Search results with tag "Excise tax"

Form OR-20-S Instructions 2020 Oregon S Corporation Tax

www.oregon.govOregon has two types of corporate taxes: excise and income. Excise tax is the most common. Most corpora-tions don’t qualify for Oregon’s income tax. Excise tax requirements. Excise tax is a tax for the privi - lege of doing business in Oregon. It’s measured by net income. S corporations doing business in Oregon must file a Form OR-20-S to ...

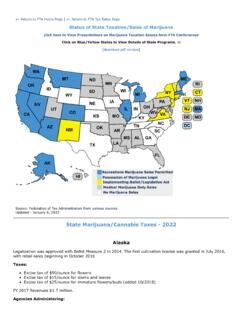

State Marijuana/Cannabis Taxes - 2022 - Tax Admin

www.taxadmin.orgApr 21, 2022 · Excise tax of $50/ounce for flowers Excise tax of $15/ounce for stems and leaves Excise tax of $25/ounce for immature flowers/buds (added 10/2018) FY 2017 Revenues $1.7 million. Agencies Administering: AL. AK AZ AR CA CO CT DE DC FL GA HI ID IL IN IA KS KY LA ME MD MA MI MN MS MO MT NV NE NH NJ NM NY NC ND OH OK OR PA RI SC SD TN TX …

GENERAL INSTRUCTIONS FOR FILING THE GENERAL …

dotax.ehawaii.goveral excise tax your business has to pay during the year. • You must file monthly if you will pay more than $4,000 in general excise tax per year. • You may file quarterly if you will pay $4,000 or less in general excise tax per year. • You may file semiannually if you will pay $2,000 or less in general excise tax …

The Legal Nature Of The Income Tax - Lost Horizons

losthorizons.comTHE INCOME TAX IS AN EXCISE TAX ARISING ONLY UPON THE HAPPENING OF DISTINGUISHED TAXABLE EVENTS The income tax is an excise, and applies only to objects suited to an excise.

MAINE REVENUE SERVICES

www.maine.govGENERAL INSTRUCTIONS The Application for Tax Registration is a combined application. ... • Railroad Excise Tax • Initiator of Deposit ... Trust fund taxes include sales & use taxes, gasoline tax, special fuels tax, recycling assistance fees and income tax withholdi ng. Under Maine law, the owner(s) and person(s) who control the fi nances ...

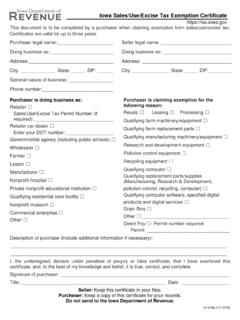

Iowa Sales/Use/Excise Tax Exemption Certificate

eep.ioIowa Sales/Use/Excise Tax Exemption Certificate https://tax.iowa.gov 31-014a (05/21/18) This document is to be completed by a purchaser when claiming exemption from sales/use/excise tax.

California Buyer’s Guide to Tax

www.cdtfa.ca.govHow are electronic cigarettes taxed? Electronic cigarettes and cartridges are subject to . sales and use tax, and, as of April 1, 2017, are subject to the same excise tax imposed on tobacco products other than cigarettes. Are sales of medical cannabis taxable? Yes, sales of medical cannabis are subject to sales tax

Go to www.irs.gov/Form6627 - IRS tax forms

www.irs.govstocks tax on ODCs. If you need more lines for any part of the form, prepare additional sheets using the same format as the part. Attach the additional sheets with Form 6627 to Form 720, Quarterly Federal Excise Tax Return. See Pub. 510, Excise Taxes, for more information on environmental taxes. See the Instructions for Form 720 for information on

2020 Form OR-20 Oregon Corporation Excise Tax …

www.oregon.gov150-102-020-1 (Rev. 10-08-21) 4 2020 Form OR-20 Instructions excise tax laws are in Chapter 317 of the Oregon Revised Statutes. Note: All interest on obligations of the 50 states and their subdivisions are subject to Oregon excise tax.

