Search results with tag "Sales tax"

Guidelines for Sales Tax Refund Procedures - Virginia

www.tax.virginia.govwhen the sales tax was remitted to Virginia Tax and to which locality the sales tax was allocated when recovering the amount of sales tax previously reported and remitted to Virginia Tax. Example 6 Customer purchases an item from Dealer for a sales price of $100.00 on July 1, 2017 and pays $5.30 in sales tax for a total of $105.30.

FYI Sales 4 Taxable and Tax Exempt Sales of Food and ...

tax.colorado.govAll state sales tax and, if applicable, state-collected local and RTD/CD, or RTA taxes must be reported and remitted with the Retail Sales Tax Return (DR 0100). Effective March 1, 2010 sales and purchases of nonessential food items and packaging provided with purchased food and beverage items are taxable at the state sales and use tax rate of 2.9%.

GT-800006 Sales and Use Tax on Boats

www.floridasalestax.comFor sales tax purposes, a boat dealer and yacht broker are the same. What is Taxable? All boat sales and deliveries in this state are subject to Florida’s 6 percent sales and use tax, unless exempt. Generally, Florida boat dealers and yacht brokers must collect sales tax from the purchaser at the time of sale or delivery.

Form ST-810 New York State and Local Quarterly Sales and ...

www.tax.ny.govMake check or money order payable to New York State Sales Tax. Write on your check your sales tax identification number, ST-810, and 11/30/21. Penalty and interest are calculated on the amount in box 17, Taxes due. Add Sales and use tax column total (box 14) to Total special taxes (box 15) and subtract Total tax credits, advance

Audit Manual - Indiana

www.in.govindiana dor audit manual 3 what to expect from a sales and use tax audit sales and use tax overview registration and reporting requirements documentation requests sales tax audit procedures use tax audit procedures electronic vs. paper records concluding the audit sales and use tax reference material chapter 9 “general” income tax audits

How to Manage Sales and Purchasing Tax in the US …

help.sap.como Use Tax Account - define the account to be used for the tax amount in purchase documents, when Use Tax is configured. Use tax is a scenario whereby the vendor doesn’t charge you sales tax; however, you still need to pay these taxes. See the Use Tax section for more information.

N-22-1: Suspension of Certain Taxes on Motor Fuel and Diesel …

www.tax.ny.gov(Article 12-A), prepaid sales tax, and state sales and use taxes (Article 28) on motor fuel and highway diesel motor fuel are suspended. The additional state salesposed intax im the Metropolitan Commuter Transportation District (MCTD) is also suspended. Counties and cities can elect a cents-per-gallon or percentage rate sales tax method on fuel.

Business Owner’s Guide for Sales and Use Tax

floridarevenue.comAfter you register as a sales and use tax dealer with the Department, you will receive by mail: • A Certificate of Registration (Form DR-11) • A Florida Annual Resale Certificate for Sales Tax (Form DR-13) • An initial supply of tax returns (sales and use tax Form DR-15 or DR-15EZ) unless you are filing electronically

State and Local Sales Tax Rates, 2021 - Tax Foundation

files.taxfoundation.orgpercent), Washington (9.23 percent), and Alabama (9.22 percent). • No state rates have changed since Utah increased the state-collected share of its sales tax from 5.95 percent to 6.1 percent in April 2019. • Sales tax rates differ by state, but sales tax bases also impact how much

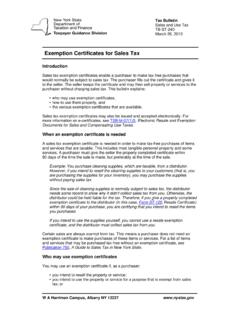

TB-ST-240:(3/10):Exemption Certificates for Sales Tax:tbst240

www.tax.ny.govSales tax exemption certificates enable a purchaser to make tax-free purchases that would normally be subject to sales tax. The purchaser fills out the certificate and gives it to the seller. The seller keeps the certificate and may then sell property or services to the purchaser without charging sales tax. This bulletin explains:

MISSOURI DEPARTMENT OF REVENUE SALES TAX

dor.mo.govForm 126), contact a customer service representative at (573) 751-5860, or send an e-mail to businesstaxregister@dor.mo.gov. A Sales and Use Tax Bond is required for adding sales tax locations to your account if you have not met the one year good pay history requirement. Sign and Date Return: Taxpayer or authorized agent must sign the return.

