Search results with tag "Form 4506"

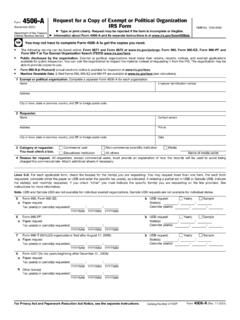

Instructions for Form 4506-A (Rev. 11-2021) - IRS tax forms

www.irs.govInstructions for Form 4506-A (Revised November 2021) Request for a Copy of Exempt or Political Organization IRS Form Section references are to the Internal Revenue Code unless otherwise noted. Future Developments. For the latest information about developments related to Form 4506-A and its instructions, such as legislation enacted after this

Instructions for Form 8821 (Rev. September ... - IRS tax forms

www.irs.govcompleting Form 4506-T, Request for Transcript of Tax Return, or Form 4506T-EZ, Short Form Request for Individual Tax Return Transcript. Alternatively, you may call 800-908-9946 to order a transcript over the phone. If you want a photocopy of an original tax return, use Form 4506, Request for Copy of Tax Return. There is a

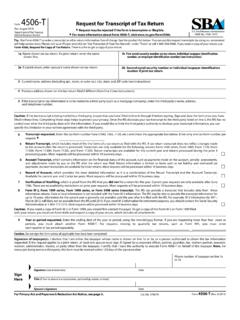

COVID Disaster IRS Form 4506T Instructions

www.sba.govIRS Form 4506T Instructions . 1.ave a copy of your 2019 Federal Tax Return available for reference when completing the H 4506T. 2. Confirm you are using the March 2019 version available on the SBA.gov website: Form 4506-T (Rev. 3-2019) (sba.gov) 3.he 4506T should be completed using your name and social security number T (SSN) if you

Note: Form 4506-T begins on page 3.

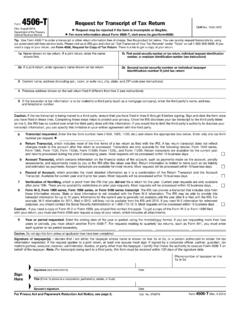

www.irs.govNote: Form 4506-T begins on page 3. Kansas City Fax Number for Filing Form 4506-T Has Changed . The fax number for filing Form 4506-T with the IRS center in Kansas City has changed.

Amended and Prior Year Returns - IRS tax forms

apps.irs.govIRS2Go phone app or completing Form 4506T or Form 4506T-EZ, Request for Transcript of Tax Return. To get a copy of the original return, complete and mail Form 4506, Request for a Copy of Tax Return, to the appropriate IRS office listed on the form. There is a charge to receive a copy of the original return.

Signature Titles on IRS Form 4506-T

www.sba.govForm 94X series, Employment Tax Returns ... Signature Titles on IRS Form 4506-T . Form 1041, US Income Tax for Estates and Trusts . For Estates: •Signature of one of the following: • Executor/Executrix • Administrator/Personal Representative • Trustee • Heir at law • Next of kin • Beneficiary • Current date Form 1041,

Disaster Form 4506-T Request for Transcript of Tax Return ...

yoursourcenews.comForm 4506-T on behalf of the taxpayer. Note: This form must be received by IRS within 120 days of the signature date. Signatory attests that he/she has read the attestation clause and upon so reading declares that he/she has the authority to sign the Form 4506-T. See instructions. Phone number of taxpayer on line 1a or 2a . Sign Here Signature

Instructions for Form 706-NA (Rev ... - IRS tax forms

www.irs.govForm 4506-T. Specific instructions are available for requesting online transcripts using the TDS or hardcopy transcripts using Form 4506-T. For questions about estate tax closing letter requests, go to Frequently Asked Questions on Estate Taxes. Definitions The following definitions apply in these instructions. United States. The United States

How to Disaster App March 2020 - Small Business …

www.sba.govCompleting IRS Form 4506-T 32. Request for Transcript of Tax Return 33 Submit form 4506T. If the eSign option populates click through until the document is successfully completed. Request for Transcript of Tax Return - Download / Upload 34 If you dont do the form online the

Income-Based Repayment Application/Request

www.ocap.orgAGI and other federal income tax return information to your loan holder. If required, your loan holder will include IRS Form 4506-T or 4506T-EZ with this IBR plan request or will provide instructions for obtaining the IRS forms. (b) Other documentation of your AGI, as …

IRS Form 4506-T: Request for Transcript of Tax Return

oag.ca.govForm 4506-T (Rev. September 2013) Department of the Treasury Internal Revenue Service . Request for Transcript of Tax Return. a. Request may be rejected if the form is incomplete or illegible.

New Fresno Fax Number - Internal Revenue Service …

www.irs.govNew Fresno Fax Number. The fax number listed for the Internal Revenue Service RAIVS Team office in Fresno, California in Form 4506-T and Form 4506T-EZ changed from (559) 456-5876 to

COMMERCIAL LOAN PACKAGE CHECKLIST

www.langleyfcu.orgUse Form 4506-T to order a transcript or other return information free of charge. See the product list below. You can quickly request transcripts by using our automated self-help service tools. Please visit us at IRS.gov and click on “Get a Tax Transcript...” under “Tools” or call 1-800-908-9946. If you need a copy of your return, use

RETURN PREPARATION Gift Tax Returns— Common Mistakes

pkfod.comreturns filed by a client for whom a gift tax return is being prepared so that Schedule B can be cor-rectly completed. If the client is not certain of what years they have filed, Form 4506, Request for Copy of Tax Return, can be filed with the IRS to obtain copies of gift tax returns that they have on file for the taxpayer. 5.

