On Tax

Found 9 free book(s)Form 4506-T (Rev. 11-2021) - IRS tax forms

www.irs.gov(combines the tax return and tax account transcripts into one complete transcript), Wage and Income Transcript (shows data from information returns we receive such as Forms W-2, 1099, 1098 and Form 5498), and . Verification of Non-filing Letter (provides proof that the IRS has no record of a filed Form 1040-series tax return for the year you ...

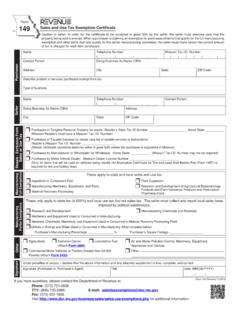

149 - Sales and Use Tax Exemption Certificate

dor.mo.govfrom state sales and use tax and local use tax, but are still subject to local sales tax. Section 144.054, RSMo, exempts electrical energy and gas (natural, artificial and propane), water, coal, energy sources, chemicals, machinery, equipment and materials used or consumed in manufacturing, processing, compounding, mining or producing any product.

State Motor Fuel Tax Rates

www.taxadmin.org/4 Tax rate is based on the average wholesale price and is adjusted annually The actual rates are: KY, 9%; and UT, 16.5%. /5 Portion of the rate is adjustable based on maintenance costs, sales volume, cost of fuel to state government, or inflation.

Minnesota enacts pass-through entity tax election

www2.deloitte.coman entity level state tax on income for taxable years beginning after December 31, 2020, provided that the limitation for the state and local tax deduction under IRC section 164(b)(6) still applies. This Tax Alert summarizes some of the provisions of …

Missouri Property Tax Credit

dor.mo.govThe Missouri Property Tax Credit Claim is a program that allows certain senior citizens and 100 percent disabled individuals to apply for a credit based on the real estate taxes or rent they have paid for the year. The credit is for a maximum of $750.00 for renters and $1,100.00 for owners. The actual credit is based on amount paid and total

2021 Form 100-E S Corporation Estimated Tax

www.ftb.ca.govFRANCHISE TAX BOARD, PO BOX 942857, SACRAMENTO CA 94257-0531 Installment 4 Due by the 15th day of 12th month of taxable year; if due date falls on weekend/holiday, see instructions. If no payment is due, do not mail this form. 6101213 Form 100-ES 2020 Estimated Tax Amount QSub Tax Amount Total Installment Amount FEIN Corporation name

Tax Rate Chart - Missouri

dor.mo.gov2020 Tax Chart. To identify your tax, use your Missouri taxable income from . Form MO-1040, Line 26Y and 26S and the tax chart in Section A below. A separate tax must be computed for you and your spouse. Calculate your Missouri tax using the online tax calculator at .

2020 California Tax Rate Schedules - FTB.ca.gov

www.ftb.ca.govPersonal Income Tax Booklet 2020 Page 93 2020 California Tax Rate Schedules To e-file and eliminate the math, go to ftb.ca.gov. To figure your tax online, go to . ftb.ca.gov/tax-rates. Use only if your taxable income on Form 540, line 19 is more than $100,000. If $100,000 or less, use the Tax Table. Form 540, line 19 is If the amount on Enter ...

2019 Withholding Tax Tables

www.tax.virginia.gov3 Daily Payroll Period Virginia Income Tax Withholding Table For Wages Paid After December 31, 2018 IF WAGES ARE- AND THE TOTAL NUMBER OF PERSONAL EXEMPTIONS CLAIMED ON FORM VA-4 OR VA-4P IS-