Search results with tag "Sales and use tax"

New Jersey Sales and Use Tax EZ Telefile System Instructions

www.state.nj.usNew Jersey Sales and Use Tax EZ Telefile System Instructions (Forms ST-50 Quarterly Return and ST-51 Monthly Remittance Statement) Do NOT Use for 3rd Quarter 2006 Rate Change The New Jersey Sales and Use Tax will be reduced in two phases between 2017 and 2018. P.L. 2016, c.57 decreases the Sales and Use Tax rate from 7% to 6.875% on and after …

Audit Manual - Indiana

www.in.govindiana dor audit manual 3 what to expect from a sales and use tax audit sales and use tax overview registration and reporting requirements documentation requests sales tax audit procedures use tax audit procedures electronic vs. paper records concluding the audit sales and use tax reference material chapter 9 “general” income tax audits

Publication 750:(11/15):A Guide to Sales Tax in New York ...

www.tax.ny.gov•filing sales tax returns and remitting any sales tax due in a timely manner as a trustee for the state (see Part 4, Filing your sales tax return), Tax Bulletins . Filing Requirements for Sales and Use Tax Returns (TB-ST-275), E-File Mandate for Businesses . TB-MU-210) and . E-File Mandate for Tax Return Preparers (TB-MU-220);

01-114 Texas Sales and Use Tax Return

comptroller.texas.govLE SALES dollars only) b LE PURCHASES dollars only) b subject tax plus Item 3) b subject to local tax t for city, transit, and SPD must al.) b 7. AMOUNT OF TAX DUE FOR THIS OUTLET (Dollars and cents) (Multiply "Amount subject to tax" by "TAX RATE" for state and local tax due) TAX RATES X 7a.State tax (include in Item 8a) = 7b.Local tax (include ...

Form ST-810 New York State and Local Quarterly Sales and ...

www.tax.ny.govMake check or money order payable to New York State Sales Tax. Write on your check your sales tax identification number, ST-810, and 11/30/21. Penalty and interest are calculated on the amount in box 17, Taxes due. Add Sales and use tax column total (box 14) to Total special taxes (box 15) and subtract Total tax credits, advance

GT-800019 Florida’s Discretionary Sales R. 09/15 Surtax

www.fa.ufl.eduFlorida’s Discretionary Sales Surtax. GT-800019 . R. 09/15 . How it applies to transactions subject to sales and use tax, including sales of motor vehicles, mobile homes, aircraft, and boats. What is Discretionary Sales Surtax? Discretionary sales surtax, also called a county tax, is imposed by most Florida counties and applies

Retailer's Information - State and Local Sales, Use and ...

www.revenue.pa.govreturnable containers are not subject to tax. The 6 percent state Sales Tax is to be collected on every. separate taxable sale in accordance with the tax table on . Page 25 . On taxable sales originating in a city or county that has imposed a local tax, a separate 1 or 2 percent local Sales and Use Tax is imposed. See chart on Page 25. Rates

Guidelines for Sales Tax Refund Procedures - Virginia

www.tax.virginia.govVirginia Retail Sales and Use Tax monthly liability. Dealers are entitled to recover the amount of sales tax refunded or credited to a customer that was previously reported and remitted to Virginia Tax on their Retail Sales and Use Tax Return or their Out-of-State Dealer's Use Tax Return for the month in which the refund or credit is made.

If your organization is RENEWING - Marylandtaxes.gov

www.marylandtaxes.govIf your organization is RENEWING its sales and use tax exemption certificate that expires September 30, 2017 then your organization must apply for the renewal of the sales and use tax exemption certificate. For more information visit www.marylandtaxes.gov This Sales and Use Tax Exemption Certificate Application is for: 1.

Department of Taxation and Finance New York State and ...

www.tax.ny.govTSB-M-18(1)S, Summary of Sales and Use Tax Changes Enacted in the 2018-2019 Budget Bill. Form ST-120, Resale Certificate, is a sales tax exemption certificate. This certificate is only for use by a purchaser who: A – is registered as a New York State sales tax vendor and has a valid Certificate of Authority issued by the Tax Department and is ...

