Real Estate Excise Tax Affidavit

Found 5 free book(s)Real Estate Excise Tax Affidavit - Wa

dor.wa.govREAL ESTATE EXCISE TAX AFFIDAVIT CHAPTER 82.45 RCW – CHAPTER 458-61A WAC when stamped by cashier. This form is your receipt THIS AFFIDAVIT WILL NOT BE ACCEPTED UNLESS ALL AREAS ON ALL PAGES ARE FULLY COMPLETED (See back of last page for instructions) Check box if partial sale, indicate % _____sold. List percentage of ownership …

Real Estate Excise Tax Affidavit - Wa

dor.wa.govReal Estate Excise Tax Affidavit (RCW 82.45 WAC 458-61A) Only for sales in a single location code on or after January 1, 2020. This affidavit will not be accepted unless all areas on all pages are fully and accurately completed. This form is your receipt when stamped by cashier. Please type or print. Check box if partial sale, indicate % sold.

Closing Commercial Real Estate Transactions

dougcornelius.comMay 09, 1995 · As with residential transactions, commercial real estate transactions will include a typical quitclaim deed, non-foreign affidavit and title affidavit. However, there will be several other documents included in the transfer package. Unless the commercial property consists of raw land, there will be an assignment and assumption of leases.

Statutes of Limitations - Stewart

www.stewart.comzState Tax Liens TEX. TAX CODE § 13.105: “Tax Lien; Period of Validity (a) The state tax lien on personal property and real estate continues until the taxes secured by the lien areestate continues until the taxes secured by the lien are paid;” BUT-----“Title 2 Taxes” (Sales, Use, Excise, Franchise,

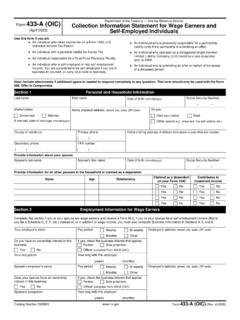

Form 433-A (OIC) (Rev. 4-2021) - IRS tax forms

www.irs.govAn individual who owes income tax on a Form 1040, U.S. Individual Income Tax Return An individual with a personal liability for Excise Tax An individual responsible for a Trust Fund Recovery Penalty An individual who is self-employed or has self-employment income. You are considered to be self-employed if you are in