Search results with tag "0546"

Form 4506-C (9-2020) - Wells Fargo

www08.wellsfargomedia.com1120, Form 1120-A, Form 1120-H, Form 1120-L, and Form 1120S. Return transcripts are available for the current year and returns processed during the prior 3 processing years. b. ... individuals, you must attach the authorization document. For example, this could be the letter

Immigration Canada ADDITIONAL FAMILY INFORMATION

www.transam.ca(DISPONIBLE EN FRANÇAIS - IMM 5406 F) ADDITIONAL FAMILY INFORMATION IMM 5406 (06-2002) E Citizenship and Immigration Canada Citoyenneté et Immigration Canada The information you provide is collected under the authority of the Immigration and Refugee Protection Act to determine if you may be admitted to Canada as an immigrant. It will be ...

Amended and Prior Year Returns - IRS tax forms

apps.irs.govIRS2Go phone app or completing Form 4506T or Form 4506T-EZ, Request for Transcript of Tax Return. To get a copy of the original return, complete and mail Form 4506, Request for a Copy of Tax Return, to the appropriate IRS office listed on the form. There is a charge to receive a copy of the original return.

Signature Titles on IRS Form 4506-T

www.sba.govForm 94X series, Employment Tax Returns ... Signature Titles on IRS Form 4506-T . Form 1041, US Income Tax for Estates and Trusts . For Estates: •Signature of one of the following: • Executor/Executrix • Administrator/Personal Representative • Trustee • Heir at law • Next of kin • Beneficiary • Current date Form 1041,

IMM 5690E : Document Checklist - Permanent Residence ...

novascotiaimmigration.comAdditional Family Information (IMM 5406) Completed, dated and signed by : everyone: in the following list: • the principal applicant • spouse or common-law partner (whether they are accompanying or not) • each dependent child over the age of 18 years (whether they are accompanying or not)

IRS Form 4506-T: Request for Transcript of Tax Return

oag.ca.govInternal Revenue Service . Request for Transcript of Tax Return. a. Request may be rejected if the form is incomplete or illegible. OMB No. 1545-1872. Tip. Use Form 4506-T to order a transcript or other return information free of charge. See the product list below. You can quickly request transcripts by using our automated self-help service tools.

Form 4506-T (Rev. 11-2021) - IRS tax forms

www.irs.govCurrent name, address (including apt., room, or suite no.), city, state, and ZIP code (see instructions) 4 . Previous address shown on the last return filed if different from line 3 (see instructions) 5 . Customer file number (if applicable) (see instructions) Note:

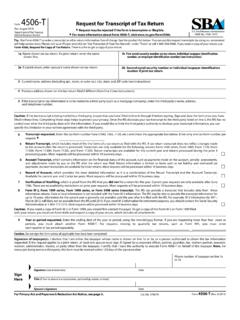

4506-T Request for Transcript of Tax Return

www.cgcc.ca.govexecute Form 4506-T on behalf of the taxpayer. Spouse’s signature Date Tip: Use Form 4506-T to order a transcript or other return information free of charge. See the product list below. You can also call 1-800-829-1040 to order a transcript. If you need a copy of your return, use Form 4506, Request for Copy of Tax Return. There is a fee to ...

NI PXI/PCI-5402/5406 Specifications

www.ni.comNI PXI/PCI-5402/5406 Specifications 2 ni.com Electromagnetic Compatibility Guidelines This product was tested and complies with the regulatory requirements and

酒 類 の 販 売 数 量 等 報 告 書 - nta.go.jp

www.nta.go.jpcc1-5604 提出用 酒 類 の 販 売 数 量 等 報 告 書 (平成 年4月1日~平成 年3月31日分) 税 務 署 整 理 欄 (単位:ℓ)

Form 4506-T Request for Transcript of Tax Return

www.sba.govaffecting Form 4506-T (such as legislation enacted after we released it) will be posted on that page. General Instructions Caution. Do not sign this form unless all applicable lines have been completed. Purpose of form. Use Form 4506-T to request tax return information. You can also designate (on line 5) a third party to receive the information.

