Tax Incentives

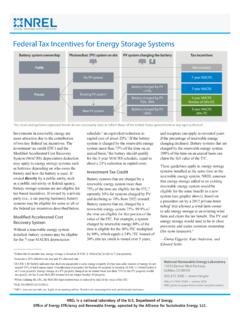

Found 7 free book(s)Federal Tax Incentives for Energy Storage Systems

www.nrel.govtax-based incentives. If owned by a private party (i.e., a tax-paying business), battery systems may be eligible for some or all of the federal tax incentives described below. Modified Accelerated Cost Recovery System. Without a renewable energy system installed, battery systems may be eligible . for the 7-year MACRS depreciation . 1

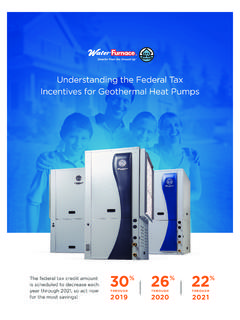

Understanding the Federal Tax Incentives for Geothermal ...

www.waterfurnace.comUnderstanding the Federal Tax Incentives for Geothermal Heat Pumps The 26% federal tax credit was extended through 2022 and will drop to 22% in 2023 before expiring altogether, so act now for the most savings!

Tax Incentives and Foreign Direct Investment

unctad.orgTax Incentives and Foreign Direct Investment: A Global Survey 4 Acknowledgements This study is the outcome of a survey of tax incentives conducted by the international tax firm of Deloitte &Touche LLP. The first part, an overview of the various issues associated with the use of tax incentives, was prepared by Donald Lecraw, Joseph Mathews and Assad

Oklahoma Business Incentives and Tax Guide

www.okcommerce.govWelcome to the 2021 Oklahoma Business Incentives and Tax Information Guide. The rules, legislation and appropriations related to taxes and incentives are very dynamic, and as changes occur, this Tax Guide will be updated. We encourage you to refer often to this on-line tax guide, as well as the various included hyperlinks, to

CONSERVATION EASEMENTS AND TAX BENEFITS

www.conservationlaw.orgE. Easements are not interests in real property that can be used in tax-free, like-kind exchanges. IV. Federal Tax Benefits and Qualification: Income Tax Deduction, Estate Tax Reduction, Estate Tax Exclusion A. Qualifying for Income Tax Deduction. (Internal Revenue Code §170(h) (26 USC §170) and Treasury Regulations §1.170A-14 (26 CFR 1.170A ...

Guide to the Federal Investment Tax Credit for Commercial ...

www.energy.govtax decisions, or when executing other binding agreements. Overview • The solar investment tax credit (ITC) is a tax credit that can be claimed on federal corporate income taxes for 30% of the cost of a solar photovoltaic (PV) system that is placed in service during the tax year.1 (Other types of renewable

Easements to Protect Historic Properties: A Useful ...

www.nps.govtax benefi ts to the donor. Recent Federal Tax Law Changes A property owner seeking a Federal tax deduction for a qualifi ed conservation contribution (including a dona-tion of an historic preservation easement) needs to be aware that there are several detailed requirements to meet, and that there are a number of recent changes to the tax laws.