Search results with tag "Tax exemption"

2022 Guide to Wisconsin Manufacturing Property Assessment

www.revenue.wi.gov2. Sales tax exemption Sales and use tax exemption may apply to machinery and equipment used by a business in producing tangible personal property . However, equipment qualifying for sales and use tax exemption, does not automatically qualify for a property tax exemption . Note: Sales tax and manufacturing property tax are administered under ...

SALES TAX EXEMPTION CLAIM GUIDELINES

www.costcobusinessdelivery.comMay 30, 2017 · SALES TAX EXEMPTION CLAIM GUIDELINES Thank you for e-mailing Costco.com. This is in response to your question about using your tax exemption status for purchases on our web site. Currently, Costco.com does not offer sales tax exemption at the point of sale. Our Tax Department will consider your exemption after your order has been …

149 - Sales and Use Tax Exemption Certificate

dor.mo.govThese apply to state and local sales and use tax. Full Exemptions. Manufacturing. Partial Exemptions. Other. Seller. Name Telephone Number Contact Person Doing Business As Name (DBA) Address City State ZIP Code These only apply to state tax (4.225%) and local use tax, but not sales tax. The seller must collect and report local sales taxes

Out-of-State Sales & New Jersey Sales Tax

www.state.nj.us• Uniform Sales & Use Tax Certificate – Multijurisdiction published by the Multistate Tax Commission • Resale Certificate for Non‑New Jersey Sellers (Form ST-3NR) • Streamlined Sales and Use Tax Certificate of Exemption (Form ST-SST) For more information see Tax Topic Bulletin S&U-6, Sales Tax Exemption Administration.

Sales Tax Exemption Administration

www.nj.govqualified individuals and businesses to purchase taxable merchandiseand services tax -free. Each exemption certificate has its own specific use. In addition, New Jersey sellers and purchasers may accept and issue the Streamlined Sales and Use Tax Certificate of Exemption (ST-SST) in lieu of the exemption certificates issued by the Division.

How to Add the Tax Exemption Status to Your Amazon …

questrompublish.bu.eduprompted to answer questions or upload documents specific to the sales tax exemption for wh ch you qualify'. If you need help With the prcu:ess, use the Contact Us link to get In touch With us for assistance. Please allow 15 minutes for tax exemption certificates created Via the Amazon Tax Exemption Tool to be active. Certificates uploaded may ...

GUIDELINES ON MSC MALAYSIA FINANCIAL INCENTIVES …

mdec.myJan 01, 2019 · 3.1 The tax exemption is granted under Income Tax (Exemption) (No. 10) Order 2018 [P.U.(A) 389/2018]. 3.2 Applications for the award of MSC Malaysia Status and the tax exemption are to be submitted together in one application to MDEC. 3.3 Each application for the award of MSC Malaysia Status and the tax exemption will be

01-925 Texas Timber Operations Sales and Use Tax …

comptroller.texas.govYou cannot use this form to claim exemption from motor vehicle tax when buying motor vehicles, including trailers. To claim motor . vehicle tax exemption, you must give a properly completed Texas Motor Vehicle Tax Exemption Certificate for Agricultural and Timber Operations (Form 14-319) to the vehicle’s seller or dealer.

Hong Kong Tax Guide 2020 - Deloitte

www2.deloitte.comProfits tax exemption . Hong Kong Tax Guide 2020 7 Losses - Tax losses may be carried forward indefinitely and offset against future taxable profits of the same taxpayer. Specific anti-avoidance legislation prevents the purchase of a loss company for the sole ... extension” scheme. Hong Kong does not allow the filing of consolidated returns ...

Documentary Stamp Tax Exemptions - Nebraska

revenue.nebraska.govDocumentary Stamp Tax Exemptions Pursuant to Neb. Rev. Stat. § 76-901 , the grantor transferring beneficial interest in or legal title to real property is taxed at the rate of $2.25 for each $1,000 value or fraction thereof. • This tax is known as the Documentary Stamp Tax and is based upon the value of the real property being

01-924 Texas Agricultural Sales and Use Tax Exemption ...

comptroller.texas.govvehicle tax exemption, you must give a properly completed Texas Motor Vehicle Tax Exemption Certificate for Agricultural and Timber Operations (Form 14-319) to the vehicle’s seller or dealer. You must also claim the exemption on the Application for Texas Title (Form

