Search results with tag "Central excise"

OFFICE OF THE CHIEF COMMISSIONER CENTRAL GST AND …

www.cbic.gov.inCommissioner, CGST & Central Excise, 1st Floor, Central Excise Building, Race Course Circle, Vadodara. Ph.No. 265- 2331008 Fax- 0265-2358719 Office of the Commissioner, CGST & Central Excise, HQ, Vadodara - I Commissionerate, CAO , Central GST & Excise Vadodara-I 2 Vadodara-II Ahari Gautam Lal, Assistant Commissioner Vadodara II

Trade Notice No. 01 Central Tax - www.taxguru

taxguru.inOFFICE OF THE CHIEF COMMISSIONER OF CENTRAL EXCISE, MUMBAI ZONE-I NEW CENTRAL EXCISE BLDG, 115, M. K. ROAD, CHURCHGATE, MUMBAI-20 TRADE NOTICE NO.01/2017.Central Tax Subject Jurisdiction of Central Tax Commissionerates, Divisions and Ranges. In exercise of powers under Section 3 read with Section 5 of the Central Goods and …

Explanatory Memorandum to Notification Nos. 02 to 15 ...

www.indiabudget.gov.inExplanatory Memorandum to Notification Nos. 01/2022-Central Excise dated the 1st February, 2022: - S.No. Notification No. Description 1. 01/2022-Central Excise dated 1st February, 2022 Seeks to further amend Notification No. 11/2017-Central Excise, dated 30th June, 2017, to increase Basic Excise Duty on Unblended Petrol and Diesel, in

Steps for Migration of existing Central Excise / Service ...

www.winmansoftware.comStep by Step Guide for GST Enrolment for existing Central Excise / Service Tax Assessees All existing Central Excise and Service Tax assessees will be migrated to GST starting 7th January 2017.

Circular No. 5 /2016 -Customs

worldtradescanner.comCentral Board of Excise & Customs ***** New Delhi, the th9 February 2016 To, All Principal Chief Commissioners Customs All Principal Chief Commissioner of Customs & Central Excise All Chief Commissioners of Customs, All Chief Commissioners of Customs & Central Excise, All Directorate-Generals, Chief Departmental Representative, ...

INDIRECT TAXATION - icmai.in

www.icmai.in2.13 Some Critical Issues in Central Excise 2.35 2.14 Assessable Value under Section 4 2.42 2.15 Value Based on Retail Sale Price 2.43 2.16 MRP Based Valuation 2.44 2.17 Assessment under Central Excise Law 2.56 2.18 Procedural Aspects under Central Excise Duty 2.59 2.19 Refund & Other Important Provisions 2.61

THE CENTRAL EXCISE ACT, 1944 [Act No. 1 of 1944]

centralexciseludhiana.gov.in(c) on the Commissioner of Central Excise, and the Central Excise authorities subordinate to him, in respect of the applicant. (2) The advance ruling referred to in sub-section (1) shall be binding as aforesaid unless there is a change in law

www.excisesurat1.nic.in

www.excisesurat1.nic.inGovernment of India / Ministry of Finance CGST & CENTRAL EXCISE COMMISSIONERATE : SURAT CENTRAL EXCISE BUILDING, CHOWK BAZAR, …

PART-1 The Central Excise Tariff Act, 1985 - vandanaintl.com

www.vandanaintl.comduties of excise shall be levied under the 4 [Central Excise and Salt Act, 1944] (1 of 1944) are specified in 3 [the first Schedule and the Second Schedule]. 3.

Citizen Charter - e-Commerce Portal of Central Board of ...

www.icegate.gov.inThe Central Board of Indirect Taxes and Customs, in the Ministry of Finance, is the apex body for administering the levy and collection of indirect taxes of the Union of India viz. Central Excise duty, Customs duty and Central Goods and Service Tax,IGST, and for facilitating cross border movement of goods & services.

LIST OF ALL CENTRAL GOVERNMENT OFFICES LOCATED AT …

aghr.cag.gov.inChief Commissioner (Min of Finance) Central Excise 2704180, 2701204, 2730488 Commissionerate, Chandigarh-1, Plot No. ccchandi@msn.com-17 C, Chandigarh 19, Sector 46. Sh. Rajinder Prasad, IRS O/o Commissioner of Central Excise & 2716577, Fax 2730488 Commissioner Custom, SCO No. 407-08, Sector-8, PKL ...

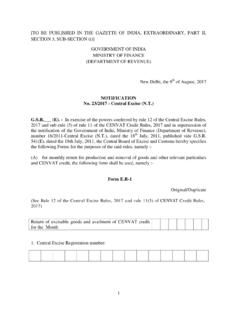

NOTIFICATION No. 23/2017 - Central Excise (N.T.) G.S.R. (E).

www.servicetax.gov.inCentral Excise Act, 1944 NCCD National Calamity Contingent Duty leviable under section 136 of the Finance Act, 2001(as amended) ADE on specified products ADE on specified products as levied under Clause 85 of the Finance Bill, 2005 10. In Tables at serial numbers 3 and 6 the ‘Other duties’ paid/payable, as applicable, may ...

