Search results with tag "Custom"

Finance (Supplementary) Act, 2022 - Explanation of ...

download1.fbr.gov.pkin the Customs Act, 1969 Few amendments in the Customs Act, 1969 have been made through the Finance (Supplementary) Act, 2022 (Annex-A), which are explained as below:- Power to determine the customs value Under Section 25A of the Customs Act, 1969, both the Collector of Customs and the Director Valuation were authorized to determine the

Bureau of Customs | Department of Finance: Bureau of …

customs.gov.phCustoms Officers authorized to demand evidence of payment of duties and taxes on imported goods openly offered for sale or kept 10 in storage. 3.19. Mission Order (MO) — shall refer to the written directive or order issued by the Commissioner of Customs or other Customs Officer authorized iñ writiñg by thé Commissioner, to carry out specific

The Cooperation Council for - Customs

www.customs.gov.sastages of the customs clearance of the goods, the exemptions and temporary admission of goods, the documents to be produced to customs for the clearance of the goods, and the provisions for the establishment of free zones and duty-free shops and the regulation of the work of the customs brokers (clearing agents),

Subject: Clarification regarding payment of Agriculture ...

www.cbic.gov.inDepartment of Revenue Central Board of Indirect Taxes & Customs (Directorate General of Export Promotion) ***** New Delhi, dated 22 February, 2021 To, All Pr. Chief Commissioners/ Chief Commissioners of Customs/ Customs (Prev.), All Pr. Chief Commissioners/ Chief Commissioners of Central Tax/ Central Excise,

Memorandum D1-8-3, Canada Border Services Agency …

www.cbsa-asfc.gc.cacompletion of the examination must work in the customs brokerage industry to maintain this qualification. The work may be as an individual licensed customs broker, as a partner, a director, the qualified officer or an employee of a licensed customs broker. If there is a …

FARM BUSINESS PLAN WORKSHEET Projected/Actual …

forms.sc.egov.usda.gov6. Ag Program Payments $ Amount 8. Custom Hire Income $ Amount 7. Crop Insurance Proceeds $ Amount 9. Other Income $ Amount. B - EXPENSES $ Amount $ Amount 11. Car and Truck 12. Chemicals 13. Conservation 14. Custom Hire 15. Feed Supplement 16. Feed Grain and Roughage 17. Fertilizers and Lime 18. Freight and Trucking 19. Gas/Fuel/Oil 20 ...

vide number G.S.R. 1303(E), dated the 17 vide No. 53/2021 ...

www.cbic.gov.inof the Customs Tariff Act, 1975 (51 of 1975), read with rules 18 and 23 of the Customs Tariff (Identification, Assessment, and Collection of Anti-dumping Duty on Dumped Articles and for Determination of Injury) Rules, 1995, the Central Government hereby rescinds the notification

C&E Online Payments in ROS or myAccount - Revenue

www.revenue.ieTax and Duty Manual C&E Online Payments in ROS & myAccount 3 2. Select Customs and Excise Taxhead and enter details – remember to use Capital letters where appropriate. The option to pay C&E will not be presented if you are not registered for C&E. 3. From the Customs and Excise Screen, enter the correct year and correct

ACT No. IV OF 1969 - National Board of Revenue

nbr.gov.bdAn Act to consolidate and amend the law relating to customs WHEREAS it is expedient to consolidate and amend the law relating to the levy and collection of customs-duties and to provide for other allied matters; It is hereby enacted as follows: - CHAPTER I PRELIMINARY 1. Short title, extent and commencement.- (1 ) This Act may be called

[TO BE PUBLISHED IN THE GAZETTE OF INDIA, …

www.indiabudget.gov.inIn exercise of the powers conferred by sub-section (1) of section 25 of the Customs Act, 1962 (52 of 1962) and sub-section (12) of section 3 of the Customs Tariff Act, 1975 (51 of 1975), the Central Government, on being satisfied that it is necessary …

Sample US Customs Declaration Form - Immihelp

www.immihelp.comCustoms Declaration 19 CFR 1 22.27, 148.12, 148.13, 148.110,148.111, 14S8i 31 CFR 531 6 FORMAPPROVED Oil,lB NO. 1651-0009 Each arriving traveler or responsible family member must provide the following

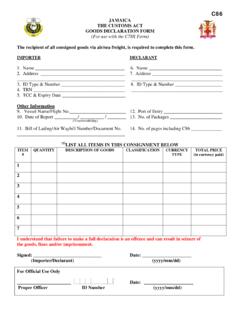

goods declaration form c86 - Jamaica Customs Agency …

www.jacustoms.gov.jmTHE CUSTOMS ACT GOODS DECLARATION FORM (For use with the C78X Form) The recipient of all consigned goods via air/sea freight, is required to complete this form. IMPORTER DECLARANT 1. Name _____ 6. Name _____ 2. Address _____ 7.

