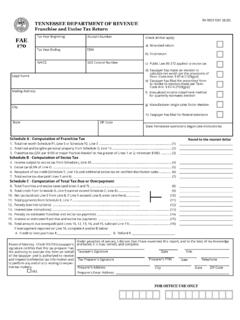

TENNESSEE DEPARTMENT OF REVENUE Franchise and Excise …

www.tn.govTENNESSEE DEPARTMENT OF REVENUE Franchise and Excise Tax Return Tax Year Beginning Account Number Tax Year Ending NAICS Legal Name Mailing Address City State ZIP Code a) Amended return b) Final return c) Public Law 86-272 applied to excise tax d) Taxpayer has made an election to calculate net worth per the provisions of Tenn. Code Ann. § 67-4 ...

2021 Form OR-20 Instructions, Oregon Corporation Excise ...

www.oregon.govUse Form OR-20, Oregon Corporation Excise Tax Return, to calculate and report the Oregon corporate excise tax liability of a business entity taxable as a C corporation doing business in Oregon. Important reminders If your registered corporation or insurance company isn’t doing business in Oregon and has no Oregon-

Mobile Home Real Estate Excise Tax Affidavit

dor.wa.govRCW 82.45.080 subjects the seller of real estate to the payment of the excise tax, and RCW 82.08.050 and 82.12.020 subjects the buyer or user of personal property to the retail sales or use tax. Therefore, if the transfer is subject to the excise tax, it is the liability of

Income Tax Is Voluntary - Truth Sets Us Free

www.truthsetsusfree.comwas, in its nature, an excise, entitled to be enforced as such.” [Brushaber v. Union Pacific Railroad Co. 240 U.S. 1, 16-17 (1916)] An excise tax is not on property, but is on privilegesPrivileges granted by the . government. Before you can be liable for an income tax, you must be exercising a government privilege that is producing income.

Date: 2022-01-01 SCHEDULE 3 Customs & Excise Tariff

www.sars.gov.zaDate: 2022-01-01 SCHEDULE 3 / PART 1 Customs & Excise Tariff. Rebate Item Tariff Heading Rebate Code CD Description Extent of Rebate 306.01 13.02 02.04 47 Datura extract, for the manufacture of scopolamine Full duty 306.01 1515.30 01.06 66 Castor oil and its fractions, for the manufacture of chloroxylenol Full duty.

Careers at MRS - maine.gov

www.maine.govMAINE TAX ALERT A Publication of Maine Revenue Services for Tax Professionals Volume 31, Issue 25 December 2021 . ... Rulemaking Activity . Rule 210, “Telecommunications Excise Tax.” MRS is proposing to add new Rule 210, which provides an overview of the excise tax levied by the State on telecommunications businesses pursuant to 36 MR.S ...

F.NO 96/1/2017-CX.1 GOVERNMENT OF INDIA MINISTRY OF ...

www.cbic.gov.inPrincipal Chief/Chief Commissioner of Central Excise (All) and Principal Chief/Chief Commissioner of Central Excise and Service Tax (All) Sub: Master Circular on Show Cause Notice, Adjudication and Recovery-reg. Madam/Sir, Board is considering issuance of a Master Circular on Show Cause Notice, Adjudication and Recovery by consolidating 85 ...

Form G-49, Annual General Excise/Use Tax Return ...

files.hawaii.govExcise and Use Tax Laws, and the rules issued thereunder. IN THE CASE OF A CORPORATION OR PARTNERSHIP, THIS RETURN MUST BE SIGNED BY AN OFFICER, PARTNER OR MEMBER, OR DULY AUTHORIED AGENT. G49_I 2019A 01 VID01 ID NO 01 ˜ Fill in this oval ONLY if this is an AMENDED return (mm-dd-yy) SIGNATURE TITLE DATE …

Government of Pakistan Revenue Division

download1.fbr.gov.pkAct, 1990 and section 43 of the Federal Excise Act, 2005, the Federal Board of Revenue is pleased to extend the date of payment and filing of Sales Tax and Federal Excise Return for the tax period of December, 2021 as per following schedule: - The date of payment of Sales Tax & FED for all taxpayers, is hereby further extended upto 25.01.2022; and

GENERAL INSTRUCTIONS FOR FILING THE GENERAL …

files.hawaii.govREMINDER: A county surcharge on the State’s general excise and use taxes is imposed on Hawaii taxpayers. Taxpayers MUST complete Part V of their periodic and annual general excise/use tax returns to assign their taxes to each county, or may be subject to a 10% penalty for noncompliance.