Instructions for Form ST-100 New York State and Local …

www.tax.ny.govexempt from state and local sales and use tax. • City of Ogdensburg – The city of Ogdensburg, in St. Lawrence County, has enacted a local sales and use tax effective March 1, 2022. The rates to charge in the county and city remain the same; this enactment only changes how transactions must be reported on sales and use tax returns.

SOUTH CAROLI NA SALES AND USE TAX MANUAL

dor.sc.govThe purpose of this sales and use tax manual is to provide businesses, Department of Revenue employees, and tax professionals a central summary of information concerning South Carolina’s sales and use tax law and regulations. To that end, the manual references specific authority,

SC Sales and Use Tax Manual - South Carolina

dor.sc.govThe purpose of this sales and use tax manual is to provide businesses, Department of Revenue employees and tax professionals a central summary of information concerning South Carolina’s sales and use tax law and regulations. To that end, the manual references specific authority,

Business Owner’s Guide for Sales and Use Tax

floridarevenue.comAfter you register as a sales and use tax dealer with the Department, you will receive by mail: • A Certificate of Registration (Form DR-11) • A Florida Annual Resale Certificate for Sales Tax (Form DR-13) • An initial supply of tax returns (sales and use tax Form DR-15 or DR-15EZ) unless you are filing electronically

2022 Guide to Wisconsin Manufacturing Property Assessment

www.revenue.wi.govSales and use tax exemption may apply to machinery and equipment used by a business in producing tangible personal property . However, equipment qualifying for sales and use tax exemption, does not automatically qualify for a property tax exemption . Note: Sales tax and manufacturing property tax are administered under different statutes . To ...

ABR, Application for Business Registration

www.revenue.state.mn.usapplicable local taxes. If you make business purchases subject to use tax, you must register for use tax filing. Sales and use tax returns are filed electronically, either over the internet or by telephone. month day year Taxable State tax sales of rate Average $7,273 x 6.875% ≅ $500 tax $1,455 x 6.875% ≅ $100 tax

GT-800006 Sales and Use Tax on Boats

www.floridasalestax.comA floating rate of interest applies to underpayments and late payments of tax. We update the rate January 1 and July 1 of each year by using the formula established in s. 213.235, F.S. ... Sales and Use Tax on Boats – Information for Dealers and Brokers, ... • Facts on Tax, a quarterly publication. • Proposed rules, notices of rule ...

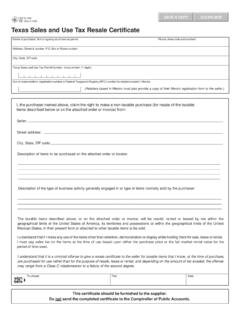

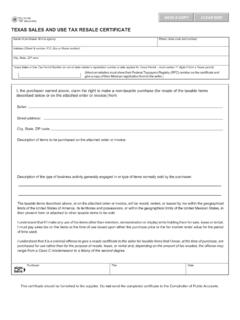

01-339 Sales and Use Tax Resale Certificate / Exemption ...

comptroller.texas.govTexas Sales and Use Tax Resale Certificate . Name of purchaser, firm or agency as shown on permit Phone (Area code and number) Address (Street & number, P.O. Box or Route number) City, State, ZIP code Texas Sales and Use Tax Permit Number (must contain 11 digits)

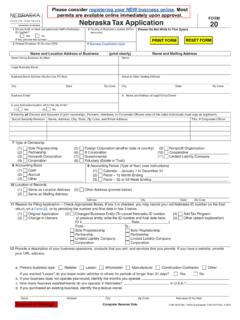

FORM Nebraska Tax Application 20

revenue.nebraska.gova. If a sales tax permit has been applied for, do not check this box since use tax is to be reported on the sales and use tax return. b. Your filing frequency is based on your estimated annual use tax liability: (1) c. $3,000 or more (monthly) (2) c $900 to $2,999 (quarterly) (4) c Less than $900 (annually) 14. Income Tax W ithholding and ...

