Example: quiz answers

Search results with tag "Sales and use tax exemption certificate"

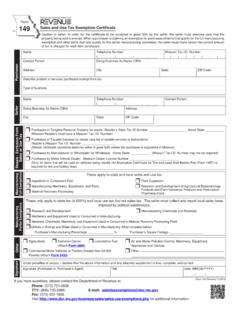

149 - Sales and Use Tax Exemption Certificate

dor.mo.govThese apply to state and local sales and use tax. Full Exemptions. Manufacturing. Partial Exemptions. Other. Seller. Name Telephone Number Contact Person Doing Business As Name (DBA) Address City State ZIP Code These only apply to state tax (4.225%) and local use tax, but not sales tax. The seller must collect and report local sales taxes

February 2021 S-211 Wisconsin Sales and Use Tax Exemption ...

www.revenue.wi.govComplete this certificate and give it to the seller. Seller: If this certificate is not fully completed, you must charge sales tax. Keep this certificate as part of your records. Wisconsin Sales and Use Tax Exemption Certificate. Do not send this certificate to the Department of Revenue. Form. S-211. S-211 (R. 2-21) This Form May Be Reproduced