International Fuel Tax Agreement (IFTA) Application

revenue.louisiana.govOR Oregon PA Pennsylvania ... Excise Section Excise Section P.O. Box 201 617 North Third Street Baton Rouge, LA 70821-0201 Baton Rouge, LA 70802 ... R-5678-L (2/02) International Fuel Tax Agreement (IFTA) Application ( ) Title: 5678-L (2/02) Author: charles cryer Created Date:

STATE OF SOUTH CAROLI NA DEPARTMENT OF REVENUE

dor.sc.govJul 01, 2017 · • The casual excise tax no longer applies to motor vehicles and motorcycles. Effective July 1, 2017, the casual excise tax only applies to aircraft, boats and boat motors. The infrastructure maintenance fee, however, is paid on motor vehicles and motorcycles at the time of registration with SCDMV under the above rules.

Real Estate Excise Tax Affidavit / Return (form 84-0001B)

dor.wa.gov5. Select the Location, Local Tax Rate, Parcel Number and True and Fair Value of all real property* (Including Leasehold interest) in which the transferred entity has an interest. Calculate the State Tax, Local Tax and Subtotal. Location Codes and Rates can be found using the Real Estate Excise Tax Rates publication on our website at

Highlights brochure: Effective Carbon Rates 2021 - OECD

www.oecd.orgEffective Carbon Rates 2021 is the most detailed and comprehensive account of how 44 OECD and G20 countries – responsible for around 80% of global carbon emissions – price carbon emissions from energy use. The effective carbon rate is the sum of tradeable emission permit prices, carbon taxes and fuel excise taxes, all of which result

COMPREHENSIVE ECONOMIC PARTNERSHIP AGREEMENT …

commerce.gov.inChapter 2 Trade in Goods Article 16 Definitions Article 17 Classification of Goods ... under international law, including those under the United Nations Convention ... the Central Board of Excise and Customs in the Department of Revenue, …

THE CENTRAL GOODS AND SERVICES TAX ACT, 2017 (12 OF …

cbic-gst.gov.in(16) ―Board‖ means the [Central Board of Indirect Taxes and Customs]4 constituted under the Central Boards of Revenue Act, 1963; (17) ―business‖ includes –– 4 Substituted for ―Central Board of Excise and Customs‖ by The Finance Act, 2018 (No. 13 of 2018) – Brought into force w.e.f. 29th March, 2018.

THE CENTRAL GOODS AND SERVICES TAX ACT, 2017 (12 OF …

www.cbic.gov.in2 Substituted for ―Central Board of Excise and Customs‖ by The Central Goods and Services Tax (Amendment) Act, 2018 (No. 31 of 2018) – Brought into force w.e.f. 01st February, 2019. 3 Substituted for ―the Appellate Authority and the Appellate Tribunal‖ by …

Understanding Goods and Services Tax

cbic-gst.gov.inAssessment, Audit, Anti-evasion & enforcement under CGST & IGST Law Levy & collection of Central Excise duty on products outside GST – Petroleum Products & Tobacco Levy & collection of Customs duties Developing linkages of CBEC - GST System with GSTN Training of officials of both Centre & States

Form CRA 3 - icmai.in

icmai.in(b) Produced under leasing arrangements (c) Produced on loan license / by third parties on job work (d) Total Production 3. Production as per Excise Records 4. Capacity Utilization (in -house) 5. Finished Goods Purchased (a) Domestic Purchase of Finished Goods

DLN: PSIC: PSOC: Kagawaran ng Pananalapi Kawanihan ng ...

www.lawphil.netExcise Tax on Goods XP090 & XP100 Naptha & Other Similar Products XM030 Gold and Chromite Alcohol Products XP110 Aviation Gasoline XM040 Copper & Other Metallic Minerals XA010-XA040 Distilled Spirits XP140 Diesel Gas XM050 Indigenous Petroleum XA061-XA090 Wines XP180 Bunker Fuel Oil XM051 Others XA051-XA053 Fermented Liquor T A X T Y P E

Columbia Gas of Ohio Rules and Regulations Governing the ...

www.columbiagasohio.comInterim, Emergency and Temporary PIP Plan Tariff Schedule Rider 24 05-28-21 Excise Tax Rider 25 12-03-08 Non-Temperature Balancing Service 26 04-01-13 Infrastructure Replacement Program Rider 27 04-29-21 Demand Side Management Rider 28 04-29-21 Uncollectible Expense Rider 29 05-28-21 Gross Receipts Tax Rider 30 12-03-08

Form G-17, Rev. 2016, Resale Certificate for Goods General ...

files.hawaii.govGeneral Excise Tax Law and subject to the taxing jurisdiction of the State. That the nature and character of the Purchaser’s business is: ... That the Purchaser, pursuant to section 237-13(2)(F)(i), HRS, and section 18-237-13-02(d)(2)(B), Hawaii Administrative

