Search results with tag "Central excise act"

PART-1 The Central Excise Tariff Act, 1985 - chemexcil.in

chemexcil.inSection 3 of the 5[Central Excise Act, 1944] (1 of 1944) ... of 1944)” in any Central Act shall, on and after the commencement of this Act, be construed as a reference to the Schedule to this Act. 25. Power of Central Government to amend First and Second Schedules.

-q fir-fT'O Gl cF - Income Tax Department

www.incometaxindia.gov.indefined in the specified Act, the Central Excise Act,1944, the Customs Act, 1962, the Customs Tariff Act, I 975 or the Finance Act,1994, as the case may be, shall have the meaning respectively assigned to them in that Act. CHAPTER II RELAXATION OF CERTAIN PROVISIONS OF SPECIFIED ACT Relaxation certain of 3.

THE GAZETTE OF INDIA

www.sezindia.nic.inthis Act but defined in the Central Excise Act, 1944, the Industries (Development and Regulation) Act, 1951, the Income–tax Act, 1961, the Customs Act, 1962 and the Foreign Trade ( Development and Regulation) Act, 1992 shall have the meanings respectively assigned to them in those Acts. 65 of 1951. 43 of 1961. 52 of 1962. 22 of 1992. CHAPTER II

DEPARTMENT OF Expenditure | MoF |GoI

www.doe.gov.inCentral Excise Act, 1944, the Gold Control Act,1968 and the Finance Act, 1994; and (b) To write off irrecoverable amounts of central excise duty or service tax upto Rs.10 lakhs subject to a report to the next higher authority. (a) Full powers for abandonment of irrecoverable amounts of fines and penalties imposed under the Finance Act, 1994; and

BONDS UNDER CENTRAL EXCISE ACT, 1994 CA Vinay Gandhi

memberfiles.freewebs.comCentral Excise is collected on goods manufactures at the time of removal from factory. The Act derives its authority from entry 84 of Union List (List-I), seventh …

THE CUSTOMS TARIFF ACT, 1975 - Central Board of Indirect ...

www.cbic.gov.inProvided further that in the case of an article imported into India, where the Central Government has fixed a tariff value for the like article produced or manufactured in India under sub-section (2) of section 3 of the Central Excise Act, 1944 (1 of 1944), the value of the imported article shall be deemed to be such tariff value. Explanation.

INDIRECT AND DIRECT---TTTAXAXAX MANAGEMENT

www.icmai.inCentral Excise Act, 1944(CEA) : The basic Act which provides the constitutional power for charging of duty,valuation, powers of officers, provisions of arrests, penalty, etc. Central Excise Tariff Act, 1985 (CETA) : This classifies the goods under 96 chapters with specific codes assigned.

INDIRECT TAXATION - icmai.in

www.icmai.in(d) Central Excise Audit and Special Audit under 14A and 14AA of Central Excise Act (e) Impact of tax on GATT 94, WTO, Anti Dumping processing (f) Tariff Commission and other Tariff authorities. 3. Customs Laws (a) Basic concepts of Customs Law (b) Types of customs duties, Anti-Dumping Duty, Safeguard Duty

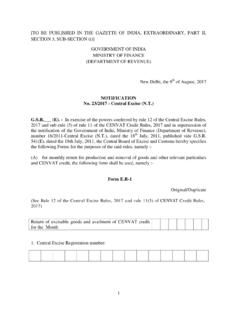

NOTIFICATION No. 23/2017 - Central Excise (N.T.) G.S.R. (E).

www.servicetax.gov.inCentral Excise Act, 1944 NCCD National Calamity Contingent Duty leviable under section 136 of the Finance Act, 2001(as amended) ADE on specified products ADE on specified products as levied under Clause 85 of the Finance Bill, 2005 10. In Tables at serial numbers 3 and 6 the ‘Other duties’ paid/payable, as applicable, may ...

THE CUSTOMS ACT, 1962* ARRANGEMENT OF SECTIONS

www.indiacode.nic.inRate of duty and tariff valuation in respect of goods imported or exported by post or courier. 6 SECTIONS 84. Regulations regarding goods imported or to be exported by post or courier. ... Applications of certain provisions of Central Excise Act. 8 CHAPTER XV APPEALS SECTIONS 128. Appeals to Commissioner (Appeals). 128A. Procedure in appeal ...

Circular No. 37/11/2018-GST F. No.349/47/2017-GST ...

www.rceglobal.comtransitional credit pertains to duties and taxes paid under the existing laws viz., under Central Excise Act, 1944 and Chapter V of the Finance Act, 1994, the same cannot be said to have been availed during the relevant period and thus, cannot be treated as part of ‘Net ITC’. 9.

Circular No. 1053/02/2017-CX F.No. 96/1/2017-CX.I ...

www.eximguru.com2.7 Discussion on Limitation: As per the provisions of Central Excise Act, 1944, the duty which has not been levied or paid or has been short levied or short paid or erroneously refunded can be demanded only within normal period i.e. within two years from the relevant date.

CENTRAL EXCISE ACT - taxmann.com

www.taxmann.comDIVISION ONE CENTRAL EXCISE ACT Central Excise Act, 1944 1.3 DIVISION TWO CENTRAL EXCISE RULES & OTHER RULES Central Excise Rules, 2002 2.3 Central Excise Valuation (Determination of Price of Excisable