Manufacturing and Research - California

www.cdtfa.ca.govA partial sales and use tax exemption allows certain manufacturers, researchers and developers to pay a lower sales or use tax rate on qualifying equipment purchases and leases. PARTIAL TAX EXEMPTION LAW CHANGES. Beginning January 1, 2018, the partial tax exemption law changed to include: - Specified electric power generation or distribution

Guidelines for Sales Tax Refund Procedures

www.tax.virginia.govGuidelines for Retail Sales and Use Tax Refund Claim Procedures A-2 The majority of Virginia Retail Sales and Use Tax exemption certificates are “self-executed” or “self-issued” by the taxpayer. Currently, Virginia Tax only issues exemption certificates to

Consumers Certificate of Exemption Sales Tax Exemption ...

www.fa.ufl.edupayment of the sales tax plus a penalty of 200% of the tax, and may be subject to conviction of a third-degree felony. Any violation will require the revocation of this certificate. 6. If you have questions about your exemption certificate, please call Taxpayer Services at 850-488-6800. The mailing address is PO Box 6480, Tallahassee, FL 32314 ...

01-339 Sales and Use Tax Resale Certificate / Exemption ...

comptroller.texas.govTexas Sales and Use Tax Exemption Certification . This certificate does not require a number to be valid. Name of purchaser, firm or agency Address (Street & number, P.O. Box or Route number) Phone (Area code and number) City, State, ZIP code. I, the purchaser named above, claim an exemption from payment of sales and use taxes (for the purchase ...

General Excise Tax (GET) - State of Hawaii Department of ...

ag.hawaii.govtax-exempt status. As a result, we do not issue tax exemption certificates to tax-exempt organizations, government agencies, or credit unions to exempt their purchases from Hawaii businesses. Many nonprofit and religious organizations like universities and churches are exempt from federal and state income taxes, but

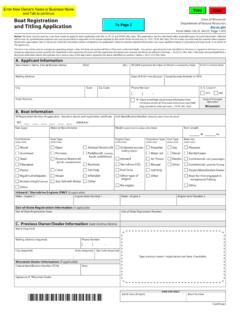

April 2021 Wisconsin Boat Registration and Titling ...

dnr.wi.govWisconsin County Primarily Kept: Tax Exemption. A purchase is not subject to the sales tax if any of the following situations . apply (see instructions for more information). Exemptions are subject to review. If exempt from sales tax, check the box for exemption reason below. 1. Purchase Price Include the amount for boat, motor(s), and accessories.

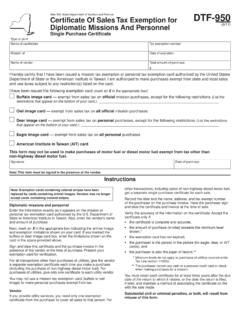

Form DTF-950:9/11: Certificate of Sales Tax Exemption for ...

www.tax.ny.govYou may not use a mission tax exemption card (buffalo or owl image) to make personal purchases exempt from tax. Vendor If you provide utility services, you need only one exemption certificate from the purchaser to cover all sales to that person. For other transactions, including sales of non-highway diesel motor fuel,

WISCONSIN SALES AND USE TAX EXEMPTION CERTIFICATE

dpi.wi.govthe direct pay exemption, if the purchaser checks the “other purchases exempt by law” line and enters all the required direct pay information.) Under the sales and use tax law, all receipts from sales of tangible personal property or taxable services are subject to the tax until the contrary is established. However,

GEORGIA AGRICULTURAL TAX EXEMPTION (GATE) …

forms.agr.georgia.govThe Georgia Agricultural Tax Exemption program (GATE) is an agricultural sales and use tax exemption certificate issued by the Georgia Department of Agriculture (GDA) that identifies its user as a qualified farmer or agricultural producer.

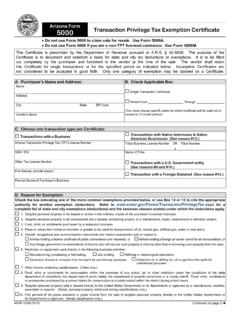

Form 5000 - Transaction Privilege Tax Exemption Certificate

2009-2017.state.govNOTE: Limited to authorization on the U.S. Department of State Diplomatic Tax Exemption Card. The vendor shall retain a copy of the U.S. Department of State Diplomatic Tax Exemption Card and any other documentation issued by the U.S. Department of State. Motor vehicle purchases or leases must be pre-authorized by the Office of Foreign Missions ...