BONDS UNDER CENTRAL EXCISE ACT, 1994 CA Vinay Gandhi

memberfiles.freewebs.comCentral Excise is collected on goods manufactures at the time of removal from factory. The Act derives its authority from entry 84 of Union List (List-I), seventh …

Designation Email id. Phone no. O/o Chief ... - IceGate

www.icegate.gov.inO/o the Chief Commissioner of Central Excise Customs & Service Tax:: Central Excise Building Port Area:: Custom House, Visakhapatnam-530 035. 1. Kshitij Jain DC Kshitij.jain@icegate.gov.in 9010326000 2. B. Jyothi Kiran DC Jyoti.kiran@gov.in 9425010500 3. Dipak Zala AC dipakbhai.zala@icegate.gov.in 9505095863 4.

LIST OF CASE TYPES IN HIGH COURT OF KARNATAKA

karnatakajudiciary.kar.nic.inCEA Central Excise Appeal OS Original Suit ... EXCISE Excise Act KVOA Karnataka Village O fficers Abolition Act LR Land Reforms Act Page : 7 . LIST OF CASE TYPES IN HIGH COURT OF KARNATAKA ----- CASE TYPE CASE DESCRIPTION ...

Government of India Ministry of Finance Department of ...

www.cbic.gov.in(vii) removing the references to Commissioner of Central Excise/ Central Excise officer as the Customs work relating to the EOUs is now handled by the jurisdictional Customs officers. (d) For promoting indigenization and export of electronics, Ministry of Electronics & Information Technology (MeitY) had recommended that the period

Circular No. 1053/02/2017-CX F.No. 96/1/2017-CX ... - EximGuru

www.eximguru.com1.1 Demand: Under the provisions of the Central Excise Act, 1944, demand can be issued when any duty of Central Excise has not been levied or paid or has been short-levied or short-paid or where any duty has been erroneously refunded, for any reason. The demand of duty

Criminal Matters - Matters challenging prosecution under ...

main.sci.gov.inIndirect Taxes Matters - Appeals u/s 35 L of Central Excise and Salt Act, 1944. 106 C.A. No. 10409-10410/2014 III M/S BHARTI AIRTEL LTD. RAHUL JAIN[P-1] Versus THE COMMISSIONER OF CENTRAL EXCISE, PUNE MUKESH KUMAR MARORIA[R-1] K. R. SASIPRABHU[INT] [ LIST THESE APPEAL IN THE FOURTH WEEK OF NOVEMBER ,2021 …

Account Codes in Central Excise (Major Head 0038)

cexhyd1.nic.inSr.No. Description Code 1 Basic Excise Duties 00380003 2 Chemicals 00380006 3 Patent & Proprietary Medicines 00380007 4 Auxiliary Duties of Excise 00380010

INDIRECT AND DIRECT---TTTAXAXAX MANAGEMENT

www.icmai.inCentral Excise Act, 1944(CEA) : The basic Act which provides the constitutional power for charging of duty,valuation, powers of officers, provisions of arrests, penalty, etc. Central Excise Tariff Act, 1985 (CETA) : This classifies the goods under 96 chapters with specific codes assigned.

Arbitration Matters - SLPs challenging Arbitration Matters

main.sci.gov.incommissioner of central excise service tax pune1 b. krishna prasad[p-1] versus m/s matheson k air india pvt. ltd. director arvind gupta[r-1] 104. 2 connected c.a. no. 5654/2021 xvii-a commissioner of cgst and central excise mukesh kumar maroria versus m/s universal dredging and reclamation corporation ltd. ia no. 114755/2021 - ex-parte stay

DEPARTMENT OF Expenditure | MoF |GoI

www.doe.gov.inCentral Excise Act, 1944, the Gold Control Act,1968 and the Finance Act, 1994; and (b) To write off irrecoverable amounts of central excise duty or service tax upto Rs.10 lakhs subject to a report to the next higher authority. (a) Full powers for abandonment of irrecoverable amounts of fines and penalties imposed under the Finance Act, 1994; and

Annex II CENTRAL EXCISE Chapter 1 to 20 - Ieport

www.ieport.comNo.12/2014-Central Excise dated 11th July, 2014, may be referred to for details. These changes will come into effect immediately owing to a declaration under the Provisional Collection of Taxes Act, 1931.