Form 4506-T Request for Transcript of Tax Return

www.sba.govaffecting Form 4506-T (such as legislation enacted after we released it) will be posted on that page. General Instructions Caution. Do not sign this form unless all applicable lines have been completed. Purpose of form. Use Form 4506-T to request tax return information. You can also designate (on line 5) a third party to receive the information.

Form 4506-C (9-2020) - Bank of America

homeloanhelp.bankofamerica.com4506-C (9-2020) Form . 4506-C (September 2020) Department of the Treasury - Internal Revenue Service. IVES Request for Transcript of Tax Return. OMB Number 1545-1872. . Do not sign this form unless all applicable lines have been completed. . Request may be rejected if the form is incomplete or illegible. . For more information about Form 4506-C ...

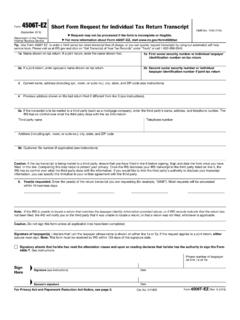

Form 4506-T-EZ (Rev. 11-2021) - IRS tax forms

www.irs.govUse Form 4506-T to request tax return transcripts, tax account information, W-2 information, 1099 information, verification of non-filing, and record of account. Customer File Number. The transcripts provided by the IRS have been modified to protect taxpayers’ privacy. Transcripts only display partial personal information, such as

Form 4506 Request for Copy of Tax Return - IRS tax forms

www.irs.gov1040 return, or 03/31/2017 for a first quarter Form 941 return. Signature and date. Form 4506 must be signed and dated by the taxpayer listed on line 1a or 2a. The IRS must receive Form 4506 within 120 days of the date signed by the taxpayer or it will be rejected.

Form 4506T-EZ (Rev. 3-2019) - IRS tax forms

www.irs.govreceive a transcript. Form 4506T-EZ cannot be used by taxpayers who file Form 1040 based on a tax year beginning in one calendar year and ending in the following year (fiscal tax year). Taxpayers using a fiscal tax year must file Form 4506-T, Request for Transcript of Tax Return, to request a return transcript.

Form 4506T-EZ (Rev. 7-2017) - fayservicing.com

www.fayservicing.comUse Form 4506-T to request tax return transcripts, tax account information, W-2 information, 1099 information, verification of non-filing, and record of account.

Form 4506-T (Rev. 3-2019), SVOG Request for Transcript of ...

www.sba.govForm 4506-T on behalf of the taxpayer. Note: This form must be received by IRS within 120 days of the signature date. Signatory attests that he/she has read the attestation clause and upon so reading declares that he/she has the authority to sign the Form 4506-T. See instructions. Sign Here . Signature (see instructions)

Form 4506-A (Rev. 11-2021) - IRS tax forms

www.irs.govForm 4506-A (November 2021) Department of the Treasury Internal Revenue Service Request for a Copy of Exempt or Political Organization IRS Form

Form 4506-T (Rev. 3-2019) - Small Business Administration

www.sba.govperiods, you must attach another Form 4506-T. For requests relating to quarterly tax returns, such as Form 941, you must enter each quarter or tax period separately. 12 / 31 / 201. 9. 12 / 31 / 201. 8. 12 / 31 / 201. 7. Caution: Do not sign this form …

Form 4506-T (Rev. 3-2019) - IRS tax forms

www.irs.govForm 4506-T (March 2019) Department of the Treasury Internal Revenue Service . Request for Transcript of Tax Return. ... display partial personal information, such as the last four digits of the taxpayer's Social Security Number. Full financial and tax …

4506-T Request for Transcript of Tax Return

www.irstaxrecords.comForm 4506-T (Rev. 9-2015) Page 2 Section references are to the Internal Revenue Code unless otherwise noted. Future Developments For the latest information about Form 4506-T and its

4506-T Request for Transcript of Tax Return

www.cgcc.ca.govWashington, DC 20224. Do not send the form to this address. ... Mail or fax Form 4506-T to the address below for the state you lived in when that return was filed. ... below shows two different service centers, mail your request to the service center based on the address of your most recent return. Chart for individual transcripts (Form 1040 ...

Form 4506-T Request for Transcript of Tax Return

www.irs.govForm 4506-T (Rev. August 2014) Department of the Treasury Internal Revenue Service . Request for Transcript of Tax Return Request may be rejected if the form is incomplete or illegible.

Form 4506-T Request for Transcript of Tax Return Internal ...

www.steverumberg.comForm 4506-T (Rev. January 2010) Department of the Treasury Internal Revenue Service . Request for Transcript of Tax Return ' Request may be rejected if the form is incomplete or illegible.

Form 4506-T (Rev. 3-2021)

www.irs.govEnter the tax form number here (1040, 1065, 1120, etc.) and check appropriate box below. only one tax number per request. . a Return Transcript, which includes most of the line items of a tax return as filed with the IRS. A tax return transcript does not reflect changes made to the account after the return …

Similar queries

Instructions for Form 4506-A, IRS tax forms, Form, Form 4506, Instructions, Form 8821, Completing Form 4506, Completing, Note: Form 4506-T begins on, Amended, Form 4506T-EZ, Return, Personal, Small Business, Request, New Fresno Fax Number, Internal Revenue Service, The Internal Revenue Service, COMMERCIAL LOAN, Returns, Form 4506-C 9-2020, Bank of America, 4506, 2020, Form 4506-T-EZ, Small Business Administration, Request for Transcript of Tax Return, Washington, Address, Service, Form 4506-T Request for Transcript of Tax Return, Request for Transcript of Tax Return Request, Tax return