Liquor Act [No. 59 of 2003] - Gov

www.gov.za(a) has the meaning determined in terms of the Customs and Excise Act, (b) in the absence of a meaning contemplated in paragraph (a), has the “this Act’’ includes any schedule, and any regulation or notice made under this Act. (2) For all purposes of this Act, the question whether, at the time of producing,

THE CUSTOMS ACT, 1969 (IV OF 1969)

download1.fbr.gov.pkTHE CUSTOMS ACT,1969 (i) CONTENTS CHAPTER 1 PRELIMINARY Section Page 1. Short title, extent and commencement. 1 2. Definitions. 1 CHAPTER II APPOINTMENT OF OFFICERS OF CUSTOMS AND THEIR POWERS 3. Appointment of officers of customs. 8 3A. The Directorate General (Intelligence and Investigation), 8 Customs and Federal Excise 3B.

Circular No. 87/06/2019-GST F. No. 267/80/2018-CX.8 ...

www.cbic.gov.inAct, 2018 (No. 31 of 2018) which provides that section 140(1) of the CGST Act, 2017 be amended with retrospective effect to allow transition of CENVAT credit under the existing law viz. Central Excise and Service Tax law, only in respect of “eligible duties”. In this regard, doubts have been expressed as to whether the

MAINE REVENUE SERVICES

www.maine.govGENERAL INSTRUCTIONS The Application for Tax Registration is a combined application. ... • Railroad Excise Tax • Initiator of Deposit ... Trust fund taxes include sales & use taxes, gasoline tax, special fuels tax, recycling assistance fees and income tax withholdi ng. Under Maine law, the owner(s) and person(s) who control the fi nances ...

TTB F 5000.24sm Excise Tax Return

www.ttb.govOfficer, Regulations and Rulings Division, Alcohol and Tobacco Tax and Trade Bureau, 1310 G Street, NW, Box 12, Washington, D.C. 20005. An agency may not conduct or sponsor, and a pon is not required to responders to, a collection of information unless it displayent, va lid OMB s a curr control number. TTB F 5000.24sm (11/2016) 35,9$&< $&7

Subject: Clarification regarding payment of Agriculture ...

www.cbic.gov.inDepartment of Revenue Central Board of Indirect Taxes & Customs (Directorate General of Export Promotion) ***** New Delhi, dated 22 February, 2021 To, All Pr. Chief Commissioners/ Chief Commissioners of Customs/ Customs (Prev.), All Pr. Chief Commissioners/ Chief Commissioners of Central Tax/ Central Excise,

SERVICE TAX RULES, 1994

www.cbic.gov.inInsurance Act, 1938 (4 of 1938); (cc) "large taxpayer" shall have the meaning assigned to it in the Central Excise Rules, 2002. (cca) "legal service" means any service provided in relation to advice, consultancy or assistance in any branch of law, in any manner and includes representational services before

ssc.nic.in

ssc.nic.inCentral Board of Direct Taxes/ Central Board of Excise and Customs. National Human Rights Commission, New Delhi. Facilitation Centre, Department of Personnel and Training, North Block, New Delhi. Estt.-B Division, Department of Personnel & Training, North Block, New Delhi. Director General of Re-settlement and Re-employment of Ex-serviceman, RX ...

Real Estate Excise Tax Affidavit - Wa

dor.wa.govLegal description of property (if more space is needed, you may attach a separate sheet to each page of the affidavit) 5 Select Land Use Code(s): 7 List all personal property (tangible and intangible) included in selling

PRINCIPAL CHIEF COMMISSIONER OF CENTRAL GOODS & …

www.cbic.gov.in285 COMMISSIONER OF CENTRAL GOODS & SERVICES TAX, 38 M.G. MARG, CIVIL LINES, ALLAHABAD211 001. CONTROL ROOM : 2404028 FAX : 2408764 E-mail: cexallah@excise.nic.in ...

TAXI & PRIVATE HIRE VEHICLE LICENSING INSPECTION …

content.tfl.gov.ukAbatement Systems & Alternative Fuel Systems Taximeter and Associated Fittings Taximeter, Lamp Box, Roof Lamp, Seals and Associated Fittings ... DVLA Driver and Vehicle Licensing Agency MIB Motor Insurance Bureau ... LTPH London Taxi and Private Hire VEL Vehicle Excise Licence and Registration Act MOT Roadworthiness Certificate issued by VOSA ...

THE VALUE ADDED TAX ACT 1998

www.mra.mu2 levy” has the same meaning as in the Excise Act;30* ["Commissioner"] Definition deleted31* [“Committee”] Definition deleted32* ["Customs" ] Definition deleted33* “customs duty” means the duty leviable under the Customs Act 1988 and the Customs Tariff Act; “customs laws” has the same meaning as in the Customs Act 1988;

INTERMEDIATE : PAPER - 11 - icmai.in

icmai.in3.0 Valuation under Customs Introduction Valuation of Imported Goods ... Study Note 10 : Audit 10.1 Audit under GST 283 10.2 Types of Audit 283 Study Note 11 : Anti Profiteering ... Central Board of Excise and Customs (CBEC) is an important part of Department of Revenue.