MALÎ TATİL İHDAS EDİLMESİ HAKKINDA KANUN

www.mevzuat.gov.tr10031 MALÎ TATİL İHDAS EDİLMESİ HAKKINDA KANUN Kanun Numarası: 5604 Kabul Tarihi : 15/3/2007 Yayımlandığı R.Gazete : Tarih : 28/3/2007 Sayı : 26476

SUO UM 990-4506 MN01 EN - APC by Schneider Electric

www.apc.comSmart-UPS On-Line SRT8K/10K Tower/Rack-Mount 6U 1 Product Description The APC™ by Schneider Electric Smart-UPS™ On-Line SRT is a high performance uninterruptible power supply (UPS). The UPS helps provide protection for electronic equipment from utility power blackouts, brownouts, sags,

Note: Form 4506-T begins on page 3.

www.irs.govNote: Form 4506-T begins on page 3. Kansas City Fax Number for Filing Form 4506-T Has Changed . The fax number for filing Form 4506-T with the IRS center in Kansas City has changed.

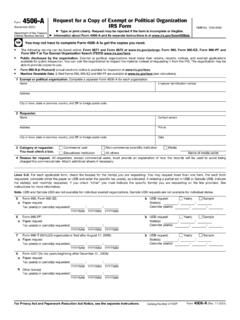

Instructions for Form 4506-A (Rev. 11-2021) - IRS tax forms

www.irs.govForms 990, Return of Organization Exempt From Income Tax, 990-EZ, Short Form Return of Organization Exempt From Income Tax, 990-PF Return of Private Foundation or Section 4947(a)(1) Trust treated as a Private Foundation, and 990-T, Exempt Organization Business Income Tax Return received in 2017 or

MWV 5460 TB2004 2 Moisture - Glatfelter

www.glatfelter.comTechnical Bulletin 2 As the temperature of the air increases, its ability to hold moisture increases. Air, when heated, will retain the same absolute humidity, but its relative humidity

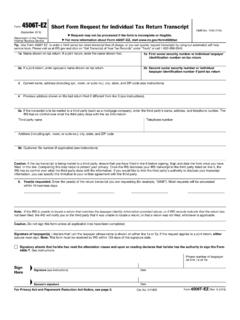

Form 4506-T-EZ (Rev. 11-2021) - IRS tax forms

www.irs.govreturn. Form 4506T-EZ cannot be used by taxpayers who file Form 1040 based on a tax year beginning in one calendar year and ending in the following year (fiscal tax year). Taxpayers using a fiscal tax year must file Form 4506-T, Request for Transcript of Tax Return, to request a return transcript. Use Form 4506-T to request tax return

Form 4506 Request for Copy of Tax Return - IRS tax forms

www.irs.gov1040 return, or 03/31/2017 for a first quarter Form 941 return. Signature and date. Form 4506 must be signed and dated by the taxpayer listed on line 1a or 2a. The IRS must receive Form 4506 within 120 days of the date signed by the taxpayer or it will be rejected.

How to Disaster App March 2020 - Small Business …

www.sba.govCompleting IRS Form 4506-T 32. Request for Transcript of Tax Return 33 Submit form 4506T. If the eSign option populates click through until the document is successfully completed. Request for Transcript of Tax Return - Download / Upload 34 If you dont do the form online the

Form 4506-T (Rev. 3-2019) - Small Business Administration

www.sba.govThere is a fee to get a copy of your return. 1a . Name shown on tax return. If a joint return, enter the name shown first. 1b First social security number on tax return, individual taxpayer identification number, or employer identification number (see instructions) 2a . If a joint return, enter spouse’s name shown on tax return.