Bureau of Customs | Department of Finance: Bureau of Customs

customs.gov.phTo provide policy guidelines for the availment of preferential tariff treatment under the various FTAs or any trade agreement To promote trade facilitation by streamlining the issuance of certificate of origin and proof of origin for preferential and non- preferential tariff treatment consistent with international best practices. Page I of 10

JANUARY 2022

www.insightsonindia.comThere is a limit of ₹200 per transaction and an overall limit of ₹2,000 for all transactions until the balance in the ... Non-tariff measure (NTMs) are defined as policy measures, other than ordinary customs tariffs, that can potentially have an economic effect on international trade in goods, changing quantities traded, or prices or both. ...

Union Budget

www.indiabudget.gov.in36 60) and a standard rate of duty of 5% has been prescribed in the First Schedule of the Customs Tariff Act, 1975. Further, a new dedicated tariff item 0511 91 40 has been . 3 inserted for Artemia cysts in Chapter 5 and a standard rate of duty of 5% has been prescribed. These changes are being made effective from 01.05.2022.

ACT : VALUE-ADDED TAX ACT, NO. 89 OF 1991 (the VAT Act ...

www.sars.gov.zaas required in terms of section 54(3) of the VAT Act.4 G Locally manufactured goods where the excise duty or environmental levy has not been included in the selling price [s 16(3)(a)(iv)] a) SAD 500 Customs Declaration Form. b) DA 75 Ad Valorem Excise Duty Form or DA 616A Environmental Levy for Plastic Bags Form or DA 260 Excise Account Form.

SC-DT-C-13 - Refunds and Drawbacks - External Policy

www.sars.gov.zaunder Schedule 1 Part 1 (ordinary Customs duty) and subsequently to be re-exported in terms of Schedule 5 may not be claimed according to this procedure but must be claimed directly from the SARS Revenue Branch Office on a VAT 201. i) No refund of duty may be granted if a claim for the duty involved has been paid by an insurance company.

User’s Guide - Saltillo

cache.saltillo.com2 for Handle (black), 4 for attaching Amp to Colored Case (silver) The extra hardware could be a potential choking hazard, use with caution. NOVA chat Editor Install CD NovaChat Editor is used for programming from a PC and for backing up custom files. Includes: Galaxy Tab User’s Guide, VocabPC Tour Guide and a copy of this Guide

FINANCE ACT, 2021: IMPLEMENTATION FOR LEGAL …

portal.citn.orgCustoms, Excise Tariffs, Etc. (Consolidation) Act by charging N10 excise duty per litre on non-alcoholic, carbonated and sweetened beverages. Part IV: sections 18-22 FA amended 5 sections of the FIRS (Establishment) Act, namely sections 25, 28, 35, 50, 68. The amendment effected in section 68 of the Act has transformed the FIRS Act to

The Elements of Moral Philosophy

sites.middlebury.educulture. If we assume that everyone shares our values, then we are merely being naïve. 2.2. Cultural Relativism To many people, this observation—“Different cultures have different moral codes”—seems like the key to understanding morality. There are no universal moral truths, they say; the customs of different societies are all that exist.

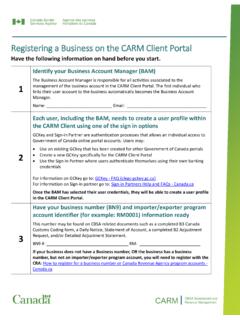

Registering a Business on the CARM Client Portal - CSCB

cscb.caThis number may be found on CBSA related documents such as a completed B3 Canada Customs Coding form, a Daily Notice, Statement of Account, a completed B2 Adjustment ... How to register for a business number or Canada Revenue Agency program accounts - Canada.ca . 2 CARM CBSA Assessment and

JPMorgan Investment Account Agreements and Disclosures …

www.chase.comBrokerage Account Agreement . Investment Advisory Services Account Agreement . ... customs and usages of the exchange or market and its clearinghouse where securities transactions are settled by JPMS, and all applicable laws, rules and regulations of federal and state authorities and self-regulatory agencies including, but not limited to, the

High Speed, Low Noise Video Op Amp Data Sheet AD829

www.analog.comAvailable in tape and reel in accordance with EIA-481A standard . GENERAL DESCRIPTION The "% is a low noise (1.7 nV/√Hz), high speed op amp with capacitor. The AD829 and the transimpedance amplifier are both custom compensation that provides the user with gains of 1 to 20 while maintaining a bandwidth >50 MHz. Its 0.04° differential

ssc.nic.in

ssc.nic.inCentral Board of Direct Taxes/ Central Board of Excise and Customs. National Human Rights Commission, New Delhi. Facilitation Centre, Department of Personnel and Training, North Block, New Delhi. Estt.-B Division, Department of Personnel & Training, North Block, New Delhi. Director General of Re-settlement and Re-employment of Ex-serviceman, RX ...

Budget 2022-23 7 Feb

d19k0hz679a7ts.cloudfront.netIncome Tax Customs Tax 18p Borrowings and Other Liabilities 20p Other Expenditure 6p Pensions Subsidies 6p Defence 17p 4p Union Excise Duties 7 p GST & Other Taxes 18p lop Non-Tax Revenue Non-Debt Capital Receipts lop States' Share of Taxes & Interest Central Duties 8 p Centrally Sponsored Schemes Finance Payments Commission and Sector 18p 20p ...