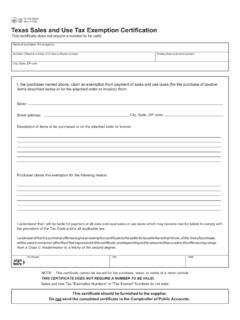

01-339 Sales and Use Tax Resale Certificate / Exemption ...

gov.texas.govTexas Sales and Use Tax Exemption Certification This certificate does not require a number to be valid. Name of purchaser, firm or agency Address (Street & number, P.O. Box or Route number) Phone (Area code and number) City, State, ZIP code I, the purchaser named above, claim an exemption from payment of sales and use taxes (for the purchase of ...

01-339 Sales and Use Tax Resale Certificate

gato-docs.its.txstate.edu01-339 (Rev.6-04/5) TEXAS SALES AND USE TAX RESALE CERTIFICATE Name of purchaser, firm or agency Phone (Area code and number) Address (Street & number, P.O. Box or Route number) City, State, ZIP code Texas Sales or Use Tax Permit Number (or out-of-state retailer's registration number or date applied for Texas Permit – must contain 11 digits if from a Texas …

Form ST-12 Commonwealth of Virginia Sales and Use Tax ...

www.tax.virginia.govI certify I am authorized to sign this Certificate of Exemption and that, to the best of my knowledge and belief, it is true and correct, made in good faith, pursuant to the Virginia Retail Sales and Use Tax Act. By: _____f _____ Signature. Title. Information for dealer:

February 2021 S-211 Wisconsin Sales and Use Tax Exemption ...

www.revenue.wi.govComplete this certificate and give it to the seller. Seller: If this certificate is not fully completed, you must charge sales tax. Keep this certificate as part of your records. Wisconsin Sales and Use Tax Exemption Certificate. Do not send this certificate to the Department of Revenue. Form. S-211. S-211 (R. 2-21) This Form May Be Reproduced

January 2021 S-114TEL Instructions for Wisconsin TeleFile ...

www.revenue.wi.govInstructions for Wisconsin TeleFile – Sales and Use Tax Return. Use these instructions when you file your Wisconsin Sales and Use Tax return by phone. For detailed return instructions, see Form S-114. Instructions for lines 1 through 29. Line 1. Enter total sales. If you have no sales to report, enter “0” . Lines 2 – 8

Form ST-9, Virginia Retail Sales and Use Tax

www.tax.virginia.govApr 09, 2021 · ST-9 6210051 Rev 02/21 Form ST-9 Virginia Retail Sales and Use Tax Return For Periods Beginning On and After April 1, 2021 All Form ST-9 filers are required to file and pay electronically at www.tax.virginia.gov. See ST-9A Worksheet for return completion instructions.

UNIFORM SALES & USE TAX …

www.mtc.govIts use is limited to use as a resale certificate subject to the provisions of Title 18, California Code of Regulations, Section 1668 (Sales and Use Tax Regulation 1668, Resale Certificate). B. By use of this certificate, the purchaser certifies that …

Motor Fuel Taxes - Connecticut General Assembly

www.cga.ct.govfuels sold for use in motor vehicles are exempt from the sales and use tax (CGS § 12-412(15)). The motor vehicle fuels tax is a per-gallon excise tax that applies to sales of gasoline, gasohol, and ... Wisconsin 30.90 32.90 Montana 32.00 32.75 Georgia 27.90 32.20 Utah 31.10 31.11 Iowa 30.50 30.50 Vermont 12.10 30.17 Maine 30.00 30.01 ...