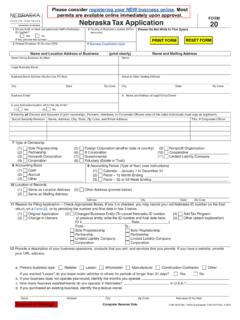

FORM Nebraska Tax Application 20

revenue.nebraska.gova. If a sales tax permit has been applied for, do not check this box since use tax is to be reported on the sales and use tax return. b. Your filing frequency is based on your estimated annual use tax liability: (1) c. $3,000 or more (monthly) (2) c $900 to $2,999 (quarterly) (4) c Less than $900 (annually) 14. Income Tax W ithholding and ...

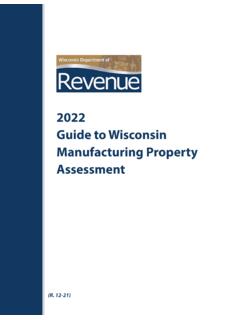

2022 Guide to Wisconsin Manufacturing Property Assessment

www.revenue.wi.govSales and use tax exemption may apply to machinery and equipment used by a business in producing tangible personal property . However, equipment qualifying for sales and use tax exemption, does not automatically qualify for a property tax exemption . Note: Sales tax and manufacturing property tax are administered under different statutes . To ...

Application for Sales Tax Exemption Certificate

www.tax.nd.govAPPLICATION FOR SALES TAX EXEMPTION CERTIFICATE OFFICE OF STATE TAX COMMISSIONER SFN 21919 (6-2021) See the Exempt Organization guideline for more detail about organizatons that qualify for a sales tax exemption on purchase transactions. This application should be filed only by federal, state, local or tribal governments; federal …

UNIFORM SALES & USE TAX …

www.mtc.govAbsent strict compliance with these requirements, Oklahoma holds a seller liable for sales tax due on sales where the claimed exemption is found to be invalid, for whatever reason, unless the Tax Commission determines that purchaser should be pursued for collection of the tax resulting from improper presentation of a certificate. 17.

Contractors and New Jersey Taxes - State

www.state.nj.usSales Tax Rate Change The New Jersey Sales and Use Tax rate becomes 6.625% on January 1, 2018, as a result of legislation that reduced the rate in two phases. The rate was 6.875% between January 1, 2017, and December 31, 2017, in accordance with P.L. 2016, c.57. The Sales Tax rate was 7% in 2016.

Form ST-100 New York State and Local Quarterly Sales and ...

www.tax.ny.govTax. Write on your check your sales tax identification number, ST-100, and 11/30/21. If you are filing this return after the due date and/or not paying the full amount of tax due, STOP! You are not eligible for the vendor collection credit. If you are not eligible, enter 0 in box 18 and go to 7B. Add Sales and use tax column total (box 14) to ...

West Virginia State Tax Department CAPITAL IMPROVEMENT …

tax.wv.govTSD-310 CAPITAL IMPROVEMENT RULE: SALES AND USE TAX FOR CONSTRUCTION TRADES Page 2 of 17 However, if vendors collect less than $250.00 of sales tax each month, the vendor may file a quarterly sales tax return due on the 20th day of the month following the close of each calendar quarter.

hio

tax.ohio.gov23, 2008, Canada) for titling, registration or use, the Ohio sales tax should be collected at six percent (6%) of the price of the vehicle. A sale to a Nonresident who will remove the vehicle purchased to one of the seven states where sales tax must be collected may still qualify for exemption from the sales tax if a valid Ohio exemption exists.

Provincial Sales Tax (PST) Bulletin - British Columbia

www2.gov.bc.cathe Provincial Sales Tax Act. An invoice signed by you and the customer that • lists the goods, • expressly states that the customer is liable for paying PST, and • expressly states that the customer’s PST is payable under section 80, 80.3 or 80.6 of the Provincial Sales Tax Act.

February 2021 S-211 Wisconsin Sales and Use Tax Exemption ...

www.revenue.wi.govComplete this certificate and give it to the seller. Seller: If this certificate is not fully completed, you must charge sales tax. Keep this certificate as part of your records. Wisconsin Sales and Use Tax Exemption Certificate. Do not send this certificate to the Department of Revenue. Form. S-211. S-211 (R. 2-21) This Form May Be Reproduced

UNIFORM SALES & USE TAX …

www.mtc.govAlabama: Each retailer shall be responsible for determining the validity of a purchaser’s claim for exemption. 2. Arizona: This certificate may be used only when making purchases of tangible personal property for resale in the ordinary ... When the applicable tax would be sales tax, it is the seller who owes that tax unless the seller takes a ...