10.31.2021 HEI Q4 10K

www.heico.comwell as military and business aircraft operators. The FSG also manufactures and sells specialty ... complex composite assemblies for commercial aviation, defense and space applications. Further, ... custom power supply designs, cable assemblies, high voltage power supplies, high voltage interconnection devices and wire, high voltage energy ...

Subject: Revised instruction for stuffing and sealing of ...

www.cbic.gov.inThe jurisdictional Commissioner of Customs shall depute officers to supervise examination, stuffing and sealing of the reefer containers. (iv) T he officers deputed for supervised stuffing would ensure that the reefer containers are stuffed with only such export goods as are sensitive to temperature and in accordance ...

Statutory Maternity Pay (SMP) - GOV.UK

assets.publishing.service.gov.ukOr you can contact HM Revenue & Customs Employer helpline on 0300 200 3200. If you are an employee Your employer has given you this form because you cannot get SMP, or your employer cannot pay you SMP any more. You can find out the reason why in Part D. If you disagree with your employer’s decision not to pay you SMP,

Instructions: Custom Panel for models SCC30, SCC50 and …

scotsmanhomeice.com9. Drill pilot holes for wood screws. Use drill stop to prevent drilling through the panel. 10. Mount panel to door using wood screws or supplied panel mounting screws. Note: When installed Ice machine must be adjusted for height to position top of door to desired clearance. 17-3249-01 by

8® - Customs

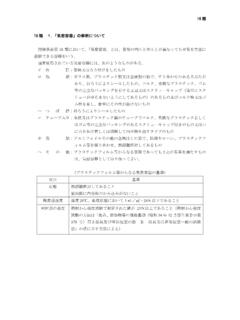

www.customs.go.jp8® 1.フレッシュソーセージ等の畜肉製品等を含め関税率表第1類から第38類までの物品について は、未完成の物品は完成品に属するという考え方はない(関税率表解説の通則2(a)参照。

19 類 類又は 項 1.いった麦等を ... - Customs

www.customs.go.jp19類 19類又は21.01項 1.いった麦等をひきわりにしたものについて. 麦茶等に使われる「いり麦」等については、「穀物調製品(

ARTICLE I GENERAL MOST-FAVOURED-NATION …

www.wto.org1. With respect to customs duties and charges of any kind imposed on or in connection with importation or exportation or imposed on the international transfer of payments for imports or exports, and with respect to the method of levying such duties and charges, and with respect to all rules and formalities in connection with

CN 22 - India Post

www.indiapost.gov.inSystem developed by the World Customs Organization. (5*) Country of origin means the country where the goods originated, e.g. were produced, manufactured or assembled. (6), (7) Give the total value and weight of the item. (8) Your signature and the date confirm your liability for the item. Note. – It is recommended that designated operators ...

Modern Judaism: Issues and Challenges - Province of …

www.edu.gov.mb.carituals, history, culture, and customs; and to begin incorporating Jewish practices into their lives. The length and format of the course of study will vary from congregation to congregation, but most require a course in basic Judaism and individual study with a rabbi, as well as participating in communal rituals, home practice, and synagogue life.

TREAD BOLDLY - Howe & Howe Technologies

www.howeandhowe.comƹ Custom dual rate shocks SYSTEM FUEL CAPACITY 44 gal DRIVE SYSTEM Track (rubber) SYSTEM VOLTAGE 12 volt DC/300 amps CHASSIS CONSTRUCTION Steel chassis RIPSAW F4 DUAL-TRACKED OFF-ROAD VEHICLE TREAD BOLDLY HOWEANDHOWE.COM VEHICLE WEIGHT 10,000 lb TURNING RADIUS 8 ft TOP SPEED 55 mph GROUND CLEARANCE 20 in …

CUSTOMS TARIFF - SCHEDULE

www.cbsa-asfc.gc.ca84 - 1 Issued April 1, 2021 CUSTOMS TARIFF - SCHEDULE Tariff Item SS Description of Goods Unit of Meas. MFN Tariff Applicable Preferential Tariffs 84.01 Nuclear reactors; fuel elements (cartridges), non-irradiated, for nuclear

Similar queries

Customs, Valuation, Of Customs, The Commissioner of Customs, Commissioner, Duty, Department, Excise, Customs brokerage, FARM BUSINESS PLAN WORKSHEET Projected/Actual, Custom, The Customs Tariff Act, The Customs Tariff, ACT No. IV OF 1969, Of customs-duties, Customs Declaration Form, Immihelp, Customs Declaration, DECLARATION FORM, Form, Policy, 2,000, Tariff, First Schedule, Customs Tariff Act, 13 - Refunds and Drawbacks - External Policy, Schedule 1, Ordinary Customs, Schedule, NOVA chat, NovaChat, Culture, Canada Customs, Canada Revenue, Canada, Brokerage, Standard, Union, Commission, Military, Assemblies, Cable assemblies, Commissioner of Customs, Instructions: Custom Panel for models, Drill, GENERAL MOST-FAVOURED-NATION, Customs duties, Duties, Modern Judaism: Issues and Challenges, And customs, CUSTOMS TARIFF - SCHEDULE