Streamlined Sales and Use Tax Agreement Certificate of ...

www.sai.ok.govStreamlined Sales and Use Tax Agreement Certificate of Exemption . This is a multi-state form. Not all states allow all exemptions listed on this form. Purchasers are responsible for knowing if they qualify to claim exemption from tax in the state that would otherwise be due tax on this sale. The seller may be required to provide this exemption

Exemption Certificates Pub. KS-1520 Rev. 11-15

ksrevenue.govRevenue’s basic sales tax publication, KS-1510, Kansas Sales and Compensating Use Tax. As a registered retailer or consumer, you will receive updates from the Kansas Department of Revenue when changes are made in the laws governing sales and use tax exemptions. Keep these notices with this booklet for future reference. You may also obtain the

CDTFA-101, Claim for Refund or Credit - California

www.cdtfa.ca.govPlease select the tax or fee program that applies to your claim for refund or credit. Sales and Use Tax . Lumber Assessment . Prepaid Mobile Telephony Services (MTS) Surcharge For overpayments of use tax by a purchaser of a vehicle or undocumented vessel to the CDTFA-101-DMV, Claim for Refund or Credit for Tax Paid to DMV. For the above tax/fee ...

West Virginia State Tax Department CAPITAL IMPROVEMENT …

tax.wv.govTSD-310 CAPITAL IMPROVEMENT RULE: SALES AND USE TAX FOR CONSTRUCTION TRADES Page 2 of 17 However, if vendors collect less than $250.00 of sales tax each month, the vendor may file a quarterly sales tax return due on the 20th day of the month following the close of each calendar quarter.

Certificate of Exemption - Streamlined Sales and Use Tax ...

www.tax.nd.govCERTIFICATE OF EXEMPTION. OFFICE OF STATE TAX COMMISSIONER. SFN 21999 (4-2020) Do not send this form to the Streamlined Sales Tax Governing Board. Send the completed form to the seller and keep a copy for your records.

Exemption Certificate - dor.sd.gov

dor.sd.govStreamlined Sales and Use Tax Agreement. The seller is relieved of the responsibility for collecting and remitting sales tax on the sale or sales for which the purchaser provided an exemption certificate if ALL of the following conditions are met: 1. All fields on the exemption certificate are completed by the purchaser. 2.

TENNESSEE DEPARTMENT OF REVENUE Application for …

www.tn.govTenn. Code Ann. §§ 67-6-102 and 67-6-206 provide sales and use tax exemptions for industrial machinery and reduced rates for water and energy fuel for qualified manufacturers or …

Detailed Instructions for Application for Texas Title and ...

content.govdelivery.comFeb 17, 2022 · Sales and use tax must be paid. Indicate the vehicle sales price in second space provided on Line (a). Rebates are only applicable for new vehicles sold by a dealership to a retail purchaser. (f) provides for a late tax payment penalty of 5% or 10% of the amount in (e). Check the appropriate box if you are a . new resident . to Texas, obtained ...

UNIFORM SALES & USE TAX …

www.mtc.gov6. District of Columbia: This certificate is not valid as an exemption certificate. It is not valid as a resale certificate unless it contains the purchaser’s D.C. sales and use tax registration number. 7. Florida: The Department of Revenue no longer accepts out-of …

Employer Account Change Form RTS-3 R. 06/21

floridarevenue.comFlorida Business Tax Application (DR-1). RTS-3 R. 06/21 . Rule 73B-10.037, F.A.C. Effective 07/21. ... Sales and Use Tax. Business Location Address Mailing Address. RT Benefit/Claims Notice Employer's Quarterly Report. RT Tax Rate Notice New Address Information: (name of business or individual) Mailing Address: City/State/ZIP: Fax Number:

VSA 12 (11/10/2020) AFFIDAVIT IN LIEU OF TITLE ... - Virginia

www.dmv.virginia.govsales and use tax, available original documents evidencing ownership and other supporting affidavits. 4. Insurance companies must submit a $25.00 processing fee in addition to the fees associated with the forms listed above. Page 2 AFFIDAVIT VERIFICATION As a sworn law enforcement officer with the VA DMV Law Enforcement Division, I verify that I