STATE EXCISE TAX RATES FOR NON-CIGARETTE TOBACCO …

www.tobaccofreekids.orgof the states with the lowest percentage of price OTP taxes have high rates of smokeless use by high school males, such as WV (14.5%). 1. Nationwide, 5.8% of high school boys and 1.6% of girls use smokeless tobacco. 2. It is important to raise tax rates on all tobacco products to prevent initiation with or switching to

THE CUSTOMS ACT, 1962* ARRANGEMENT OF SECTIONS

www.indiacode.nic.inRate of duty and tariff valuation in respect of goods imported or exported by post or courier. 6 SECTIONS 84. Regulations regarding goods imported or to be exported by post or courier. ... Applications of certain provisions of Central Excise Act. 8 CHAPTER XV APPEALS SECTIONS 128. Appeals to Commissioner (Appeals). 128A. Procedure in appeal ...

-q fir-fT'O Gl cF - Income Tax Department

www.incometaxindia.gov.indefined in the specified Act, the Central Excise Act,1944, the Customs Act, 1962, the Customs Tariff Act, I 975 or the Finance Act,1994, as the case may be, shall have the meaning respectively assigned to them in that Act. CHAPTER II RELAXATION OF CERTAIN PROVISIONS OF SPECIFIED ACT Relaxation certain of 3.

Motor Fuel Taxes - Connecticut General Assembly

www.cga.ct.govThe motor vehicle fuels tax is a per-gallon excise tax that applies to sales of gasoline, gasohol, and diesel, among other fuels. The current fuel tax rate on gasoline and gasohol is 25 cents per gallon, ... Oregon 36.00 38.83 Ohio 38.50 38.51 US Average* 25.64 36.38 North Carolina 36.10 36.35 Maryland 26.70 36.30 Connecticut 25.00 35.75 West ...

GRA – Ghana Revenue Authority

gra.gov.ghCustoms Act, 2015 (Act 891); and Application for licence under the Excise Duty Act, 2014 (Act 878). Title registrations and transactions (i) Contracts including contracts for supply of goods, works and services Government Agencies, Local Government Authorities and (ii) Submission of tender for supply of other bodies in which public

EXCISE TAX - Maine

www.maine.govVehicle Excise Tax. The Maine State Statutes regarding excise tax can be found in Title 36, Section 1482. PLEASE NOTE The State of Maine Property Tax Division only provides quotes to the Municipal Excise Tax Collector and not to individuals. HOMEPAGE Property Tax Division 51 Commerce Drive, PO Box 9106 Augusta, Maine 04332-9106 Phone (207) 624-5600

EXCISE DUTY ACT - Kenya Revenue Authority

www.kra.go.ke"aircraft” means every description of conveyance by air of human beings or goods; ... “Commissioner” means the Commissioner-General appointed under the Kenya Revenue Authority Act (Cap. 469); ... “duty of customs” means import duty, countervailing duty, or surtax charged under the East African Community Customs Management Act, 2004;

Similar queries

Oregon, Excise, Excise tax, Central Excise, Excise taxes, TENNESSEE, Franchise and Excise Tax Return Tax, Return, Form, Mobile Home, Excise Tariff, Tariff, MAINE TAX, Maine, Chief, Chief Commissioner of Central Excise, Division, Hawaii, Registration, Real Estate Excise Tax Affidavit, Real, Real Estate, Effective Carbon Rates 2021, OECD, Effective, Goods, Classification of Goods, Under, Central, Audit, Form CRA 3, Resale Certificate for Goods General, General Excise Tax Law, Excise Act, CUSTOMS ACT, Customs, MAINE REVENUE SERVICES, GENERAL, Maine law, Excise Tax Return, Department, Description, List, PRINCIPAL CHIEF COMMISSIONER OF CENTRAL GOODS &, COMMISSIONER OF CENTRAL GOODS & SERVICES, Vehicle, INSPECTION, Abatement, Motor, Vehicle Excise, Tariff Act, INTERMEDIATE : PAPER - 11, Valuation under, Valuation, Audit under, Taxes, Central Excise Act, Connecticut General Assembly, EXCISE DUTY ACT, Commissioner, The Commissioner, Of customs, Import

![Liquor Act [No. 59 of 2003] - Gov](/cache/preview/f/a/e/a/9/4/4/d/thumb-faea944deb2f6b2b8f1e7bc24cf60d5f.jpg)