Form 4506-A (Rev. 11-2021) - IRS tax forms

www.irs.govForm 4506-A (November 2021) Department of the Treasury Internal Revenue Service Request for a Copy of Exempt or Political Organization IRS Form

COVID Disaster IRS Form 4506T Instructions

www.sba.govIRS Form 4506T Instructions . 1.ave a copy of your 2019 Federal Tax Return available for reference when completing the H 4506T. 2. Confirm you are using the March 2019 version available on the SBA.gov website: Form 4506-T (Rev. 3-2019) (sba.gov) 3.he 4506T should be completed using your name and social security number T (SSN) if you

RETURN PREPARATION Gift Tax Returns— Common Mistakes

pkfod.comreturns filed by a client for whom a gift tax return is being prepared so that Schedule B can be cor-rectly completed. If the client is not certain of what years they have filed, Form 4506, Request for Copy of Tax Return, can be filed with the IRS to obtain copies of gift tax returns that they have on file for the taxpayer. 5.

Shuttered Venue Operators Grant - sba.gov

www.sba.govOct 20, 2021 · o For applicants who filed Form 990 or 990 -EZ, call 877-829-5500, from 8 a.m. to 5 p.m. local time. Step 2: • If the IRS tells you that your tax return has been received and processed, please follow the instructions to fill out another 4506 -T and ensure that all information is …

Income-Based Repayment Application/Request

www.ocap.org2. Either (a) or (b) as required by your loan holder, unless you check the box in #3 below: (a) A completed IRS Form 4506-T or 4506T-EZ providing your consent for the IRS to disclose your AGI and other federal income tax return information to your loan holder.

Disaster Form 4506-T Request for Transcript of Tax Return ...

yoursourcenews.comForm 4506-T on behalf of the taxpayer. Note: This form must be received by IRS within 120 days of the signature date. Signatory attests that he/she has read the attestation clause and upon so reading declares that he/she has the authority to sign the Form 4506-T. See instructions. Phone number of taxpayer on line 1a or 2a . Sign Here Signature

How to complete an IRS Form 4506 T for Tax Return …

www.niu.eduWhen the form is complete, submit the 4506‐T directly to the IRS by either mailing it or faxing it to the appropriate locaon. (See page 2) Where to Send a Completed 4506-T: ‐T: Do not submit a copy of the 4506-T to the Financial Aid and Scholarships Office. Please submit the form directly to

IRS Tax Transcript Online Request

www.mcckc.eduPaper Request Form - IRS Form 4506T-EZ or IRS Form 4506-T In most cases, for electronic tax return filers, IRS income tax return information is available for the IRS data retrieval tool (DRT) or the IRS Tax Return Transcript within 2–3 weeks after the electronic IRS income tax return has been accepted by the IRS.

IRS Tax Return Transcript and IRS Record of Account ...

www.ccc.eduOnly one signature is required. Sign the IRS Form 4506-T exactly as your name appeared on the original tax return. If you changed your name after submitting your tax return, also sign your current name. • Mail or fax the completed IRS Form 4506-T to the appropriate address (or FAX number) provided on page 2 of IRS Form 4506-T.

Form 4506-T (Rev. 3-2019), SVOG Request for Transcript of ...

www.sba.govForm 4506-T on behalf of the taxpayer. Note: This form must be received by IRS within 120 days of the signature date. Signatory attests that he/she has read the attestation clause and upon so reading declares that he/she has the authority to sign the Form 4506-T. See instructions. Sign Here . Signature (see instructions)

COMMERCIAL LOAN PACKAGE CHECKLIST

www.langleyfcu.orgUse Form 4506-T to order a transcript or other return information free of charge. See the product list below. You can quickly request transcripts by using our automated self-help service tools. Please visit us at IRS.gov and click on “Get a Tax Transcript...” under “Tools” or call 1-800-908-9946. If you need a copy of your return, use

Form 4506-T (Rev. 3-2019) - IRS tax forms

www.irs.govForm 4506-T (March 2019) Department of the Treasury Internal Revenue Service . Request for Transcript of Tax Return. ... display partial personal information, such as the last four digits of the taxpayer's Social Security Number. Full financial and tax …

Form 4506T-EZ (Rev. 3-2019) - IRS tax forms

www.irs.govreceive a transcript. Form 4506T-EZ cannot be used by taxpayers who file Form 1040 based on a tax year beginning in one calendar year and ending in the following year (fiscal tax year). Taxpayers using a fiscal tax year must file Form 4506-T, Request for Transcript of Tax Return, to request a return transcript.

