Use Tax On Repair Of Tangible Personal Property

Found 7 free book(s)Sales and Use Tax on Repair of Tangible Personal Property

floridarevenue.comFlorida Department of Revenue, Sales and Use Tax on Repair of Tangible Personal Property, Page 2 Maintenance or Service Warranty Contracts – A service warranty is “any contract or agreement for the cost of maintaining, repairing, or replacing tangible personal property.”

Sales and use tax exemption certificate for manufacturing ...

dor.wa.gov• places tangible personal property in the container, package, or wrapping in which the tangible personal property is normally sold or transported • is integral to research and development, or • is a repair and replacement part or repair/cleaning labor for eligible items. You cannot use this exemption for: • consumable items

SALES AND USE TAX ON SERVICES - Connecticut General …

www.cga.ct.govDec 15, 2015 · real property, including the voluntary evaluation, prevention, treatment, containment or removal of hazardous waste or air, water, or soil contaminants (CGS § 12-407(a)(37)(I)) Radio and television repair (CGS § 12-407(a)(37)(O)) Repair or maintenance services to tangible personal property and maintenance, repair, or warranty

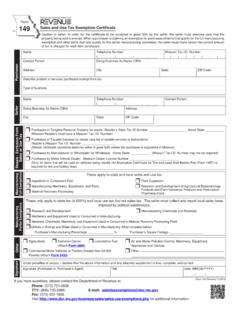

149 - Sales and Use Tax Exemption Certificate

dor.mo.gov• Purchases of Tangible Personal Property for resale: Retailers that are purchasing tangible personal property for resale purposes are exempt. from sales or use tax. The purchaser’s state tax ID number can be found on the Missouri Retail …

Form ST-4, Exempt Use Certificate - LANJ

www.lanj.orgpurchased will be used for an exempt purpose under the Sales & Use Tax Act. The tangible personal property or services will be used for the following exempt purpose: The exemption on the sale of the tangible personal property or services to be used for the above described exempt purpose is provided in subsection N.J.S.A. 54:32B- (See reverse side

INFORMATION FOR CONTRACTORS - Province of Manitoba

www.gov.mb.carepair of real property. • Contractors are required to pay RST on purchases, rentals and leases of equipment ;repairs to equipment and supplies they use in performing ; work on real property. [See page of this bulletin for tax payment on 4 equipment temporarily brought into Manitoba by non-resident contractors].

New York State and Local Sales and Use Tax ST-121 Exempt ...

www.tax.ny.govPage 2 of 4 ST-121 (1/11) Part 2 — Services exempt from tax (exempt from all state and local sales and use taxes) Enter Certificate of Authority number here (if applicable) H. Installing, repairing, maintaining, or servicing qualifying property listed in Part 1, items A through D. Please indicate the type of qualifying property being serviced by marking an X in the applicable box(es):