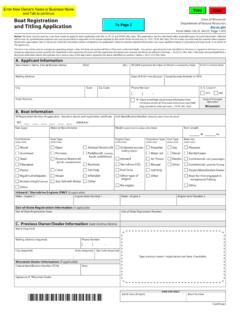

April 2021 Wisconsin Boat Registration and Titling ...

dnr.wi.govWisconsin County Primarily Kept: Tax Exemption. A purchase is not subject to the sales tax if any of the following situations . apply (see instructions for more information). Exemptions are subject to review. If exempt from sales tax, check the box for exemption reason below. 1. Purchase Price Include the amount for boat, motor(s), and accessories.

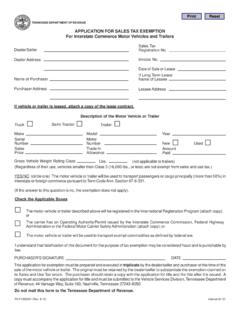

APPLICATION FOR SALES TAX EXEMPTION For Interstate ...

www.tn.govSales Price Model Motor Number Trade-In Allowance Year New Used Amount Paid Gross Vehicle Weight Rating Class Lbs. (Regardless of their use, vehicles smaller than Class 3 (16,000 lbs., or less) are not exempt from sales and use tax.) Check the Applicable Boxes The motor vehicle or trailer described above will be registered in the International ...

Certificate of Exemption - Streamlined Sales and Use Tax ...

www.tax.nd.govCERTIFICATE OF EXEMPTION. OFFICE OF STATE TAX COMMISSIONER. SFN 21999 (4-2020) Do not send this form to the Streamlined Sales Tax Governing Board. Send the completed form to the seller and keep a copy for your records.

Form DTF-806:5/11: Application for Refund or Credit of ...

www.tax.ny.govForm DTF-806:5/11: Application for Refund or Credit of Sales or Use Tax Paid on a Casual Sale of Motor Vehicle, dtf806 Keywords "Application,Refund,Credit,Sales Tax,Use Tax,Casual Sale,Motor Vehicle" Created Date: 8/11/2011 4:55:21 PM

State and Local Sales Tax Rates, 2020 - Tax Foundation

files.taxfoundation.orgThe five states with the highest average local sales tax rates are Alabama (5.22 percent), Louisiana (5.07 percent), Colorado (4.75 percent), New York (4.52 percent), and Oklahoma (4.44 percent). Average local rates rose the most in Illinois, changing the state’s combined ranking from 7th highest to 6th highest. Part of this increase can be ...

Association of Mutual Funds in India

www.amfiindia.comGoods and Services Tax Act (GST), pegged as a major tax reform post-independence, has already been ... of the government machinery. Going forward, there will be no separate sales tax on goods and service tax on services. 2. Who is required to pay GST? ... acronym of Harmonized System of Nomenclature, is an eight digit service/goods specific code.

Steamlined Certificate of Exemption

dor.wa.govStreamlined Sales Tax Agreement Certificate of Exemption (Washington State) Do not send this form to the Streamlined Sales Tax Governing Board. Send the completed form to the seller and keep a copy for your records. This is a multi-state form. Not all states allow all exemptions listed on this form.

Form ST-101 New York State and Local Annual Sales and Use ...

www.tax.ny.govMar 01, 2021 · See Form ST-101-I, Instructions for Form ST-101, page 5. Where to file your return and attachments Web File your return at www.tax.ny.gov (see Highlights in instructions). (If you are not required to Web File, mail your return and attachments to: NYS Sales Tax Processing, PO Box 15169, Albany NY 12212-5169)

Services Subject to Sales Tax in Ohio

sbdcec.com¾Motor vehicle fuel subject to the state motor fuel tax. [5739.02(B)(6)] ¾Motor vehicles and parts used for transporting tangible personal property by persons engaged in high-way transportation for hire. [5739.02(B)(32)] ¾ Emergency and fire-protection vehicles and equipment used by nonprofit organizations in providing

Retailers’ Sales Tax (ST-16) - ksrevenue.gov

ksrevenue.gov(ST-16) Tired of paper and postage? Try our online business center – a secure, convenient, and simple way to manage all of your business tax accounts. Visit . ksrevenue.gov. and sign into the . Customer Service Center KDOR . to get started. GENERAL INFORMATION • the ending • The due date is the 25th day of the month following date of this ...