February 2021 S-211 Wisconsin Sales and Use Tax Exemption ...

www.revenue.wi.govComplete this certificate and give it to the seller. Seller: If this certificate is not fully completed, you must charge sales tax. Keep this certificate as part of your records. Wisconsin Sales and Use Tax Exemption Certificate. Do not send this certificate to the Department of Revenue. Form. S-211. S-211 (R. 2-21) This Form May Be Reproduced

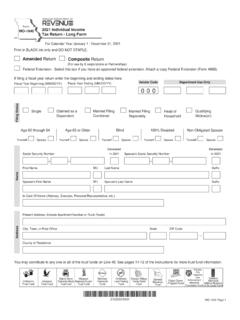

MO-1040A 2021 Individual Income Tax Return Single/Married ...

dor.mo.govElderly Home. Delivered Meals. 00. ... horized aliens as defined under federal law and that I am not eligible for any tax exemption, credit, or abatement if I employ such unaut aliens. Refund (continued) ... Worksheet for Net State Income tax, Line 9 of Missouri Itemized Deductions. 00. 00. 2. State and local income taxes from Federal Form 1040 ...

PHILIPPINE TAX CALENDAR

ahcaccounting.com• Submission of notarized sworn declaration of gross receipts/sales with COR by income recipients, availing of lower EWT rate or tax exemption, to withholding agents. • Submission of notarized sworn declaration of new income recipients, availing of lower EWT rate or tax exemption, by withholding agents to the BIR for December 2020.

50-759 Application for Property Tax Exemption

comptroller.texas.govThis application is for use in claiming a property tax exemption for one motor vehicle used for both the production of income and personal non-income producing activities pursuant to Tax Code Section 11.254. Motor vehicle means a passenger car or light truck as defined by Transportation Code Section 502.001.

1350 STATE OF SOUTH CAROLINA DEPARTMENT OF …

dor.sc.govB(3) - Vehicle exemption for Disabled Veterans A veteran who is totally and permanently disabled from a service-connected disability may apply for a Property Tax exemption for two private passenger vehicles they own or lease. To qualify for the exemption, the vehicle must be registered solely in the name of the veteran, or jointly with a spouse.

Form RP-487:2/20:Application for Tax Exemption of Wind …

www.tax.ny.govEmail address Tax map number of section/block/lot: Property identification (see tax bill or assessment roll) Written description (attach additional sheet(s) if necessary): 2 Is the energy system installed on property owned or controlled by New York State, a department or

2021 Form OR-41 Instructions, Fiduciary Income Tax, 150 ...

www.oregon.govfor National and Community Service in 2021, you may sub - ... tion to claim the tax credit by purchasing bonds if the bond proceeds are used to finance the purchase of affordable ... • IRC Section 529 tax exemption for earnings on college savings plan …

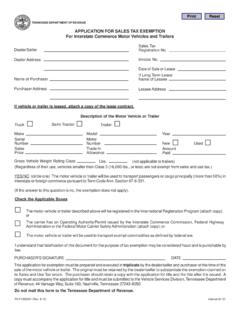

APPLICATION FOR SALES TAX EXEMPTION For Interstate ...

www.tn.govAdministration or the Federal Motor Carrier Safety Administration (attach copy); or The motor vehicle or trailer will be used to transport exempt commodities as defined by federal law. I understand that falsification of this document for the purpose of tax exemption may be considered fraud and is punishable by law.

Pub 610 - Use Tax

azdor.gov30. A use tax exemption is allowed for prepared food, drink or condiment donated by a restaurant to a nonprofit charitable I.R.C. 501(c)(3) organization that regularly serves meals to the needy and indigent on a continuing basis at no cost. 31. Other exemptions as provided by Arizona Revised Statutes, Section 42-5159. For Additional Information ...

Georgia Department of Agriculture (GDA) Frequently …

forms.agr.georgia.govreturned to the to you. Any denial may be appealed to the Georgia Agriculture Tax Exemption Advisory Board in writing within 30 days of denial. Appeals should be sent to the Georgia Agriculture Tax Exemption Program at 19 Martin Luther King …

Claim for Property Tax Exemption of Veteran or Surviving ...

www.state.nj.usdisabled veterans, or their surviving spouses no longer need to serve during a specific war period or other emergency to receive the property tax exemption. This Act amends P.L. 1948, c. 259, and supplements chapter 4 of Title 54 of the Revised Statutes.

PROPERTY TAX BENEFITS FOR PERSONS 65 OR OLDER

floridarevenue.comCertain property tax benefits are available to persons 65 or older in Florida. Eligibility for property tax exemptions depends on certain requirements. Information is available from the property appraiser’s office in the county where the applicant owns a homestead or other property. Available Benefits. A board of county commissioners or the ...