E-595E - NC

files.nc.govStreamlined Sales and Use Tax Agreement Certificate of Exemption: Multistate Supplemental Name of purchaser State Reason for exemption Identification number (if required) AR GA IA IN KS KY MI MN NC ND NE NJ NV OH OK RI SD TN* UT VT WA WI WV WY *SSUTA Direct Mail provisions are not in effect for Tennessee. 2 Page 2 E-595E Web-Fill 6-19

Sales and Use Tax on Aircraft - Florida Department of Revenue

floridarevenue.comSales and Use Tax All aircraft sold, delivered, used, or stored in Florida are subject to Florida’s sales and use tax, plus any applicable discretionary sales surtax, unless exempt. Florida aircraft dealers and brokers are required to collect tax from the purchaser at the time of sale or delivery.

Sales and Use Tax on Motor Vehicles - floridarevenue.com

floridarevenue.comFlorida Department of Revenue, Sales and Use Tax on Motor Vehicles, Page 1 . GT-800030 . R. 12/17 . Sales and Use Tax . on Motor Vehicles. Definitions Motor vehicle – An automobile, motorcycle, truck, trailer, semi-trailer, truck tractor and semi-trailer combination, or any other vehicle operated on the roads of Florida used to transport ...

Sales and Use Tax on Building Contractors

floridarevenue.comFlorida Annual Resale Certificate for Sales Tax . is used for tax-exempt purchases you intend to resell. Contractors who enter into . retail sale plus installation contracts . and sell materials to the real property owner that are specifically described and itemized in the contract may use their . Florida Annual Resale Certificate for Sales Tax

Sales and Use Tax on Repair of Tangible Personal Property

floridarevenue.comFlorida’s Sales and Use Tax (GT-800013) • Florida’s Discretionary Sales Surtax (GT-800019) • Florida Annual Resale Certificate for Sales Tax (GT-800060) Information, forms, and tutorials …

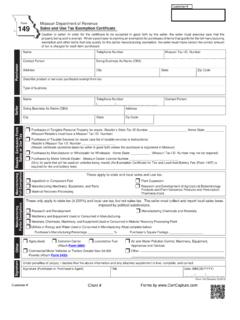

Sales and Use Tax Exemption Certificate Form 149

www.salestaxhandbook.comAddress City State Zip Code Describe product or services purchased exempt from tax Type of business Form 149 Missouri Department of Revenue Sales and Use Tax Exemption Certificate Purchaser Caution to seller: In order for the certificate to be accepted in good faith by the seller, the seller must exercise care that the property being sold is ...

Sales Tax Relief for Sellers of Meals

portal.ct.govrequired to provide information about the sales of meals it made during the applicable week. This information will be provided at the time the seller files Form OS-114, Connecticut Sales and Use Tax Return, for the period that includes the applicable week.

Similar queries

Sales and Use Tax EZ Telefile System Instructions, Sales and Use Tax, Manual, Indiana, Sales Tax, USE TAX, New York, Sales, Boats, Retailer's Information, Guidelines for Sales Tax Refund Procedures, Virginia, Virginia Tax, If your organization is RENEWING, Resale certificate, Certificate, Information, Florida, Tax returns, ABR, Application for Business Registration, Tax sales, Update, Quarterly, Sales and Use Tax Resale Certificate, State, Nebraska Tax, Sales and use, 12 Commonwealth of Virginia Sales and Use Tax, Certificate of Exemption, Sales and Use Tax Exemption Certificate, Instructions for Wisconsin TeleFile, Instructions for Wisconsin TeleFile – Sales and Use Tax, Instructions, Connecticut General Assembly, Wisconsin, Exemption Certificates, CONSTRUCTION, Exemption certificate, Tennessee, Texas, RTS-3 R, Sales and Use Tax on Repair of Tangible Personal Property