Business axes for Motor ehicle Transactions

ksrevenue.govKansas dealer sells a new car for $26,000. GM, the company . that manufactured the car, issues a $3,000 rebate check to the . purchaser. The dealer should charge sales tax on the $26,000 with no deduction for the rebate - as the manufacturer’s rebate was paid to the purchaser rather than being assigned to the

MISSOURI DEPARTMENT OF REVENUE MOTOR VEHICLE …

dor.mo.govJACKSON COUNTY (Sni Valley Fire Protection District) JACKSON COUNTY 1.750% 2345 JACKSON COUNTY (Inter City Fire Protection District) JACKSON COUNTY 2.250% 2367. ... PEMISCOT COUNTY PEMISCOT COUNTY 2.500% MISSOURI DEPARTMENT OF REVENUE MOTOR VEHICLE BUREAU LOCAL SALES TAX RATE CHART

Teas Worksheet - Merced College

www.mccd.edu10) bought a new flat screen TV, The sales tax was S2LO,35, the delivery charge was $35. art the interest amounted toS880.32. If she paid SISg down ard makes twertwfour monthly Of What is paving altogether? Jonathon needs to but a 1b whee of cheese into 16 equal portions. How much wileach portion weigh? Sasha Anderson 2012

Sales Tax on Motor Vehicles in Tennessee

www.tn.gov• $1,600 x 2.25% (local sales tax) = $36 • $1,600 x 2.75% (Single Article tax rate) = $44 • Total tax due on the vehicle = $1,851 if purchased in Tennessee • Minus credit for $1,518 FL sales tax paid (must be on bill of sale) • $333 tax still due at time of registration.

Tax Update - Davidson & Company LLP

davidson-co.comresidential rent or certain health care services). SALES TAXES — GST, HST, PST OR QST? There are a number of changes in Canadian sales tax rates this year. The GST (Goods and Services Tax) applies at 5% throughout Canada. However, in the provinces that have “harmonized” with the GST, the HST (Harmonized Sales Tax) applies instead, at a higher

Sales and Use Tax Notice - TN.gov

www.tn.govwithout Paying Tax. If the entity regularly makes sales of merchandise, it must register with the Department to collect and pay sales tax on its sales. In addition to the Tennessee Certificate of Registration, the entity will receive a resale certificate that can be used to make tax-exempt purchases of merchandise that it resells.

Sales and Use Tax on Building Contractors

floridarevenue.comFlorida Annual Resale Certificate for Sales Tax . is used for tax-exempt purchases you intend to resell. Contractors who enter into . retail sale plus installation contracts . and sell materials to the real property owner that are specifically described and itemized in the contract may use their . Florida Annual Resale Certificate for Sales Tax

SALES AND SERVICE TAX (SST) (SALES TAX)

www.mida.gov.mySales Tax (Exemption From Registration) Order 2018 ... The manufacture of batik fabrics using traditional techniques of manual block printing, manual screen printing and, or hand drawing or painting and the articles thereof. 17. The installation of air conditioners in motor vehicles.

SALES TAX FORM ST-3

www.salestaxhandbook.comTax Act with respect to the use of the Resale Certificate, and it is my belief that the seller named herein is not required to collect the sales or use tax on …

Sales Tax Relief for Sellers of Meals

portal.ct.govrequired to provide information about the sales of meals it made during the applicable week. This information will be provided at the time the seller files Form OS-114, Connecticut Sales and Use Tax Return, for the period that includes the applicable week.

Sales Tax Return Form 53-1 - Missouri Department of …

dor.mo.govMissouri Tax I.D. Number – This is an eight digit number issued by the Missouri Department of Revenue to identify your business. If you have not registered with the Department, ... Rate: The rate percentage must include the combined state, conservation, parks and soils, and any applicable local or transportation sales tax rate percentages ...

Similar queries

Guidelines for Sales Tax Refund Procedures, Virginia, Sales tax, Virginia Tax, Sales, Exempt, Sales and Use Tax, Manual, Indiana, Use tax, Sales and use, Florida, Tax returns, State and Local Sales Tax Rates, 2021, Alabama, Exemption Certificates for Sales Tax, Missouri, Form, Bond, Nebraska Tax, Quarterly, APPLICATION FOR SALES TAX, Application, New Jersey, State, New Jersey Sales, York State and Local Quarterly Sales, CONSTRUCTION, Ohio sales tax, Ohio, Provincial Sales Tax (PST) Bulletin, Certificate, Sales and Use Tax Exemption Certificate, Wisconsin, Tax Exemption, Exemption, Motor, Vehicle, Motor vehicle, State and Local Sales Tax Rates, 2020, Goods and Services Tax, Goods, Services, Harmonized, Certificate of Exemption, Exemptions, Form ST, Fuel, Kansas, JACKSON COUNTY, District, COUNTY, Worksheet, Merced College, Motor Vehicles, Tennessee, Harmonized Sales Tax, Tennessee Certificate, Tax Act, Missouri Department, Department, Conservation