Nebraska Resale or Exempt Sale Certificate FORM for Sales ...

revenue.nebraska.govTax Exemption Chart. 3. Purchases made by organizations that have been issued a Nebraska Exempt Organization Certificate of Exemption (Certificate of Exemption). Reg-1-090, Nonprofit Organizations; Reg-1-091, Religious Organizations; and Reg-1-092, Educational Institutions, identify these organizations.

FACTORS CAUSING INEFFICIENCY ON TAX REVENUE …

repository.out.ac.tzrevenue available in Tanzania, Investigate the major problems/obstacles hinders ... misuse of tax exemptions extended to business communities and excessively used by tax ... governments have stronger incentives to promote economic growth since they are . revenue collection? ’. Revenue . university .

Sales and Use Tax Exemption Certificate

libertyhardwoodsinc.comSelect the appropriate box for the type of exemption to be claimed and complete any additional information requested. • Purchases of Tangible Personal Property for resale: Retailers that are purchasing tangible personal property for resale purposes are exempt

Preliminary Change of Ownership Report - Ventura County

recorder.countyofventura.orgDISABLED VETERAN: If you checked YES, you may qualify for a property tax exemption. A claim form must be filed and all requirements met in order to obtain the exemption. Please contact the Assessor for a claim form. PART 1: TRANSFER INFORMATION. If you check YES to any of these statements, the Assessor may ask for supporting documentation.

Provincial Sales Tax (PST) Bulletin

www2.gov.bc.caAct (the Act) and the Provincial Sales Tax Exemption and Refund Regulation (the Regulation). This bulletin also provides details on the information and documentation collectors must obtain ... Members of the Diplomatic and Consular Corps.....28 . Supporting Documentation ...

Extra-Statutory Concessions - GOV.UK

assets.publishing.service.gov.ukA99. FSA/PIA review of sales of Freestanding Additional Voluntary Contributions Schemes (FSAVCS): Tax Treatment of compensation A100. Tax exemption for compensation paid on bank accounts owned by holocaust victims A101. Personal …

MO-1040 2021 Individual Income Tax Return - Long Form

dor.mo.govElderly Home . Delivered Meals . Trust Fund Missouri National Guard ... (see worksheet on page 7 of the instructions)..... 2. Total additions (from ... horized aliens as defined under federal law and that I am not eligible for any tax exemption, credit, or abatement if I employ such unaut

CONTRIBUTION OF INFORMATION TECHNOLOGY IN …

granthaalayah.comhardware, and income tax exemption on exports for 10 years. The result was an increase in the number of software companies. Information Technology Act passed in 2000 gave a boost to e-commerce. National broadband policy announced in 2004 made broadband available to 20 million Indians by 2010.

Tax Guide to Taxation in Cambodia - Deloitte US

www2.deloitte.comGuide to taxation in Cambodia - 2020 Tax incentives Quality Investment Project status investments Investment incentives including tax exemptions are available for a range of business activities, which are not in the negative list of investment activities prohibited by laws.

Exemptions from Capital Acquisitions Tax (CAT)

www.revenue.ieFor the inheritance tax exemption, the main condition is that the inheritance must be taken on or after the death of the insured person and not later than one year after this death. For the gift tax exemption, the main condition is that the proceeds from the policy must be payable on a date that is more than eight years after the

Similar queries

Sales tax exemption Sales, Tax exemption, Sales, Sales tax, SALES TAX EXEMPTION CLAIM GUIDELINES, SALES TAX EXEMPTION, Exemption, Partial, State, Use Tax Certificate, Multijurisdiction, Resale Certificate, Exemption certificates, Tax exemption certificates, Certificates, Income Tax, Tax Exemption Certificate, Scheme, Documentary, Tax exemptions, Nebraska, Application, Manufacturing and Research, Partial tax exemption, Guidelines for Sales Tax Refund Procedures, Guidelines for, Claim, Virginia, Virginia Tax, Certificate, Exemption certificate, Churches, Wisconsin, WISCONSIN SALES, Form 5000, U.S. Department of State Diplomatic Tax Exemption Card, Department of State, Elderly, Worksheet, Income, Personal, Disabled veterans, DISABLED, National, Bonds, Administration, Georgia Department of Agriculture (GDA) Frequently, Georgia, Certificate FORM, ON TAX, Available, Incentives, Exempt, Preliminary Change of Ownership, Diplomatic, Extra-Statutory Concessions, Tax Guide, Guide, Tax incentives