Instructions, Forms & Document Checklist

www.immigratemanitoba.comAdditional Dependants/Declaration [IMM 0008DEP] (PDF, 472 KB) July 2011, if applicable –Schedule A Background/Declaration [IMM 5669] (PDF, 170 KB) December 2012 Additional Family Information [IMM 5406] (PDF, 134 KB) April 2008

IMM 5534 E : Document Checklist - Dependent Child

irp-cdn.multiscreensite.comAdditional Family Information (IMM 5406) The principal applicant (even if under 18 years old) must complete this form. Note: If the principal applicant is under 18, this form must be signed by a parent or legal guardian acting on the child's behalf.

Form 4506-C (9-2020) - Bank of America

homeloanhelp.bankofamerica.com4506-C (9-2020) Form . 4506-C (September 2020) Department of the Treasury - Internal Revenue Service. IVES Request for Transcript of Tax Return. OMB Number 1545-1872. . Do not sign this form unless all applicable lines have been completed. . Request may be rejected if the form is incomplete or illegible. . For more information about Form 4506-C ...

Form 4506-T (Rev. 3-2019) - Small Business Administration

www.sba.govperiods, you must attach another Form 4506-T. For requests relating to quarterly tax returns, such as Form 941, you must enter each quarter or tax period separately. 12 / 31 / 201. 9. 12 / 31 / 201. 8. 12 / 31 / 201. 7. Caution: Do not sign this form …

Supplemental Checklist for COVID EIDL Intake Form

www.sba.govForm 4506-T, so that IRS will accept and provide the tax transcript data to SBA in a timely manner. The address listed here must be an exact match to the 2019 (or 2020 the Applicant did not operate in 2019) tax filings with the IRS. Field – Organization Type:

IMM 5533 E : Document Checklist - Spouse (Including ...

its-site.ams3.digitaloceanspaces.comAdditional Family Information (IMM 5406) The following person(s) must fill out their own copy of this form: You (the principal applicant), any of your family members 18 years of age or older. Please refer to the Basic Guide for information about who qualifies as a "family member".

Instructions for Form 8821 (Rev. September ... - IRS tax forms

www.irs.govcompleting Form 4506-T, Request for Transcript of Tax Return, or Form 4506T-EZ, Short Form Request for Individual Tax Return Transcript. Alternatively, you may call 800-908-9946 to order a transcript over the phone. If you want a photocopy of an original tax return, use Form 4506, Request for Copy of Tax Return. There is a

Similar queries

Form 4506-C, 1120, Form 1120, Form 1120S, Attach, ADDITIONAL FAMILY INFORMATION, IMM 5406, Additional Family Information IMM 5406, Information, Amended, IRS tax forms, Form, Form 4506T-EZ, Return, Form 4506, Personal, 4506-T, Request for Transcript of Tax Return, Internal Revenue Service . Request for Transcript of Tax Return, Request, Transcript, Service, City, 4506, PXI/PCI-5402/5406 Specifications, 5604, Instructions, SUO UM 990-4506 MN01 EN, APC by Schneider Electric, Note: Form 4506-T begins on, Instructions for Form 4506-A, PF Return of Private Foundation, Private Foundation, MWV 5460 TB2004 2 Moisture, Moisture, Form 4506-T-EZ, Form 4506-T, Small Business, Completing, Small Business Administration, Tax return, Form 4506T, 4506T, Returns, How to complete an IRS Form 4506 T for Tax Return, 4506T-EZ, COMMERCIAL LOAN, Instructions, Forms & Document Checklist, Additional, Additional Family Information [IMM 5406, Document Checklist - Dependent Child, Form 4506-C 9-2020, Bank of America, 2020, Family, Form 8821, Completing Form 4506