COMPOUNDING OF OFFENCES – A CURSE IN DISGUISE?

www.swamyassociates.comprosecution has already been launched before the filing of the application, as per proviso to Section 32 K (1) of the Act. As per Rule 3 (1) of the Central Excise (Compounding of Offences) Rules, 2005, an

Notification No. 13/2011-Central Excise (N.T.)

servicetaxchennai.gov.in[to be published in the gazette of india, extraordinary, part ii, section 3, sub-section (i)] government of india ministry of finance (department of revenue)

Circular No. 87/06/2019-GST F. No. 267/80/2018-CX.8 ...

www.cbic.gov.inAct, 2018 (No. 31 of 2018) which provides that section 140(1) of the CGST Act, 2017 be amended with retrospective effect to allow transition of CENVAT credit under the existing law viz. Central Excise and Service Tax law, only in respect of “eligible duties”. In this regard, doubts have been expressed as to whether the

Circular No. 37/11/2018-GST F. No.349/47/2017-GST ...

www.rceglobal.comtransitional credit pertains to duties and taxes paid under the existing laws viz., under Central Excise Act, 1944 and Chapter V of the Finance Act, 1994, the same cannot be said to have been availed during the relevant period and thus, cannot be treated as part of ‘Net ITC’. 9.

All about GST TRAN-1

taxguru.in3 Central Excise CGST 4 CVD under Customs Act CGST 5 SAD under Customs Act (not available to service providers) CGST 6 NCCD on inputs CGST Details of statutory forms received under CST Act’1956. (from 01-04-2015 to 30-06-2017) S.No. Type of Form C/F/E/H/I Form No. TIN no. of issuer Name of issuer Form Value Sales Value Rate under VAT 1C 2F

Lesson 5 Customs Law - ICSI

www.icsi.eduCustoms , Central Excise Duties and Service Tax Drawback Rules,1995 Re-Export of Imported Goods (Drawback of Customs Duties) Rules, 1995 Customs Valuation (Determination of Price of Imported Goods) Rules, 2007 Customs Valuation (Determination of Value of Export Goods) Rules, 2007 Customs (Advance Rulings) Rules, 2002

EXPORT RESTRICTIONS DGFT (SCHEDULE 2 OF ITC (HS ...

customsandforeigntrade.com(DoR) Development Commissioner (Handicrafts) / EPCH certifying the goods as artware/ handicrafts. A decision to reject a certificate issued by the Development Commissioner (Handicrafts)/ EPCH should be taken only with approval of the Commissioner of Customs / Central Excise and after discussions with the certificate issuing authority.

THE GAZETTE OF INDIA

www.sezindia.nic.inthis Act but defined in the Central Excise Act, 1944, the Industries (Development and Regulation) Act, 1951, the Income–tax Act, 1961, the Customs Act, 1962 and the Foreign Trade ( Development and Regulation) Act, 1992 shall have the meanings respectively assigned to them in those Acts. 65 of 1951. 43 of 1961. 52 of 1962. 22 of 1992. CHAPTER II

Understanding Goods and Services Tax

cbic-gst.gov.inAssessment, Audit, Anti-evasion & enforcement under CGST & IGST Law Levy & collection of Central Excise duty on products outside GST – Petroleum Products & Tobacco Levy & collection of Customs duties Developing linkages of CBEC - GST System with GSTN Training of officials of both Centre & States

CENTRAL EXCISE ACT - taxmann.com

www.taxmann.comDIVISION ONE CENTRAL EXCISE ACT Central Excise Act, 1944 1.3 DIVISION TWO CENTRAL EXCISE RULES & OTHER RULES Central Excise Rules, 2002 2.3 Central Excise Valuation (Determination of Price of Excisable

central board of excise & customs new delhi - ada.org.in

www.ada.org.inAns. The existing taxation system (VAT & Central Excise) will continue in respect of the above commodities. 6 7 Q 6A. What will be status of Tobacco and Tobacco products under the GST regime? Ans. Tobacco and tobacco products would be subject to ... Act, 2016 provides that every decision of …

centralexcisechennai.gov.in

centralexcisechennai.gov.inoffice of the commissioner of central excise chennai-i commissionerate no. 26/1, mahathma gandhi road, chennai- 600 034. housekeeping" services

centralexcisechennai.gov.in

centralexcisechennai.gov.ingovernment of india ministry of finance department of revenue office of the chief commissioner of central excise:: chennai zone 2¶1, mahatma gandhi road:: chennai - 600 034.

Similar queries

COMMISSIONER CENTRAL, Commissioner, Central excise, Central, Excise, The Central, Existing Central Excise / Service Tax Assessees, Circular, Chief, Chief Commissioner, Under, Valuation, Under Central Excise, THE CENTRAL EXCISE ACT, 1944 [Act, The Central Excise, The Central Excise Tariff Act, 1985, Of Central, Chandigarh, Commissioner of central excise, CENTRAL EXCISE ACT, CASE TYPES IN HIGH COURT OF KARNATAKA, EXCISE Excise Act, Customs, 1944, Auxiliary, INDIRECT AND DIRECT---TTTAXAXAX MANAGEMENT, Annex II CENTRAL EXCISE Chapter 1, COMPOUNDING OF OFFENCES – A CURSE IN DISGUISE, Notification, THE GAZETTE OF INDIA, Audit, CENTRAL EXCISE ACT Central Excise Act

![THE CENTRAL EXCISE ACT, 1944 [Act No. 1 of 1944]](/cache/preview/b/9/e/1/9/f/4/6/thumb-b9e19f46cfce9d1313b2121292b36b8a.jpg)