CHAPTER 237 GENERAL EXCISE TAX LAW - hawaii.gov

files.hawaii.govGENERAL EXCISE TAX LAW CHAPTER 237, Page 1 (Unofficial Compilation) CHAPTER 237 GENERAL EXCISE TAX LAW Definitions;Administration Section 237-1 Definitions

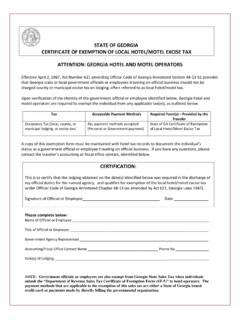

STATE OF GEORGIA CERTIFICATE OF EXEMPTION OF LOCAL …

sao.georgia.govOccupancy Tax (local, county, or municipal lodging, or excise tax) ALL payment methods accepted (Personal or Government payment) State of GA Certificate of Exemption of Local Hotel/Motel Excise Tax . A copy of this exemption form must be maintained with hotel tax records to document the individual’s

Coal Excise Tax - Internal Revenue Service

www.irs.govCOAL EXCISE TAX FOREWORD This Market Segment Specialization Program (MSSP) guide was developed to provide excise tax agents with specific tools to examine issues relating to

Careers at MRS - maine.gov

www.maine.govMAINE TAX ALERT A Publication of Maine Revenue Services for Tax Professionals Volume 31, Issue 25 December 2021 . ... Rulemaking Activity . Rule 210, “Telecommunications Excise Tax.” MRS is proposing to add new Rule 210, which provides an overview of the excise tax levied by the State on telecommunications businesses pursuant to 36 MR.S ...

2021 Form OR-20 Instructions, Oregon Corporation Excise ...

www.oregon.govUse Form OR-20, Oregon Corporation Excise Tax Return, to calculate and report the Oregon corporate excise tax liability of a business entity taxable as a C corporation doing business in Oregon. Important reminders If your registered corporation or insurance company isn’t doing business in Oregon and has no Oregon-

FAE170 - Franchise and Excise Tax Return Instructions

www.tn.gov$100. Franchise tax may be prorated on short period returns , but not below the $100 minimum. Complete the Short Period Return Worksheets and retain them for your records when filing a short period return. The franchise tax may not be prorated on returns covering 52 weeks filed by 52/53 week filers. Schedule B – Computation of Excise Tax

HAWAII ADMINISTRATIVE RULES TITLE 18 …

files.hawaii.govgeneral excise tax law 237- 1 (unofficial compilation) hawaii administrative rules title 18 department of taxation chapter 237 general excise tax law

Article 11: Relating to Taxation – Excise on Motor ...

www.rilin.state.ri.usANALYSIS AND BACKGROUND The motor vehicle excise tax applies to all motor vehicles and trailers, including leased vehicles. There are material differences in tax rates, ratios of assessment, and exemption levels among communities.

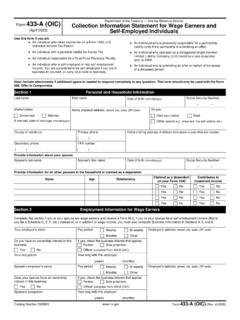

Form 433-A (OIC) (Rev. 4-2021) - IRS tax forms

www.irs.govAn individual who owes income tax on a Form 1040, U.S. Individual Income Tax Return An individual with a personal liability for Excise Tax An individual responsible for a Trust Fund Recovery Penalty An individual who is self-employed or has self-employment income. You are considered to be self-employed if you are in

Quarterly Federal Excise Tax Return - IRS tax forms

www.irs.govForm 720 (Rev. March 2022) Department of the Treasury Internal Revenue Service . Quarterly Federal Excise Tax Return. . See the Instructions for Form 720.

Income Tax Is Voluntary - Truth Sets Us Free

www.truthsetsusfree.comwas, in its nature, an excise, entitled to be enforced as such.” [Brushaber v. Union Pacific Railroad Co. 240 U.S. 1, 16-17 (1916)] An excise tax is not on property, but is on privilegesPrivileges granted by the . government. Before you can be liable for an income tax, you must be exercising a government privilege that is producing income.

Oregon 2016 Corporation Excise Tax Form OR-20 Instructions

www.oregon.gov150-102-020-1 (Rev. 10-16) 1 Form OR-20 Instructions Oregon 2016 Corporation Excise Tax Form OR-20 Instructions Go electronic! Fast • Accurate • Secure File corporate tax returns through the Federal/State e-filing program.

Motor Fuel Taxes - Connecticut General Assembly

www.cga.ct.govThe motor vehicle fuels tax is a per-gallon excise tax that applies to sales of gasoline, gasohol, and diesel, among other fuels. The current fuel tax rate on gasoline and gasohol is 25 cents per gallon, ... Oregon 36.00 38.83 Ohio 38.50 38.51 US Average* 25.64 36.38 North Carolina 36.10 36.35 Maryland 26.70 36.30 Connecticut 25.00 35.75 West ...

CHAPTER 237 GENERAL EXCISE TAX LAW - Hawaii

files.hawaii.govGENERAL EXCISE TAX LAW §237-1 CHAPTER 237, Page 3 (Unofficial Compilation) Law Journals and Reviews Taxes in Hawaii since July 1, 1968: A Report on the Unreported Decisions of Judge Dick Yin Wong, Arthur B. Reinwald, 9 HBJ 95.

Iowa Sales/Use/Excise Tax Exemption Certificate

tax.iowa.govIowa Sales/Use/Excise Tax Exemption Certificate, page 2 . 31-014b (01/10/19) Instructions This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. The seller must retain this certificate as …

National Health Expenditure Projections 2018-2027

www.cms.govanticipated to grow 5.4 percent related to the excise tax on high-cost insurance plans. Key Trends in Projected National Health Expenditures by Sector Prescription Drugs After having grown just 0.4 percent in 2017, prescription drug spending …

www.irs.gov/Form637 for the latest information. Part I

www.irs.govList products subject to federal excise tax you bought for the exclusive use of your organization ... ozone-depleting chemicals (ODCs) for export. 1. List the ODCs you import or manufacture for export. ... List the companies from which you buy ODCs for export. 3. List the number of pounds for each type of ODC you exported in this calendar year ...

Real Estate Customs by State Yes No Customary Standard Fee ...

www.republictitle.comMaine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Real Estate Customs by State First American Title National Commercial Services Yes No ... Excise tax up to 2.78 percent of the sales price plus a $5.00 State Technology fee …

STATE OF GEORGIA CERTIFICATE OF EXEMPTION …

sao.georgia.govSTATE OF GEORGIA CERTIFICATE OF EXEMPTION OF LOCAL HOTEL/MOTEL EXCISE TAX ATTENTION: GEORGIA HOTEL AND MOTEL OPERATORS Effective April 2, 1987, Act Number 621 amending Official Code …

Similar queries

Oregon, Excise, EXCISE TAX, Quarterly, Nature Of The Income Tax, The income tax, MAINE REVENUE SERVICES, GENERAL, Maine law, Cigarettes, IRS tax forms, Oregon excise tax, CHAPTER 237 GENERAL EXCISE TAX LAW, Form, COAL EXCISE TAX, Internal Revenue Service, MAINE TAX, Maine, Franchise and Excise Tax Return, Franchise tax, Return, HAWAII ADMINISTRATIVE RULES TITLE 18, Hawaii administrative rules title 18 department, Article 11: Relating to Taxation, Form 433, Form 720, Federal, Connecticut General Assembly, CHAPTER 237, Ozone, Depleting chemicals